U.S. Dollar In Positive Territory Despite Rising Jobless Claims

28 Mai 2015 - 3:59PM

RTTF2

The U.S. dollar held firm against its major rivals on Thursday,

despite data showing an increase in initial jobless claims in the

week ended May 23, as investors seemed confident on steadily

improving labor market.

The Labor Department released a report showing that initial

jobless claims edged up to 282,000, an increase of 7,000 from the

previous week's revised level of 275,000.

The continued increase came as a surprise to economists, who had

expected jobless claims to dip to 270,000 from the 274,000

originally reported for the previous week.

Investors now look forward to pending home sales data for April,

due shortly, for further clues about economy.

The demand for greenback was underpinned on prospectus of a Fed

rate hike around September. Slew of economic data released this

week supported hopes that the U.S. economic recovery is gathering

pace, after a slowdown in the first quarter.

The greenback showed mixed trading in the Asian session. It was

trading lower against the euro, pound and the franc but was up

against the yen.

The greenback stayed firm at an early 12-1/2-year high of 124.38

against the yen, compared to Wednesday's closing value of 119.36.

Continuation of the greenback's bullish move may lead it to a

resistance around the 135.00 level.

The yen was hit hard on expectations of monetary policy

divergence by the Bank of Japan, compared to that of the Federal

Reserve. While the BoJ is committed to maintain its extremely

accommodative policy, fears that its U.S. peer will begin to hike

rates as early as this year are abounding.

The greenback remained near early nearly 3-week high of 1.5265

versus the pound, after having fallen to 1.5385 at 4:00 am ET. The

greenback is poised to find resistance around the 1.52 zone.

The pound fell after data confirmed that U.K. economy grew at a

slower pace in the first quarter.

Data published by the Office for National Statistics showed that

U.K. gross domestic product expanded 0.3 percent in the first

quarter, which was weaker than the 0.6 percent seen a quarter

ago.

The greenback advanced to 1.2512 against the loonie, its

strongest since April 15. At Wednesday's close, the pair was valued

at 1.2450. The next possible resistance for the greenback-loonie

pair is seen around the 1.26 zone.

The greenback climbed to a 1-1/2-month high of 0.7625 against

the aussie and more than a 4-year high of 0.7141 against the kiwi,

reversing from an early low of 0.7760 and a 2-day low of 0.7271,

respectively. Continuation of the greenback's uptrend may lead it

to resistance levels of around 0.75 against the aussie and 0.70

against the kiwi.

Bouncing off from early 2-day lows of 0.9449 against the franc

and 1.0950 against the euro, the greenback edged up to 0.9511 and

1.0875, respectively. The greenback is likely to challenge

resistance around 0.96 against the franc and 1.05 against the

euro.

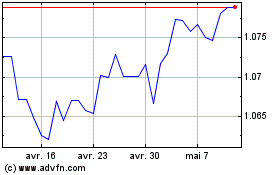

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024