Total: Second Interim Dividend: The Board of Directors Decides to Remove the Discount on the Scrip Dividend

12 Décembre 2017 - 6:57PM

Business Wire

Regulatory News:

The Board of Directors of Total (Paris:FP) (LSE:TTA) (NYSE:TOT)

met on December 12, 2017 and declared a 2017 second interim

dividend of €0.62 per share, in accordance with the Board’s

decision of July 26, 2017, unchanged compared to the 2017 first

interim dividend and representing an increase of 1.6% compared to

the 2016 second interim dividend. The Board of Directors also

decided to offer, under the conditions set by the fourth resolution

at the Combined Shareholders’ Meeting of May 26, 2017, the option

for shareholders, including holders of its American Depositary

Shares, to receive the 2017 second interim dividend in cash or in

new shares of the Company.

Given current oil prices above 60 $/b and the performance of the

Group in terms of cash-flow generation in such environment, the

Board of Directors has decided to remove the discount offered on

the share price for the new shares to be issued as payment of the

2017 second interim dividend. As a result, the share price for the

new shares to be issued is set at €46.55, equal to the average

opening price on Euronext Paris for the twenty trading days

preceding the Board of Directors on December 12, 2017, reduced by

the amount of the interim dividend, rounded up to the nearest cent.

Shares issued as payment of the 2017 second interim dividend will

carry immediate dividend rights. An application will be made to

admit the new shares for trading on the Euronext Paris market.

The ex-dividend date for the 2017 second interim dividend is set

for December 19, 2017. Shareholders may select to receive the 2017

second interim dividend payment in new shares during the period

from December 19, 2017, to January 3, 2018, both dates inclusive,

by instructing their financial advisors.

For Total’s American Depositary Shares (ADS), the ex-dividend

date for the 2017 second interim dividend is set for December 15,

2017. ADS holders may select to receive the 2017 second interim

dividend payment in new shares during the period from December 19,

2017, to December 28, 2017, both dates inclusive, by instructing

their financial brokers.

Shareholders who do not select to receive the 2017 second

interim dividend payment in new shares within the specified

timeframe will receive the 2017 second interim dividend due to them

in cash. The date for the payment in cash is planned for January

11, 2018.

For shareholders who elect to receive the 2017 second interim

dividend in shares, the date for the delivery of the shares is

planned for January 11, 2018. For holders of Total’s American

Depositary Receipts, the delivery of the ADSs is planned for

January 19, 2018.

If the amount of the 2017 second interim dividend for which the

option is exercised does not correspond to a whole number of

shares, the shareholders may opt to receive either the number of

shares immediately above, having paid a cash adjustment on the day

they exercise their option, or the number of shares immediately

below, plus a balancing cash adjustment.

About Total

Total is a global integrated energy producer and provider, a

leading international oil and gas company, and a major player in

low-carbon energies. Our 98,000 employees are committed to better

energy that is safer, cleaner, more efficient, more innovative and

accessible to as many people as possible. As a responsible

corporate citizen, we focus on ensuring that our operations in more

than 130 countries worldwide consistently deliver economic, social

and environmental benefits. total.com

* * * * *

Cautionary note

This news release is provided for information purposes only and

does not constitute an offer to purchase securities. This news

release and any other document relating to payment of dividends in

shares may only be published outside of France in conformity with

applicable local laws and regulations and shall not constitute an

offer for securities in jurisdictions where such an offer would

violate applicable local law. The option to receive the 2017 second

interim dividend in shares is not open to shareholders residing in

any jurisdiction where such option would give rise to a

registration requirement or require the granting of any

authorization from local securities regulators; shareholders

residing outside of France are required to inform themselves of any

restrictions which may apply under their local law and comply with

such restrictions. Shareholders must inform themselves of the

conditions and consequences of the exercise of such option, which

may be applicable under local law. In making their decision to

receive the dividend in shares, shareholders must consider the

risks associated with an investment in shares.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171212006143/en/

TotalMedia Relations: +33 1 47 44 46

99presse@total.com@TotalPressorInvestors Relations: +44 (0)207 719

7962ir@total.com

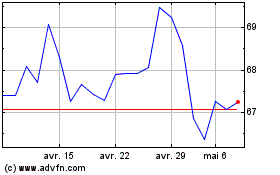

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

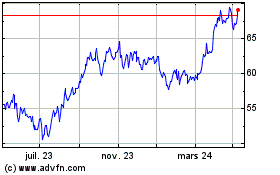

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024