| Title of

Security |

CUSIP/ISIN |

Outstanding

Principal Amount |

Acceptance Priority

Level |

Principal Amount

Tendered |

Principal Amount

Accepted |

Early Tender

Premium(4) |

Total

Consideration(5) |

| 6.250%

notes due 2022(1) |

03938LAX2/US03938LAX29 |

$1,100,000,000 |

1 |

$440,843,000 |

$440,843,000 |

$50 |

$1,146.25 |

| 6.750%

notes due 2041(2) |

03938LAS3/US03938LAS34 |

$1,000,000,000 |

2 |

$370,995,000 |

$370,995,000 |

$50 |

$1,190.00 |

| 7.000%

notes due 2039(3) |

03938LAP9/US03938LAP94 |

$1,500,000,000 |

3 |

$382,538,000 |

$382,538,000 |

$50 |

$1,212.50 |

- The interest rate on the 6.250% notes due 2022 has changed

pursuant to an interest adjustment clause and is currently

6.750%.

- The interest rate on the 6.750% notes due 2041 has changed

pursuant to an interest adjustment clause and is currently

7.250%.

- The interest rate on the 7.000% notes due 2039 has changed

pursuant to an interest adjustment clause and is currently

7.500%.

- Per $1,000 principal amount of Notes validly tendered at or

prior to the Early Tender Time and not validly withdrawn.

- Per $1,000 principal amount of Notes validly tendered at or

prior to the Early Tender Time and not validly withdrawn. Includes

the Early Tender Premium. Does not include Accrued Interest (as

defined herein).

October 13, 2017 - ArcelorMittal (the "Company" or

"ArcelorMittal") announces the early tender results of its

tender offers (the "Offers") to purchase for cash, for a

combined aggregate purchase price (exclusive of Accrued Interest

(as defined herein)) of up to $1,250,000,000 (the "Initial

Maximum Tender Cap"), its outstanding 6.250% notes due 2022

(CUSIP 03938LAX2/ISIN US03938LAX29) (the "2022 Notes"),

6.750% notes due 2041 (CUSIP 03938LAS3/ISIN US03938LAS34)

(the "2041 Notes") and 7.000% notes due 2039 (CUSIP

03938LAP9/ISIN US03938LAP94) (the "2039 Notes" and, together

with the 2022 Notes and the 2041 Notes, the "Notes"). The

Company has decided to increase the Initial Maximum Tender Cap to

$1,410,627,664 (such amended amount, the "Revised Maximum Tender

Cap") so as to avoid proration of any series of validly

tendered Notes.

This announcement does not contain the full terms and conditions

of the Offers, which are contained in the offer to purchase dated

September 28, 2017 (as it may be amended or supplemented from time

to time, the "Offer to Purchase"), and is subject to the

offer restrictions set out below and more fully described in the

Offer to Purchase.

The table above sets forth information with respect to the Notes

that were validly tendered at or prior to 5:00 p.m., New York City

time, on October 12, 2017 (the "Early Tender Time") and not

withdrawn.

The Company has accepted for purchase on the Early Settlement

Date all Notes tendered at or prior to the Early Tender Time. Since

the Offers were fully subscribed as of the Early Tender Time (based

on the Revised Maximum Tender Cap), holders who validly tender

Notes following the Early Tender Time will not have any of their

Notes accepted for purchase.

The Offers will expire at 11:59 p.m., New York City time, on

October 26, 2017, unless extended (as may be extended, the

"Expiration Time").

Subject to the terms and conditions set forth in the Offer to

Purchase, with respect to all such Notes validly tendered at or

prior to the Early Tender Time and not validly withdrawn and

accepted for purchase pursuant to the Offers, the Company expects

to pay the Total Consideration, together with any accrued and

unpaid interest from, and including, the immediately preceding

interest payment date applicable to such Notes to, but excluding,

the Early Settlement Date (the "Accrued Interest"), to the

Holders on the second Business Day after the Early Tender Time,

being October 16, 2017 (such date, the "Early Settlement

Date"). The "Total Consideration" is the U.S. dollar

amount payable per $1,000 principal amount of the Notes set forth

in the table above and includes an early tender premium of $50 per

$1,000 principal amount of Notes (the "Early Tender

Premium").

The "Withdrawal Deadline" with respect to the Offers was

5:00 p.m., New York City time, on October 12, 2017. Notes already

tendered pursuant to the Offers may no longer be withdrawn, and any

Notes tendered after the Withdrawal Deadline and at or prior to the

Expiration Time may not be withdrawn.

ArcelorMittal will fund the Offers with existing cash

resources. The Offers are being made to reduce gross debt and

interest expense through the early repayment of certain medium- to

long-term bonds issued by the Company.

