U.S. Dollar Advances Ahead Of US Tax Vote

16 Novembre 2017 - 8:37AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

European session on Thursday, as positive U.S. consumer inflation

and retail sales data underscored expectations for a Fed rate hike

next month and investors awaited the House of Representatives' vote

on tax legislation due later in the day.

The U.S. consumer price inflation matched forecasts and retail

sales unexpectedly rose in October, separate reports showed on

Wednesday.

The probability of the December rate hike has increased to 97

percent following the data, according to the CME Fed watch

tool.

Investors also await progress on U.S. tax reform as House

Republicans are expected to vote on the bill later today.

The House plan cuts the corporate tax rate to 20 percent from 35

percent and shrinks the tax brackets to four from seven, adding to

more than $1.4 trillion federal deficit over a decade.

Meanwhile, the Senate Republicans' attempt to overhaul the tax

code is facing opposition from two Republican lawmakers, as they

raised concerns about the provisions of the bill.

Sen. Ron Johnson told Wednesday that he would not support the

bill because it treats large corporations differently than small

pass-through businesses.

The greenback traded mixed in the Asian session. While it rose

against the yen and the franc, it held steady against the euro and

the pound.

The greenback climbed to a 2-day high of 1.1757 against the

euro, from a low of 1.1801 hit at 1:45 am ET. If the greenback

extends rise, 1.16 is possibly seen as its next resistance

level.

Final data from Eurostat showed that Eurozone inflation slowed

slightly as initially estimated in October. Inflation eased to 1.4

percent in October from 1.5 percent in September.

The greenback advanced to a 2-day high of 0.9928 against the

Swiss franc, compared to 0.9883 hit late New York Wednesday. The

greenback is seen finding resistance around the 1.02 area.

The greenback that closed Wednesday's trading at 112.88 against

the Japanese yen rose to 113.33. On the upside, 115.00 is possibly

seen as the next resistance level for the greenback.

The greenback hit 0.6837 against the kiwi, its strongest since

October 31. Continuation of the greenback's uptrend may see it

challenging resistance around the 0.67 mark.

The greenback recovered to 1.2773 against the loonie, from an

early low of 1.2754. Next key resistance for the greenback is seen

around the 1.285 level.

On the flip side, the greenback dropped to 1.3200 against the

pound, after having advanced to 1.3135 at 2:15 am ET. On the

upside, 1.30 is possibly seen as the next resistance for the

greenback.

Data from the Office for National Statistics showed that UK

retail sales grew moderately in October.

Retail sales increased 0.3 percent in October from September,

but slightly faster than the expected 0.2 percent.

The greenback held steady against the aussie, after having eased

to 0.7609 from an early near a 5-month high of 0.7569. The pair

closed Wednesday's trading at 0.7588.

Data from the Australian Bureau of Statistics showed that

Australia's unemployment rate came in at a seasonally adjusted 5.4

percent in October.

That beat forecasts for 5.5 percent, which would have been

unchanged from the September reading.

Looking ahead, U.S. weekly jobless claims for the week ended

November 11, industrial production and export and import prices for

October and NAHB housing market index for November as well as

Canada manufacturing sales for September and ADP employment report

for October are set for release in the New York session.

At 9:00 am ET, the Bank of England officials Mark Carney, Ben

Broadbent, Jon Cunliffe, Jo Place, Dave Ramsden and Sam Woods will

speak at Future Forum in St. George's Hall Liverpool.

At 12:00 pm ET, SNB board member Andrea Maechler delivers a

speech titled "Capital market developments and Swiss monetary

policy" at the SNB's Money Market Event, in Geneva.

The Federal Reserve Governor Lael Brainard speaks about

financial technology at the Third Annual Financial Stability

Conference hosted by the University of Michigan at 3:45 pm ET.

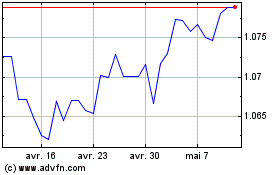

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024