UTMOST CONFIDENCE FOR THE 2015 OUTLOOK

- GOOD REVENUE MOMENTUM: €23,880M

(+4.9% AT CONSTANT EXCHANGE RATES AND +1.6% AT CONSTANT SCOPE AND

EXCHANGE RATES)

- ONGOING REBALANCING BETWEEN THE

GROUP’S CLIENT BASE: 61% MUNICIPAL AND 39% INDUSTRIAL

- AJUSTED OPERATING CASH FLOW

INCREASED 17.3%1 TO €2,164M, WHILE THAT OF THE

COMBINED WATER AND WASTE ACTIVITIES INCREASED

13.2%1

- ADJUSTED OPERATING INCOME INCREASED

23% TO €1,108M

- ADJUSTED NET INCOME INCREASED 79% TO

€326M

- 2015 DIVIDEND OF €0.70 PER SHARE

PAID IN CASH. IN 2016, DIVIDEND AT LEAST EQUAL TO €0.70 PER

SHARE

- DIVIDEND TO BE COVERED BY 2015

CURRENT NET INCOME AND FREE CASH FLOW EXCLUDING NET FINANCIAL

DIVESTMENTS

Regulatory News:

Veolia Environnement (Paris:VIE):

Antoine Frérot, Veolia’s Chairman and Chief Executive Officer

indicated: “2014 results were particularly satisfying and

exceeded our objectives. All of our financial indicators recorded

steady growth and the Group’s margins improved significantly. These

excellent results were made possible by the collective efforts of

the entire Group, whose hard work and commitment I would like to

acknowledge. The solid 2014 performance allows the Group to

approach 2015 with utmost confidence and to confirm all of our

objectives. After the summer this year, we plan on presenting the

details of our new 2016-2018 strategic plan. The plan will be

focused on profitable growth in our traditional markets and new

industrial markets, while we will continue to optimize efficiency,

with priority given to improved efficiency of our industrial assets

and increasing purchasing savings. This balance between growth and

operational efficiency should allow Veolia to grow revenue at least

3% per year and grow adjusted operating cash flow at least 5% per

year in the coming years.”

1At constant exchange rates. At current exchange rates, adjusted

operating cash flow grew 17.1%, while that of the combined Water

and Waste activities grew 13.1%.

Revenue increased 4.6% (+4.9% at constant exchange rates) to

€23,880 million compared with re-presented2 €22,820

million for the year ended December 31, 2013.

Revenue in the combined Water and Waste activities increased

5.6% at constant exchange rates (+3.3% at constant consolidation

scope and exchange rates.)

- In France revenue declined slightly

(-1.4% at constant scope), with Water revenue also slightly down

due the combined impact of contractual erosion and lower price

indexation (+1.2% in 2014 versus +2.2% in 2013) related to lower

inflation. Revenue was stable in Waste activities.

- Revenue in the Europe excluding France

region increased 35.9% at constant exchange rates due to the

consolidation of Dalkia International. At constant consolidation

scope and exchange rates, revenue was stable (-0.2%), with good

momentum in Waste activities in the United Kingdom but a decline in

revenue in Germany due to the negative weather effect on the

Braunschweig contract.

- The rest of the World segment recorded

steady growth at constant consolidation scope and exchange rates

(+6.7%), with particularly good performance in the United States

(+5.8%), Asia (+6.6%), the Pacific region (+6.1%) and in Africa

Middle East (+9.3%). The segment also benefitted from the

integration of Proactiva’s Water and Waste activities in Latin

America, contributing to 23.8% growth at constant exchange

rates.

- Global businesses revenue growth

returned (+9.7% at constant consolidation scope and exchange

rates), with 3.9% growth at SARP Industries, +13.5% in engineering

and +9.5% at Sade.

By business, Water activities recorded 3.8% growth at constant

consolidation scope and exchange rates, Waste activities recorded

2.0% growth at constant consolidation scope and exchange rates,

while Energy revenue declined 5.4% constant consolidation scope and

exchange rates due to the negative impact of weather.

Pro forma3 revenue, i.e. revenue excluding Dalkia France and

with Dalkia International fully consolidated over the 12-month

period, increased 2.4% at constant exchange rates and +1.0% at

constant consolidation scope and exchange rates to €24,408 million,

despite the impact of weather.

- Veolia continues to experience good

commercial results, with nearly €9 billion in large contracts won

or renewed in 2014.

Veolia’s commercial efforts in 2014 in its new strategic growth

markets have been successful. Large contract awards were evenly

divided, with roughly half of contracts awarded in strategic growth

markets (the oil & gas, food & beverage, mining and metal,

circular economy, treatment of hazardous pollution and dismantling

sectors). These efforts put the Group on track to rebalance its

client revenue mix from 61%/39% municipal/industrial today to

50%/50%.

- Strong adjusted operating cash flow

growth of 17.3% at constant exchange rates to €2,164 million, with

13.2% growth at constant exchange rates in the combined Water and

Waste activities

- Adjusted operating cash flow

performance benefited from the acceleration of the cost savings

plan (€232 million in gross savings generated in 2014) which

contributed to 11.7% growth at constant exchange rates to €930

million in Water activities and 11.3% growth at constant exchange

rates to €943 million in Waste activities. Energy activities

recorded €335 million in adjusted operating cash flow, up 46.6% due

to the consolidation of Dalkia International. In addition, adjusted

operating cash flow benefited from the full consolidation of

Proactiva.

- By segment and at constant exchange

rates: In France, adjusted operating cash flow was stable excluding

restructuring charges. In the Europe excluding France segment,

adjusted operating cash flow posted very strong growth due to good

performance in the United Kingdom, and in Germany, the benefit from

prior restructuring efforts, while the segment also benefited from

the consolidation of Dalkia International activities. The Rest of

the World segment recorded 49.6% growth driven by the increase in

Energy results in the United States and in China, and Water

activities in Australia and the Middle East. The Global Businesses

segment recorded 12% adjusted operating cash flow growth, with

solid growth in Hazardous Waste activities, and strong growth at

VWT due to a favorable base effect in engineering activities.

- Adjusted operating cash flow includes

€99 million in restructuring charges (€78 million in 2013).

- On a pro forma basis, adjusted

operating cash flow increased 8.4% at constant exchange rates.

2 An overview of re-presented financial accounts for the period

ended December 31, 2013 in which the Morroco Water operations were

reclassified to continuing operations is presented on page 27 of

this release.

3 Throughout this press release, when referring to pro forma

figures, these figures exclude Dalkia France operations and assume

full consolidation of Dalkia International operations for the

comparative 12-month periods.

- Adjusted operating income grew 23.2%

at constant exchange rates to €1,108 million compared to

re-presented €901 million in 2013 due to the strong growth in

adjusted operating cash flow, and despite a €60 million increase in

depreciation and amortization, the reduced net contribution from

the share of joint ventures and associates (divestment of Marius

Pedersen and full consolidation of Dalkia International beginning

in the second half of 2014) and the decline in net capital gains

(€47 million in 2014 versus €123 million in 2013).

- Very strong increase in adjusted net

income, +79% to €326 million compared with re-presented €182

million in 2013.

- The re-presented cost of net financial

debt declined more than €60 million from the prior year.

- The adjusted tax rate was reduced to

31.7% versus re-presented 43% in 2013.

- Adjusted net income attributable to

non-controlling interests increased slightly to €122.9 million

versus €116.5 million in 2013.

- Net income attributable to shareholders

of the company amounted to €246 million versus a re-presented net

loss of €153 million in 2013.

- Significant improvement in net free

cash flow generation to €330 million versus re-presented €87

million in 2013, which is an increase of 243 million driven by the

strong improvement in adjusted operating cash flow, and continued

capex discipline and working capital improvement.

- Gross industrial investments increased

due to the impact of the consolidation of Dalkia International and

Proactiva but remain under control at €1,555 million in 2014 versus

re-presented €1,469 million in 2013, and representing 6.5% of

revenue (6.4% in 2013). Growth industrial investments accounted for

€885 million in 2014.

