Continued sales growth, +3.5% for the quarter

Selective investment decisions in an environment rich in

opportunities

Regulatory News:

Air Liquide (Paris:AI):

Key Figures (in millions of

euros)

Q3 2019

2019/2018

as published

2019/2018 comparable

(a)

Group Revenue

5,454

+3.5%

+3.5%

of which Gas & Services

5,242

+3.5%

+3.5%

of which Engineering &

Construction

81

-22.9%

-24.6%

of which Global Markets &

Technologies

131

+31.4%

+29.7%

(a) Growth excluding the currency, energy (natural gas and

electricity), and significant scope impacts; see reconciliation in

appendix.

Commenting on the 3rd quarter of 2019, Benoît Potier,

Chairman and CEO of Air Liquide, stated:

“Sales growth continued this quarter, with Group revenue

amounting to 5.5 billion euros, up 3.5%. Growth was driven by all

Gas & Services activities, which represent 96% of the Group's

sales, as well as our Global Markets & Technologies business.

Positive currency and significant scope impacts offset lower energy

prices.

All Gas & Services activities grew on a comparable basis,

despite a more moderate global growth. Healthcare and Electronics

were particularly dynamic, and Industrial Merchant and Large

Industries remained solid. Geographically, our business continued

to grow in every region in the world, particularly across Asia and

Europe.

In addition, the Group continued to implement its operational

efficiency program, which reached 310 million euros over the first

nine months of 2019, in line with the annual target of more than

400 million euros. Operating cash flow growth was clearly higher

than sales growth. The investment cycle remained particularly well

oriented, with a large number of opportunities 12 months out.

Investment decisions, which ensure future growth, increased sharply

in the 3rd quarter and totaled 2.7 billion euros at the end of

September.

Assuming a comparable environment, Air Liquide is confident

in its ability to deliver net profit growth in 2019, at constant

exchange rates.”

Highlights of the 3rd quarter

- Large Industries: signature of three long-term

contracts, in the United States Gulf Coast, with Methanex; in

Canada, with Shell Chemicals; and in the Philippines, with

Pilipinas Shell. Completion of the sale to Fujian Shenyuan of the

production complex.

- Industrial Merchant: launch of Qlixbi, a disruptive

innovation that combines technical and digital innovation in

the field of welding.

- Environment: participation in two innovative projects

to fight climate change, the Northern Lights CO2 capture and

storage project in Norway, and with thyssenkrupp Steel to reduce

carbon emissions linked to steel production.

- Corporate: successful launch of a 500 million dollars

long-term bond issue to fund long-term growth at a historically low

interest rate.

Group revenue for the 3rd quarter of 2019 totaled

5,454 million euros, up +3.5% on a comparable

basis. Gas & Services posted robust comparable sales growth

(+3.5%), in spite of a softening economic environment. In

Engineering & Construction, sales to third-party customers were

stable compared with the 2nd quarter, with resources mainly

attributed to internal Large Industries and Electronics projects.

Global Markets & Technologies continued its strong development

with growth of +29.7%.

The currency impact remained positive at +2.1% this quarter,

whereas the energy impact, which was neutral during the 1st half,

was unfavorable during the 3rd quarter (-2.7%). The acquisition of

Tech Air in the United States at the end of the 1st quarter of 2019

generated a significant scope impact of +0.6%. Published 3rd

quarter Group revenue growth was also therefore

+3.5%.

Gas & Services revenue for the 3rd quarter of 2019

reached 5,242 million euros, up +3.5% on a comparable

basis. Published sales were also up +3.5%, with the

unfavorable energy impact (-2.9%) offset by the favorable currency

impact (+2.2%) and the consolidation of Tech Air acquired in the

United States at the end of the 1st quarter, accounted for as the

significant scope (+0.7%).

- Gas & Services revenue in the Americas amounted to

2,137 million euros, an increase of +2.0% during the

3rd quarter of 2019. Large Industries sales were up +0.6%, affected

by customer maintenance turnarounds in the United States.

Industrial Merchant revenue posted resilient growth of +1.1%,

mainly driven by higher pricing. Electronics growth stood at +1.5%

and Healthcare continued to improve markedly (+11.1%).

