Armstrong World Industries, Inc. (NYSE:AWI), a leader in the

design, innovation and manufacture of commercial and residential

ceiling, wall and suspension system solutions, today reported

year-over-year sales and adjusted EBITDA growth for the third

quarter of 2021 as the company’s ability to manage inflationary and

supply chain challenges helped offset uneven market conditions.

“As the market continued to recover throughout the

third-quarter, we delivered solid sales growth driven by strong

price realization and the sales benefits of the 2020 acquisitions

we made to expand our Architectural Specialties business,” said Vic

Grizzle, President and CEO of Armstrong World Industries. “Our

employees executed well in the face of supply chain challenges and

inflationary pressures to maintain our best-in-class service

levels. Additionally, in the quarter we continued to advance our

Healthy Spaces and digital growth initiatives, which positions us

to deliver further growth as the pace of the non-residential

construction market recovery accelerates in

2022.”

Third-Quarter Results from Continuing

Operations

| (Dollar amounts in millions

except per-share data) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

|

Change |

|

| Net sales |

|

$ |

292.2 |

|

|

$ |

246.3 |

|

|

|

18.6 |

% |

| Operating income |

|

$ |

72.1 |

|

|

$ |

72.3 |

|

|

|

(0.3 |

)% |

| Earnings from continuing

operations |

|

$ |

50.8 |

|

|

$ |

54.2 |

|

|

|

(6.3 |

)% |

| Diluted earnings per share |

|

$ |

1.06 |

|

|

$ |

1.13 |

|

|

|

(6.2 |

)% |

| Net cash provided by operating

and investing activities |

|

$ |

57.4 |

|

|

$ |

7.2 |

|

|

|

697.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Additional Non-GAAP*

Measures |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

99 |

|

|

$ |

92 |

|

|

|

8 |

% |

| Adjusted net income |

|

$ |

56 |

|

|

$ |

51 |

|

|

|

9 |

% |

| Adjusted diluted earnings per

share |

|

$ |

1.17 |

|

|

$ |

1.07 |

|

|

|

9 |

% |

| Adjusted free cash flow |

|

$ |

58 |

|

|

$ |

46 |

|

|

|

28 |

% |

* The Company uses non-GAAP adjusted measures in

managing the business and believes the adjustments provide

meaningful comparisons of operating performance between periods and

are useful alternative measures of performance. Reconciliations of

the most comparable GAAP measure are found in the tables at the end

of this press release. Non-GAAP figures are rounded to the nearest

million and corresponding percentages are rounded to the nearest

percent based on unrounded figures.

Third-quarter 2021 consolidated net sales

increased 18.6% from prior-year results, driven primarily by

favorable Average Unit Value (“AUV”) of $26 million and incremental

sales from the acquisitions of Turf, Moz and Arktura in 2020 (“2020

Acquisitions”) of $16 million. Sales volumes for both segments

continued to recover compared to prior-year results, although the

resurgence of the pandemic in certain markets and supply chain and

labor disruptions have resulted in project delays.

Operating income was essentially unchanged from

third-quarter 2020 results, as positive AUV in the Mineral Fiber

segment, an increase in WAVE equity earnings, the positive margin

impact of incremental net sales from the 2020 Acquisitions and a

2020 CARES Act Employee Retention Credit (“ERC”) provided

favorability. This favorability was offset by higher SG&A costs

attributable to the 2020 Acquisitions, higher manufacturing costs,

increased incentive and deferred compensation expenses, a

resumption of more normalized discretionary spending compared to

cost curtailments in the prior-year due to COVID-19 uncertainty,

and investments for future growth. The prior-year period benefited

from a gain on the sale of an idled, legacy Mineral Fiber plant in

China. Excluding this gain, third-quarter operating income

increased 10% versus prior-year results.

Third-Quarter Segment Highlights

Mineral Fiber

| (Dollar amounts in

millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

|

Change |

|

| Net sales |

|

$ |

214.5 |

|

|

$ |

187.3 |

|

|

|

14.5 |

% |

| Operating income |

|

$ |

68.5 |

|

|

$ |

58.1 |

|

|

|

17.9 |

% |

| Adjusted EBITDA* |

|

$ |

86 |

|

|

$ |

79 |

|

|

|

10 |

% |

Third-quarter 2021 Mineral Fiber net sales

increased 14.5% due to a 14% increase in AUV and a 1% increase in

sales volumes. AUV performance was driven primarily by increases in

like-for-like pricing and favorable channel mix compared to the

third quarter of 2020.