- Continued working capital improvement

(+€73 million)

- Net financial debt amounted to

€8,311 million at December 31, 2014, down from re-presented €8,444

million at December 31, 2013, despite a negative foreign exchange

impact of €390 million, the delay in closing the divestment of

Israel activities to the first half of 2015 and the impact of not

selling the Moroccan activities.

- Dividend of €0.70 per share,

associated with the 2014 fiscal year, to be paid entirely in

cash.

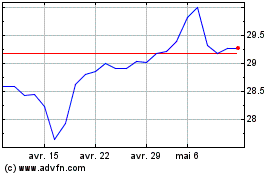

- At the Combined Shareholders’ Meeting

scheduled for April 22, 2015, the Board of Directors will propose a

dividend payment of €0.70 per share in respect of the 2014 fiscal

year, payable in cash. The ex-dividend date is fixed for May 5,

2015. The 2014 dividend will be paid beginning May 7, 2015.

- For 2016, in respect of the 2015 fiscal

year, the Board of Directors indicated that the dividend will be at

least €0.70 per share.

**********

- 2015 objectives

- Growth in revenue

- Growth in EBITDA and current operating

income

- Continued strong operational

performance

- Cost savings benefits resulting from

the continued execution of the €750 million cost savings plan

- Continued capex discipline

- The dividend and hybrid coupon payment

to be covered by current net income and paid by free cash flow

excluding net financial divestments

- Net financial debt management

- Investor Day planned for the second

half of 2015

- Veolia will present its new strategic

plan for the 2016 to 2018 period via an investor day after the

summer.

**********

The definition of all financial indicators used

in this communication can be found at the end of this press

release.

**********

Veolia group is the global leader in optimized resource

management. With over 179,000 employees* worldwide, the Group

designs and provides water, waste and energy management solutions

that contribute to the sustainable development of communities and

industries. Through its three complementary business activities,

Veolia helps to develop access to resources, preserve available

resources, and to replenish them.

In 2014, the group Veolia supplied 96 million people with

drinking water and 60 million people with wastewater service,

produced 52 million megawatt hours of energy and converted 31

million metric tons of waste into new materials and energy. Veolia

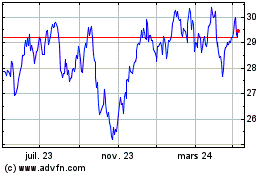

Environnement (listed on Paris Euronext: VIE and NYSE: VE) recorded

consolidated revenue of €24.4 billion* in 2014. www.veolia.com

(*) 2014 pro-forma figures including Dalkia International (100%)

and excluding Dalkia France

Important disclaimer

Veolia Environnement is a corporation listed on the Euronext

Paris. This press release contains “forward-looking statements”

within the meaning of the provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including but not limited to: the risk of suffering

reduced profits or losses as a result of intense competition, the

risk that changes in energy prices and taxes may reduce Veolia

Environnement’s profits, the risk that governmental authorities

could terminate or modify some of Veolia Environnement’s contracts,

the risk that acquisitions may not provide the benefits that Veolia

Environnement hopes to achieve, the risks related to customary

provisions of divesture transactions, the risk that Veolia

Environnement’s compliance with environmental laws may become more

costly in the future, the risk that currency exchange rate

fluctuations may negatively affect Veolia Environnement’s financial

results and the price of its shares, the risk that Veolia

Environnement may incur environmental liability in connection with

its past, present and future operations, as well as the other risks

described in the documents Veolia Environnement has filed with the

Autorités des Marchés Financiers (French securities regulator).

Veolia Environnement does not undertake, nor does it have, any

obligation to provide updates or to revise any forward-looking

statements. Investors and security holders may obtain from Veolia

Environnement a free copy of documents it filed (www.veolia.com)

with the Autorités des Marchés Financiers.

This document contains "non‐GAAP financial

measures". These "non‐GAAP financial measures" might be defined

differently from similar financial measures made public by other

groups and should not replace GAAP financial measures prepared

pursuant to IFRS standards.

FINANCIAL INFORMATION FOR THE YEAR ENDED

DECEMBER 31, 2014

A] INCOME STATEMENT

1. Revenue

1.1 General comments

(€ million)

Year ended % Change

at

Year ended December 31, constant

December

31, 2013 % Change consolidation

2014

re-presented scope and

exchange rates Revenue, published

23,879.6 22,819.7 +4.6% +1.6% Water and Waste

revenue 20,370.0 19,340.3 +5.3% +3.3%

Pro forma revenue 24,408.4 23,952.7 +1.9%

+1.0%

Group consolidated revenue rose by 1.6% at constant

consolidation scope and exchange rates (+4.6% at current

consolidation scope and exchange rates) to €23,879.6 million for

the year ended December 31, 2014, compared to re-presented

€22,819.7 million for the year ended December 31, 2013.

Changes in consolidation scope had a positive impact on

revenue for the year ended December 31, 2014 of €755.5 million,

including:

- +€433.8 million relating to the

acquisition of control of Proactiva at the end of November 2013.

Proactiva has since been fully consolidated in the Group

accounts,

- +€301 million relating to the

acquisition of the Dalkia International entities net of the impact

of the divestiture of Dalkia France.

The foreign exchange impact of -€68.9 million primarily

reflects the appreciation of the euro against the Australian dollar

(-€63.4 million), the Czech crown (-€36.3 million), the Japanese

yen (-€27.1 million), the Brazilian real (-€12.6 million), and the

Canadian dollar (-€12.4 million). The pound sterling appreciated

against the euro for an impact of €106.7 million on

revenue.

For the combined Water and Waste activities, revenue increased

by +5.3% at current consolidation scope and exchange rates and

+3.3% at constant consolidation scope and exchange rates, compared

to re-presented December 31, 2013 figures.

Pro forma Group consolidated revenue rose by +1.9%

at current consolidation scope and exchange rates (+2.4% at

constant exchange rates) to €24,408.4 million for the year ended

December 31, 2014, compared to re-presented €23,952.7 million for

the year ended December 31, 2013.

The change in quarterly revenue at constant consolidation scope

and exchange rates is a follows:

Q1 Q2 H1

2013 2014

Change

atconstantconsolidationscope

andexchange rates

2013 2014

Change

atconstantconsolidationscope

andexchange rates

2013 2014

Change

atconstantconsolidationscope

andexchange rates

Revenue, published 5 872,5 5 811,0

-1,6% 5 440,1 5 671,4

3,1%

11 312,5 11 482,4

0,7% Water and

Waste, published 4 693,9 4 876,8

3,2% 4 795,4 5 053,4

4,0%

9 489,3 9 930,1

3,6% Pro forma revenue

6 203,0 6 151,5

0,0% 5 750,3

5 863,5

2,2% 11 953,4 12 015,0

1,0% Q3 Q4

TOTAL 2014 2013 2014

Change

atconstantconsolidationscope

andexchange rates

2013 2014

Change

atconstantconsolidationscope

andexchange rates

2013 2014

Change

atconstantconsolidationscope

andexchange rates

Revenue, published 5 215,7 5 758,4

2,8% 6 291,4 6 638,8

2,4%

22 819,7 23 879,6

1,6% Water and Waste,

published 4 754,5 5 036,7

3,2%

5 096,5 5 403,3

3,0% 19 340,3

20 370,1

3,3% Pro forma revenue

5 553,6 5 754,1

1,3% 6 445,7 6

639,3

0,6% 23 952,7 24 408,4

1,0%

The change in revenue over 2014 benefited:

- in France, from the good resilience of

Water and Waste activities. Waste revenue in France remained

stable, while Water revenue contracted slightly;

- in Europe excluding France, from steady

growth due to solid momentum in the UK (+4.9% at constant

consolidation scope and exchange rates ) related to the

commissioning of Waste assets;

- in the Rest of the World, substantial

growth (+6.7% at constant consolidation scope and exchange rates)

in all regions and specifically industrial contracts in Asia and

Australia and favorable price impacts in Australia and the United

States. The segment also benefited from the consolidation of the

Water and Waste activities of Proactiva Medio Ambiente in Latin

America;

- in the Global Businesses segment, from

solid momentum, with substantial revenue growth (+9.7% at constant

consolidation scope and exchange rates) made possible by the

start-up of major engineering-construction projects at Veolia Water

Technologies and SADE.

