UK Industrial Production Growth Slows On Oil & Gas Extraction

08 Septembre 2017 - 10:12AM

RTTF2

UK industrial production grew at a slower pace in July amid the

weakness in oil and gas extraction and a bigger-than-expected

decline in construction output due to fall in new work.

Industrial production grew 0.2 percent month-on-month in July,

slower than the 0.5 percent increase seen in June, data from the

Office for National Statistics showed Friday. The monthly rate came

in line with expectations.

The expansion was largely driven by manufacturing output, which

advanced 0.5 percent led by car production. Factory output expanded

for the first time so far this year. Economists had forecast a

moderate growth of 0.3 percent after stagnation in June.

Meanwhile, the mining and quarrying output fell 1.2 percent as

oil and gas extraction contracted 1.4 percent.

Year-on-year growth in industrial production improved marginally

to 0.4 percent in July, while the annual rate was expected to

stabilize at 0.3 percent.

Manufacturing output increased 1.9 percent annually after

expanding 0.6 percent a month ago. The pace of expansion was

forecast to accelerate to 1.7 percent in July.

Another report from the ONS showed that the construction output

fell 0.9 percent in July from June, driven by a 1.4 percent drop in

all new work. Output was forecast to ease 0.3 percent.

In a separate communique, the ONS said the visible trade deficit

widened in the three months to July, primarily due to an increase

in the imports of finished manufactured goods.

The visible trade deficit increased by GBP 1.1 billion to GBP

34.4 billion in the three months ended July.

The total trade including goods and services showed a shortfall

of GBP 8.6 billion primarily due to the widening of goods deficit,

which was partially offset by a widening of the trade in services

surplus by GBP 0.7 billion.

In July, the total trade deficit was almost stable at GBP 2.87

billion. At the same time, the visible trade deficit totaled GBP

11.57 billion in July compared to GBP 11.53 billion in the previous

month.

Today's flurry of activity data suggests that external-facing

sectors are still providing little offset to the consumer slowdown,

Ruth Gregory, an economist at Capital Economics, said. But there

are some signs that net trade could provide more support in the

quarters ahead.

Elsewhere, the British Chambers of Commerce on Friday upgraded

its UK growth forecast for this year to 1.6 percent from 1.5

percent, citing moderately stronger outlook for consumer spending

growth.

However, the outlook for 2018 and 2019 were lowered to 1.2

percent and 1.4 percent, respectively. A weaker contribution from

net trade and more subdued consumer spending growth were the main

reasons for the slight downgrade, the lobby said.

According to the BCC, the first increase in UK official interest

rates, to 0.5 percent, will occur in third quarter of 2018.

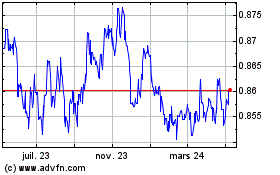

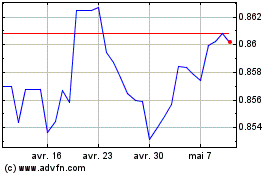

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024