UK Unemployment Rate At 42-Year Low; Wage Growth Remains Low

13 Septembre 2017 - 10:18AM

RTTF2

The UK jobless rate dropped to its lowest level in 42 years and

wage growth remained subdued during the three months ended July,

official data showed Wednesday.

The jobless rate fell to 4.3 percent, the lowest since 1975, the

Office for National Statistics said. Economists had forecast the

rate to remain unchanged at 4.4 percent.

The number of unemployed decreased by 75,000 from the three

months to April to 1.46 million in the May to July period.

At the same time, the employment rate was 75.3 percent, the

highest since records began in 1971.

Average earnings including bonus climbed 2.1 percent from the

previous year, the same rate as in the second quarter, but slower

than the expected rate of 2.3 percent. In the same period, real pay

fell 0.4 percent from last year.

At 2.9 percent, inflation rose to a more than five-year high in

August on clothing and petrol prices.

Although the unemployment rate fell even further below the Bank

of England's estimate of the equilibrium rate, wage growth

continues to be disappointingly flat, Andrew Wishart, an economist

at Capital Economics, said.

While some policymakers are clearly close to the limit of their

tolerance of higher inflation, the weakness of wages growth seems

likely to maintain the reluctance of the majority of members to add

to households' pain by raising interest rates in the very near

term, the economist added.

At its September meeting, the BoE is widely expected to maintain

its interest rate at a record low 0.25 percent and asset purchase

programme at GBP 435 billion.

In August, the claimant count held steady at 2.3 percent, ONS

said. The number of people claiming unemployment benefits fell

2,800 after declining 2,900 in July.

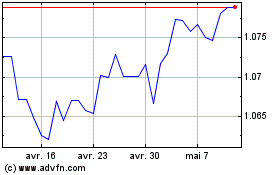

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024