1.2 Revenue by segment

Revenue (€ million)

Year ended Year ended

Foreign

December December 31, %

change Internal External exchange

31, 2014 2013 2014/2013

growth growth impact re-presented

France 5,556.7 5,627.4 -1.3%

-1.4% +0.1% n/a

Europe, excluding France

6,623.3 4,830.9 +37.1% -0.2%

+36.1% +1.2%

Rest of the World 4,595.4

3,789.6 +21.3% +6.7% +17.1% -2.5%

Global Businesses 4,517.7 4,162.5 +8.5%

+9.7% -0.4% -0.8%

Other 2,586.5

4,409.3 -41.3% -4.5% -37.0%

+0.2%

Group 23,879.6 22,819.7

+4.6% +1.6% +3.3%

-0.3%

France

Revenue in France was stable overall at -1.4% at constant

consolidation scope, compared to re-presented December 31, 2013

figures.

- Water activities reported a 2.3%

contraction in revenue (at current and constant consolidation

scope). Revenue benefited from tariff indexation increases (+1.2%),

which partially offset contractual erosion, as well as the -0.7%

decrease in volumes sold and lower construction activity due to

shrinkage in the public works market.

- Waste activities reported relatively

stable revenue (+0.1% at current consolidation scope, -0.3% at

constant consolidation scope). A slightly favorable volume effect

(+0.4%) and an increase in net prices (+0.7% excluding materials),

were offset by lower recycled raw material prices and volumes.

Europe, excluding France

Revenue of the Europe, excluding France segment grew +37.1% at

current consolidation scope and exchange rates (-0.2% at constant

consolidation scope and exchange rates). The external growth impact

is mainly related to the acquisition of control of the Dalkia

International subsidiaries in Europe at the end of July 2014 in the

amount of €1,742.1 million. At constant consolidation scope and

exchange rates, the change is largely related to:

- in the United Kingdom: revenue rose

substantially by +15.4% at current consolidation scope and exchange

rates (+4.9% at constant consolidation scope and exchange rates)

due to the contribution of integrated contracts in Waste operations

(higher business volumes relating to the start-up of the PFI in

Staffordshire and the increase in construction revenue,

particularly in Leeds) and the increase in commercial collection,

hazardous waste and industrial services volumes;

- in the Central and Eastern European

countries: revenue grew 0.2% at constant consolidation scope and

exchange rates (+73.5% at current consolidation scope and exchange

rates) in line with tariff increases in the Water business (mainly

in the Czech Republic and Romania), offset by a decrease in

construction activities in Romania (Water);

- these impacts were partially offset by

declining revenue in Germany of nearly -5.4% at constant

consolidation scope and exchange rates, primarily due to the

continuing decline in commercial collection and sorting-recycling

volumes in the Waste business, as well as the unfavorable weather

impact in the first and fourth quarters of 2014 for the

Braunschweig contract.

Rest of the World

Revenue of the Rest of world segment increased +21.3% at current

consolidation scope and exchange rates (+6.7% at constant

consolidation scope and exchange rates).

This increase was driven primarily by sustained revenue

growth:

- in the United States, where revenue

rose sharply by +8.5% at current consolidation scope and exchange

rates (+5.8% at constant consolidation scope and exchange rates)

mainly due to revenue growth in Energy activities (attributable to

harsh weather conditions in the first half, new projects and higher

natural gas and diesel prices);

- in Australia, where revenue grew by

+6.2% at constant consolidation scope and exchange rates (+3.1% at

current consolidation scope and exchange rates), due primarily to

higher commercial collection tariffs and new contract wins in Water

(QGC).

The external growth impact is mainly related to the acquisition

of control of Proactiva Medio Ambiente at the end of November 2013

in the amount of €433.8 million.

Global Businesses

Revenue of the Global Businesses segment grew +8.5% at current

consolidation scope and exchange rates (+9.7% at constant

consolidation scope and exchange rates). The increase was mainly

due to the following changes:

- +13.5% at constant consolidation scope

and exchange rates and +11.0% at current consolidation scope and

exchange rates for Veolia Water Technologies. This solid momentum

in revenue was primarily driven by the start-up of major projects

in the industrial Design and Build sector (particularly the Az Zour

North and Sadara desalination projects in the Middle East);

- +9.5% at constant consolidation scope

and exchange rates and +9.3% at current consolidation scope and

exchange rates for SADE. The increase is mainly related to

international revenue growth (Ivory Coast, Hungary, Bulgaria,

Moldavia, Peru) and growth in telecom activities in France;

- +5.1% at current consolidation scope

and exchange rates and +3.9% at constant consolidation scope and

exchange rates for SARPI, with an increase in hazardous waste

landfill and treatment volumes (used oil regeneration) and biogas

recovery activities.

Other

The Other segment comprises the contribution of Dalkia France up

to the date of the unwinding of the Dalkia joint venture on July

25, 2014, Water activities in Morocco and industrial multiservice

contracts.

The significant fall in revenue over the period (-41.3% at

current consolidation scope and exchange rates, -4.5% at constant

consolidation scope and exchange rates) is essentially due to the

unfavorable impacts of the 2014 winter in Dalkia France and the

scheduled end of gas cogeneration contracts in France over the

first half of 2014.

The external growth impact is mainly related to the

deconsolidation of Dalkia France as of July 25, 2014.

1.3 Revenue by business

Revenue (€ million)

Year ended December 31,

2014 Year ended December 31, 2013

re-presented

% change 2014/2013 Internal growth External

growth Foreign exchange impact

Water

11,215.1 10,741.4 +4.4% +3.8%

+1.5% -0.9%

Waste 8,506.3

8,099.7 +5.0% +2.0% +2.6% +0.4%

Energy (*) 3,926.1 3,756.5 +4.5%

-5.4% +9.9% +0.0%

Other

232.1 222.1 +4.5% +0.0% +4.5%

n/a

Group 23,879.6

22,819.7 +4.6% +1.6%

+3.3% -0.3%

(*) Energy activities mainly include the contribution of TNAI in

the United States, Dalkia France until July 25, 2014, as well as

the entities of Dalkia International fully consolidated on the same

date.

Revenue benefited from:

- stable Operations activities (+0.4% at constant consolidation

scope and exchange rates and +2.0% at current consolidation scope

and exchange rates), with the consolidation scope impact mainly

corresponding to the consolidation of the Water activities of

Proactiva Medio Ambiente;

- growth in Technologies and Networks activities (Veolia Water

Technologies & SADE) of +11.4% at constant consolidation scope

and exchange rates (+9.7% at current consolidation scope and

exchange rates) in line with the start-up of major projects at

Veolia Water Technologies, mainly in the industrial Design and

Build sector (particularly desalination projects in the Middle

East) and the growth in the international activities of SADE;

- In Waste, growth of 2.0% at constant

consolidation scope and exchange rates (including +0.6% for volumes

and +0.9% for price increases), primarily due to:

- in the United Kingdom, the contribution of integrated

contracts (particularly Leeds and Staffordshire) and solid momentum

in commercial collection;

-in Australia (higher commercial collection tariffs);

- the consolidation scope impact mainly corresponds to the

consolidation of the Waste activities of Proactiva Medio

Ambiente.

- Energy revenue fell -5.4% during the

period at constant consolidation scope and exchange rates (compared

to an increase of +4.5% at current consolidation scope and exchange

rates). This decline was mainly due to the negative weather impact

of the 2013-2014 winter compared with the particularly harsh

weather the year before and the impact of the scheduled end of gas

cogeneration contracts in France over the first half of 2014. The

revenue growth of +4.5% at current consolidation scope and exchange

rates is mainly attributable to:

- the positive impact of TNAI activities in North America (price

increases indexed to gas prices over the first half of 2014),

- the consolidation scope impact of the unwinding of the Dalkia

joint venture from the third quarter of 2014, and therefore the

full consolidation of the Dalkia International activities, net of

the removal of the Dalkia France entities.

