press release

BUSINESS REVIEW FOR THE FIRST

QUARTER OF 2017

Paris - April 26, 2017

KEY FINANCIALS

| In € millions, Total-Share basis |

Q1 2017 |

Q1 2016 |

% Change |

| Gross rental income - Shopping centers |

293.2 |

291.9 |

+0.4 |

| Gross rental income - Other activities |

7.3 |

7.9 |

-8.6 |

| Total gross rental income

total |

300.4 |

299.8 |

+0.2 |

| Management, administrative and other income (fees) |

20.2 |

22.9 |

-12.0 |

| Total revenues |

320.6 |

322.8 |

-0.7 |

OPERATING PERFORMANCE Total revenues

For the first quarter of 2017,

gross rental income (total share) rose to €300.4 million from

€299.8 million for the same period last year, as the

contribution from organic growth offset the impact of disposals

(-€6.3 million).

Shopping center gross rental income (GRI, total share) increased by

0.4%, or €1.3 million, to €293.2 million in the period.

Disposals completed in 2016 and early 2017 had a negative

€5.9 million impact on shopping center GRI while the

contribution from index-linked adjustments was +0.7%.

GRI from other activities amounted to €7.3 million.

Management, administrative and related income (fees) totaled

€20.2 million, down €2.7 million from the first quarter

last year due to seasonal effects.

Total revenues for the first quarter of 2017 reached

€320.6 million, virtually unchanged versus the same period

last year.

Retailer sales

On a rolling twelve-month basis,

retailer sales were up by 0.6%. On a like-for-like portfolio

basis,1 retailer sales in Klépierre's shopping malls declined by

0.6% in Q1 2017 compared to the same quarter last year, mainly due

to negative calendar effects: one less Saturday in January and one

less working day in February 2017. This year, after a downward

trend in January, broadly stable in February, retailer sales

recovered in March. These figures benefited from no contribution of

extensions or recent developments.

In this context, retailers in France (-1.3%), Italy (-2.2%) and

Scandinavia (-0.6%) posted slower sales in the first quarter while

Iberia (+0.4%) and CEE & Turkey (+6.6%) remained solid. In

France, consumers slowed spending ahead of the spring elections

while, in Italy, retailer sales were impacted by increased

competition in Milan.

Leasing activity

Leasing activity was very dynamic.

In the first quarter, Klépierre signed a total of 523 leases,

representing €10.0 million in additional annual minimum

guaranteed rents (excluding contributions from extension and

greenfield projects), a clear acceleration compared to the first

quarter of 2016 (386 leases and €4.2 million in additional

MGR).

Klépierre also accelerated the implementation of its "Destination

Food" strategy, with the introduction of innovative concepts such

as Five Guys (Hoog Catharijne, Alexandrium), Grom (Val d'Europe,

Prado), Johnny Rockets (Lonato), Leon (Hoog Catharijne) and

Wagamama (Prado). New dedicated food areas in Hoog Catharijne

(City Square, Pavillon), Val d'Europe (Place des Étoiles) and the

Prado rooftop are further enhancing the attractiveness of the food

& beverage offering in Klépierre's malls.

Leasing activity in France was bolstered by the launch of the

re-leasing campaign at St.Lazare Paris, which is capturing great

reversion with trendy brands. NYX, Rituals, Levi's, Calzedonia and

Bialetti plan to open new shops while leases with Petit Bateau and

Pylones were renewed. In addition, in the first quarter of 2018,

Sephora will unveil one of its largest stores in the world (and

2nd largest in

France) with a 1,000+ sq.m. store in a new and innovative concept.

These successes underscore the relevance of Klépierre's strategy of

transforming the St. Lazare hub into a disruptive retail

destination. Sephora has also signed 4 additional leases for

Klépierre malls: in Annecy Courier (renewal), Marseille Bourse

(opening), Val d'Europe (new concept) and Villiers-en-Bière

(renewal).