- Revenue in the Europe zone reached 1,742 million

euros over the quarter, up +3.3%, driven mainly by good

Healthcare sales momentum (+4.8%) and strong growth in Industrial

Merchant (+4.6%). Large Industries sales (+0.6%) benefited from

high hydrogen demand from refiners in the Benelux, but activity was

weaker in Germany and Southern Europe.

- Revenue in Asia Pacific totaled 1,207 million

euros in the 3rd quarter of 2019, up +7.2%. Sales growth

in Large Industries (+10.3%) benefited from several start-ups in

the 4th quarter of 2018 in China, including the last contributions

from Fujian Shenyuan. Industrial Merchant sales growth (+3.7%) was

in line with that of the 2nd quarter overall. Electronics continued

to enjoy strong revenue growth in the 3rd quarter (+7.3%) despite a

marked decrease in Equipment & Installation sales compared with

a particularly high level in the 3rd quarter of 2018.

- Revenue in Middle East and Africa amounted to 156

million euros, up +1.5% over the quarter. Large

Industries activity was up slightly. Industrial Merchant remained

very dynamic in the Middle East, Egypt and India, with strong

helium sales in particular.

In line with the 1st half of the year, all businesses

contributed to the growth of Gas & Services revenue, in

particular Healthcare and Electronics. Large Industries

(+3.3%) benefited notably from the contribution to sales of

several ramp-ups in Asia, including the last contributions from

Fujian Shenyuan, and to a lesser extend in Europe. In a softening

economic environment, growth in Industrial Merchant stood at

+2.4%, driven mainly by successful pricing management,

growth in consumer-related markets and a favorable number of

working days. Sales growth was high in Healthcare

(+5.9%), in particular in Home Healthcare in Europe and in

Latin America, and in Medical Gases in the United States.

Electronics maintained a significant increase in revenue

(+5.8%) despite a high basis of comparison, as Equipment

& Installation (E&I) sales were very strong during the 3rd

quarter of 2018 ; growth stood at +8.6% excluding E&I.

Consolidated Engineering & Construction revenue, at

81 million euros, was stable compared with the 2nd quarter,

with resources mainly attributed to internal Large Industries and

Electronics projects.

Global Markets & Technologies sales were up

+29.7% in the 3rd quarter at 131 million euros.

Biomethane remained the main contributor to growth, with the

ramp-up of several units in Europe. Equipment sales related to the

Turbo‑Brayton technology, which enables the cryogenic refrigeration

and reliquefaction of natural gas when transported by sea, also

posted strong growth.

Efficiency gains reached 310 million euros

since the beginning of the year, up more than +20% compared with

end‑September 2018 and slightly ahead of the annual objective,

reinforced and now fixed at more than 400 million euros.

Cash flows from operating activities before changes in

working capital requirements amounted to 3,458 million

euros for the first 9 months of the year, an increase of

+8.8% excluding IFRS16, which was largely higher than the

increase in sales as published (+6.3%). It stood at the high level

of 21.1% of sales and at 19.9% excluding IFRS16. Net

capital expenditure1 totaled 1,834 million euros, up +10.8%

compared with end-September 2018, and represented 11.2% of

sales, in line with the NEOS strategic plan.

Industrial and financial investment decisions totaled

2.7 billion euros since the beginning of the year, including

the acquisition of Tech Air in the United States completed at the

end of the 1st quarter. Industrial decisions were up markedly by

about +20%. The strong momentum of investment projects continued

with the 12-month portfolio of opportunities reaching 2.8

billion euros.

1 Including transactions with minority shareholders

3rd QUARTER 2019 REVENUE

Except where indicated, all revenue and operating income

recurring growth discussed below are made on a comparable

basis, excluding the currency, energy and significant scope

impacts. The reference to Airgas corresponds to the Group’s

Industrial Merchant and Healthcare activities in the United

States.

