Total's Renewables Bet Disappoints in Third Quarter -- Update

27 Octobre 2017 - 4:47PM

Dow Jones News

By Sarah Kent

French oil giant Total SA has laid out a vision to expand in

renewables and power. The challenge is to turn this business into a

consistent profit machine.

The company's new gas, renewables and power segment earnings

were down 49% in the third quarter compared with a year earlier,

the company said Friday. Tough times in the solar-power sector,

where Total is a big player in the U.S., made the division the

company's worst-performing business unit in the period. The

quarterly comparison was made more stark because results last year

were boosted by the sale of a solar farm stake.

Total's power section remains a relatively small part of its

business, generating $97 million in operating income in the third

quarter compared with over $1.4 billion from its oil-and-gas

exploration and production business. Overall, Total reported a

sharp increase in net profit in the period to $2.7 billion, up 39%

from a year earlier.

Earnings were boosted by higher oil and gas production, higher

crude prices, a strong refinery business, and cost cuts. Total

executives said the company remains an oil-and-gas business

first.

However, Total has moved more aggressively than many of its

peers into the renewables and power sectors, making many

acquisitions. In 2016, it paid $1 billion for a French maker of

industrial batteries and it owns a majority stake in

California-based solar panel maker SunPower Corp.

Total Chief Executive Patrick Pouyanné has said 20% of Total's

energy output will be from low-carbon sources such as wind and

solar by 2035.

"In energy, if you want to make a cash machine you invest for 10

or 15 years," Mr. Pouyanne said. "This segment is will bring value,

but let's be patient."

Despite its results this quarter, Total's gas, renewables and

power division remains profitable and delivered a return on capital

of nearly 7% in the third quarter, more than the exploration and

production unit.

Some of Total's rivals have been more cautious about new energy

technologies, after getting burned in the past. This month, Bob

Dudley, the CEO of BP PLC, said that while uncertainty remains over

which technologies will become most successful, his company is

avoiding "large speculative investments" in renewables.

Total remains committed to its bigger ambitions for producing

electricity and is seeking to build a presence across the supply

chain, but the lackluster performance of that segment this year

highlights the challenge big oil companies face in developing new

energy businesses.

The company acknowledges the difficulties the division has

faced, largely because of the depressed market for solar panels.

The value of Total's stake in SunPower has fallen since it acquired

a majority holding in 2011, amid a sharp decline in the price of

panels.

But Total's bet on power doesn't just depend on solar and

storage. The same unit includes its liquefied natural gas business.

LNG is a superchilled fuel that can be shipped around the world.

Rivals such as Exxon Mobil Corp. and Royal Dutch Shell PLC have

made similar bets on LNG.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

October 27, 2017 10:32 ET (14:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

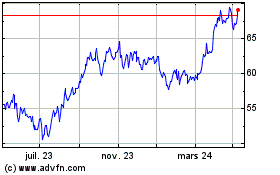

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

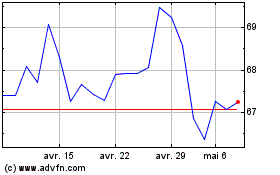

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024