Third-quarter Mineral Fiber operating income

increased 17.9% from prior-year results primarily due to a $20

million benefit from favorable AUV, an $8 million increase in WAVE

equity earnings and a $4 million benefit related to the ERC, which

was partially offset by a $10 million increase in manufacturing

costs, a $4 million increase in incentive and deferred compensation

expenses, higher SG&A expenses attributable to more normalized

discretionary spending and investments in growth initiatives.

Architectural Specialties

| (Dollar amounts in

millions) |

|

For the Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

|

Change |

|

| Net sales |

|

$ |

77.7 |

|

|

$ |

59.0 |

|

|

|

31.7 |

% |

| Operating income |

|

$ |

5.0 |

|

|

$ |

9.1 |

|

|

|

(45.1 |

)% |

| Adjusted EBITDA* |

|

$ |

13 |

|

|

$ |

13 |

|

|

|

1 |

% |

Third-quarter 2021 net sales in Architectural

Specialties increased 31.7% from prior-year results, driven by a

$16 million increase from the 2020 Acquisitions and higher organic

sales volumes due to recovering economic activity as COVID-19

impacts decline.

The year-over-year decline in operating income was primarily

driven by an $8 million increase in SG&A expenses related to

the 2020 Acquisitions and the negative margin impact from custom

project delays in an inflationary environment, which were partially

offset by the positive impact of increased sales.

Unallocated Corporate

The Company reported an Unallocated Corporate

operating loss of $1.4 million in the third quarter of 2021

compared to income of $5.1 million in the third quarter of 2020,

driven primarily by the $7 million gain reported in the prior-year

period from the sale of an idled, legacy Mineral Fiber plant in

China.

Current 2021 Outlook

“Although the recovery in our markets was uneven

throughout the quarter, it is improving, and we see many strong

indicators of future growth. We remain focused on our long-term

strategic growth priorities by investing in our Healthy Spaces and

digital initiatives that are driving higher SG&A and capital

investments. In addition, with our robust cash flow generation, we

remain confident in our ability to execute against all our capital

allocation priorities,” said Brian MacNeal, AWI CFO. “In light of

third-quarter results, we are narrowing our full year guidance and

maintaining our prior mid-point guidance. We now expect increased

net sales of 17% to 18% and adjusted EBITDA of 13% to 15% versus

the prior year.”

| |

|

For the year ending December 31, 2021 |

|

| (Dollar amounts in millions

except per-share data) |

|

Prior Guidance |

|

|

Current Guidance |

|

| Net Sales |

|

$ |

1,085 |

|

|

to |

|

$ |

1,105 |

|

|

$ |

1,095 |

|

|

to |

|

$ |

1,105 |

|

| Adjusted EBITDA* |

|

$ |

370 |

|

|

to |

|

$ |

380 |

|

|

$ |

372 |

|

|

to |

|

$ |

378 |

|

| Adjusted diluted earnings per

share* |

|

$ |

4.20 |

|

|

to |

|

$ |

4.40 |

|

|

$ |

4.25 |

|

|

to |

|

$ |

4.35 |

|

| Adjusted free cash flow* |

|

$ |

195 |

|

|

to |

|

$ |

210 |

|

|

$ |

198 |

|

|

to |

|

$ |

208 |

|

Earnings Webcast

Management will host a live internet broadcast

beginning at 10:00 a.m. E.T. today, to discuss third-quarter 2021

results. This event will be broadcast live on the Company's

website. To access the call and accompanying slide presentation, go

to www.armstrongceilings.com and click Investors. The replay of

this event will be available on the Company's website for up to one

year after the date of the call.

Uncertainties Affecting Forward-Looking

Statements

Disclosures in this release, including without

limitation, those relating to future financial results, market

conditions and guidance, the impacts of COVID-19 on our business,

and in our other public documents and comments, contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Those statements provide

our future expectations or forecasts and can be identified by our

use of words such as “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,”

“will,” “would,” “could,” “should,” “seek,” and other words or

phrases of similar meaning in connection with any discussion of

future operating or financial performance. Forward-looking

statements, by their nature, address matters that are uncertain and

involve risks because they relate to events and depend on

circumstances that may or may not occur in the future. As a result,

our actual results may differ materially from our expected results

and from those expressed in our forward-looking statements. A more

detailed discussion of the risks and uncertainties that could cause

our actual results to differ materially from those projected,

anticipated or implied is included in the “Risk Factors” and

“Management’s Discussion and Analysis” sections of our reports on

Form 10-K and 10-Q filed with the U.S. Securities and Exchange

Commission (“SEC”). Forward-looking statements speak only as of the

date they are made. We undertake no obligation to update any

forward-looking statements beyond what is required under applicable

securities law.