In Spain, the ongoing implementation of the Clubstore® concept in

Plenilunio has triggered an acceleration of renewals and

refurbishments, including Stradivarius and Pull&Bear (both

including a store extension), Okaïdi, C&A, Levi's and Etam. New

tenants, such as Skechers and Lush, are arriving and will further

improve Plenilunio's position as one of the leading platforms in

Madrid for international retailers.

After signing 24 leases with Inditex in 2016, Klépierre signed six

additional leases in the first quarter of 2017, including a

3,000-sq.m. Zara store in Nový Smichov (Prague).

DEBT POSITION AND FINANCING UPDATE

On February 9, 2017, Klépierre

issued a 10-year, €500 million bond with a 1.375% coupon.

[2]

On March 13, 2017, Klépierre announced a share buyback program up

to €500 million. As of April 25, 3,748,000 shares had been

repurchased at an average €35.85 per share, representing an

investment of €134 million.

As of March 31, 2017, the Group's consolidated net debt amounted to

€8,510 million, a reduction of €103 million compared to

year-end 2016. Klépierre's average debt duration remained stable at

6 years and the net cost of debt continued to decrease below

2.0%.

On April 25, 2017, the dividend was paid out to shareholders for a

total amount of €562 million (€1.82 per share for fiscal year

2016).

DEVELOPMENT PIPELINE AND ASSET

ROTATION Successful delivery of two

iconic projects

After three years of construction,

on April 12, 2017, Klépierre unveiled a 17,000-sq.m. extension at

Val d'Europe (near Paris), bringing the French mall's total

sales area to more than 105,000 sq.m. The extension features 30 new

brands, including flagship stores. The Group is currently

implementing the Clubstore® concept through a refurbishment of the

entire shopping center. Between April 12 and April 23,

Val d'Europe received 0.6 million visitors, a 31% increase

compared to the same period last year.[3] Watch the

video here.

On April 6, 2017, the Group officially opened 16,000 sq.m. of new

retail space, leased-up at 85%, at Hoog Catharijne (Utrecht),

the leading mall in the Netherlands. New stores were added to the

shopping center's offering: on the fashion segment (Zara, Zara

Home, Bershka, Stradivarius, NAME IT, WE, Men At Work, Claudia

Sträter, Bijou Brigitte, Manfield, Parfois, Nike,

Jack & Jones, Vero Moda, Sissy-Boy, Timberland), Food

/ Restaurant (Leon, Comptoir Libanais, Burger Federation, Five

Guys, Vapiano, Exki and McDonald's new concept) or Health &

Beauty (Yves Rocher, MAC, Rituals). Between April 5 and April 18,

the newly opened part of Hoog Catharijne received nearly 1.1

million visitors, an 11% increase compared to the same period

last year[4].

Disposals signed for

€213.0 million

Since January 1, 2017, Klépierre

has completed disposals of non-core assets for

€177.3 million[5], across

Europe (Norway, Sweden, France and Spain). Based on 2016 rents, the

implied yield of shopping centers sold amounts to 5.7% while sale

prices are slightly above the last appraised values. In addition,

assets worth €35.7 million are currently under sale or

purchase promissory agreements.

OUTLOOK CONFIRMED

In 2017, Klépierre expects net

rental income to continue to grow on a like-for-like basis, while

operational and financial costs should be further reduced. Assuming

stable or lower net debt, Klépierre expects to generate net current

cash flow per share of between €2.35 and €2.40.

