UK Meets Budget Deficit Target In FY2016-17

25 Avril 2017 - 9:41AM

RTTF2

The British government limited its budget deficit for the

financial year 2016-17 almost within its targets and the figure hit

the lowest level seen since the financial crisis.

In the financial year ending March 2017, public sector net

borrowing decreased by GBP 20 billion to GBP 52.0 billion, data

published by the Office for National Statistics showed Tuesday.

This was the lowest deficit since the financial year ending

March 2008 and slightly above the Office for Budget

Responsibility's estimate of GBP 51.7 billion.

The deficit was at 2.6 percent of gross domestic product in the

2016/17 financial year.

It is pleasing and welcome news for Chancellor Philip Hammond as

he essentially met the markedly lowered 2016/17 fiscal target

contained in March's budget, IHS Markit economist Howard Archer

said.

This is helpful for the Chancellor's and government's

credibility, which is all the more welcome given the looming snap

general election, Archer added.

March's UK public sector finances figures confirmed the large

fall in borrowing that the OBR expected in the 2016-17 fiscal year

but, with much of the drop due to temporary factors, borrowing is

set to rise in 2017-18, Scott Bowman, a UK economist at Capital

Economics, said.

Nonetheless, looking through these temporary factors, fiscal

policy is still set to provide a significant drag on GDP growth

over the next few years, the economist said.

In March, PSNB excluding banks increased by GBP 0.8 billion from

the previous year to GBP 5.1 billion in March. This was the highest

March borrowing since 2015.

At the end of March, public sector net debt was GBP 1.72

trillion, equivalent to 86.6 percent of GDP.

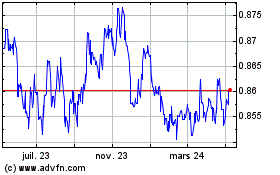

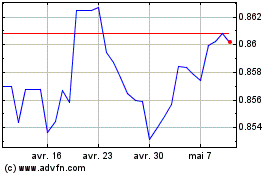

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs Sterling (FX:EURGBP)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024