The Other segment essentially comprises revenue from industrial

multiservice contracts.

2. Adjusted operating cash flow

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013

re-presented

% Change % Change at constant exchange rates Adjusted

operating cash flow, published 2,164.3 1,847.6

+17.1% +17.3% Water and Waste adjusted operating cash flow

1,885.1 1,667.0 +13.1% +13.2% Pro forma

adjusted operating cash flow 2,308.1 2,138.1

+8.0% +8.4%

Adjusted operating cash flow amounted to €2,164.3 million

for the year ended December 31, 2014, compared to re-presented

€1,847.6 million for the year ended December 31, 2013, up

+17.3% at constant exchange rates (+17.1% at current consolidation

scope and exchange rates).

For the combined Water and Waste activities, adjusted operating

cash flow rose +13.1% at current consolidation scope and exchange

rates and +13.2% at constant exchange rates.

The foreign exchange impact on adjusted operating cash flow was

limited to -€2.2 million and mainly reflects the appreciation of

the euro against the Australian dollar (-€7 million) and the Czech

crown (-€4.5 million). The pound sterling appreciated against the

euro for €12 million.

In 2014, the increase in adjusted operating cash flow benefited

from:

- the sizeable contribution of cost

savings plans;

- stability in France, excluding

restructuring costs;

- significant growth in Europe excluding

France, particularly for Waste activities in the United Kingdom and

Germany;

- strong momentum in the Rest of the

World, particularly for Energy activities in the United States and

China, and Water activities in Australia, Gabon and the Middle

East;

- sustained growth of Global Businesses,

particularly at Veolia Water Technologies and in hazardous

waste;

- positive consolidation scope impacts

relating to the consolidation of Dalkia International, and the full

consolidation of Proactiva Medio Ambiente in Latin America.

Conversely, adjusted operating cash flow was negatively impacted

by:

- in France, the change in recycled metal

prices in Waste, contractual erosion in Water activities, and

French Water restructuring charges relating to the voluntary

departure plan in the amount of -€41 million, recorded in

non-recurring items within operating income;

- lower profits for the Braunschweig

contract in Germany, due to an unfavorable weather impact;

- a difficult first half of 2014 for

Dalkia in France, due to unfavorable weather conditions and the

impact of the scheduled end of gas cogeneration contracts.

Changes in adjusted operating cash flow by segment were

as follows:

(€ million)

Adjusted operating cash flow Year

ended December 31, 2014 Year ended December 31, 2013

re-presented

% Change at current exchange rates

at constant exchange rates France 537.0 576.9 -6.9%

-6.9% Europe, excluding France 691.6 495.6 +39.6% +38.3% Rest of

the World 543.8 367.9 +47.8% +49.6% Global Businesses 206.3 185.6

+11.1% +12.0% Other (*) 185.6 221.6 -16.2%

-16.2%

Adjusted operating cash flow

2,164.3 1,847.6 +17.1%

+17.3% Adjusted operating cash flow margin

9.1% 8.1%

(*) The Other segment essentially comprises the activities of

Dalkia in France up to the unwinding of the Dalkia joint venture on

July 25, 2014.

As of the second half of 2014 and in tandem with the

reorganization and acquisition of control of Dalkia International,

the Group decided to review and standardize its policy for

chargebacks of centralized corporate costs to the subsidiaries in

France and internationally retroactively from January 1, 2014.

These impacts have no impact at Group level on the financial

indicators presented below. In order to make appropriate year over

year comparisons, they have been cancelled out in the 2013

comparative period in the analysis by segment of adjusted operating

cash flow, adjusted operating income, and operating income after

share of net income (loss) of equity-accounted entities.

Changes in adjusted operating cash flow by business were

as follows:

(€ million)

Adjusted operating cash flow

Year ended December 31, 2014

Year ended December 31, 2013

re-presented

% Change at current exchange rates

at constant exchange rates Water 930.0 838.9 +10.9%

+11.7% Waste 942.7 842.9 +11.8% +11.3% Energy (*) 335.3 228.7

+46.6% +46.6% Other (43.7) (62.9) +30.5%

+30.5%

Adjusted operating cash flow

2,164.3 1,847.6 +17.1%

+17.3% Adjusted operating cash flow margin

9.1% 8.1%

(*)Energy activities mainly include the contribution of TNAI in

the United States, Dalkia France until July 25, 2014, as well as

the entities of Dalkia International fully consolidated on the same

date.

3. Operating income after share of net income (loss) of

equity-accounted entities and adjusted operating income

The reconciliation of adjusted operating cash flow with

adjusted operating income for the years ended December 31, 2014

and 2013 re-presented is as follows:

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013

re-presented

% Change % Change at constant exchange rates Adjusted

operating cash flow 2,164.3 1,847.6 +17.1%

+17.3% Depreciation and amortization (1,246.8)

(1,187.4) Adjusted net capital gains on disposals

46.7 122.6 Operating provisions, fair value adjustments and other

50.5 (13.4) Share of adjusted net income of joint ventures and

associates (excluding capital gains on disposals) 93.7

131.4 Adjusted operating income

1,108.4 900.8 +23.0%

+23.2%

The increase in depreciation and amortization charges is

primarily due to the consolidation of Dalkia International

activities as of July 25, 2014 and the full-year impact of the

Proactiva depreciation and amortization charges, including in both

cases the depreciation and amortization impacts relating to the

purchase price allocation process.

Adjusted net capital gains on disposals for the year

ended December 31, 2014 include the impact of the June 2014 sale of

Marius Pedersen for €48.9 million. For the year ended December 31,

2013, the item mainly related to capital gains on industrial

divestitures (specifically the sale of the SADE head office), and

the impact of the deconsolidation of the Italian Waste

entities.

The change in operating provisions includes the change in

non-recurring cash restructuring costs between 2014 and 2013 for

€20.6 million. Other than this impact, the decrease in charges to

operating provisions is attributable to the absence of asset

impairment charges that were recorded in the Africa Middle East

region in 2013, offset by a negative comparison impact of

approximately -€27 million in VE S.A. regarding reversals of senior

executive pension provisions.

The change in adjusted operating income breaks down as

follows:

Adjusted operating income (€ million)

Year

ended December 31, 2014 Year ended December 31,

2013

re-resented

% Change % Change at constant exchange rates France

223.3 206.8 +8.0% +8.0% Europe, excluding

France 308.0 211.7 +45.5% +44.4% Rest of the World 300.7 148.1

+103.1% +103.8% Global Businesses 99.7 113.3 -12.0% -10.9% Other

(*) 176.7 220.9 -20.1% -19.3%

Total 1,108.4 900.8

+23.0% +23.2%

(*)The Other segment essentially comprises the activities of

Dalkia in France, which were sold in July 2014.

For the years ended December 31, 2014 and December 31, 2013

re-presented, the reconciliation of operating income after share

of net income (loss) of equity-accounted entities and adjusted

operating income is as follows:

Year ended

December 31, 2014

(€ million)

Operating income after share of net income (loss) of

equity-accounted entities (A) Adjustments (1)

(B)

Adjusted operating income

(C)

France 227.4 4.1 223.3 Europe, excluding

France (120.3) (428.3) 308.0 Rest of the World 243.3 (57.4) 300.7

Global Businesses 99.6 (0.1) 99.7 Other 617.2 440.5

176.7

Total 1,067.2

(41.2) 1,108.4

(C) = (A)-(B)

(1) For the year ended December 31, 2014, the items that are not

included in adjusted operating income include:

- The capital gain related to the

unwinding of the Dalkia joint venture for €494.7 million,

- Goodwill impairments of -€299.1 million

on Energy activities in Central Europe, and goodwill impairments

for entities consolidated under the equity method for -€12.5

million,

- Non-current asset impairments amounting

to -€180.0 million, in particular in Central and Eastern Europe, as

well as in China,

- Restructuring costs of -€29.5 million

relating to the head office voluntary departure plan, as well as in

French Water operations, the United Kingdom, North America and

Poland.

