The North Sea Is Suddenly, Surprisingly, an Oil Hot Spot

19 Septembre 2017 - 3:29PM

Dow Jones News

By Sarah Kent

LONDON -- For over a decade, the North Sea's once-booming oil

sector was mired in decline. Against the odds, it has emerged as an

unlikely bright spot in today's stormy global energy industry.

Investors have sunk more than $16 billion so far this year into

European deals for assets mostly located in the North Sea, a flurry

that far outstrips energy deal activity in all but American shale

country and Canada's oil sands, according to Edinburgh-based energy

consulting firm Wood Mackenzie. The biggest deal came last month,

with Total SA's $5 billion purchase of A.P. Moeller-Maersk's North

Sea-focused oil-and-gas business.

The deal was a sign major oil companies are still willing to

invest significant amounts in the region. Many are refocusing on

relatively new areas where they can grow, as private-equity funds

buy up aging assets and infrastructure that key players have been

looking to shed.

Royal Dutch Shell PLC is planning on spending $600 million to $1

billion a year in the North Sea in the coming years, while BP PLC

expects to double its production there by 2020. Norway's Statoil

ASA has greenlighted production from a new North Sea field that, at

its peak, could pump more oil than the entire nation of Ecuador, a

member of the Organization of the Petroleum Exporting

Countries.

"We see the North Sea turning things around," BP Chief Executive

Bob Dudley recently told an oil conference in Aberdeen, Scotland,

the center of the British oil industry.

The whirl of activity marks a new chapter for the vast

oil-producing region in the waters separating Great Britain from

Northern Europe.

Just last year, the U.K.'s North Sea energy industry was

described as "at the edge of a chasm" by trade association Oil

& Gas UK, as low oil prices hammered investment in a region

full of aging, depleted fields. At its peak around 2000, the North

Sea produced similar amounts of oil to Saudi Arabia, but output has

fallen by around 34% since then, a trajectory that only recently

began to reverse.

The region still faces significant challenges. Despite all the

M&A activity, only a handful of new developments have been

approved this year. And a record number of proposals to dismantle

existing infrastructure was submitted in the first half of this

year, according to Wood Mackenzie.

But the stabilization in oil prices, some new oil and gas

discoveries and the emergence of private-equity money have helped

create a sense of optimism across the North Sea industry not seen

since prices crashed in 2014.

Private-equity funds have built up war chests totaling $15

billion for North Sea acquisitions, Wood Mackenzie said. Companies

backed by funds including EIG Global Energy Partners, Carlyle Group

and CVC Capital Partners have already bought sizable asset packages

in the region.

Among the largest, after Total, was the $3.8 billion deal made

in January by Chrysaor Holdings Ltd., the EIG-backed oil company,

for a chunk of Shell's North Sea assets. Shell is now focused on

maintaining its North Sea output at around 150,000 barrels a day

into the late 2020s.

"The North Sea is in a window of opportunity," Linda Cook,

chairman of Chrysaor and chief executive of EIG's investment

vehicle, Harbour Energy, said in an interview. "We intend for this

to be the first of many acquisitions in the region."

BP has also approached potential buyers about its North Sea oil

assets -- although, like Shell, it says it remains committed to the

region.

In fact, BP and other major oil players say they are looking at

growth in the North Sea, especially in an area west of the Shetland

Islands that was once considered too difficult to develop. Chevron

Corp. is sitting on one of the region's largest undeveloped fields,

which the company says it is working to advance this year.

Total's deal last month is evidence that big oil companies

continue to see value in the region. It marked the biggest North

Sea-weighted deal in more than a decade, according to Wood

Mackenzie, and was Total's largest purchase since the oil-and-gas

megamergers at the turn of the century.

The oil-price downturn over the past three years has forced oil

producers to make deep cost cuts and driven down prices for

contractors and services. Those changes are starting to show

results.

BP has slashed its average production costs in the North Sea

from a peak of more than $30 a barrel in 2014 to less than $15 a

barrel at present. By the end of the decade, the company expects

that to come down to below $12 a barrel, Mr. Dudley said last

week.

Shell's costs have fallen by 60% -- a reduction matched at

competitors, said Steve Phimister, the company's U.K. production

director.

"The thing that has differentiated the North Sea is that we've

been using that downturn to right the ship," said Mr.

Phimister.

(END) Dow Jones Newswires

September 19, 2017 09:14 ET (13:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

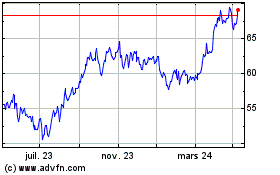

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

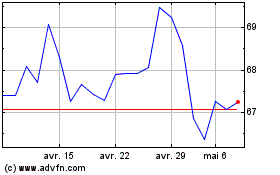

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024