Analysis of 3rd quarter 2019 revenue

REVENUE

Revenue (in millions of euros)

Q3 2018

Q3 2019

2019/2018 published

change

2019/2018 comparable

change

Gas & Services

5,066

5,242

+3.5%

+3.5%

Engineering & Construction

105

81

-22.9%

-24.6%

Global Markets & Technologies

100

131

+31.4%

+29.7%

TOTAL REVENUE

5,271

5,454

+3.5%

+3.5%

Revenue by quarter (in millions of

euros)

Q1 2019

Q2 2019

Q3 2019

Gas & Services

5,237

5,299

5,242

Engineering & Construction

93

83

81

Global Markets & Technologies

111

129

131

TOTAL REVENUE

5,441

5,511

5,454

2019/2018 Group published

change

+8.6%

+7.0%

+3.5%

2019/2018 Group comparable

change

+5.0%

+4.7%

+3.5%

2019/2018 Gas & Services comparable

change

+4.8%

+5.0%

+3.5%

Group

Group revenue for the 3rd quarter of 2019 totaled 5,454

million euros, up +3.5% on a comparable basis. Gas &

Services posted robust comparable sales growth (+3.5%), in

spite of a softening economic environment. In Engineering &

Construction, sales to third-party customers were stable compared

with the 2nd quarter, with resources mainly attributed to internal

Large Industries and Electronics projects. Global Markets &

Technologies continued its strong development with growth of

+29.7%.

The currency impact remained positive at +2.1% this quarter,

whereas the energy impact, which was neutral during the 1st half,

was unfavorable during the 3rd quarter (-2.7%). The acquisition of

Tech Air in the United States at the end of the 1st quarter of 2019

generated a significant scope impact of +0.6%. Published 3rd

quarter Group revenue growth was also therefore

+3.5%.

Gas & Services

Gas & Services revenue for the 3rd quarter of 2019 reached

5,242 million euros, up +3.5% on a comparable basis.

All businesses contributed to growth and in particular Healthcare

and Electronics. Large Industries (+3.3%) benefited notably

from the contribution to sales of several ramp-ups in Asia,

including the last contributions from Fujian Shenyuan, and to a

lesser extend in Europe. In a softening economic environment,

growth in Industrial Merchant stood at +2.4%, driven mainly

by successful pricing management (+3.8%), growth in

consumer-related markets and a favorable number of working days.

Sales growth was high in Healthcare (+5.9%), in particular

in Home Healthcare in Europe and in Latin America, and in Medical

Gases in the United States. Electronics maintained a significant

increase in revenue (+5.8%) despite a high basis of

comparison, as Equipment & Installation (E&I) sales were

very strong during the 3rd quarter of 2018 ; growth stood at +8.6%

excluding E&I.

Published sales were also up +3.5%, with the

unfavorable energy impact (-2.9%) offset by the favorable currency

impact (+2.2%) and the consolidation of Tech Air acquired in the

United States at the end of the 1st quarter, accounted for as the

significant scope (+0.7%).

Revenue by geography and business

line (in millions of euros)

Q3 2018

Q3 2019

2019/2018 published

change

2019/2018 comparable

change

Americas

2,017

2,137

+5.9%

+2.0%

Europe

1,779

1,742

-2.0%

+3.3%

Asia-Pacific

1,099

1,207

+9.9%

+7.2%

Middle East & Africa

171

156

-9.1%

+1.5%

GAS & SERVICES REVENUE

5,066

5,242

+3.5%

+3.5%

Large Industries

1,454

1,374

-5.6%

+3.3%

Industrial Merchant

2,312

2,471

+6.9%

+2.4%

Healthcare

862

915

+6.1%

+5.9%

Electronics

438

482

+10.2%

+5.8%

Americas

Gas & Services revenue in the Americas amounted to 2,137

million euros over the quarter, an increase of +2.0%.

Large Industries sales were up +0.6%, affected by customer

maintenance turnarounds in the United States. Industrial Merchant

revenue posted resilient growth of +1.1%, mainly driven by higher

pricing. Electronics growth stood at +1.5% and Healthcare continued

to improve markedly (+11.1%).