COVID-19

The impact of the COVID-19 pandemic on our

future consolidated results of operations remains uncertain. In

2020, we experienced a significant decrease in customer demand

throughout our business during the second through fourth quarters

due to COVID-19. Specifically, we noted delays in construction

driven by temporary closures of non-essential businesses, with the

most significant impacts in the major metropolitan areas impacted

by COVID-19. In response to COVID-19, we temporarily reduced

capital expenditures and discretionary spending including

compensation, travel and marketing expenses in 2020. Customer

demand continued to improve in the first nine months of 2021 but

remained lower than pre-pandemic levels. We continue to monitor and

manage the impact of COVID-19 and its potential impacts to our

business, most notably global supply chain and labor disruptions,

which have contributed to raw material and transportation cost

inflation, in addition to construction activity delays.

About Armstrong and Additional

Information

Armstrong World Industries, Inc. (AWI) is a

leader in the design and manufacture of innovative commercial and

residential ceiling, wall and suspension system solutions in the

Americas. With $937 million in revenue in 2020, AWI has

approximately 2,800 employees and a manufacturing network of 15

facilities, plus six facilities dedicated to its WAVE joint

venture.

More details on the Company’s performance can be

found in its report on Form 10-Q for the quarter ended

September 30, 2021 that the Company expects to file with the

SEC today.

Reported Financial Highlights

FINANCIAL HIGHLIGHTSArmstrong World Industries,

Inc. and Subsidiaries(Amounts in millions, except for per-share

amounts)(Unaudited)

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Net sales |

|

$ |

292.2 |

|

|

$ |

246.3 |

|

|

$ |

824.1 |

|

|

$ |

698.2 |

|

| Cost of goods sold |

|

|

181.5 |

|

|

|

155.1 |

|

|

|

521.0 |

|

|

|

447.9 |

|

| Gross profit |

|

|

110.7 |

|

|

|

91.2 |

|

|

|

303.1 |

|

|

|

250.3 |

|

| Selling, general and

administrative expenses |

|

|

62.3 |

|

|

|

41.0 |

|

|

|

176.5 |

|

|

|

108.8 |

|

| Change in fair value of

contingent consideration |

|

|

(0.3 |

) |

|

|

- |

|

|

|

(9.8 |

) |

|

|

- |

|

| (Gain) related to sale of fixed

and intangible assets |

|

|

- |

|

|

|

(6.9 |

) |

|

|

- |

|

|

|

(21.0 |

) |

| Equity (earnings) from joint

venture |

|

|

(23.4 |

) |

|

|

(15.2 |

) |

|

|

(68.1 |

) |

|

|

(48.2 |

) |

| Operating income |

|

|

72.1 |

|

|

|

72.3 |

|

|

|

204.5 |

|

|

|

210.7 |

|

| Interest expense |

|

|

6.1 |

|

|

|

6.1 |

|

|

|

17.4 |

|

|

|

18.7 |

|

| Other non-operating (income)

expense, net |

|

|

(1.4 |

) |

|

|

(3.2 |

) |

|

|

(4.3 |

) |

|

|

361.8 |

|

| Earnings (loss) from continuing

operations before income taxes |

|

|

67.4 |

|

|

|

69.4 |

|

|

|

191.4 |

|

|

|

(169.8 |

) |

| Income tax expense (benefit) |

|

|

16.6 |

|

|

|

15.2 |

|

|

|

48.0 |

|

|

|

(50.9 |

) |

| Earnings (loss) from continuing

operations |

|

|

50.8 |

|

|

|

54.2 |

|

|

|

143.4 |

|

|

|

(118.9 |

) |

| Net gain (loss) from discontinued

operations |

|

|

- |

|

|

|

(0.2 |

) |

|

|

(2.1 |

) |

|

|

(3.0 |

) |

| Net earnings (loss) |

|

$ |

50.8 |

|

|

$ |

54.0 |

|

|

$ |

141.3 |

|

|

$ |

(121.9 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per share

of common stock, continuing operations |

|

$ |

1.06 |

|

|

$ |

1.13 |

|

|

$ |

2.98 |

|

|

$ |

(2.48 |

) |

| Diluted (loss) per share of

common stock, discontinued operations |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(0.04 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) per share of

common stock |

|

$ |

1.06 |

|

|

$ |

1.13 |

|

|

$ |

2.94 |

|

|

$ |

(2.54 |

) |

| Average number of diluted common

shares outstanding |

|

|

47.8 |

|

|

|

48.0 |

|

|

|

48.0 |

|

|

|

47.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEGMENT RESULTSArmstrong World Industries, Inc.