RETAILER SALES like-for-like

change

FOR THE FIRST QUARTER OF 2017

| Countries |

Q1 2017

Year-on-Year Change |

|

France |

-1.3% |

| Belgium |

-1.5% |

| France-Belgium |

-1.3% |

| Italy |

-2.2% |

|

Norway |

0.5% |

|

Sweden |

-0.6% |

| Denmark |

-3.0% |

| Scandinavia |

-0.6% |

|

Spain |

0.9% |

| Portugal |

-0.7% |

| Iberia |

0.4% |

|

Poland |

3.8% |

|

Hungary |

11.4% |

| Czech

Republic |

7.3% |

|

Turkey |

6.5% |

| CEE and Turkey |

6.6% |

| The Netherlands |

N/A |

| Germany |

-2.7% |

| TOTAL |

-0.6% |

TOTAL REVENUES

| In € millions |

Total Share |

|

Group Share |

| Q1 2017 |

Q1 2016 |

|

Q1 2017 |

Q1 2016 |

|

France |

100.4 |

100.3 |

|

82.7 |

83.0 |

| Belgium |

4.4 |

4.1 |

|

4.4 |

4.1 |

| France-Belgium |

104.8 |

104.4 |

|

87.1 |

87.1 |

| Italy |

51.8 |

50.9 |

|

51.0 |

50.0 |

|

Norway |

18.5 |

17.7 |

|

10.4 |

9.9 |

|

Sweden |

16.0 |

17.1 |

|

9.0 |

9.6 |

| Denmark |

14.2 |

13.4 |

|

8.0 |

7.5 |

| Scandinavia |

48.8 |

48.2 |

|

27.4 |

27.0 |

|

Spain |

22.8 |

23.4 |

|

22.0 |

22.6 |

| Portugal |

5.5 |

5.2 |

|

5.5 |

5.2 |

| Iberia |

28.3 |

28.5 |

|

27.5 |

27.8 |

|

Poland |

8.8 |

8.4 |

|

8.8 |

8.4 |

|

Hungary |

5.5 |

5.3 |

|

5.5 |

5.2 |

| Czech

Republic |

7.5 |

6.6 |

|

7.5 |

6.6 |

|

Turkey |

8.2 |

8.7 |

|

7.6 |

8.0 |

| Others |

0.7 |

0.9 |

|

0.7 |

0.8 |

| CEE and Turkey |

30.8 |

30.0 |

|

30.1 |

29.2 |

| The Netherlands |

15.0 |

15.6 |

|

15.0 |

15.6 |

| Germany |

13.6 |

14.3 |

|

13.0 |

13.6 |

SHOPPING CENTERS

GROSS RENTAL INCOME |

293.2 |

291.9 |

|

251.2 |

250.3 |

| Other activities |

7.3 |

7.9 |

|

7.3 |

7.9 |

TOTAL

GROSS RENTAL INCOME |

300.4 |

299.8 |

|

258.4 |

258.3 |

| Management, administrative and related income (fees) |

20.2 |

22.9 |

|

19.2 |

21.7 |

| TOTAL REVENUES |

320.6 |

322.8 |

|

277.7 |

280.0 |

| Equity Accounted Investees* |

22.3 |

23.9 |

|

21.2 |

22.3 |

* Contributions from Equity

Accounted Investees include investments in jointly-controlled

companies and investments in companies under significant influence.

Equity Accounted Investees are accounted for a total value of

€1,425 million as of December 31, 2016.

