American Luxury Is Finally in Vogue -- Heard on the Street

25 Mai 2021 - 12:01PM

Dow Jones News

By Carol Ryan

European luxury brands tend to be better investments than

American ones, but this year may be an exception.

Shares in Tapestry, the New York-listed holding company for

labels including Coach and Kate Spade, are up 40% since the start

of the year, while Michael Kors-owner Capri has gained 27%. That

puts both stocks ahead of big European peers such as Hermès, LVMH

Moët Hennessy Louis Vuitton and Gucci-owner Kering.

One reason is that the U.S. brands reported better than expected

sales in their latest quarterly numbers, thanks in part to strong

demand for designer clothing and handbags in China. Their

e-commerce businesses are growing quickly: Tapestry's online sales

have doubled in a year and now comprise almost 30% of turnover.

The two companies have also managed their inventory levels

better lately, allowing them to sell more products at full price

and increase their gross margins. And their valuations had more

ground to make up after investors fled to the safest luxury stocks

such as Birkin handbag maker Hermès throughout 2020.

American luxury names have sometimes outperformed in the past,

but it isn't the norm. In terms of share-price gains, Capri has

beaten Hermès and LVMH in just three of the last nine calendar

years. The U.S. stocks have also been far more volatile, after

several years of overexpansion damaged perceptions of their brands

among consumers. While Europe's top couturiers have overexpanded at

times too, on the whole they are better at managing their brand

image. The continuity provided by anchor shareholders such as

LVMH's Bernard Arnault, the world's second-richest man, may

help.

Tapestry and Capri's store locations could work to their

advantage in 2021, though. Both businesses still make around

three-fifths of revenue in their domestic U.S. markets, where a

strong economic rebound is boosting demand for high-end fashion.

Lower exposure to Europe, where even the most global French and

Italian brands still have a big presence, is a plus in the short

term. Luxury sales in traditional hot spots such as Paris, London

and Milan are expected to be sluggish until tourism recovers.

Designer stores in Europe rely on overseas visitors for around half

of their sales, Jefferies estimates.

The American stocks also look comparatively cheap at around 14

times projected earnings, below the 10-year average. Most European

names command at least double that multiple and are finding

investors increasingly hard to impress. On the day that Hermès

reported blistering first-quarter sales growth of 44%, its shares

inched up just 2%. The brand's Paris-listed stock currently fetches

56 times expected earnings.

Less exclusive brands and lower profit margins mean that U.S.

luxury names will never be as highly prized as their European

rivals -- either by shoppers or shareholders. But this year's broad

economic recovery gives the more affordable end of the sector the

chance to regain some lost ground.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

May 25, 2021 05:55 ET (09:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

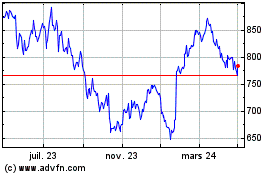

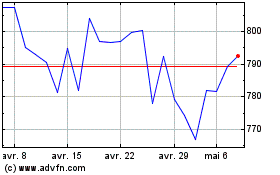

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Lvmh Moet Hennessy Louis... (EU:MC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024