Citigroup Global Markets Limited, HSBC Securities (USA) Inc.,

Merrill Lynch International and RBC Capital Markets, LLC have been

appointed to serve as dealer managers for the Offers. D.F. King has

been retained to serve as the information agent and tender agent in

connection with the Offers.

For additional information regarding the terms of the Offers,

please contact Citigroup Global Markets Limited by email at

liabilitymanagement.europe@citi.com or by telephone at +44 20 7986

8969 (London), +1 800 558 3745 (toll free within the U.S.) or

collect at +1 212 723 6106, HSBC Securities (USA) Inc. by telephone

at +44 20 7992 6237 (London), +1 888 HSBC 4LM (toll free within the

U.S.) or collect at +1 212 525 5552, Merrill Lynch International by

email at dg.lm_emea@baml.com or by telephone at +44 20 7996 5420

(London), +1 888 292 0070 (toll free within the U.S.) or collect at

+1 980 388 3646 and RBC Capital Markets, LLC by email at

liability.management@rbccm.com or by telephone at +44 20 7029 7420

(London), +1 877 381 2099 (toll free within the U.S.) or collect at

+1 212 618 7822. Requests for documents and questions regarding the

tender of Notes may be directed to D.F. King via email:

arcelor@dfking.com or telephone: New York: +1 800 814 4284 (toll

free within U.S.) or collect at

+ 1 212 269 5550 and London: +44 20 7920

9700.

A copy of the Offer to Purchase is available at

http://www.dfking.com/arcelor and may also be obtained at no charge

from D.F. King.

None of ArcelorMittal, the dealer managers or the information

and tender agent makes any recommendation as to whether any holder

of the Notes should tender or refrain from tendering all or any

portion of the principal amount of the Notes.

Capitalized terms used and not defined herein have the meanings

ascribed to them in the Offer to Purchase.

Important Information

This press release is neither an offer to purchase nor a

solicitation to buy any Notes nor is it a solicitation for

acceptance of the Offers. The Company is making the Offers only by,

and pursuant to the terms of, the Offer to Purchase. The Offers are

not being made to (nor will tenders of Notes be accepted from or on

behalf of) holders of Notes in any jurisdiction in which the making

or acceptance thereof would not be in compliance with the

securities, blue sky or other laws of such jurisdiction. This

announcement must be read in conjunction with the Offer to

Purchase.

###

United Kingdom. The communication of the Offer to

Purchase and any other documents or materials relating to the

Offers has not been approved by an authorized person for the

purposes of section 21 of the Financial Services and Markets Act

2000 (the "FSMA"). Accordingly, such documents and/or

materials are not being distributed to, and must not be passed on

to, the general public in the United Kingdom. The communication of

such documents and/or materials is exempt from the restriction on

financial promotions under section 21(1) of the FSMA on the basis

that it is only directed at and may only be communicated to: (1)

persons who are outside the United Kingdom; (2) investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Order")); (3) those persons who are existing members or

creditors of the Company or other persons within Article 43(2) of

the Order; (4) high net worth companies, and other persons to whom

it may lawfully be communicated, falling within Article 49(2)(a) to

(d) of the Order or (5) any other persons to whom such documents

and/or materials may lawfully be communicated in circumstances in

which section 21(1) of the FSMA does not apply to the Company (all

such persons together being referred to as "relevant

persons"). The Offer to Purchase and any other documents or

materials relating to the Offers are only available to relevant

persons. Any person who is not a relevant person should not act or

rely on this document or any of its contents.

France. The Offers are not being made, directly or

indirectly, to the public in the Republic of France. The Offer to

Purchase and any other documents or offering material relating to

the Offers may not be distributed or caused to be distributed to

the public in the Republic of France. Only (a) persons providing

investment services relating to portfolio management for the

account of third parties (personnes fournissant le service

d'investissement de gestion de portefeuille pour compte de tiers)

and/or (b) qualified investors (investisseurs qualifiés) acting for

their own account, other than individuals (each a "Qualified

Investor") as defined in, and in accordance with, Articles L.

411-1, L. 411-2 and D. 411-1 of the French Code monétaire et

financier and applicable regulations thereunder, are eligible to

participate in the Offers. Neither the Offer to Purchase, nor any

other such offering material has been submitted for clearance to

the Autorité des marchés financiers.

Italy. None of the Offers, the Offer to Purchase or any

other documents or materials relating to the Offers have been or

will be submitted to the clearance procedure of the Commissione

Nazionale per le Società e la Borsa ("CONSOB") pursuant to

applicable Italian laws and regulations. The Offers are being

carried out in the Republic of Italy ("Italy") as exempted

offers pursuant to article 101-bis, paragraph 3-bis of the

Legislative Decree No. 58 of February 24, 1998, as amended (the

"Financial Services Act") and article 35-bis, paragraph 4 of

CONSOB Regulation No. 11971 of May 14, 1999, as amended. Holders or

beneficial owners of the Notes that are resident or located in

Italy can tender their Notes for purchase through authorized

persons (such as investment firms, banks or financial

intermediaries permitted to conduct such activities in Italy in

accordance with the Financial Services Act, CONSOB Regulation No.