- Large Industries revenue was up +0.6%. In the

United States, air gases and hydrogen volumes were down due to

several customer maintenance turnarounds and weaker demand for

oxygen. Nonetheless, sales benefited from the solid growth of the

cogeneration activity in the United States and strong momentum in

Latin America, in particular in Mexico, with the start-up of a

hydrogen-supply contract during the 2nd quarter, and in Brazil with

the commissioning of a nitrogen pipeline at the end of the 1st

quarter.

- Industrial Merchant sales posted resilient growth of

+1.1%, driven by higher pricing of +4.7% and a favorable

number of working days. In North America, gas sales were up in

Research and in consumer-related markets such as Food and

Pharmaceuticals while they were down in industrial sectors such as

Construction and Metal Fabrication. Hardgoods revenue declined

markedly in the United States, mainly due to the slowdown in

industrial sectors. Moreover, 3rd quarter sales included the impact

of the disposal during the 2nd quarter of an Airgas safety services

business. In South America, double-digit growth was driven in

particular by a strong volume increase of liquid gas in

Brazil.

- Healthcare revenue was up +11.1%. Medical Gases

sales growth was solid in the United States, in particular with

proximity care players where cylinders with a digital interface

have enjoyed significant success. Activity remained very strong in

Latin America, in particular in Colombia.

- Electronics sales were up +1.5% driven by high

Carrier Gases sales growth.

Americas

- Air Liquide and Shell Chemicals announced in late July

the renewal of contracts for the supply of oxygen,

nitrogen, steam and electricity to Shell’s Scotford facility in

Alberta, Canada. To support this renewed long‑term

commitment, Air Liquide will further enhance its Scotford site

operations, which will support future growth in this key industrial

basin and create additional operational efficiencies

Europe

Revenue in the Europe zone reached 1,742 million euros

over the quarter, up +3.3%, driven mainly by good Healthcare

sales momentum (+4.8%) and strong growth in Industrial Merchant

(+4.6%). Large Industries sales (+0.6%) benefited from high

hydrogen demand from refiners in the Benelux, but activity was

weaker in Germany and Southern Europe.

- Large Industries revenue was up +0.6%. Markedly

higher hydrogen sales in the Benelux were boosted by high demand

from refiners connected to the pipeline network. Activity was

weaker in Germany in Steel and Chemicals, as well as in Italy in

Steel. Business continued to grow in Eastern Europe.

- Industrial Merchant sales were up strongly

(+4.6%), with almost all countries contributing to growth.

This was mainly driven by high price impacts (+3.3%), the

development of the Pharmaceuticals and Food markets, and a positive

working day impact. Gas volumes per working day were stable.

Revenue in Eastern Europe continued to enjoy double-digit

growth.

- In Healthcare, sales growth was strong at +4.8%,

with scope impact (non-significant) being unfavorable this quarter

due to the disposal in Germany of a non-core business in Hygiene.

Home Healthcare momentum was strong with, in particular, a marked

increase in the number of diabetic patients treated in Scandinavia

and France, and sleep apnea patients treated in France. Medical

Gases sales for hospitals improved despite constant price

pressure.

Europe

- In July, Air Liquide and thyssenkrupp Steel announced to

join forces in a pioneering project to develop lower carbon

steel production. For the first time, hydrogen will be injected

to partially replace pulverized coal at a large scale in the blast

furnace during steel production reducing carbon emissions. Air

Liquide will ensure to its client a stable supply of hydrogen from

its 200 km network in the Rhine-Ruhr Area.

- Air Liquide announced in mid-October a partnership with

ArcelorMittal in a pilot project in Belgium to capture

CO2 emissions from the steelmaking process and recycle them into

bioethanol. Air Liquide Engineering & Construction will

provide a technology solution to purify the offgas coming from the

blast furnace. These gases will then be injected into a bioreactor

to produce bioethanol.

- In October, Air Liquide announced the signature of a

long-term contract in Kazakhstan. Air Liquide

Munay Tech Gases, a company jointly owned by Air Liquide (75%)

and the Kazakhstan national oil & gas company (25%), will

build, own and operate a new nitrogen unit in a growing chemical

basin, requiring a 15 million euros investment. This new

unit will supply up to 8,000 Nm3/h nitrogen and should be

operational in 2021.

