U.S. Dollar Strengthens Ahead Of U.S. Jobs Data

06 Octobre 2017 - 5:31AM

RTTF2

The U.S. dollar climbed against its major counterparts in Asian

session on Friday on optimism over progress in U.S. tax reform plan

and investors awaited the U.S. jobs report amid indications of

solid economic growth.

House of Representatives passed a $4.1 trillion budget on

Thursday, to help pass a sweeping tax reform bill with a simple

majority in the Senate. The GOP tax reform framework unveiled last

week proposes tax cuts for corporations, small businesses and

individuals.

The Labor Department report is expected to show that the economy

may have added 90,000 jobs in September following an increase of

156,000 jobs in August. The unemployment rate is expected to hold

at 4.4 percent.

Thursday's data on jobless claims, factory orders and trade

balance as well as a slew of Fed speeches continued to support the

currency.

Fed Funds Futures are currently pricing in an 84% probability of

a 25bps hike in December.

The greenback advanced to more than a 4-month high of 0.7091

against the kiwi, more than 5-week high of 1.2591 against the

loonie and near a 3-month high of 0.7743 against the aussie, from

Thursday's closing values of 0.7111, 1.2565 and 0.7795,

respectively. The next possible resistance for the greenback is

seen around 0.69 against the kiwi, 1.27 against the loonie and 0.76

against the aussie.

The greenback spiked up to 0.9800 against the franc, a level

unseen since May 30. If the greenback extends rise, 0.99 is

possibly seen as its next resistance level.

The greenback that closed Thursday's trading at 112.80 against

the yen climbed to a 3-day high of 113.03. The greenback is seen

finding resistance around the 114.00 area.

Preliminary data from the Cabinet Office showed that Japan's

leading index improved to the highest level seen since early 2014

in August.

The leading index, which measures the future economic activity,

rose to 106.8 in August from 105.2 in the previous month.

The greenback strengthened to a 2-day high of 1.1686 against the

euro and more than a 4-week high of 1.3073 against the pound, up

from yesterday's closing quotes of 1.1812 and 1.3119, respectively.

On the upside, 1.15 and 1.29 are likely seen as the next resistance

levels for the greenback against the euro and the pound,

respectively.

Looking ahead, U.S. and Canadian jobs data for September, U.S.

wholesale sales and consumer credit for August as well as Canada

Ivey PMI for September are set for release in the New York

session.

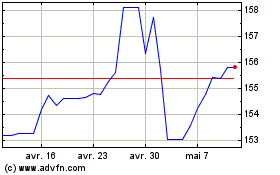

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024