16190 of October 29, 2007, as amended, and Legislative Decree No.

385 of September 1, 1993, as amended) and in compliance with any

other applicable laws and regulations and with any requirements

imposed by CONSOB or any other Italian authority. Each intermediary

must comply with applicable laws and regulations concerning

information duties vis-à-vis its clients in connection with the

Notes or the Offer to Purchase.

Belgium. Neither the Offer to Purchase nor any other

document or materials relating to the Offers has been, or will be,

submitted or notified to, or approved by, the Belgian Financial

Services and Markets Authority ("Autorité des services et marchés

financiers"/"Autoriteit voor Financiële Diensten en Markten"). The

Offers are not being made in Belgium by way of a public offering

within the meaning of Articles 3, §1, 1° and 6, §1 of the Belgian

Law of April 1, 2007 on public takeover bids ("loi relative aux

offres publiques d'acquisition"/"wet op de openbare

overnamebiedingen"), as amended from time to time. Accordingly, the

Offer to Purchase may not be, and is not being, advertised and the

Offers will not be extended and the Offer to Purchase and any other

documents or materials relating to the Offers may not, has not, and

will not, be distributed, directly or indirectly, to any person in

Belgium other than to "qualified investors"

("investisseur qualifié"/"gekwalificeerde belegger") within

the meaning of Article 10, §1 of the Belgian Law of June

16, 2006 on the public offering of securities and the admission of

securities to trading on a regulated market ("loi relative aux

offres publiques d'instruments de placement et aux admissions

d'instruments de placement à la négociation sur des marchés

réglementés"/"wet op de openbare aanbieding van

beleggingsinstrumenten en de toelating van beleggingsinstrumenten

tot de verhandeling op een gereglementeerde markt") (as amended

from time to time), as referred to in Article 6, §3, of said

Belgian Law of April 1, 2007 on public takeover bids. Insofar as

Belgium is concerned, the Offers are made only to qualified

investors, as this term is defined above. Accordingly, the

information contained in the Offer to Purchase or in any other

documents or materials relating to the Offers may not be used for

any other purpose or disclosed or distributed to any other person

in Belgium.

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company,

with a presence in 60 countries and an industrial footprint in 18

countries. Guided by a philosophy to produce safe, sustainable

steel, we are the leading supplier of quality steel in the major

global steel markets including automotive, construction, household

appliances and packaging, with world-class research and development

and outstanding distribution networks.

Through our core values of sustainability, quality and

leadership, we operate responsibly with respect to the health,

safety and wellbeing of our employees, contractors and the

communities in which we operate.

For us, steel is the fabric of life, as it is at the heart of

the modern world from railways to cars and washing machines. We are

actively researching and producing steel-based technologies and

solutions that make many of the products and components people use

in their everyday lives more energy efficient.

We are one of the world's five largest producers of iron ore and

metallurgical coal. With a geographically diversified portfolio of

iron ore and coal assets, we are strategically positioned to serve

our network of steel plants and the external global market. While

our steel operations are important customers, our supply to the

external market is increasing as we grow.

In 2016, ArcelorMittal had revenues of $56.8 billion and crude

steel production of 90.8 million tonnes, while own iron ore

production reached 55.2 million tonnes.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia

(MTS).

For more information about ArcelorMittal please visit:

http://corporate.arcelormittal.com/

|

|

|

|

Contact information ArcelorMittal Investor Relations |

|

|

|

|

|

Europe |

+442075431156 |

|

Americas |

+13128993985 |

|

Retail |

+442075431156 |

|

SRI |

+442075431156 |

|

Bonds/Credit |

+33171921026 |

|

|

|

|

|

|

|

Contact information ArcelorMittal Corporate

Communications |

|

|

E-mail: |

press@arcelormittal.com |

|

Phone: |

+442076297988 |

|

|

|

|

|

|

|

ArcelorMittal Corporate Communications |

|

|

|

|

| Paul

Weigh |

+442032142419 |

|

|

|

|

France |

|

|

Image 7 |

|

|

Sylvie Dumaine / Anne-Charlotte Creach |

+33153707470 |

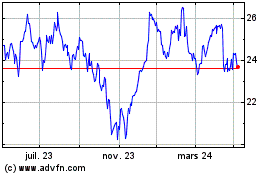

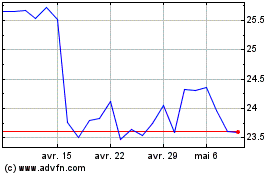

ArcelorMittal (EU:MT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

ArcelorMittal (EU:MT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024