Asia-Pacific

Revenue in Asia Pacific totaled 1,207 million euros in

the 3rd quarter of 2019, up +7.2%. Sales growth in Large

Industries (+10.3%) benefited from several start-ups in the 4th

quarter of 2018 in China, including the last contributions from

Fujian Shenyuan. Industrial Merchant sales growth (+3.7%) was in

line with that of the 2nd quarter overall. Electronics continued to

enjoy strong revenue growth in the 3rd quarter (+7.3%) despite a

marked decrease in Equipment & Installation sales compared with

a particularly high level in the 3rd quarter of 2018.

- Large Industries sales (+10.3%) benefited in

particular from three major start-ups in China during the 4th

quarter of 2018, including the last two months of contribution from

Fujian Shenyuan, the disposal of which was finalized at the

beginning of September. Moreover, hydrogen sales to refiners also

improved markedly in Singapore.

- In Industrial Merchant, revenue was up +3.7%, in

line with 2nd quarter growth. In China, cylinder gas volumes

continued to improve significantly. In South-East Asia, sales also

enjoyed sustained growth. Moreover, helium sales were high across

the region. The price impacts in the region made a positive

contribution (+0.4%) compared with the previous year, and was lower

than in the 2nd quarter. Indeed, liquid gases had enjoyed

exceptionally high price impacts in China during the 3rd quarter of

2018.

- Electronics revenue posted growth of +7.3%, and

above +10% excluding Equipment & Installations. Carrier Gases

sales benefited from the ramp-up of units in China, Japan, Taiwan

and Singapore. The success of the new enScribeTM offering for the

etching of electronic chips contributed to the strong development

of Advanced Materials, in particular in Korea.

Asia-Pacific

- In mid-September, Air Liquide announced the signature of a

long-term contract for the supply of hydrogen to Shell’s

Tabangao refinery in Batangas, Philippines. Air Liquide will invest

30 million euros in the construction of a state-of-the-art

Hydrogen Manufacturing Unit (HMU) that will be fitted with a CO2

recovery unit that mitigates direct carbon emission levels by

capturing and liquifying the CO 2 for other uses.

Middle East and Africa

Revenue in Middle East and Africa amounted to 156 million

euros, up +1.5% over the quarter. Large Industries

activity was up slightly. Industrial Merchant remained very dynamic

in the Middle East, Egypt and India, with strong helium sales in

particular. Development continued in Healthcare in Egypt and Saudi

Arabia.

Engineering & Construction

Consolidated Engineering & Construction revenue, at 81

million euros, was stable compared with the 2nd quarter, with

resources mainly attributed to internal Large Industries and

Electronics projects. Total sales including Group projects

continued to grow double digit.

Order intake for the Group and third-party customers reached

500 million euros since the beginning of the year. These

orders came from the Americas, followed by Asia and Europe. More

than half of this order intake related to Air Separation Units for

Large Industries and ultra-pure nitrogen production units for the

semi-conductor industry.

Global Markets & Technologies

Global Markets & Technologies sales were up +29.7% in

the 3rd quarter at 131 million euros. Biomethane remained

the main contributor to growth, with the ramp-up of several units

in Europe. Equipment sales related to the Turbo‑Brayton technology,

which enables the cryogenic refrigeration and reliquefaction of

natural gas when transported by sea, also posted strong growth.

Order intake for Group projects and third-party customers

totaled 362 million euros since the beginning of the year,

an increase of +9.2%.

Innovation

- In early September, Air Liquide signed a Memorandum of

Understanding with Equinor and its partners (Shell and Total) to

explore collaboration in a CO2 capture and storage project,

Northern Lights. The Northern Lights project is aimed to mature

the development of offshore carbon storage on the Norwegian

Continental Shelf and has the potential to be the first storage

project site in the world receiving CO2 from industrial sources in

several European countries.

- In mid-September, Air Liquide announced the launch of

Qlixbi, a breakthrough packaged gas offer including a new

generation of gas cylinder and a suite of digital solutions

designed to revolutionize the customer experience in welding.

Developed in collaboration with more than 700 welding customers,

this innovation will improve the way they use and manage gases in

their daily operations thanks to a revolutionary connector (“Click

& Weld”), a reserve indicator on the cylinder combined with an

IoT (“Internet of Things”) system and a digital application.