Year ended December 31, 2013 re-presented

Adjustments (€ million) Operating income after share

of net income (loss) of equity-accounted entities (A)

Impairment losses on goodwill (1)

(B)

Other (2)

(C)

Adjusted operating income

(D)

France 109.7 - (97.1) 206.8 Europe, excluding France 30.4

(168.3) (13.0) 211.7 Rest of the World 125.1 (0.2) (22.8) 148.1

Global Businesses 108.4 - (4.9) 113.3 Other 274.4 -

53.5 220.9

Total 648.0

(168.5) (84.3) 900.8

(D) = (A)-(B)-(C)

(1) For the re-presented year ended December 31, 2013, this item

comprised -€168.0 million in goodwill impairment for Waste

activities in Germany and Poland.

(2) Restructuring costs relating to the voluntary departure plan

in Water activities in France (in the amount of

-€97 million) and the headquarters, as well as income of +€82

million relating to the fair value remeasurement of the interest

previously held in Proactiva are reclassified in “Other”

adjustments in operating income. The impairment losses on the

securities of equity-accounted companies are also presented in the

“Other” adjustments column, i.e. -€12.2 million for China, -€4.9

million for India and -€8.4 million for Dalkia in the United

Kingdom and Latin America.

4. Analysis by segment of adjusted operating cash flow and

adjusted operating income

FRANCE

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented % Change at

current exchange rates % Change at constant exchange rates

Adjusted operating cash flow

537.0 576.9

-6.9% -6.9% Adjusted operating cash flow margin

9.7% 10.3%

Adjusted operating income *

223.3 206.8

+8.0% +8.0%

* including the share of adjusted net income (loss) of joint

ventures and associates.

Adjusted operating cash flow decreased by 6.9% at constant and

current exchange rates to €537.0 million for the year ended

December 31, 2014, compared with re-presented €576.9 million for

the year ended December 31, 2013.

The decline in the adjusted operating cash flow of Water

activities in France was primarily due to the restructuring costs

generated by the voluntary departure plan of -€41 million for the

year ended December 31, 2014, in addition to contractual erosion

and the decrease in volumes.

Regarding Waste activities, adjusted operating cash flow was

hindered by:

- the trend in scrap metal prices,

- the decrease in tonnage

landfilled.

Adjusted operating cash flow in France nevertheless benefited

from the positive impact of the cost cutting program.

Adjusted operating income increased by 8.0% at constant and

current exchange rates to €223.3 million for the year ended

December 31, 2014, compared with re-presented €206.8 million for

the year ended December 31, 2013.

The adjusted operating income of Waste activities in France

declined compared with re-presented December 31, 2013 figures, in

line with the change in adjusted operating cash flow.

The adjusted operating income of Water activities in France

increased, mainly due to lower depreciation and amortization

charges. This decline was primarily attributable to the exceptional

rise in net depreciation and amortization charges recognized in

2013 due to the planned reorganization of Water activities and its

impact on information systems.

EUROPE EXCLUDING FRANCE

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented % Change at

current exchange rates % Change at constant exchange rates

Adjusted operating cash flow

691.6 495.6

+39.6% +38.3% Adjusted operating cash flow margin

10.4% 10.3%

Adjusted operating income *

308.0 211.7

+45.5% +44.4%

* including the share of adjusted net income (loss) of joint

ventures and associates.

Adjusted operating cash flow in Europe excluding France

increased by 38.3% at constant exchange rates (39.6% at current

exchange rates) to €691.6 million for the year ended December 31,

2014, compared with re-presented €495.6 million for the year ended

December 31, 2013. It includes the contribution of the Dalkia

International business in Europe as of July 25, 2014.

For the year ended December 31, 2014, growth in adjusted

operating cash flow was particularly marked for Waste operations in

the United Kingdom, mainly due to the contribution of integrated

contracts. It also benefited from the net impact of cost reduction

plans.

The adjusted operating cash flow of Waste activities in Germany

sharply improved, whereas the Braunschweig contract was penalized

by unfavorable weather conditions in the first quarter of 2014,

which negatively impacted electricity, gas and heating margins.

Adjusted operating income increased by 44.4% at constant

exchange rates (45.5% at current exchange rates) to €308.0 million

for the year ended December 31, 2014, compared with re-presented

€211.7 million for the year ended December 31, 2013.

This increase was attributable to the rise in adjusted operating

cash flow, offset by:

- movements in operating provisions

relating to the fair value remeasurement of Waste assets in the

course of divestiture in Poland for around -€20 million;

- the increase in net depreciation and

amortization charges, in line with the consolidation of the Dalkia

International entities from the third quarter of 2014.

REST OF THE WORLD

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented % Change at

current exchange rates % Change at constant exchange rates

Adjusted operating cash flow

543.8 367.9

+47.8% +49.6% Adjusted operating cash flow margin

11.8% 9.7%

Adjusted operating income *

300.7 148.1

+103.1% +103.8%

* including the share of adjusted net income (loss) of joint

ventures and associates.

Adjusted operating cash flow increased by 49.6% at constant

exchange rates and 47.8% at current exchange rates to €543.8

million for the year ended December 31, 2014, compared with

re-presented €367.9 million for the year ended December 31,

2013.

This steady growth in adjusted operating cash flow primarily

involved:

- Energy activities in the United

States;

- the full consolidation of Proactiva

Medio Ambiente since November 28, 2013;

- China, which benefited from favorable

volume and commercial impacts in Energy activites;

- the solid momentum of Water activities

in Australia, mainly due to the performance of new contracts;

and

- the robust performance of Water

activities in Gabon and the Middle East.

Adjusted operating income increased to €300.7 million for the

year ended December 31, 2014, compared with re-presented €148.1

million for the year ended December 31, 2013, due to the

improvement in adjusted operating cash flow and positive movements

in operating provisions, particularly in the United States and

Gabon.

The increase in adjusted operating income was partially offset

by:

- the increase in net depreciation and

amortization charges, particularly for the Proactiva Medio Ambiente

entities, which have been fully consolidated since the end of

November 2013;

- the decline in the share of net income

of joint ventures, particularly for Water activities in China due

to asset impairment provisions recognized in 2014.

GLOBAL BUSINESSES

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented % Change at

current exchange rates % Change at constant exchange rates

Adjusted operating cash flow

206.3 185.6

+11.1% +12.0% Adjusted operating cash flow margin

4.6% 4.5% Adjusted

operating income *

99.7 113.3 -12.0%

-10.9%

* including the share of adjusted net income (loss) of joint

ventures and associates.

Adjusted operating cash flow increased by 12.0% at constant

exchange rates (11.1% at current exchange rates) to €206.3 million

for the year ended December 31, 2014, compared with re-presented

€185.6 million for the year ended December 31, 2013, in line

with:

- the rise in the hazardous waste volumes

treated and landfilled via the increase in authorized

capacity,

- the steady growth of Veolia Water

Technologies, due to the start-up of major industrial Design and

Build projects and the decrease of the losses arising from the

construction of the sludge incineration plant in Hong Kong,

- the net impact of cost reduction

plans.

Adjusted operating income declined by 10.9% at constant exchange

rates (-12.0% at current exchange rates) to €99.7 million for the

year ended December 31, 2014, compared with re-presented €113.3

million for the year ended December 31, 2013. This decrease in

adjusted operating income was due to the recognition of disposal

gains in 2013, mainly relating to Water activities in Portugal

(€15.6 million) and the SADE headquarters (€23.6 million).

OTHER

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented % Change at

current exchange rates % Change at constant exchange rates

Adjusted operating cash flow

185.6 221.6

-16.2% -16.2% Adjusted operating income *

176.7 220.9 -20.1% -19.3%

* including the share of adjusted net income (loss) of joint

ventures and associates.

Adjusted operating cash flow of the Other segment, including

Dalkia France, decreased by 16.2% at constant and current exchange

rates to €185.6 million for the year ended December 31, 2014,

compared with re-presented €221.6 million for the year ended

December 31, 2013.

