Avon Rubber Buys 3M's Ballistic-Protection Unit for Up to $116 Million -- Deal Digest

07 Août 2019 - 10:05AM

Dow Jones News

By Adria Calatayud

ACQUIRER: Avon Rubber PLC (AVON.LN), a U.K. manufacturer of

respiratory-protection equipment.

SELLER: 3M Co. (MMM).

TARGET: 3M's ballistic-protection business and the rights to the

Ceradyne brand.

PRICE: Up to $116 million, comprising an initial cash price of

$91 million and a further consideration of up to $25 million

subject to the outcome of pending tenders.

EXPECTED CLOSE: The acquisition is expected to close in the

first half of Avon Rubber's fiscal year ending March 31, 2020.

RATIONALE: Avon Rubber said the deal represents an attractive

opportunity, as the target has established positions with the U.S.

Department of Defense and law-enforcement customers as well as a

track record of profitable revenue growth. The acquisition

significantly widens Avon's protection product range and deepens

its presence in the U.S., the company said. Synergies of $5 million

in the first full year of ownership are expected, Avon Rubber

said.

STOCK MOVE: Avon Rubber shares at 0726 GMT were up 7.9% at 1,428

pence.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

August 07, 2019 03:50 ET (07:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

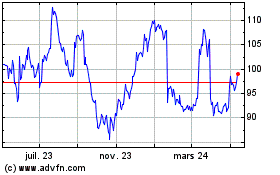

3M (NYSE:MMM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

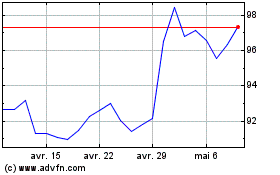

3M (NYSE:MMM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024