By Paul Vigna

Earnings season is a good time to not only assess the health of

corporate America but also a chance to get a picture of the state

of the consumer.

As the reports roll in, investors will be awash in data, and it

can be difficult, especially in this uncertain economic

environment, to identify the most telling numbers. The coronavirus

pandemic has been a boon to some sectors, such as technology, while

battering companies in the financial and energy industries.

The uneven performance is reflected in the market's returns this

year. The S&P 500 is off just 0.2% in 2020. The tech sector has

surged 17%, while the financial and energy groups are off 22% and

39%, respectively. Given the wide gap, investors need to parse data

across sectors. Here are a few key metrics to watch:

Whirlpool's North American Sales

Whirlpool Corp. makes washers, dryers and kitchen appliances, so

its sales trends show homeowner appetite for big-ticket items. Home

Depot Inc. and Lowe's Cos. offer similar products, but they sell so

many other things, it is impossible to know the size of the

individual purchases.

Whirlpool's quarterly North American sales had been pretty

steady at about $3 billion for the past two years. They slid to

$2.5 billion in the first quarter and are expected to fall to $2.3

billion in the second quarter. Analysts don't expect a recovery to

prior levels until the third quarter of 2021, according to FactSet.

Whirlpool shares are down 3.4% this year.

Whirlpool is scheduled to report results Wednesday.

Discount-Store Sales

For a sense of how the consumer is faring, take a look at

discount stores.

When times are tough and Americans are looking to save money,

discount stores are an obvious destination. So while rising sales

are good news, it is a sign that times might be tough out

there.

Walmart Inc., the world's largest retailer, is a good proxy for

the state of the consumer. But Walmart has been trying to sell more

upscale products and going toe-to-toe online with Amazon.com

Inc.

Watch for Dollar General Corp.'s sales. It has 16,000 stores in

46 states, so it has broad reach. Sales were rising through 2018

and 2019 as job creation and economic growth were tapering off.

They were up again in the first quarter and are expected to post a

rise in the second as well. Dollar General shares are up 21% this

year, while Walmart is up 11%.

Dollar General has yet to set an earnings date.

Apple's iPhone Sales

The iPhone isn't just an iconic product. It is a great proxy for

discretionary spending. Are people willing to shell out more for

it, or are they saving money and buying Android phones? Or not

buying phones at all?

Apple has a loyal and affluent customer base that can afford the

phones, even with the current economic conditions, said Canaccord

Genuity analyst T. Michael Walkley. The results will give an

indication of how the upper-end consumer is faring.

Sales of the iPhone are projected to register a fall to $22.21

billion in Apple's most recent quarter. Although that is well below

the $29 billion it sold in the previous period, it likely reflects

that people are waiting for the next upgrade cycle.

Apple, shares of which are up 31% this year, is scheduled to

report July 30.

Freddie Mac's Mortgage Loans Gains and Losses

There is no bigger financial commitment most people will ever

make than buying a house.

The Federal Home Loan Mortgage Corp., or Freddie Mac, is a

government-sponsored enterprise that buys mortgages on the

secondary market, packages them into securities and then sells

those to investors.

The company's quarterly reports have a wealth of valuable

information on the mortgage market. Keep an eye on the delinquency

rate and look for anything executives say about forbearance efforts

as homeowners struggle to keep up with their bills.

In May, the company reported its delinquency rate on

single-family homes rose to 0.81% from 0.64% in April. It had been

steady around 0.6% before that.

"All the data in terms of [mortgage] forbearance we've been

watching like a hawk," said Larry McDonald, author of the Bear

Traps Report newsletter.

Freddie Mac has yet to set a date for its second-quarter report.

The stock is down 29% this year.

Exxon Mobil's Downstream Operations

Even with the current emphasis on sustainability, oil is still

one of the most important commodities in the world, and the amount

that is being consumed is a proxy for economic activity.

Exxon Mobil's "downstream" operations are an important area to

watch. This business segment represents all of its operations, like

refining and selling, after it pumps oil out of the ground.

Downstream revenue is expected to fall to $24.68 billion in the

second quarter, from $44.69 billion in the first and $54.03 billion

a year earlier. Shares are down 38% this year.

Exxon is scheduled to report results July 31.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

July 19, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

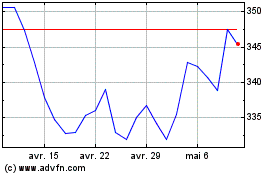

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024