Angel Oak Financial Strategies Income Term Trust Announces Preliminary Results of Rights Offering

15 Octobre 2021 - 3:00PM

Business Wire

Angel Oak Financial Strategies Income Term Trust (NYSE: FINS)

(the Fund) today announced the preliminary results of its

transferable rights offering (the Offer). The Offer commenced on

September 20, 2021 and expired on October 14, 2021 (the Expiration

Date).

The Offer entitled rights holders to subscribe for up to an

aggregate of 5,076,333 of the Fund’s common shares of beneficial

interest, par value $0.001 per share (Common Shares). The final

subscription price of $16.06 per Common Share was determined based

upon a formula equal to 86% of the Fund’s net asset value per

Common Share at the close of trading on the NYSE on the Expiration

Date. As a result of high investor demand, the Offer was

over-subscribed. The over-subscription requests exceeded the

over-subscription shares available. Accordingly, the shares

subscribed for pursuant to the over-subscription privilege of the

Offer will be allocated pro rata among those fully exercising

record date shareholders who over-subscribed based on the number of

rights originally issued to them by the Fund. The Common Shares

subscribed for will be issued after completion of the pro rata

allocation of over-subscription shares and receipt of all

shareholder payments.

The Fund will issue all of the 5,076,333 Common Shares offered

pursuant to the Offer. The gross proceeds of the Offer are expected

to be approximately $81.6 million.

“We are very pleased with the results of the FINS rights

offering,” said Johannes Palsson, Portfolio Manager for the Fund.

“We continue to see significant opportunities across the non-bank

financials landscape, and efficiently raising new capital to

further allocate to non-bank financials allows us to expand the

portfolio’s investment opportunities as we seek to deliver

compelling risk-adjusted returns for our investors,” said

Palsson.

ABOUT FINS

Led by Angel Oak’s experienced financial services team, FINS

invests predominantly in U.S. financial sector debt as well as in

selective opportunities across financial sector preferred and

common equity. Under normal circumstances, at least 50% of FINS’s

portfolio is publicly rated as investment grade or, if unrated, is

judged by Angel Oak to be of investment grade quality.

ABOUT ANGEL OAK CAPITAL ADVISORS, LLC

Angel Oak Capital Advisors is an investment management firm

focused on providing compelling fixed-income investment solutions

to its clients. Backed by a value-driven approach, Angel Oak

Capital Advisors seeks to deliver attractive, risk-adjusted returns

through a combination of stable current income and price

appreciation. Its experienced investment team seeks the best

opportunities in fixed income, with a specialization in

mortgage-backed securities and other areas of structured

credit.

Information regarding the Fund and Angel Oak Capital Advisors

can be found at www.angeloakcapital.com.

Past performance is neither indicative nor a guarantee of future

results. Investors should read the prospectus supplement and

accompanying prospectus and consider the investment objective and

policies, risk considerations, charges and ongoing expenses of an

investment carefully before investing.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211015005340/en/

Media: Trevor Davis, Gregory FCA for Angel Oak Capital

Advisors 443-248-0359 trevor@gregoryfca.com

Company Contact: Randy Chrisman, Chief Marketing &

Corporate IR Officer, Angel Oak Capital Advisors 404-953-4969

randy.chrisman@angeloakcapital.com

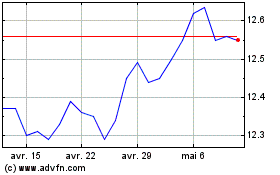

Angel Oak Financial Stra... (NYSE:FINS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Angel Oak Financial Stra... (NYSE:FINS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024