and Subsidiaries(Amounts in millions)(Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2021 |

|

|

|

|

2020 |

|

|

2021 |

|

|

|

|

2020 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mineral Fiber |

|

$ |

214.5 |

|

|

|

|

$ |

187.3 |

|

|

$ |

611.3 |

|

|

|

|

$ |

542.9 |

|

| Architectural Specialties |

|

|

77.7 |

|

|

|

|

|

59.0 |

|

|

|

212.8 |

|

|

|

|

|

155.3 |

|

| Total net sales |

|

$ |

292.2 |

|

|

|

|

$ |

246.3 |

|

|

$ |

824.1 |

|

|

|

|

$ |

698.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2021 |

|

|

|

|

2020 |

|

|

2021 |

|

|

|

|

2020 |

|

| Segment operating income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mineral Fiber |

|

$ |

68.5 |

|

|

|

|

$ |

58.1 |

|

|

$ |

201.2 |

|

|

|

|

$ |

173.7 |

|

| Architectural Specialties |

|

|

5.0 |

|

|

|

|

|

9.1 |

|

|

|

7.5 |

|

|

|

|

|

20.9 |

|

| Unallocated Corporate |

|

|

(1.4 |

) |

|

|

|

|

5.1 |

|

|

|

(4.2 |

) |

|

|

|

|

16.1 |

|

| Total consolidated operating

income |

|

$ |

72.1 |

|

|

|

|

$ |

72.3 |

|

|

$ |

204.5 |

|

|

|

|

$ |

210.7 |

|

Selected Balance Sheet Information(Amounts in

millions)

|

|

|

(Unaudited)September 30, 2021 |

|

|

December 31, 2020 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

$ |

310.3 |

|

|

$ |

311.8 |

|

| Property, plant and equipment,

net |

|

|

527.3 |

|

|

|

529.9 |

|

| Other noncurrent assets |

|

|

867.3 |

|

|

|

876.8 |

|

|

Total assets |

|

$ |

1,704.9 |

|

|

$ |

1,718.5 |

|

| Liabilities and shareholders’

equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

194.3 |

|

|

$ |

172.3 |

|

| Noncurrent liabilities |

|

|

988.4 |

|

|

|

1,095.3 |

|

| Equity |

|

|

522.2 |

|

|

|

450.9 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

1,704.9 |

|

|

$ |

1,718.5 |

|

Selected Cash Flow Information(Amounts in

millions)(Unaudited)

|

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

| Net earnings (loss) |

|

$ |

141.3 |

|

|

$ |

(121.9 |

) |

| Other adjustments to reconcile

net earnings (loss) to net cash provided by operating

activities |

|

|

12.9 |

|

|

|

284.9 |

|

| Changes in operating assets and

liabilities, net |

|

|

(16.3 |

) |

|

|

(14.6 |

) |

| Net cash provided by operating

activities |

|

|

137.9 |

|

|

|

148.4 |

|

| Net cash (used for) investing

activities |

|

|

(5.4 |

) |

|

|

(52.2 |

) |

| Net cash (used for) financing

activities |

|

|

(175.1 |

) |

|

|

(2.5 |

) |

| Effect of exchange rate changes

on cash and cash equivalents |

|

|

— |

|

|

|

(0.2 |

) |

| Net (decrease) increase in cash

and cash equivalents |

|

|

(42.6 |

) |

|

|

93.5 |

|

| Cash and cash equivalents at

beginning of year |

|

|

136.9 |

|

|

|

45.3 |

|

| Cash and cash equivalents at end

of period |

|

$ |

94.3 |

|

|

$ |

138.8 |

|

Supplemental Reconciliations of GAAP to

non-GAAP Results (unaudited)(Amounts in millions, except

per share data)

