RUBIS: CONTINUED GROWTH - NET INCOME: 22% - DIVIDEND GROWTH: 11% TO €2.68

13 Mars 2017 - 5:35PM

Paris, March 13, 2017, 5.35 p.m.

At its meeting of March 10, 2017,

the Board of Management finalized the 2016 financial statements,

which were approved by the Supervisory Board at its meeting of

March 13, 2017. An unqualified certification report is currently

being issued by the Statutory Auditors.

2016 was characterized by sound

growth in overall business volumes (up by 15%) resulting in an

excellent performance in terms of net income, Group share, which

was up by 22% at €208 million.

| (in

€M) |

2015 |

2016 |

Change |

Revenue Gross operating profit (EBITDA)

Current operating profit (EBIT), of which

Rubis Énergie

Rubis Support and Services

Rubis Terminal

Net profit, Group's share

Cash flow

Capex

Earnings per share (fully diluted)

Dividend per share |

2,913

345

240

155

48

49

170

261

143

€4.06

€2.42 |

3,004

411

300

192

69

51

208

326

163

€4.64

€2.68 |

+3%

+19%

+25%

+24%

+43%

+4%

+22%

+25%

-

+14%

+11% |

* Amount proposed to the

O&EGM of June 8, 2017.

Note: contribution breakdown between Rubis Énergie

and Support and Services business has been modified in 2015 set of

results. Above figures reflect this change.

The results were driven by

Rubis Énergie (petroleum products distribution

business), which posted a 17% increase in volumes (up by 5% at

constant scope). In total, Rubis Énergie's EBIT rose by 24% to €192

million (up by 9% at constant scope).

The Support and

Services business, which includes Sara (Antilles refinery) and

all shipping, trading and services activities, reported EBIT of €69

million, an increase of 43% (up by 19% at constant scope). The

division's excellent performance is attributable to the full

consolidation of Sara and strong growth in trading activities in

the Caribbean.

Rubis

Terminal recorded overall growth in revenues of 5%, driven by

international operations (up by 11%). The division continued its

policy of extending its capacity in petrochemicals (ARA zone) and

petroleum (new strategic storage contracts in France). Factoring in

the share of earnings of equity associates (Antwerp and Turkey),

EBIT was €63 million, an increase of 8% (versus 4% as

reported).

Capital expenditure for the Group

totaled €163 million, plus €27 million in net acquisitions of

subsidiaries.

The consolidated financial

structure was particularly sound at year-end, with a debt-to-EBITDA

ratio of 0.6 leaving scope to envision new acquisitions.

The excellent quality of these

results will allow the Group to propose the payment of a dividend

of €2.68 per share, an increase of 11%, at the next Shareholders'

Meeting, a figure in line with historic growth.

RUBIS

ÉNERGIE: Fuel distribution

Rubis Énergie's volumes grew by

17% (up by 5% at constant scope). Overall growth in volumes

combined with the positive impact of the redeployment in South

Africa and acquisition-led growth (contributions from acquisitions

made in 2015, notably on Réunion Island) resulted in a sharp

increase in EBIT at €192 million (up by 24%). At constant scope,

EBIT grew by 9%.

Rubis Énergie's growth by region

breaks down as follows:

-

Europe recorded stable volumes despite

particularly unfavorable weather conditions in the winter of 2016.

EBITDA, which was stable (-1%), reflects the economic reality of

performance; the 15% growth in EBIT is attributable to the impact

of provisions (reversals) spread over various subsidiaries;

-

the Caribbean posted growth of 9% (1.6 million

cubic meters) over the period, driven by the good performance of

the US economy, with its positive effects on tourism, as well as

purchasing power gains resulting from the sharp drop in energy

prices. EBIT, which was down 5% (impact of cyclone Matthew,

Jamaica's quality-product supply issues disrupting all operators,

transfer of aviation activity to the Cayman Islands), must be seen

against the particularly favorable context for margin in

2015;

-

lastly, the strong upturn in earnings in Africa

(EBIT up by 90%), which recorded volume growth of 65% to 907,000

cubic meters, is attributable both to the performance of the legacy

scope (South Africa, Morocco, Madagascar) and to the new scopes

acquired mid-2015, in particular SRPP and Djibouti. Bitumen

business in Africa (Eres) was penalized by a severe shift in

Nigeria's economy, which triggered a sharp impairment of local

currency.

