By Sarah Nassauer and Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 25, 2020).

Nearly six months into the coronavirus pandemic in the U.S.,

big-box retailers are emerging as business winners while

competitors -- including some apparel sellers and small businesses

-- struggle.

The big sellers' strength wasn't always a sure thing. Early in

the Covid-19 pandemic, while they had rising sales, they also had

rising costs and complications as they tried to keep workers and

customers safe and product moving.

But now, Walmart Inc., Home Depot Inc. and a handful of other

big retailers are delivering not only strong sales but also strong

profits. Last week, Target Corp. posted an 80% jump in earnings

from a year ago, while profit leapt 75% at Lowe's Cos. Amazon.com

Inc.'s profit doubled to a record $5.2 billion in its June

quarter.

Several factors tie their success together. These big companies

had already invested to build their online businesses and had cash

on hand to adjust to the pandemic. They were selling what people

were buying and had large supply networks they could tap to

eventually restock. In addition, most were deemed essential

retailers early in the pandemic and thus have largely remained

open.

When the coronavirus surfaced in the Raleigh-Durham area this

spring, Target stores were ready for the sharp increase in online

orders. Most had already allowed shoppers to pick up items in

parking lots. All had staffers in back rooms packing up orders.

"We had a lot of the infrastructure in place, and we just had to

ramp up, " said Je'Varis Richardson, a Target district manager who

oversees 13 stores in North Carolina.

Since February, Mr. Richardson's stores more than doubled the

number of staff focused on packing online orders. Red and white

signs were added to 50 more parking spots, designated as pickup

areas. That preparedness helped Target report a record jump in

quarterly sales and a 195% growth in digital sales.

Walmart, Amazon, Target, Home Depot, Lowe's and Costco Wholesale

Corp. accounted for 29.1% of all U.S. retail sales in the second

quarter, according to Craig Johnson, president of consulting firm

Customer Growth Partners, up from 25.6% in the same period a year

ago.

Investors will get another check of big-box retail's power when

electronics giant Best Buy Co. reports its latest results on

Tuesday.

Sales at smaller retailers fell 7% between March and mid-August

compared with the same period last year, according to Womply, a

data firm which tracks revenue at more than 70,000 small U.S.

retailers. Many smaller chains had to clamber to start taking

online orders or offer local delivery.

Carrie Tell, owner of a True Value Hardware store in Hopewell

Junction, N.Y., has also seen demand for her products surge as

shoppers spend more time at home, gardening and fixing things

around the house. But unlike the larger retailers, her store, which

has six full-time employees, wasn't ready for the e-commerce swell,

she said.

Ms. Tell had planned to start offering goods for sale online in

April, but the company she had booked to catalog her products to

list online canceled when the state went into lockdown. "It really

was exactly the moment when I could have used it," she said.

Her cashiers took curbside-delivery orders over the phone -- and

called customers back to complete their purchases. Ms. Tell offered

free local deliveries. Sales spiked but with the added labor costs,

store-sanitizing and delivery expenses during the pandemic, her

business is just slightly up compared with last year, she said.

Before the pandemic, Walmart, Target and many large retailers

had already spent heavily to build e-commerce warehouses, mobile

apps and delivery networks to compete with Amazon. Now they can

leapfrog smaller retailers or those in weaker financial situations,

such as department stores, said Matthew Hamory, a managing director

in the retail practice at consulting firm AlixPartners.

"We will see a sort of winnowing out of the folks who were

already structurally disadvantaged against the big box," he

said.

Big-box profits benefited from higher prices. Strong consumer

demand -- boosted by government stimulus checks -- and a shortage

of some goods lessened the pressure to offer discounts.

"It just doesn't make sense for a retailer to be aggressive with

the promotions right now," said Michael Lasser, a retail analyst at

UBS. The outsize sales gains at large chains have more than offset

higher expenses, such as wages and cleaning.

Many already weakened retailers such as department stores and

apparel retailers gave up more ground to their big-box competitors

amid forced closures, spending shifts and lagging e-commerce

capabilities. Since May, several chains have filed for bankruptcy

protection with plans to close many stores, including Lord &

Taylor, J.C. Penney Co. and Stage Stores Inc.

Meanwhile, apparel spending rose at big-box stores such as

Target and Walmart, which offer one-stop shopping, likely grabbing

business from floundering competitors, say retail analysts.

Both Target and Walmart faced online challenges early in the

pandemic as demand for household goods surged nationally. Walmart

reduced the number of pickup and delivery windows it offered in

March and April, instead using store workers to replace

out-of-stock products by unloading trucks and stocking shelves.

"That lasted for a few weeks, but the team recovered," Walmart

CEO Doug McMillon told analysts in June. Walmart has increased

store pickup and delivery slots by around 30% since February,

executives said last week. E-commerce sales rose 97% in the latest

quarter.

Target had planned to add fresh food to its pickup and drive-up

services in about half of stores this year, but paused that rollout

in March "given the severe swings we were seeing in store traffic

and the onslaught of new routines we are asking our store teams to

perform," said Target CEO Brian Cornell last week.

By May, Target rolled out the services at an accelerated pace

and is now offering them in 1,500 stores. Same-day pickup and

delivery sales rose 270% in the most recent quarter. Sales from

digital channels accounted for 17.2% of Target's total revenue for

the quarter, the highest percentage in company history.

Some shoppers are being trained to use these online services at

big-box retailers and won't go back to competitors, said Mr. Hamory

from AlixPartners. "That share may have permanently shifted to

bigger companies that were better able to capture it."

Suzanne Kapner contributed to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Jennifer

Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

August 25, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

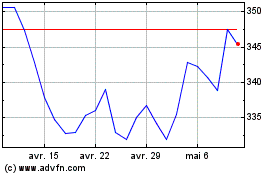

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024