To supplement its consolidated financial

statements presented in accordance with accounting principles

generally accepted in the United States (“GAAP”), the Company

provides additional measures of performance adjusted to exclude the

impact of certain discrete expenses and income including adjusted

net sales, adjusted EBITDA, adjusted diluted earnings per share

(EPS) and adjusted free cash flow. Investors should not consider

non-GAAP measures as a substitute for GAAP measures. The Company

excludes certain acquisition related expenses (i.e. – changes in

the fair value of contingent consideration, deferred compensation

accruals, impact of adjustments related to the fair value of

inventory and deferred revenue) for recent acquisitions. The

deferred compensation accruals are for cash and stock awards that

will be recorded over the vesting period, as such payments are

subject to the sellers’ and employees’ continued employment with

the Company. The Company excludes all acquisition-related

intangible amortization from adjusted earnings from continuing

operations and in calculations of adjusted diluted earnings per

share. Examples of other excluded items include plant closures,

restructuring charges and related costs, impairments, separation

costs, environmental site expenses and related insurance

recoveries, endowment level charitable contributions, and certain

other gains and losses. The Company also excludes income/expense

from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP

results as it represents the actuarial net periodic benefit

credit/cost recorded. For all periods presented, the Company was

not required and did not make cash contributions to the RIP based

on guidelines established by the Pension Benefit Guaranty

Corporation, nor does the Company expect to make cash contributions

to the plan in 2021. Adjusted free cash flow is defined as cash

from operating and investing activities, adjusted to remove the

impact of cash used or proceeds received for acquisitions and

divestitures, legacy environmental matters and litigation. The

Company believes adjusted free cash flow is useful because it

provides insight into the amount of cash that the Company generates

for discretionary uses, after expenditures for capital investments

and adjustments for acquisitions and divestitures. The Company uses

these adjusted performance measures in managing the business,

including communications with its Board of Directors and employees,

and believes that they provide users of this financial information

with meaningful comparisons of operating performance between

current results and results in prior periods. The Company believes

that these non-GAAP financial measures are appropriate to enhance

understanding of its past performance, as well as prospects for its

future performance. The Company also uses adjusted EBITDA and

adjusted free cash flow as factors in determining at-risk

compensation for senior management. These non-GAAP measures may not

be defined and calculated the same as similar measures used by

other companies. A reconciliation of these adjustments to the most

directly comparable GAAP measures is included in this release and

on the Company’s website. These non-GAAP measures should not be

considered in isolation or as a substitute for the most comparable

GAAP measures. Non-GAAP financial measures utilized by the Company

may not be comparable to non-GAAP financial measures used by other

companies.

In the following charts, numbers may not sum due

to rounding. Non-GAAP figures are rounded to the nearest million

and corresponding percentages are rounded to the nearest percent

based on unrounded figures.

Consolidated Results

from Continuing Operations – Adjusted EBITDA

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Earnings (Loss) from

continuing operations, Reported |

|

$ |

51 |

|

|

$ |

54 |

|

|

$ |

143 |

|

|

$ |

(119 |

) |

|

Add/(Less): Income tax expense (benefit), reported |

|

|

17 |

|

|

|

15 |

|

|

|

48 |

|

|

|

(51 |

) |

| Earnings (Loss) before

tax, Reported |

|

$ |

67 |

|

|

$ |

69 |

|

|

$ |

191 |

|

|

$ |

(170 |

) |

|

Add: Interest/other income and expense, net |

|

|

5 |

|

|

|

3 |

|

|

|

13 |

|

|

|

381 |

|

| Operating Income,

Reported |

|

$ |

72 |

|

|

$ |

72 |

|

|

$ |

205 |

|

|

$ |

211 |

|

|

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

4 |

|

|

Add: Acquisition-related impacts (2) |

|

|

3 |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

Add: Net environmental expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

(Less): Gain on sale of idled China plant facility |

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

|

|

(21 |

) |

| Operating Income,

Adjusted |

|

$ |

76 |

|

|

$ |

67 |

|

|

$ |

210 |

|

|

$ |

195 |

|

|

Add: Depreciation |

|

|

16 |

|

|

|

19 |

|

|

|

46 |

|

|

|

47 |

|

|

Add: Amortization |

|

|

7 |

|

|

|

6 |

|

|

|

28 |

|

|

|

15 |

|

| Adjusted

EBITDA |

|

$ |

99 |

|

|

$ |

92 |

|

|

$ |

284 |

|

|

$ |

257 |

|

(1) RIP expense represents only the plan service

cost that is recorded within Operating Income. For all periods

presented, we were not required to and did not make cash

contributions to our RIP.(2) Represents the impact of

acquisition-related adjustments for the fair value of acquired

inventory and deferred revenue, changes in fair value of contingent

consideration and deferred compensation and restricted stock

expenses.

