Aveva Fiscal Year 2018 Pretax Profit Falls 34% After Reverse Takeover

14 Juin 2018 - 10:02AM

Dow Jones News

By Oliver Griffin

Aveva Group PLC (AVV.LN) reported Thursday a 34% fall in

pro-forma pretax profit for fiscal 2018, after booking a number of

exceptional and other one-off costs, some of which relate to its

reverse acquisition by France's Schneider Electric SE (SU.FR).

The industrial-software company said that pro-forma pretax

profit, which is adjusted to assume that the combined company has

been in operation for the whole year, fell to 64.6 million pounds

($86.5 million), from GBP98.3 million a year earlier. Revenue on

the same basis rose to GBP704.6 million, from GBP648.7 million.

Pro-forma adjusted earnings before interest and tax, the

company's preferred measure which strips out exceptionals and other

one-off items, rose to GBP165.6 million, from GBP152.0 million.

Aveva and Schneider announced in September that the French

company would fold its software assets into its U.K. counterpart's

operations and pay it GBP550 million for a 60% stake in the

combined entity. The deal completed on March 1.

Aveva said that good progress has been made in the integration

of the two businesses and that it is targeting annualized cost

synergies of approximately 5% of total fiscal 2018 costs, or around

GBP25 million. The synergies are expected to be fully implemented

by the end of the 2020 financial year.

Aveva said it proposed to maintain its final dividend at 27

pence per share.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

June 14, 2018 03:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

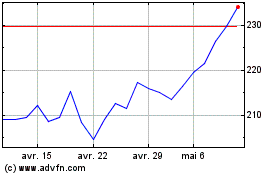

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

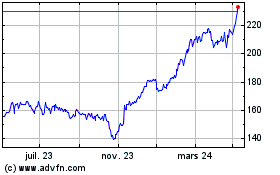

Schneider Electric (EU:SU)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024