AM Best Affirms Credit Ratings of Blue Whale Re Ltd.

04 Avril 2019 - 4:04PM

Business Wire

AM Best has affirmed the Financial Strength Rating of A

(Excellent) and the Long-Term Issuer Credit Rating of “a+” of Blue

Whale Re Ltd. (Blue Whale) (Burlington, VT). The outlook of these

Credit Ratings (ratings) is stable.

The ratings reflect Blue Whale’s balance sheet strength, which

AM Best categorizes as very strong, as well as its strong operating

performance, neutral business profile and appropriate enterprise

risk management (ERM).

The ratings also reflect Blue Whale’s strategic position as the

captive insurer for Pfizer Inc. (Pfizer) [NYSE: PFE], a leading

global pharmaceutical company. As Blue Whale insures or reinsures

Pfizer’s global property exposures, it plays an important role in

Pfizer’s overall ERM and assumes a critical role in protecting the

Pfizer enterprise’s assets.

Blue Whale’s capitalization is very strong, albeit reliant on

its parent. It operates at conservative underwriting leverage

levels; however, it provides coverages with extremely large limits,

and its gross exposures per loss occurrence are elevated. Although

Blue Whale benefits from reinsurance protection, its net retentions

remain very substantial. Reinsurance is provided by a large panel

of reinsurers, and Blue Whale relies on significant capacity to

support its obligations. Therefore, it depends heavily on

reinsurance. Nevertheless, AM Best recognizes the quality of the

reinsurers, and the substantial financial resources and support

available to the captive as part of the Pfizer group.

Due to the nature of the relationship between Blue Whale and

Pfizer, changes in Pfizer’s credit risk can have certain impact on

Blue Whale’s ratings, as it is dependent on Pfizer’s ability to

support its credit risk profile, competitiveness and risk

management. The captive continues to be an integral component of

Pfizer’s risk management platform. AM Best’s view of third-party

credit ratings and Pfizer’s market-based credit risk measures

indicate stability, resulting in Blue Whale’s outlooks being

stable.

The company’s results rebounded in 2018, as the captive

recovered from the impact of Hurricane Maria, which occurred in

late 2017. Resolution of all Hurricane Maria-related claims is

expected by mid-2019, after which time reserves are expected to

return to historical levels.

Positive rating actions could occur if the company’s operating

performance improves to outperform similarly rated peers with

supportive risk-adjusted capitalization. Negative rating action

could occur if underwriting performance weakens and negatively

impacts risk-adjusted capitalization over time, or if there is a

material shift in risk profile that could potentially undermine the

stability and profitability of the company. In addition, negative

rating action could occur if the parent’s credit profile materially

deteriorates.

AM Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit

www.ambest.com/captive.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Understanding Best’s Credit Ratings. For

information on the proper media use of Best’s Credit Ratings and AM

Best press releases, please view Guide for Media - Proper

Use of Best’s Credit Ratings and AM Best Rating Action Press

Releases.

AM Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2019 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190404005470/en/

Dan TeclawSenior Financial Analyst+1 908 439 2200, ext.

5394dan.teclaw@ambest.com

Susan MolineuxDirector+1 908 439 2200, ext.

5829susan.molineux@ambest.com

Christopher SharkeyManager, Public Relations+1 908 439 2200,

ext. 5159christopher.sharkey@ambest.com

Jim PeavyDirector, Public Relations+1 908 439 2200, ext.

5644james.peavy@ambest.com

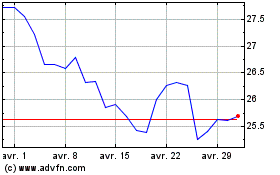

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024