Mineral Fiber

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Operating Income,

Reported |

|

$ |

69 |

|

|

$ |

58 |

|

|

$ |

201 |

|

|

$ |

174 |

|

|

Add: Net environmental expenses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

| Operating Income,

Adjusted |

|

$ |

69 |

|

|

$ |

58 |

|

|

$ |

201 |

|

|

$ |

175 |

|

|

Add: D&A |

|

|

18 |

|

|

|

20 |

|

|

|

53 |

|

|

|

54 |

|

| Adjusted

EBITDA |

|

$ |

86 |

|

|

$ |

79 |

|

|

$ |

254 |

|

|

$ |

228 |

|

Architectural Specialties

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Operating Income,

Reported |

|

$ |

5 |

|

|

$ |

9 |

|

|

$ |

8 |

|

|

$ |

21 |

|

|

Add: Acquisition-related impacts (1) |

|

|

3 |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

| Operating Income,

Adjusted |

|

$ |

8 |

|

|

$ |

9 |

|

|

$ |

9 |

|

|

$ |

21 |

|

|

Add: D&A |

|

|

5 |

|

|

|

4 |

|

|

|

21 |

|

|

|

8 |

|

| Adjusted

EBITDA |

|

$ |

13 |

|

|

$ |

13 |

|

|

$ |

29 |

|

|

$ |

29 |

|

(1) Represents the impact of acquisition-related

adjustments for the fair value of acquired inventory and deferred

revenue, changes in fair value of contingent consideration and

deferred compensation and restricted stock expenses.

Unallocated Corporate

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Operating (Loss) Income,

Reported |

|

$ |

(1 |

) |

|

$ |

5 |

|

|

$ |

(4 |

) |

|

$ |

16 |

|

|

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

4 |

|

|

|

4 |

|

|

(Less): Gain on sale of idled China plant facility |

|

- |

|

|

|

(7 |

) |

|

- |

|

|

|

(21 |

) |

|

Operating (Loss), Adjusted |

|

- |

|

|

- |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

Add: D&A |

|

- |

|

|

- |

|

|

|

1 |

|

|

|

1 |

|

| Adjusted

EBITDA |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

(1) RIP expense represents only the plan service

cost that is recorded within Operating Income. For all periods

presented, we were not required to and did not make cash

contributions to our RIP.

Adjusted Free Cash Flow

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Net cash provided by

operating activities |

|

$ |

56 |

|

|

$ |

70 |

|

|

$ |

138 |

|

|

$ |

148 |

|

| Net cash provided by

(used for) investing activities |

|

|

1 |

|

|

|

(63 |

) |

|

|

(5 |

) |

|

|

(52 |

) |

| Net cash provided by

operating and investing activities |

|

$ |

57 |

|

|

$ |

7 |

|

|

$ |

133 |

|

|

$ |

96 |

|

|

Add: Acquisitions, net |

|

|

1 |

|

|

|

74 |

|

|

|

1 |

|

|

|

74 |

|

|

(Less)/Add: Payments related to sale of international, net (1) |

|

|

- |

|

|

|

(20 |

) |

|

|

12 |

|

|

|

(21 |

) |

|

Add: Environmental payments, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

Add: Net Payments to WAVE for Portion of Proceeds from Sale of

International Business |

|

|

- |

|

|

|

3 |

|

|

|

- |

|

|

|

13 |

|

|

(Less): Proceeds from sale of Idled China Plant facility |

|

|

- |

|

|

|

(19 |

) |

|

|

- |

|

|

|

(19 |

) |

| Adjusted Free Cash

Flow |

|

$ |

58 |

|

|

$ |

46 |

|

|

$ |

145 |

|

|

$ |

145 |

|

(1) Amounts for the three and nine months ended

September 30, 2020 include related income tax impacts.

