AXA Launches $2 Billion Share Buyback as It Posts Higher Nine-Month Revenues

04 Novembre 2021 - 6:20PM

Dow Jones News

By Ed Frankl

AXA SA said Thursday that it will be launching a share buyback

program worth 1.7 billion euros ($1.97 billion), as it posted

increased nine-month revenues.

The French insurer said the buyback will be launched on or

around Nov. 8 and be complete by the end of April 2022, with the

company canceling all repurchased shares.

The company added that it intends to launch a further buyback in

2022 for up to EUR500 million to neutralize earnings dilution from

disposals after Dec. 1, 2020.

AXA also announced that its nine-month activity indicators, with

total gross revenue of EUR75.97 billion in the January to September

period, compared with EUR73.39 billion last year, driven by its

French business.

The top-line figure is a rise of 4% year-on-year on a reported

basis, or 7% like-for-like.

All business lines and geographies contributed to the growth,

AXA's Chief Financial Officer Alban de Mailly Nesle said in a

statement.

Gross revenues at its property and casualty business grew 5%

like-for-like, while in life and savings, it grew by 12%, notably

on individual savings products in France, AXA said.

At the company's U.S. subsidiary AXA XL, gross revenues rose 6%

on a comparable basis. The company said Hurricane Ida losses in the

summer were estimated at around EUR400 million.

The company's closely watched Solvency II ratio was 214% at

Sept. 30, up 2 percentage points from the end of the second

quarter.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

November 04, 2021 13:05 ET (17:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

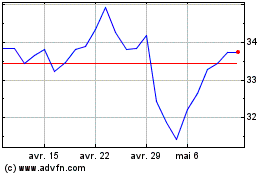

Axa (EU:CS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Axa (EU:CS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024