Amid Ad-Industry M&A, Omnicom Says It Isn't Looking for Big Deals

16 Avril 2019 - 6:52PM

Dow Jones News

By Alexandra Bruell

As Madison Avenue's big-ticket acquisition spree continues,

Omnicom Group Inc. intends to stick with smaller deals.

The ad giant will continue to focus on bolt-on acquisitions and

data partnerships, the company said Tuesday during its

first-quarter earnings call with analysts. Omnicom owns agencies

such as BBDO, OMD and FleishmanHillard.

The agency business has seen a slew of activity on the M&A

front as the sector tries to modernize and keep up with changes

brought on by the rise of digital advertising.

Ad giant Publicis Groupe SA on Sunday announced its $4.4 billion

acquisition of data firm Epsilon, Accenture PLC this month acquired

the high-profile creative agency Droga5, and Interpublic Group of

Cos. late last year acquired data firm Acxiom Corp.'s marketing

services unit.

"If I or the team felt threatened in any way, we'd look for the

appropriate acquisitions to complete our offerings to our clients,"

Chairman and Chief Executive John Wren said during Omnicom's

earnings call. "I simply don't feel that way right now."

Omnicom doesn't need another creative agency like Droga5 because

it already has "good agencies," he said. The company has similar

feelings about the Epsilon transaction. "They don't have anything

from what I can observe that's unique or so proprietary," Mr. Wren

said.

While Omnicom continues to invest in data capabilities, in most

cases it would rather rent than own data, said Jonathan Nelson,

chief executive of Omnicom Digital, during the call. The company

expressed similar sentiments after IPG's Acxiom deal.

But Omnicom hasn't sworn off deal making entirely. "We're going

to continue to pursue deals," Chief Financial Officer Philip

Angelastro said. "We're pretty disciplined about it."

The company in 2018 and early 2019 sold various assets,

including sales support businesses MarketStar and Sellbytel.

Omnicom wasn't prepared to keep investing what was needed for the

future of those businesses, and was able to find buyers that made

more sense for them, Mr. Angelastro said.

Omnicom will continue to seek operational efficiencies from real

estate, back-office services, procurement and IT, he added.

As ad businesses brace for heightened privacy regulation,

Omnicom says not much is changing at this time.

"What we're trying to do is find that fuzzy line of privacy and

take a few steps back from it," said Mr. Nelson. "I think that

policy has worked so far and will likely work going forward."

Omnicom reported a 4.4% decrease in revenue to $3.47 billion in

the first quarter due in part to foreign-exchange rates and

dispositions, slightly beating analyst expectations. Organic

revenue, a key metric that strips out currency effects and

acquisitions, increased 2.5% compared with the first quarter last

year.

Organic revenue grew 2% in the U.S.; 1.3% in the U.K.; 4% in

Europe; 2.1% for the Asia Pacific; and 12.8% for the Middle East

and Africa. Latin America decreased 3%.

Earnings per share in the quarter increased 3 cents to $1.17,

beating analyst expectations. Operating profit in the first quarter

increased 1.7% to $428.9 million.

Write to Alexandra Bruell at alexandra.bruell@wsj.com

(END) Dow Jones Newswires

April 16, 2019 12:37 ET (16:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

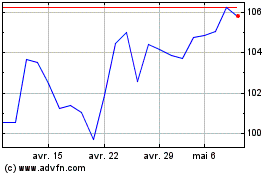

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Publicis Groupe (EU:PUB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024