Broadly speaking, the 2016

performance must be assessed in the light of the all-time high

results posted in 2015, which enjoyed the full impact of the price

structure resulting in an exceptional 15% increase in unit

margins.

RUBIS

SUPPORT AND SERVICES: Refining, shipping and trading-supply

This subgroup includes Rubis

Énergie's supply tools for petroleum products:

Rubis Support and

Services' EBIT totaled €69 million (up by 43%):

-

the results of Sara (71% interest in the Antilles refinery), now

fully consolidated, are accounted for in accordance with the

decree; they were stable compared with 2015 ;

- the

contribution of the trading-supply-shipping business increased

sharply to €39 million on the back of strong growth in the

petroleum products trading business and a better contribution from

shipping (12 vessels chartered or fully owned). In total, 1.3

million cubic meters were traded within the division in 2016;

- the bitumen

trading-supply business offered fewer opportunities in 2016 given

the configuration of prices between the Americas-Europe-Asia

regions, leading to a decline in its contribution. Ultimately,

Eres' strategy is to diversify its supplies while securing outlets

in retail distribution through alliances or joint ventures.

RUBIS

TERMINAL: Bulk liquid storage

The storage business reported a 2%

increase in revenues. However, activity measured in terms of

storage revenues for the total assets of the scope (including

equity associates) increased by 5% to €181.2 million, breaking down

as follows:

-

Storage France (+2%):

-

the petroleum business, which accounts for 76%

of billings in France, recorded growth of 4%, in a context where

consumption of petroleum products was down slightly (-0.6%) in

France,

-

other products, which together account for

one-quarter of total revenues, were stable;

-

Outside France (+11%):

-

the 8% increase in revenues in terminals in

Northern Europe reflects a large increase on the Antwerp site due

to new contracts, while the revenues from the Rotterdam site were

affected by the renegotiation of spot contracts into medium-term

contracts. Both terminals carried out capacity extensions over the

year (in Rotterdam, 80% of new capacity built in 2016 is now

reserved);

-

Turkey, which posted a 14% increase in revenues,

had a good start to the year thanks to good trader activity, while

the year-end was marked by the resumption of trader activity with

Iraq (Kurdistan).

Reported EBIT rose by 4% to €54

million. Factoring in the share of earnings of equity associates

(Antwerp and Turkey), EBIT rose by 8%:

-

storage France grew by 9%, with a positive

contribution from trading;

-

the Rotterdam and Antwerp sites were down 10%

(excluding one-shots in 2015) due to expenses related to the

commissioning of new capacity at the Rotterdam site (35,000 cubic

meters);

-

lastly, the Ceyhan terminal recorded strong

growth in its contribution to €6.4 million (+29%), thanks to the

readjustment of prices, good trader activity over a large part of

the year and the resumption of transit of fuel oil to

Kurdistan.

The Group is confident in its

ability to continue to generate organic growth and to pursue its

acquisition policy.

Upcoming events:

First-quarter 2017 revenue: May

9, 2017 (Market closing)

| Press

Contact |

Analysts Contact |

| PUBLICIS CONSULTANTS -

Aurélie Gabrieli |

RUBIS - Bruno

Krief |

| Tel: +33 (0) 1 4482

4883 |

Tel: +33 (0) 1 4417

9595 |

Download

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: RUBIS via Globenewswire

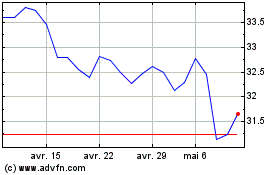

Rubis (EU:RUI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Rubis (EU:RUI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024