Swiss Franc Falls Amid Risk Appetite

08 Juin 2017 - 7:59AM

RTTF2

The Swiss franc declined against its most major counterparts in

the European session on Thursday amid risk appetite, as Chinese

exports and imports data topped expectations, signaling improvement

in the world's second-largest economy.

China's May exports rose 8.7 percent from a year earlier in

dollar terms, while imports jumped 14.8 percent, official data

showed. Analysts surveyed by Bloomberg News expected exports and

imports to surge by 7.2 percent and 8.3 percent, respectively.

Voting gets underway in the U.K. with the latest polls

predicting a narrow victory for Theresa May's party over the main

opposition Labour Party. The election would give the U.K. Prime

Minister a chance to expand her parliamentary majority ahead of the

start of negotiations on leaving the European Union.

The European Central Bank's policy decision is awaited, with ECB

President Mario Draghi expected to perform a complicated balancing

act on rates as the euro zone recovers.

Data from the Federal Statistical Office showed that

Switzerland's consumer price inflation accelerated unexpectedly in

May.

Inflation rose marginally to 0.5 percent in May from 0.4 percent

in April. Inflation was forecast to ease slightly to 0.3

percent.

The franc held steady against its major rivals in the Asian

session, with the exception of the yen.

The franc fell to a 9-day low of 1.2539 against the pound and

6-day low of 1.0876 against the euro, off its early highs of 1.2474

and 1.0848, respectively. If the franc extends decline, 1.26 and

1.10 are likely seen as its next support levels against the pound

and the euro, respectively.

Reversing from an early high of 0.9629 against the dollar, the

franc edged down to 0.9673. The next possible support for the franc

is seen around the 0.98 region.

On the flip side, the franc rose back to 113.89 against the yen,

heading to pierce its early 2-day high of 113.98. Continuation of

the franc's uptrend may see it challenging resistance around the

115.00 level.

Data from the Cabinet Office showed that Japan's gross domestic

product was revised down to +0.3 percent on quarter in the first

three months of 2017.

That missed forecasts for an increase of 0.6 percent after last

month's preliminary reading called it at 0.5 percent.

Looking ahead, the European Central Bank announces decision on

interest rates at 7:45 am ET. The bank is expected to keep refi

rate at zero percent and asset purchase program at EUR 60 billion a

month.

In the New York session, U.S. weekly jobless claims for the week

ended June 3, Canada housing starts for May and new housing price

index for April are set for release.

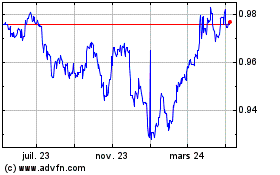

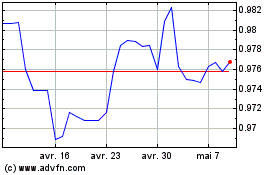

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024