Excluding Dalkia France, the adjusted operating cash flow of the

Other segment improved, particularly due to:

- the robust performance of the Moroccan

subsidiaries in Water,

- the impact of cost reductions following

the regrouping of the corporate headquarters facilities completed

since July 2013,

- the favorable variation in head office

restructuring costs (voluntary departure plans) between December

31, 2013 and December 31, 2014.

Dalkia France adjusted operating cash flow fell by 38.3% at

constant and current exchange rates for the half-year ended June

30, 2014. This decrease was mainly due to particularly unfavorable

weather conditions, the impact of the programmed cessation of gas

cogeneration contracts and unfavorable movements in energy

prices.

Adjusted operating income decreased by 19.3% at constant

exchange rates (-20.1% at current exchange rates) to €176.7 million

for the year ended December 31, 2014, compared with re-presented

€220.9 million for the year ended December 31, 2013.

Excluding Dalkia France, the segment’s adjusted operating income

was slightly down compared to 2013.

Changes, excluding Dalkia France, were impacted by:

- reversals of pension provisions

following modifications to VE S.A. executive management pension

plans, which fell by €27 million compared with re-presented

December 31, 2013;

- the negative comparison impact relating

to capital gains on financial divestments realized in 2013,

particularly the deconsolidation of the Italian Waste

entities;

- the write-down of the financial

receivable on an industrial multi-service agreement in Portugal in

2014. Veolia’s residual exposure under this multi-service agreement

totaled €74 million as of December 31, 2014.

Nevertheless, it benefited from the impact of the divestiture of

Marius Pedersen in June 2014 in the amount of €48.9 million and the

absence of asset impairment charges recorded in the Africa-Middle

East region in 2013.

Selling, general and administrative costs

Selling, general and administrative expenses declined from

re-presented €3,017.8 million for the year ended December 31, 2013

to €2,996.7 million for the year ended December 31, 2014,

representing a decrease of 0.7% at current consolidation scope and

exchange rates.

The ratio of selling, general and administrative expenses on

sales fell from re-presented 13.2% for the year ended December 31,

2013 to 12.5% for the year ended December 31, 2014.

At constant consolidation scope, method and exchange rates, and

excluding non-recurring items, selling, general and administrative

expenses decreased by nearly 5%.

This decrease is due to the asset optimization policy and the

cost reduction program implemented by the Group since 2012.

5. Net finance costs

The financing rates for the years ended December 31, 2014 and

December 31, 2013 re-presented break down as follows:

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013 re-presented

Net finance costs (543.9) (594.5)

Re-presented net finance costs (468.2)

5.31% (494.1) 5.11% Impact of the consolidation of

Proactiva and Morocco debts

-0.14% Impact of the Dalkia

transaction

-0.30%

Net finance costs re-presented, excluding these scope

impacts (431.1) 4.87%

(494.1) 5.11%

Net finance costs (re-presented for the finance costs of

discontinued operations, and excluding bond buyback costs in 2013

and 2014 treated as a non-recurring item) declined by nearly €60

million in 2014, compared with 2013.

On a comparable scope basis, the financing rate for the year

ended December 31, 2014 fell sharply to 4.87%, compared with

re-presented 5.11% for the year ended December 31, 2013:

- before inclusion of the external debt of the Dalkia

International activities which have been fully consolidated since

July 25, 2014;

- before reconsolidation of the external debt of Morocco Water

activities at the end of 2014 in application of IFRS 5 and;

- before the full-year impact of the consolidation of

Proactiva’s external debt following the acquisition of control at

the end of 2013.

Other financial income and expenses break down as follows:

Other financial income and expenses

(€ million)

Year ended December 31, 2014 Year ended December 31,

2013 re-presented Revenue from financial assets

+62.8 (1)

+118,8 Unwinding of the discount on provisions (non-cash)

(45.3) (41.7) Other (30.7) (25.0)

Adjusted other income and expenses (13.2)

+52.1

(1) Including the decline in interest paid on Dalkia

International loans of -€53 million following the buyback of EDF’s

share and the change in consolidation method.

6. Tax expense

For the year ended December 31, 2014, the income tax expense

totaled -€167.3 million, compared with re-presented

-€119.4 million for the year ended December 31, 2013.

Excluding certain non-recurring items, the adjusted tax rate

dropped to 31.7% for the year ended December 31, 2014, compared

with re-presented 43.0% for the year ended December 31, 2013. This

significant decrease in the tax rate was mainly due to the improved

results of the French tax group, which is still reporting a loss

(with no impact on the tax expense as losses are not activated for

the French tax group).

Year ended December 31, 2014 (€ million) Pre-tax

income/(loss) Income tax expense Tax rate

Effective 417.3 (167.3) 40.1%

Adjustment of non-recurring items

Bond buyback costs 62.3 - Impact of Dalkia transaction (3.7) 4.7

Restructuring 29.5 (2.1) Other 15.0 -

Adjusted rate 520.4 (164.7) 31.7%

7. Net income (loss) from discontinued operations

The net loss from discontinued operations was €21.9 million for

the year ended December 31, 2014, compared with re-presented net

income of €34.0 million for the year ended December 31, 2013 and

includes equity-accounted entities divested or in the course of

divestiture.

The re-presented net income from discontinued operations for the

year ended December 31, 2013 mainly concerned global urban lighting

activities (Citelum) in Energy activities and the investment in

Berliner Wasser divested in early December 2013.

8. Net income (loss) of other equity-accounted entities

Net income of other equity-accounted entities (Transdev Group)

totaled €11.5 million for the year ended December 31, 2014,

compared with a re-presented net loss of €51.5 million for the year

ended December 31, 2013. It includes the contribution of the

Transdev Group shareholding in SNCM and reflects the fair

assessment of the residual financial risk related to the Group’s

exposure in the context of bankruptcy proceedings, and with respect

to its indirect shareholding in SNCM.

9. Net income (loss) attributable to non-controlling

interests

The net income attributable to non-controlling interests was

€85.3 million for the year ended December 31, 2014, compared with

re-presented €107.8 million for the year ended December 31, 2013.

This decrease was mainly due to the downturn in the performance of

Dalkia International and Dalkia France in the first half of 2014

and the unwinding of the Dalkia joint venture on July 25, 2014.

10. Net income (loss) attributable to owners of the Company

Net income attributable to owners of the Company was €246.1

million for the year ended December 31, 2014, compared with a

re-presented net loss of €153.4 million for the year ended December

31, 2013. Adjusted net income attributable to owners of the Company

was €326.1 million for the year ended December 31, 2014, compared

with re-presented €182.0 million for the year ended December 31,

2013.

Given the weighted average number of shares outstanding of 543.0

million in 2014 (basic and diluted) and re-presented 524.4 million

in 2013 (basic and diluted), earnings per share attributable to

owners of the Company (basic and diluted) were €0.33 for the year

ended December 31, 2014, compared with -€0.32 for the year ended

December 31, 2013. Adjusted net income per share attributable to

owners of the Company (basic and diluted) was €0.60 for the year

ended December 31, 2014, compared with re-presented €0.35 for the

year ended December 31, 2013.

Adjusted net income for the year ended December 31, 2014 breaks

down as follows:

Year ended December 31, 2014 (€ million)

Adjusted Adjustments Total Operating income (loss)

after share of net income (loss) of equity-accounted entities

1,108.4

(41.2)(*)

1,067.2 Net finance costs (481.6) (62.3)(**) (543.9) Other

financial income and expenses (13.2) (1.0) (14.2) Income tax

expense (164.6) (2.7) (167.3) Net income (loss) of other

equity-accounted entities - 11.5 11.5 Net income (loss) of

discontinued operations - (21.9) (21.9) Non-controlling interests

(122.9) 37.6 (85.3)

Net income (loss)

attributable to owners of the Company 326.1

(80.0) 246.1

* Adjustments to operating income are presented in paragraph

3.

