Alstom Releases 2023 Strategic Plan, Financial Objectives

24 Juin 2019 - 8:01AM

Dow Jones News

By Anthony Shevlin

Alstom SA (ALO.FR) on Monday laid out its new strategic plan and

objectives for 2023, and said that it expects its growth to

outperform the market.

The French train maker expects average annual sales growth over

the period to fiscal 2023 of around 5%.

The company sees its adjusted earnings before interest and taxes

margin to reach around 9% in fiscal 2023, as a result of

operational efficiency measures.

Alstom expects the conversion from net income to free cash flow

to be above 80% by fiscal 2023, boosted by capital-expenditure

stabilization and the mid-term stability of working capital.

The company will introduce a dividend policy with a pay-out

ratio of between 25% and 35%, which will be rolled out as early as

the current fiscal year.

Looking to fiscal 2020, Alstom says it will be a year of

stabilized growth after the "exceptional sales and profitability"

of fiscal 2019.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

June 24, 2019 01:46 ET (05:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

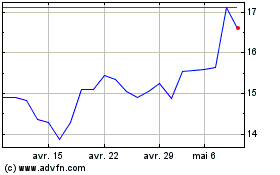

Alstom (EU:ALO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alstom (EU:ALO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024