Investment cycle

The strong momentum of investment projects continued and was

reflected in the high level of the main indicators described

below.

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

Industrial and financial investment decisions totaled 983

million euros for the 3rd quarter of 2019, i.e., a total of 2.7

billion euros since the beginning of the year. This amount

included the acquisition of Tech Air in the United States, which

was completed at the end of the 1st quarter. Industrial

investment decisions were up markedly by around +20% over the

first nine months and accounted for almost all decisions during the

3rd quarter. These included two major investments in the United

States in Large Industries: one new Air Separation Unit connected

to Air Liquide’s pipeline network on the Gulf Coast and a project

including one new Air Separation Unit, new syngas production

capacities and the replacement of existing assets by more efficient

units. Investments in Electronics in Asia continued, and those

contributing to efficiencies were up around +60% compared with the

first nine months of 2018, representing more than 10% of the amount

of industrial decisions.

The total investment backlog amounted to 2.5 billion

euros, an increase of more than 200 million euros compared with

the end of June 2019, with new investment decisions more than

offsetting the start-up of new units. These investments should lead

to a future contribution to annual sales of approximately 0.9

billion euros per year after a full ramp-up of the units.

Investment decisions

- In mid-September, Air Liquide announced an investment of

more than 270 million US dollars in the U.S. Gulf Coast to

support a new long-term agreement with Methanex Corporation

to supply oxygen, nitrogen and utilities. To serve Methanex

and its other customers in the industrial basin that encompases

Geismar and Baton Rouge, Air Liquide will build two new Air

Separation Units with a capacity of 2,500 tons/day of oxygen

each and invest in connected infrastructure assets -

increasing the company’s Mississippi River Pipeline’s

supply capacity by more than 25%.

START-UPS

Five new units started up during the 3rd quarter of 2019.

These mainly included the start-up of several units for

Electronics in Asia producing air gases, ultra-pure

nitrogen, Advanced Materials and carbon dioxide. In Large

Industries, a new pipeline network in the Middle East and an

extension of the pipeline network in Northern Europe were

commissioned.

The contribution to sales of these unit start-ups and

ramp-ups totaled 98 million euros over the 3rd quarter of

2019 and 283 million euros since the beginning of the year. This

mainly included additional sales relating to Large Industries unit

start-ups in the 4th quarter of 2018 in China, including the last

contributions from Fujian Shenyuan following the finalization of

its disposal at the beginning of September, unit start-ups for

Electronics customers in Asia and unit ramp-ups for Large

Industries in Europe. Over 2019, contribution forecasts have been

upgraded and should approximate 320 million euros.

PORTFOLIO OF OPPORTUNITIES

The 12-month portfolio of opportunities totaled 2.8

billion euros, a slight increase compared with 2.7 billion

euros at the end of June 2019. New projects entering the portfolio

offset those signed by the Group, awarded to the competition or

delayed.

As the major investments decided in the United States during the

3rd quarter have been removed from the portfolio, Asia became the

leading region with one third of opportunities, followed by Europe,

the Americas and the Middle East. Almost two thirds of the

portfolio of opportunities came from Large Industries, in

particular from Chemicals. The Integrated Circuit industry for

Electronics was the second largest contributor.

For more than half of the projects, the amount of investment was

below 50 million euros. It was between 100 and 200 million euros

for five projects. Almost one quarter of the portfolio of

opportunities contributed to the Climate Objectives.

Operating Performance

The Group’s efficiency gains reached 113 million euros in the

3rd quarter and 310 million euros since the beginning of the

year, up more than +20% compared with end-September 2018. They are

slightly ahead of the annual objective now fixed at more than 400

million euros, following the reinforcement of the program since the

beginning of the year.

The increase in efficiencies was driven by four main factors.

The roll-out of a continuous improvement approach carried on

across the various entities, in particular at Airgas where the

contribution to efficiencies is gathering pace. The Group has also

continued its transformation with the commissioning of

shared platforms, notably the launch of the European business

support center in Lisbon, and the continued roll-out of digital

tools such as the remote operation and optimization centers for

Large Industries production units (Smart Innovative Operations,

SIO). Contributions to efficiencies from digital tools increased.