Consolidated Results from Continuing Operations –

Adjusted Diluted Earnings Per Share

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

Total |

|

|

Per DilutedShare |

|

|

Total |

|

|

Per DilutedShare |

|

|

Total |

|

|

Per DilutedShare |

|

|

Total |

|

|

Per DilutedShare |

|

| Earnings (Loss) from

continuing operations, Reported |

|

$ |

51 |

|

|

$ |

1.06 |

|

|

|

$ |

54 |

|

|

$ |

1.13 |

|

|

|

$ |

143 |

|

|

$ |

2.98 |

|

|

|

$ |

(119 |

) |

|

$ |

(2.48) |

|

|

| Add/(Less): Income tax expense

(benefit), reported |

|

|

17 |

|

|

|

|

|

|

$ |

15 |

|

|

|

|

|

|

|

48 |

|

|

|

|

|

|

|

(51 |

) |

|

|

|

|

| Earnings (Loss) from

continuing operations before income taxes, Reported |

|

|

67 |

|

|

|

|

|

|

$ |

69 |

|

|

|

|

|

|

$ |

191 |

|

|

|

|

|

|

$ |

(170 |

) |

|

|

|

|

| Add: RIP expense (1) |

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

370 |

|

|

|

|

|

| Add: Acquisition-related impacts

(2) |

|

|

3 |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| Add: Acquisition related

amortization (3) |

|

|

4 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

| (Less)/Add: Net environmental

expenses |

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

| (Less): Gain on sale of idled

China plant facility |

|

|

- |

|

|

|

|

|

|

|

(7 |

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

(21 |

) |

|

|

|

|

| Add: Accelerated Depreciation

from closed facility |

|

- |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

| Adjusted earnings from

continuing operations before income taxes |

|

$ |

74 |

|

|

|

|

|

|

$ |

68 |

|

|

|

|

|

|

$ |

210 |

|

|

|

|

|

|

$ |

188 |

|

|

|

|

|

| (Less): Adjusted income tax

expense (4) |

|

|

(18 |

) |

|

|

|

|

|

|

(17 |

) |

|

|

|

|

|

|

(53 |

) |

|

|

|

|

|

|

(46 |

) |

|

|

|

|

| Adjusted net

income |

|

$ |

56 |

|

|

$ |

1.17 |

|

|

|

$ |

51 |

|

|

$ |

1.07 |

|

|

|

$ |

157 |

|

|

$ |

3.28 |

|

|

|

$ |

142 |

|

|

$ |

2.93 |

|

|

| Adjusted EPS change versus Prior

Year |

|

9 |

% |

|

|

|

|

|

|

|

|

|

|

12 |

% |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Shares Outstanding

(5) |

|

47.8 |

|

|

|

48.0 |

|

|

|

48.0 |

|

|

|

48.3 |

|

|

| Adjusted Tax Rate (6) |

|

25 |

% |

|

|

25 |

% |

|

|

25 |

% |

|

|

25 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) RIP expense represents the entire actuarial

net periodic pension expense (credit) recorded as a component of

earnings from continuing operations. For all periods presented, we

were not required to and did not make cash contributions to our

RIP.(2) Represents the impact of acquisition-related adjustments

for the fair value of acquired inventory and deferred revenue,

changes in fair value of contingent consideration and deferred

compensation accruals.(3) Represents the intangible amortization

related to acquired entities, including customer relationships,

developed technology, software, trademarks and brand names,

non-compete agreements and other intangibles.(4) Adjusted income

tax expense is calculated using the adjusted tax rate multiplied by

the adjusted earnings from continuing operations before income

taxes.(5) Dilutive shares are as-reported. 2020 dilutive shares

outstanding for the nine months ended September 30, 2020 include

anti-dilutive common stock equivalents which are excluded from U.S.

GAAP Accounting.(6) The tax rate for the three and nine months

ended September 30, 2020 excludes the first quarter 2020 pension

annuitization and the gain on the sale of our idled China

facility.

Adjusted EBITDA Guidance

|

|

|

For the Year Ending December 31, 2021 |

|

|

|

|

Low |

|

|

High |

|

| Net income |

|

$ |

189 |

|

to |

$ |

194 |

|

|

Add: Interest expense |

|

|

23 |

|

|

|

23 |

|

|

(Less): RIP credit (1) |

|

|

(4 |

) |

|

|

(4 |

) |

|

Add: Income Tax Expense |

|

|

62 |

|

|

|

63 |

|

| Operating

income |

|

$ |

270 |

|

to |

$ |

277 |

|

|

Add: RIP expense (2) |

|

|

4 |

|

|

|

4 |

|

|

Add: Depreciation |

|

|

63 |

|

|

|

63 |

|

|

Add: Amortization |

|

|

35 |

|

|

|

35 |

|

| Adjusted

EBITDA |

|

$ |

372 |

|

to |

$ |

378 |

|

(1) RIP credit represents the actuarial net

periodic benefit expected to be recorded as a component of other

non-operating income. We do not expect to and do not plan to make

cash contributions to our RIP in 2021 based on guidelines

established by the Pension Benefit Guaranty Corporation.(2) RIP

expense represents only the plan service cost that is recorded

within Operating Income. For all periods presented, we were not

required and did not make cash contributions to our RIP.

