Amended Current Report Filing (8-k/a)

07 Octobre 2019 - 10:46PM

Edgar (US Regulatory)

Alcoa Corp true 0001675149 0001675149 2019-09-07 2019-09-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 7, 2019

ALCOA CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

1-37816

|

|

81-1789115

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

201 Isabella Street, Suite 500

Pittsburgh, Pennsylvania

|

|

15212-5858

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (412) 315-2900

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

AA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

Alcoa Corporation (“Alcoa” or the “Company”) is filing this Amendment No. 1 on Form 8-K/A (this “Amendment”) to amend its Current Report on Form 8-K, as originally filed with the U.S. Securities and Exchange Commission on September 9, 2019 (the “Original Form 8-K”) to disclose the third quarter 2019 charge relating to the below-described restructuring. The Original Form 8-K reported that the Board of Directors of the Company had approved, effective November 1, 2019, a new operating model to reduce complexity and overhead costs by eliminating the business unit structure and consolidating sales, procurement, and commercial functions at an enterprise level, with related organizational changes planned. At the time of the filing of the Original Form 8-K, the Company was unable to make a good faith determination of the estimated amount or range of amounts of costs that would result in connection with the restructuring or estimated amount or range of amounts of the charge that will result in future cash expenditures in connection with the restructuring program. The Company hereby amends the Original Form 8-K to include such information.

Except as noted above, this Amendment does not modify or update in any way the disclosures made in the Original Form 8-K.

|

Item 2.02

|

Results of Operations and Financial Condition.

|

For the third quarter 2019, the Company has recorded a $37 million restructuring charge ($26 million after tax and non-controlling interest, or $0.14 per share), for employee termination and severance costs as described below under Item 2.05.

The information contained in this Item 2.02 shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 2.05

|

Costs Associated With Exit or Disposal Activities.

|

For the third quarter 2019, the Company has recorded a $37 million restructuring charge ($26 million after tax and non-controlling interest, or $0.14 per share) for employee termination and severance costs related to the restructuring. The Company anticipates that the majority of the $37 million of costs will be paid in cash in the fourth quarter 2019, with the remainder paid in the first quarter 2020.

Alcoa expects to realize approximately $60 million of associated annual operating cost savings beginning in the second quarter 2020 after implementation of the new operating model and the restructuring is substantially complete.

Forward-Looking Statements

This Current Report on Form 8-K/A contains statements that relate to future events and expectations, including those relating to the restructuring (including the Company’s expectations regarding the estimated costs and financial charge impacting quarterly financial performance, estimated cash outlays, anticipated completion and payment dates, and expected annual savings) and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements that reflect the Company’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although the Company believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Additional information concerning factors that could cause actual results to differ materially from those projected in the forward-looking statements is contained in the Company’s filings with the U.S. Securities and Exchange Commission. The Company disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ALCOA CORPORATION

|

|

|

|

|

|

|

|

|

|

Date: October 7, 2019

|

|

|

|

By:

|

|

/s/ Jeffrey D. Heeter

|

|

|

|

|

|

|

|

Jeffrey D. Heeter

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

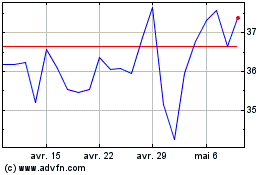

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

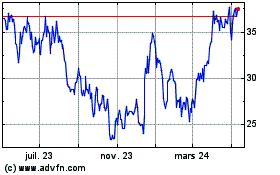

Alcoa (NYSE:AA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024