Today's Top Supply Chain and Logistics News From WSJ

14 Juin 2017 - 12:57PM

Dow Jones News

By Imani Moise

Sign up:With one click, get this newsletter delivered to your

inbox.

French oil giant Total SA is setting its sights on electricity

as the commodity firm seeks to transform itself into an energy

company. Total sees electricity as a hedge against oil's eventual

decline and is assembling a new business around it, WSJ's Russell

Gold writes. Total Chairman and Chief Executive Patrick Pouyanné

wants to turn the company into one of the world's largest suppliers

of electricity, or what he often calls "the energy of the 21st

century." Already a large producer of natural gas, Total is

diversifying, snapping up a French maker of industrial batteries, a

utility supplier in Belgium and a stake in a U.S. maker of solar

panels. It's a big change from Total's core business since power

grids tend to be regional while oil can be shipped globally. Even

as Total doubles down on electricity, the International Energy

Agency says consumer demand for oil will keep growing for another

two decades unless governments move faster to curb emissions.

Saudi Arabia is slashing its U.S. oil exports in a bid to reduce

a global supply glut that has been hammering crude prices. The

reductions could be a step to ensure production cuts by the

Organization of the Petroleum Exporting Companies work as intended,

WSJ's Alison Sider Summer Said and Timothy Puko report. The

November deal to rein in oil output was supposed to reduce bloated

global inventories, but U.S. companies have rushed in to fill the

void. State-owned Saudi Arabian Oil Co. is the world's largest oil

producer and crude exporter, and the projected July drop in exports

would amount to a near three-decade low for this time of year.

Analysts say Aramco's plans show Saudi Arabia is getting serious

about addressing the supply glut, although some investors remain

skeptical.

Panama cut ties with Taiwan in favor of Beijing, citing China's

importance as a user of the Panama Canal and its role as the No. 1

supplier of goods in the Colon free-trade zone. The move gives

China another victory in its efforts to isolate the island, which

could be crippling to Taiwan's economy, WSJ's Eva Dou and Jenny W.

Hsu write. Taiwan remains a key link in the global technology

supply chain, but its exports have fallen in recent years,

displaced in part by Chinese competitors. China's maritime power is

growing, meanwhile, and plays a major role at the Panama Canal and

at the country's burgeoning free trade zone. China's growing

economic heft has pushed more of Taiwan's allies to switch their

diplomatic recognition to Beijing, .

E-COMMERCE

Chinese online retailer JD.com Inc. plans to use artificial

intelligence and robots to cut costs and "create a business model

that is almost totally out of human control," Chief Executive

Richard Liu tells WSJ's Li Yuan. China's second-largest online

retailer after Alibaba Group Holding Ltd., JD.com has assembled an

Amazon-like distribution network to deliver goods to its customers,

and is now testing 30-minute delivery windows in some areas. The

company is already experimenting with heavy-duty drones and smart

warehouses, and sees automation as essential for clamping down on

logistics costs and maximizing efficiency. JD.com also has

ambitions to expand into the U.S., but says it needs to ease its

reliance on small sellers and suppliers in order to appeal to

foreign shoppers.

QUOTABLE

IN OTHER NEWS

Logistics startup ShipBob raised $17.5 million to help it open

e-commerce distribution centers in more cities. (WSJ)

Uber Technologies Inc. Chief Executive Travis Kalanick is taking

an indefinite leave, extending the management turmoil at the

ride-hailing giant. (WSJ)

Commerce Secretary Wilbur Ross says the Trump administration can

reach better trade terms through diplomacy than through tariffs.

(WSJ)

Italy's Alitalia SpA airline filed for bankruptcy in the U.S.,

where it faced the threat of losing access to New York over unpaid

bills. (WSJ)

J. Crew Group Inc. is asking lenders for more time to pay off

some $567 million in debt as the retailer copes with slumping

sales. (WSJ)

Luxury retailer Neiman Marcus Group Ltd. is abandoning efforts

to sell itself and plans to go it alone and focus on e-commerce.

(WSJ)

Container shipping firm CMA CGM SA will acquire Brazil's

Mercosul Line from global market leader Maersk Line. (Business

Times)

Japan's delivery giant Yamato Transport is raising base rates

for the first time in 27 years because it has to pay more to hire

and retain drivers. (Bloomberg)

Spanish dockworkers and port employers are in talks to avert a

two-day strike. (Journal of Commerce)

U.S. lawmakers are pushing for a fix to the Highway Trust Fund.

(The Hill)

Rail bottlenecks in North Dakota have eased since the 2015 oil

bust. (Grand Forks Herald)

The Owner-Operator Independent Drivers Association says it will

still fight the electronic logging devices mandate despite the

rejection of its appeal by the Supreme Court. (Truckinginfo)

Los Angeles and Long Beach signed a pact setting zero-emissions

goals at their neighboring ports. (Los Angeles Times)

Malaysia's palm oil inventory fell after a 17% surge in exports

in May. (Nikkei Asian Review)

Chinese air carriers are stepping up flights to Latin America,

including new scheduled and charter all-cargo operations. (The

Loadstar)

Hong Kong-based Kerry Logistics took a stake in Kazakhstan-based

Globalink Logistics DWC to expand services across central Asia.

(Air Cargo News)

IKEA designers are training with engineers at the National

Aeronautics and Space Administration to learn advanced methods of

compact storage. (Quartz)

ABOUT US

Imani Moise is a reporter for WSJ Logistics Report. Follow the

entire WSJ Logistics Report team: @brianjbaskin , @PaulPage

@jensmithWSJ and @EEPhillips_WSJ and follow the WSJ Logistics

Report on Twitter at @WSJLogistics.

(END) Dow Jones Newswires

June 14, 2017 06:42 ET (10:42 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

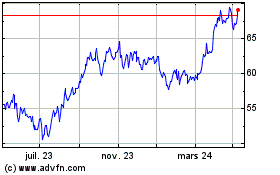

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

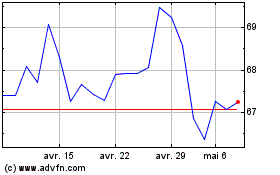

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024