The streamlining of oxygen supply network in Home Healthcare and

the renewal of the bulk logistics chain in Asia showcased the

constant efforts in place to optimize the supply chain.

Purchasing gains accounted for more than 25% of

efficiencies.

Cash flows from operating activities before changes in

working capital requirements amounted to 3,458 million

euros for the first nine months of the year, an increase of

+8.8% excluding IFRS16, which was largely higher than the

increase in sales as published (+6.3%). It stood at the high level

of 21.1% of sales and at 19.9% excluding IFRS16. Net

capital expenditure2 totaled 1,834 million euros, up +10.8%

compared with end-September 2018, and represented 11.2% of

sales, in line with the NEOS strategic plan. Net debt

excluding the liabilities linked to leases (IFRS16) reached

13,249 million euros at September 30, 2019. The net

debt to equity ratio, adjusted for the seasonal effect of

the dividend, stood at 66.9%.

2 Including transactions with minority shareholders

Bonds

- In early September, Air Liquide issued bonds on the American

bond market for an amount of 500 million U.S dollars with a

10-year maturity at a yield of 2.362%. With this transaction,

the Group confirms its willingness to foster long-term

relationships with American credit investors.

Outlook

Sales growth continued this quarter, with Group revenue

amounting to 5.5 billion euros, up +3.5%. Growth was driven by all

Gas & Services activities, which represent 96% of the Group's

sales, as well as the Global Markets & Technologies business.

Positive currency and significant scope impacts offset lower energy

prices.

All Gas & Services activities grew on a comparable basis,

despite a more moderate global growth. Healthcare and Electronics

were particularly dynamic, and Industrial Merchant and Large

Industries remained solid. Geographically, business continued to

grow in every region in the world, particularly across Asia and

Europe.

In addition, the Group continued to implement its operational

efficiency program, which reached 310 million euros over the first

nine months of 2019, in line with the annual target of more than

400 million euros. Operating cash flow growth was clearly higher

than sales growth. The investment cycle remained particularly well

oriented, with a large number of opportunities 12 months out.

Investment decisions, which ensure future growth, increased sharply

in the 3rd quarter and totaled 2.7 billion euros at the end of

September.

Assuming a comparable environment, Air Liquide is confident in

its ability to deliver net profit growth in 2019, at constant

exchange rates.

APPENDICES

Performance indicators

Performance indicators used by the Group that are not directly

defined in the financial statements have been prepared in

accordance with the AMF position 2015-12 about alternative

performance measures.

The performance indicators on revenue are the following:

- Currency impact

- Energy impact

- Significant scope impact

- Comparable sales change

CURRENCY IMPACT

Since industrial and medical gases are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the euro zone.

The currency impact is calculated based on the

aggregates for the period converted at the exchange rate for the

previous period.

ENERGY IMPACT

In addition, the Group passes on variations in the cost of

energy (electricity and natural gas) to its customers via indexed

invoicing integrated into their medium and long-term contracts.

This indexing can lead to significant variations in sales (mainly

in the Large Industries Business Line) from one period to another

depending on fluctuations in prices on the energy market.

An energy impact is calculated based on the sales of each

of the main subsidiaries in Large Industries. Their consolidation

allows the determination of the energy impact for the Group as a

whole. The foreign exchange rate used is the average annual

exchange rate for the year N-1.

Thus, at the subsidiary level, the following formula provides

the energy impact, calculated for natural gas and electricity

respectively:

Energy impact = Share of sales index to energy year (N-1) x

(Average energy price over the year (N) - Average energy price over

the year (N-1))

This indexation effect of electricity and natural gas does not

impact the operating income recurring.

SIGNIFICANT SCOPE IMPACT

The significant scope impact corresponds to the impact on

sales of all acquisitions or disposals of a significant size for

the Group. These changes in scope of consolidation are

determined:

- for acquisitions during the period, by deducting from the

aggregates for the period the contribution of the acquisition,

- for acquisitions during the previous period, by deducting from

the aggregates for the period the contribution of the acquisition

between January 1 of the current period and the anniversary date of

the acquisition,

- for disposals during the period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity as of the anniversary date of the disposal,

- for disposals during the previous period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity.

