U.S. Dollar Strengthens As Inflation Picks Up, Jobless Claims Fall Unexpectedly

14 Septembre 2017 - 11:36AM

RTTF2

The U.S. dollar climbed against its most major opponents in the

European session on Thursday, as an improvement in U.S. consumer

price inflation for August coupled with an unexpected drop in

weekly jobless claims raised hopes for further rate hike by the Fed

later this year.

Data from the Labor Department showed that U.S. consumer prices

increased slightly more anticipated in August led by a sharp jump

in energy prices.

The Labor Department said its consumer price index climbed by

0.4 percent in August after inching up by 0.1 percent in July.

Economists had expected consumer prices to rise by 0.3 percent.

Excluding food and energy prices, the core consumer price index

rose by 0.2 percent in August following a 0.1 percent uptick in the

previous month. The increase in core prices matched economist

estimates.

Separate data showed an unexpected pullback in initial jobless

claims in the week ended September 9, following a sharp jump in

first-time claims for U.S. unemployment benefits in the previous

week.

The report said initial jobless claims fell to 284,000, a

decrease of 14,000 from the previous week's unrevised level of

298,000. The drop surprised economists, who had expected jobless

claims to inch up to 300,000.

The greenback held steady against its major rivals in the Asian

session, with the exception of the euro.

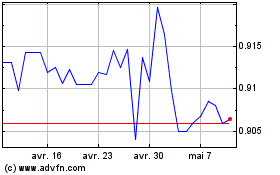

The greenback advanced to a new 4-week high of 0.9705 against

the Swiss franc, from a low of 0.9618 hit at 3:30 am ET. The

greenback-franc pair is likely to find resistance around the 0.98

region.

The Swiss National Bank maintained its expansionary monetary

policy and upgraded its inflation projections.

The interest rate on sight deposits at the SNB was retained at

-0.75 percent and the target range for the three-month Libor was

kept unchanged between -1.25 percent and -0.25 percent.

The greenback climbed to 111.04 against the Japanese yen, its

strongest since August 4. On the upside, 112.00 is possibly seen as

the next resistance for the greenback-yen pair.

The latest figures from the Ministry of Economy, Trade and

Industry showed that Japan's industrial production declined as

initially estimated in July

Industrial production dropped a seasonally adjusted 0.8 percent

month-over-month in July, reversing a 2.2 percent rise in June.

That was in line with the flash data published on August 31.

The greenback reversed from an early low of against the euro,

rising to a 2-week high of 1.1838. Continuation of the greenback's

uptrend may see it challenging resistance around the 1.17 mark.

The greenback strengthened to a 9-day high of 0.7956 against the

aussie, weekly highs of 1.2239 against the loonie and 0.7184

against the kiwi, from its early lows of 0.8016, 1.2160 and 0.7262,

respectively. If the greenback extends rise, 0.77, 0.70 and 1.25

are likely seen as its next resistance levels against the aussie,

the kiwi and the loonie, respectively.

On the flip side, the greenback weakened to more than a 1-year

low of 1.3372 against the pound, off its early 6-day high of

1.3148. The next possible support for the greenback is seen around

the 1.35 region.

The Bank of England retained its record low interest rate again

in a split vote as two members sought a rate hike.

The Monetary Policy Committee voted 7-2 to hold the interest

rate at 0.25 percent. But all nine members voted to maintain the

quantitative easing at GBP 435 billion.

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024