U.S. Dollar Climbs As Irma Impact Lessens, N.Korea Worries Ease

11 Septembre 2017 - 7:09AM

RTTF2

The U.S. dollar advanced against its most major counterparts in

early European deals on Monday, as geopolitical tensions eased

after North Korea refrained from launching new missile over the

weekend and fears about hurricane Irma waned.

Hurricane Irma was downgraded to a Category 1 storm as it moved

into northern Florida and carried maximum sustained winds of about

85 miles per hour. It was a category four storm when it hit Florida

on Sunday, cutting off power to 2 million people. Geopolitical

tensions simmered after North Korea did not conduct a missile test

over the weekend despite speculation that it would do so.

The United Nations prepared to vote on a new round of sanctions

against North Korea. The draft resolution by the U.S. called for

imposing stringent sanctions on North Korea, including a ban on all

oil and natural gas exports to the country and a freeze of all

foreign financial assets of the government and its leader. Today's

economic calendar is rather light, with investors watching U.S.

producer prices on Wednesday, consumer inflation report on

Thursday, followed by industrial production and consumer sentiment

on Friday for more clues about the economy.

The currency has been trading in a positive territory in the

Asian session.

The greenback climbed to 4-day highs of 1.1993 against the euro

and 0.9512 versus the franc, from Friday's closing values of 1.2035

and 0.9439, respectively. If the greenback extends rise, 1.18 and

0.98 are likely seen as its next resistance levels against the euro

and the franc, respectively.

The greenback hit 108.61 against the yen, its highest since

September 9. At Friday's close, the pair was valued at 107.84.

Continuation of the greenback's uptrend may see it challenging

resistance around the 110.00 area.

Data from the Bank of Japan showed that Japan's M2 money stock

rose 4.0 percent on year in August, coming in at 978.0 trillion

yen.

That was unchanged from the July reading, although it was shy of

estimates for a gain of 4.1 percent.

The greenback that closed last week's trading at 0.8054 versus

the aussie advanced to a 4-day high of 0.8028. The greenback is

seen finding resistance around the 0.79 mark.

On the flip side, the greenback weakened to 1.3199 against the

pound, after having advanced to 1.3168 at 1:15 am ET. On the

downside, 1.34 is likely seen as the next support for the

greenback.

Looking ahead, Canada housing starts for August is due at 8:15

am ET.

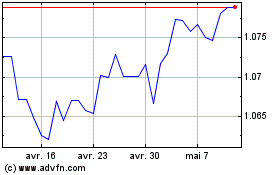

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024