COMPARABLE SALES CHANGE

Comparable sales change excludes the currency, energy and

significant scope impacts described above.

Comparable sales growth for the 3rd quarter 2019 was calculated

as follow:

(in millions of euros)

Q3 2019

Q3 2019/2018 Published

Change

Currency impact

Natural gas impact

Electricity impact

Significant scope

impact

Q3 2019/2018 Comparable

Change

Revenue

Group

5,454

+3.5%

111

(134)

(12)

35

+3.5%

Impacts in %

+2.1%

-2.5%

-0.2%

+0.6%

Gas & Services

5,242

+3.5%

107

(134)

(12)

35

+3.5%

Impacts in %

+2.2%

-2.7%

-0.2%

+0.7%

Year to date comparable sales growth was calculated as

follow:

(in millions of euros)

YTD 2019

YTD 2019/2018 Published

Change

Currency impact

Natural gas impact

Electricity impact

Significant scope

impact

YTD 2019/2018 Comparable

Change

Revenue

Group

16,406

+6.3%

362

(165)

22

76

+4.4%

Impacts in %

+2.3%

-1.0%

+0.1%

+0.5%

Gas & Services

15,778

+6.3%

352

(165)

22

76

+4.4%

Impacts in %

+2.3%

-1.1%

+0.2%

+0.5%

Year to date revenue

BY GEOGRAPHY

Revenue (in millions of euros)

YTD 2018

YTD 2019

Published change

Comparable change

Americas

5,891

6,354

+7.8%

+2.2%

Europe

5,243

5,353

+2.1%

+3.9%

Asia-Pacific

3,206

3,612

+12.7%

+9.8%

Middle East & Africa

495

459

-7.4%

+1.8%

Gas & Services Revenue

14,835

15,778

+6.3%

+4.4%

Engineering & Construction

285

257

-9.8%

-11.5%

Global Markets & Technologies

313

371

+18.6%

+16.8%

GROUP REVENUE

15,433

16,406

+6.3%

+4.4%

BY WORLD BUSINESS LINE

Revenue (in millions of euros)

YTD 2018

YTD 2019

Published change

Comparable change

Large industries

4,172

4,278

+2.5%

+4.7%

Industrial Merchant

6,813

7,298

+7.1%

+2.5%

Healthcare

2,576

2,736

+6.2%

+6.0%

Electronics

1,274

1,466

+15.1%

+10.8%

GAS & SERVICES REVENUE

14,835

15,778

+6.3%

+4.4%

The slideshow that accompanies this release

is available as of 8:45 am (Paris time) at www.airliquide.com

Throughout the year, follow Air Liquide on Twitter:

@AirLiquideGroup

UPCOMING EVENT 2019 Annual results: February 11,

2020

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 80 countries with

approximately 66,000 employees and serves more than 3.6 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to be a leader in its industry,

deliver long-term performance and contribute to sustainability. The

company’s customer-centric transformation strategy aims at

profitable growth over the long term. It relies on operational

excellence, selective investments, open innovation and a network

organization implemented by the Group worldwide. Through the

commitment and inventiveness of its people, Air Liquide leverages

energy and environment transition, changes in healthcare and

digitization, and delivers greater value to all its

stakeholders.

Air Liquide’s revenue amounted to 21 billion euros in 2018 and

its solutions that protect life and the environment represented

more than 40% of sales. Air Liquide is listed on the Euronext Paris

stock exchange (compartment A) and belongs to the CAC 40, EURO

STOXX 50 and FTSE4Good indexes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191023005951/en/

Media Relations +33 (0)1 40 62 50 59 Investor

Relations Paris - France +33 (0)1 40 62 50 87 Philadelphia -

USA +1 610 263 8277

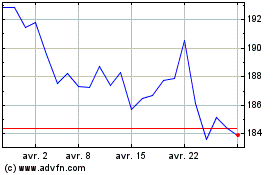

Air Liquide (EU:AI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Air Liquide (EU:AI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024