** Costs related to bond buybacks.

Re-presented adjusted net income for the year ended December 31,

2013 breaks down as follows:

Year ended December 31, 2013 re-presented (€ million)

Adjusted Adjustments Total Operating income (loss)

after share of net income (loss) of equity-accounted entities

900.8

(252.8)(*)

648.0 Net finance costs (521.4) (73.1)(**) (594.5) Other

financial income and expenses 52.1 (14.3) 37.8 Income tax expense

(133.0) 13.6 (119.4) Net income (loss) of other equity-accounted

entities - (51.5) (51.5) Net income (loss) of discontinued

operations - 34.0 34.0 Non-controlling interests (116.5)

8.7 (107.8)

Net income (loss) attributable to

owners of the Company 182.0 (335.4)

(153.4)

* Adjustments to operating income are presented in paragraph

3.

** Costs related to bond buybacks.

The Group’s return on capital employed (ROCE) after tax is as

follows:

(€ million) Net income from operations Average

capital employed ROCE after tax

2014

814.7 13,420.8 6.1% 2013

637.5 12,686.3 5.0%

The increase in the return on capital employed between 2013 and

2014 was primarily due to improved operating performance.

B] FINANCING

The following table summarizes the statement of change in net

financial debt for the years ended December 31, 2014 and December

31, 2013 re-presented.

(€ million)

Year ended December 31, 2014

Year ended December 31, 2013

re-presented

Adjusted operating cash flow (*) 2,172 1,848

Principal payments on operating financial assets excluding

discontinued operations 131 160 Industrial

investments including operating financial assets, excluding

discontinued operations (1,533) (1,411) Industrial

divestitures 63 120 Dividends received from

equity-accounted entities and joint ventures and non-consolidated

investments 80 115 Change in operating WCR excluding

discontinued operations 73 14

Operating Free Cash

Flow before Financial Acquisitions and Divestitures (*)

986 846 Interest paid (497)

(645) Operating cash flow from financing activities 48

88 Taxes paid (207) (202)

Net Free Cash

Flow (*) 330 87 Financial

investments and financial divestitures 143 864 Total

impact of unwinding Dalkia joint venture 2014 and 2013

(**)

348 - Change in receivables and other financial

assets 136 (45) Dividends paid (to shareholders,

minority interests and deeply subordinated security coupons)

(330) (208) Issues of deeply subordinated securities

- 1,470 Other cash flows (19) (1) Non-cash

flows (foreign exchange, remeasurement and other) (475)

211

Change in net financial debt 133

2,378 Net financial debt/Net cash at the beginning

of the period (8,444) (10,822)

Net financial debt/Net cash at the end of the period

(8,311) (8,444)

(*) Before impact of unwinding the Dalkia joint venture

(** )Total impact of +€348M debt reduction; including €155M

recorded as of 12/31/2013 (Dalkia France external debt moved to

liabilities held for sale)

Operating cash flow before changes in working capital

totaled €2,174.6 million for the year ended December 31, 2014,

compared with re-presented €1,960.0 million for the year ended

December 31, 2013, including adjusted operating cash flow of

€2,164.3 million (compared with re-presented €1,847.6 million in

2013), operating cash flow from financing activities of €48.3

million (compared with re-presented €88.7 million in 2013) and

operating cash flow from discontinued operations of -€38 million

(compared with re-presented €23.7 million in 2013).

An analysis of adjusted operating cash flow was previously

presented.

The cash increase associated with operating working capital

requirements (including discontinued operations in the amount

of €33 million) totaled €94 million for the year ended December 31,

2014, compared with re-presented €6 million for the year ended

December 31, 2013 (including discontinued operations in the amount

of -€8 million). Beyond the scope impacts, this increase was

primarily due to the seasonality of Energy activities in Asia.

Industrial investments, including discontinued

operations, break down by segment as follows:

(€ million)

Year ended December 31, 2014

Year ended December 31,

2013 re-presented

France (296) (313) Europe (excluding France)

(597) (365) Rest of the World (376) (268)

Global Businesses (131) (121) Other (133)

(344)

Total industrial investments excluding discontinued

operations (1,533) (1,411)

Industrial investments of discontinued operations (22)

(58)

Total industrial investments

(1,555) (1,469)

Changes in industrial investments (including discontinued

operations) in the year ended December 31, 2014, compared with

re-presented December 31, 2013, was mainly attributable to the

full-year impact of the consolidation of Proactiva, the

consolidation of Dalkia International activities (+€214 million)

and the exit of Dalkia France in the second half of 2014 (-€180

million).

Growth industrial investments (including operating financial

assets) for the year ended December 31, 2014, amounted to €885

million, compared with re-presented €914 million for the year ended

December 31, 2013. Maintenance-related industrial investments in

the year ended December 31, 2014, amounted to €670 million,

compared with re-presented €555 million for the year ended December

31, 2013.

The Group monitors the net free cash flow indicator, a

non-GAAP indicator defined at the end of this press release.

Net free cash flow for the year ended December 31, 2014

(before payment of the dividend) improved significantly,

amounting to €330 million, compared with re-presented €87 million

for the year ended December 31, 2013, and excluding the issuance

(at the beginning of January 2013) of deeply subordinated perpetual

securities denominated in euros and pound sterling in the amount of

€1,454.0 million.

The increase in net free cash flow for the year ended December

31, 2014 reflects the improvement in adjusted operating cash flow

and the tight control over industrial investments and working

capital requirements.

Financial investments for the year ended December 31,

2014 included:

- the buyout of the International Finance

Corporation (IFC) minority interest in Water activities in Central

and Eastern Europe in the amount of €90.9 million,

- the acquisition of Kendall in the

United States for a consideration of €19 million,

- the buyout of IFC and PROPARCO minority

interests in Africa and the Middle East in the amount of €34.8

million.

In 2014, financial divestitures (in enterprise value and

excluding the impact of the unwinding of the Dalkia joint venture)

amounted to €355 million (including transactions between

shareholders) and primarily included the divestiture of the

investment in Marius Pedersen for €240 million.

For the record, in 2013, financial divestitures concerned:

- the divestiture of the 24.95% stake in

Berliner Wasser for €636 million;

- the divestiture of Water activities in

Portugal in the first half of 2013 for an enterprise value of €91

million;

- the divestiture of 19.25% of the shares

held by the Group in the Sharqiyah Desalinisation Company following

the initial public offering on the Oman market of 35% of this

company’s shares, which had a €89 million impact on Group net

financial debt;

- the deconsolidation of practically all

the Group’s Waste activities in Italy following the approval of the

entity’s voluntary liquidation plan (“Concordato preventivo di

gruppo”), which had a €90 million impact on Group net financial

debt.

C] PRO FORMA FINANCIAL

INFORMATION

Pro forma figures in connection with the shareholder

restructuring of Energy activities

These figures include the 12 months’ contribution of Dalkia

International at 100% and exclude Dalkia operations in France.

These figures do not include any restatement of internal

chargebacks between the various entities or the impact of any net

synergies:

Year ended December 31,

2014 pro forma

Year ended December 31, 2013 re-presented pro forma %

Change % Change at constant exchange rates

Revenue

24,408.4 23,952.7 +1.9% +2.4%

Adjusted operating cash flow 2,308.1

2,138.1 +8.0% +8.4%

Industrial investments

(including operating financial assets) 1,567.4

1,459.1 +7.4% n/a

Adjusted operating cash flow improved overall compared with 2013

re-presented figures, due to the sharp improvement in the

profitability of Water and Waste activities, particularly outside

of France and despite the unfavorable weather conditions in 2014

for Dalkia International activities.

Pro forma segment reporting in 2014 and 2013

These figures include the 12 months’ contribution of Dalkia

International at 100% and exclude Dalkia operations in France.