Adjusted Diluted Earnings Per Share

(EPS) Guidance

|

|

|

For the Year Ending December 31, 2021 |

|

|

|

|

Low |

|

|

Per DilutedShare(1) |

|

|

High |

|

|

Per DilutedShare(1) |

|

| Net income |

|

$ |

189 |

|

|

$ |

3.94 |

|

to |

$ |

194 |

|

|

$ |

4.04 |

|

|

Add: Interest expense |

|

|

23 |

|

|

|

|

|

|

|

23 |

|

|

|

|

|

|

(Less): RIP Credit (2) |

|

|

(4 |

) |

|

|

|

|

|

|

(4 |

) |

|

|

|

|

|

Add: Income tax Expense |

|

|

62 |

|

|

|

|

|

|

|

63 |

|

|

|

|

|

| Operating

income |

|

$ |

270 |

|

|

|

|

|

to |

$ |

277 |

|

|

|

|

|

|

Add: RIP expense (3) |

|

|

4 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

(Less): Interest expense |

|

|

(23 |

) |

|

|

|

|

|

|

(23 |

) |

|

|

|

|

|

Add: Acquisition related amortization (4) |

|

|

21 |

|

|

|

|

|

|

|

21 |

|

|

|

|

|

| Adjusted earnings before

income taxes |

|

$ |

272 |

|

|

|

|

|

to |

$ |

279 |

|

|

|

|

|

|

(Less): Income tax expense (5) |

|

|

(68 |

) |

|

|

|

|

|

|

(70 |

) |

|

|

|

|

| Adjusted net

income |

|

$ |

204 |

|

|

$ |

4.25 |

|

to |

$ |

209 |

|

|

$ |

4.35 |

|

(1) Adjusted EPS guidance for 2021 is calculated

based on an adjusted effective tax rate of 25% and based on ~48

million of diluted shares outstanding.(2) RIP credit

represents the actuarial net periodic benefit expected to be

recorded as a component of other non-operating income. We do not

expect to be required to make, nor do we plan to make cash

contributions to our RIP based on guidelines established by the

Pension Benefit Guaranty Corporation.(3) RIP expense represents

only the plan service cost related to the U.S. pension plan and is

recorded as a component of operating income. We do not expect to be

required to make, nor do we plan to make cash contributions to our

RIP based on guidelines established by the Pension Benefit Guaranty

Corporation.(4) Represents the intangible amortization related to

acquired entities, including customer relationships, developed

technology, software, trademarks and brand names, non-compete

agreements and other intangibles.(5) Adjusted income tax expense is

based on adjusted earnings before income tax.

Adjusted Free Cash Flow

Guidance

|

|

|

For the Year Ending December 31, 2021 |

|

|

|

|

Low |

|

|

High |

|

| Net cash provided by

operating activities |

|

$ |

203 |

|

to |

$ |

213 |

|

|

Add: Return of investment from joint venture |

|

|

75 |

|

|

|

80 |

|

| Adjusted net cash

provided by operating activities |

|

$ |

278 |

|

to |

$ |

293 |

|

|

Less: Capital expenditures |

|

|

(80 |

) |

|

|

(85 |

) |

| Adjusted Free Cash

Flow |

|

$ |

198 |

|

to |

$ |

208 |

|

Contacts

Investors: Theresa Womble, tlwomble@armstrongceilings.com or (717) 396-6354

Media: Jennifer Johnson, jenniferjohnson@armstrongceilings.com or (866) 321-6677

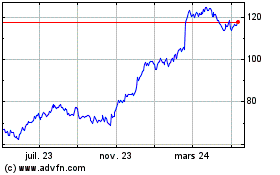

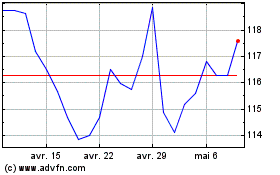

Armstrong World Industries (NYSE:AWI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Armstrong World Industries (NYSE:AWI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024