QUARTERLY REVENUES ON A TOTAL-SHARE

BASIS

| In € millions |

Q1 2017 |

Q4 2016 |

Q3 2016 |

Q2 2016 |

|

France |

100.4 |

106.6 |

101.7 |

102.8 |

| Belgium |

4.4 |

4.4 |

4.4 |

4.2 |

| France-Belgium |

104.8 |

110.9 |

106.1 |

107.0 |

| Italy |

51.8 |

51.4 |

50.6 |

51.8 |

|

Norway |

18.5 |

20.2 |

18.8 |

18.4 |

|

Sweden |

16.0 |

15.6 |

17.7 |

17.5 |

| Denmark |

14.2 |

13.5 |

14.3 |

13.5 |

| Scandinavia |

48.8 |

49.4 |

50.8 |

49.3 |

|

Spain |

22.8 |

22.2 |

23.0 |

23.8 |

| Portugal |

5.5 |

5.1 |

5.3 |

5.1 |

| Iberia |

28.3 |

27.4 |

28.3 |

28.9 |

|

Poland |

8.8 |

8.8 |

8.5 |

8.6 |

|

Hungary |

5.5 |

5.5 |

5.3 |

5.1 |

| Czech

Republic |

7.5 |

7.3 |

6.8 |

6.6 |

|

Turkey |

8.2 |

9.2 |

9.0 |

8.6 |

| Others |

0.7 |

0.8 |

0.4 |

0.8 |

| CEE and Turkey |

30.8 |

31.6 |

30.1 |

29.7 |

| The Netherlands |

15.0 |

15.2 |

15.2 |

15.1 |

| Germany |

13.6 |

13.5 |

15.0 |

14.4 |

SHOPPING CENTERS

GROSS RENTAL INCOME |

293.2 |

299.3 |

296.0 |

296.2 |

| Other activities |

7.3 |

6.8 |

8.0 |

7.9 |

TOTAL

GROSS RENTAL INCOME |

300.4 |

306.1 |

304.0 |

304.1 |

| Management, administrative and related income (fees) |

20.2 |

22.1 |

20.6 |

20.9 |

| TOTAL REVENUES |

320.6 |

328.2 |

324.6 |

325.0 |

| Equity Accounted Investees* |

22.3 |

23.0 |

23.6 |

25.0 |

* Contributions from Equity

Accounted Investees include investments in jointly-controlled

companies and investments in companies under significant influence.

Equity Accounted Investees are accounted for a total value of

€1,425 million as of December 31, 2016.

|

AGENDA |

|

July 25, 2017

|

First-Half 2017 Earnings (press release after market

close)

|

| Investor relations

contacts |

media contacts |

Hubert d'AILLIÈRES

+33 (0)1 40 67 51 37 -

hubert.daillieres@klepierre.com

Julien ROUCH

+33 (0)1 40 67 53 08 - julien.rouch@klepierre.com

|

Lorie LICHTLEN, Burson-Marsteller i&e

+33 (0)1 56 03 13 01 - lorie.lichtlen@bm.com

Camille PETIT, Burson-Marsteller

i&e

+33 (0)1 56 03 12 98 - camille.petit@bm.com |

ABOUT KLÉPIERRE

The leading pure play shopping

center property company in Europe, Klépierre combines development,

property and asset management skills. The company's portfolio is

valued at €22.8 billion at December 31, 2016 and comprises large

shopping centers in 16 countries in Continental Europe which

altogether welcome 1.1 billion visitors per year. Klépierre holds a

controlling stake in Steen & Strøm (56.1%), Scandinavia's

number one shopping center owner and manager. Klépierre is a French

REIT (SIIC) listed on Euronext Paris and included in the CAC Next

20, EPRA Euro Zone and GPR 250 indexes. It is also included in

ethical indexes, such as DJSI World and Europe, FTSE4Good, STOXX®

Global ESG Leaders, Euronext Vigeo France 20 and World 120,

and is ranked as a Green Star by GRESB (Global Real Estate

Sustainability Benchmark). These distinctions underscore the

Group's commitment to a proactive sustainable development

policy.

For more information: www.klepierre.com

This press release is available on

Klépierre's website: www.klepierre.com

[1]

Like-for-like change is on a same-center basis and excludes the

impact of asset sales and acquisitions. Retailer sales from the

Dutch portfolio are not included in these figures since Dutch

retailers do not report sales to Klépierre.

[2] For more

information, please refer to the press release published on

February 9, 2017, available on www.klepierre.com.

[3] For more

information, please refer to the press release published on April

11, 2017, available on www.klepierre.com.

[4] For more

information, please refer to the press release published on April

6, 2017, available on www.klepierre.com.

[5] Total

share, excluding duties.

PR_KLEPIERRE_2016_Q1_REVENUES_26_APRIL_2017_UK_FINAL

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Klépierre via Globenewswire

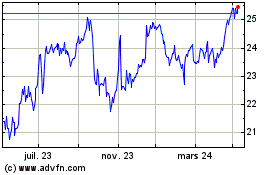

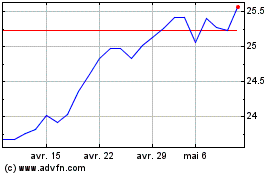

Klepierre (EU:LI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Klepierre (EU:LI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024