These figures do not include any restatement of internal

chargebacks between the various entities or the impact of any net

synergies:

Revenuein € millions

Year ended December 31,

2014pro forma Year ended December 31, 2013

re-presentedpro forma % Change % Change at

constant exchange rates France 5,573.2 5,656.6

-1.5% -1.5% Europe, excluding France 8,476.7 8,786.4 -3.5%

-3.9% Rest of the world 4,770.0 4,264.0 +11.9% +14.5% Global

businesses 4,538.9 4,198.6 +8.1% +9.0% Other 1,049.6

1,047.1 +0.2% -0.1%

Total

24,408.4 23,952.7 +1.9%

+2.4% Adjusted operating cash flowin € millions

Year ended December 31, 2014pro forma

December 31, 2013 re-presentedpro forma %

Change % Change at constant exchange rates France

537.0 576.9 -6.9% -6.9% Europe, excluding

France 935.2 960.6 -2.6% -2.6% Rest of the world 564.2 401.4 +40.6%

+42.3% Global businesses 206.3 185.6 +11.2% +12.1% Other

65.4 13.6 - -

Total

2,308.1 2,138.1 +8.0%

+8.4% Industrial investments in € millions

Year ended December 31, 2014pro forma Year

ended December 31, 2013 re-presented1pro forma

% Change France 295.7 312.8 -5.5%

Europe, excluding France 689.6 616.1 +11.9% Rest of the world 387.9

313.6 +23.7% Global businesses 130.9 121.3 7.9% Other 63.3

95.3 -33.6%

Total 1,567.4

1,459.1 +7.4%

D] NEW FINANCIAL

INDICATORS

For the dual purpose of better presentation of operating

performance and comparability with other sector companies, the

Group decided to introduce new financial indicators starting fiscal

year 2015 which will be utilized to communicate the Group’s

financial results.

These new indicators are:

- EBITDA,

- Current Operating Income,

(COI) and

- Current Net Income.

EBITDA, which replaces Adjusted operating cash flow, will

comprise the sum of all operating income and expenses received and

paid (excluding restructuring costs and renewal expenses) and

principal payments on operating financial assets.

To calculate Current Operating Income, the following

items will be excluded from operating income:

- Goodwill impairments of fully

controlled subsidiaries and equity-accounted entities,

- Restructuring charges,

- Capital gains on financial divestments,

which will now be considered as an item within net finance

costs,

- One-time and/or significant impairment

of non-current assets (tangible, intangible and operating financial

assets , and

- Impacts relating to the application of

IFRS 2 “Share-based payment”.

Current Operating Income replaces Adjusted Operating

Income. The Group wished to replace the current indicator by

current operating income to allow for the definition of a level of

operating performance that can be used to adopt a forecast

approach.

The following table shows the transition from EBITDA to

Current Operating Income.

EBITDA

-

Renewal costs - Principal payments on operating

financial assets + Share of net income (loss) of equity-accounted

entities, excluding goodwill impairment and gains or losses on

disposal of equity-accounted entities - Depreciation and

amortization charges - Net charges to operating provisions,

(excluding impairment of non-current assets) + Gains or losses on

industrial divestitures - Fair value and other

adjustments

Current Operating Income

EBITDA and Current Operating Income will be included in

the aggregates for the publication of our segment reporting as from

fiscal 2015.

Current Net Income, which will replace Adjusted Net

Income, will comprise the sum of the following items:

- Current Operating Income,

- Current net finance cost items,

- Other current financial income and

expenses, including capital gains or losses on financial

divestments (of which gains or losses included in the share of net

income of equity-accounted entities),

- Current income tax items, and

- Minority interests (excluding the

portion of minority interests relative to non-current items in the

income statement).

The share of net income of other equity-accounted entities is

not viewed as an extension of the Group’s core activities and net

income of discontinued operations will be excluded from Current Net

Income.

Where necessary, the items used to describe the Group’s

financial performance will be compared with the indicators defined

by IFRS.

These new financial indicators do not change the definition of

the Group’s net Free Cash Flow, net financial debt, published net

income or gross industrial investments.

Based on pro forma figures for the year ended December 31, 2014,

these new indicators are as follows:

- EBITDA €2,763.3 million

- Current Operating Income €1,074.0

million

- Current Net Income €314.5 million

The transition between the current indicators and these new

indicators is presented in the following tables:

Transition from Adjusted operating cash flow to EBITDA

€ million

Year ended December 31, 2014 pro forma

Adjusted operating cash flow 2,308.1

Excluded

items:

Renewal costs +263.5 Restructuring charges +78.6

Included

items:

Principal payments on operating financial assets +113.1

EBITDA 2,763.3

Transition from Adjusted operating income to Current operating

income

€ million

Year ended December 31, 2014 pro forma Adjusted

operating income 1,106.0

Excluded

items:

Impairment of property, plant and equipment, intangible

assets, and operating financial assets +9.1 Gains (losses)

on disposals of financial assets (42.2) Other +1.1

Current Operating Income 1,074.0

Transition from EBITDA to Current Operating Income

€ million

Year ended December 31, 2014 pro forma EBITDA

2,763.3 Depreciation & Amortization

(1,369,4) Provisions, fair value adjustments and other (11.9) Share

of net income of JVs and associates 68.6 Renewal expenses (263.5)

Principal payments on operating financial assets (113.1)

Current Operating Income 1,074.0

Transition from Adjusted net income to Current Net Income

€ million

Year ended December 31, 2014 pro forma Adjusted

net income (attributable to owners of the Company)

304.3

Excluded

items:

Impairment of property plant and equipment, intangible

assets and operating financial assets +9.1 Other +1.1

Current Net Income (attributable to owners of

the Company)

314.5

APPENDICES

1. Reconciliation of previously published and re-presented data

for the year ended December 31, 2013

€ million Year ended December 31, 2013

published IFRS 5 restatements (1)

Year ended December 31, 2013

re-presented

Revenue 22,314.8 504.9 22,819.7 Adjusted

operating cash flow 1,796.3 51.3 1,847.6

Operating income 490.5 (21.2) 469.3 Operating

income after share of net income (loss) of equity-accounted

entities (2) 669.2 (21.2) 648.0 Adjusted

operating income (3) 921.9 (21.1) 900.8 Net

income attributable to owners of the Company (135.3)

(18.1) (153.4) Adjusted net income attributable to owners of

the Company 223.2 (41.2) 182.0 Gross

investments 1,738.0 - 1,738.0 Net financial

debt 8,176.7 267.7 8,444.4 Loans granted to

joint ventures 2,725.0 - 2,725.0 Adjusted net

financial debt 5,451.7 267.7 5,719.4

(1) Recognition of Morocco activities in continuing

operations

(2) Including the re-presented share of net income (loss) of

joint ventures and associates for the year ended December 31,

2013

(3) Including the re-presented share of adjusted net income

(loss) of joint ventures and associates for the year ended December

31, 2013

2. Accounting definitions

Operating cash flow before changes in working capital, as

presented in the consolidated cash flow statement, is comprised of

three components: operating cash flow from

operating activities (referred to as “adjusted operating

cash flow” and known in French as “capacité d’autofinancement

opérationnelle”) consisting of operating income and expenses

received and paid (“cash”), operating cash

flow from financing activities including cash financial

items relating to other financial income and expenses and

operating cash flow from discontinued

operations composed of cash operating and financial income

and expense items classified in net income from discontinued

operations pursuant to IFRS 5. Adjusted operating cash flow does

not include the share of net income attributable to

equity-accounted entities.

Net finance costs represent the

cost of gross debt, including related gains and losses on interest

rate and currency hedges, less income on cash and cash

equivalents.

Net income (loss) from discontinued

operations is the total of income and expenses, net of tax,

related to businesses divested or in the course of divestiture, in

accordance with IFRS 5.

The new standards, IFRS 10, 11 and 12, have modified existing

indicators or created new indicators that are described below:

- Following application of the new

standards, inter-company loans granted to joint ventures are no

longer deducted from net financial debt. Non-eliminated

inter-company loans are presented in the balance sheet in loans and

financial receivables. As these loans and receivables are not

included in the Group definition of cash and cash equivalents and

these joint ventures no longer generate strictly operating flows in

the consolidated financial statements, the Group now uses in

addition to net financial debt, the indicator adjusted net financial debt. Adjusted net

financial debt is therefore equal to net financial debt less loans

and receivables to joint ventures.

The other indicators were not impacted by the new standards and

are defined as follows:

- The term “internal growth” (or “growth at constant

consolidation scope and exchange rates”) includes growth resulting

from:

- the expansion of an existing contract,