- A decisive step in BALYO’s

development that supports the added value of BALYO’s robotic

solutions and will potentially boost their deployment

- AMAZON would obtain the right to

subscribe up to 29% of BALYO’s capital depending on the level of

potential future orders by AMAZON up to EUR 300 million

- Both BALYO’s industrial partners and

major financial shareholders support this transaction

Regulatory News:

BALYO (FR0013258399, Ticker: BALYO, eligible for the

PEA-PME plan), a technological leader in the design and development

of innovative robotic solutions for material handling trucks,

announces it has signed an agreement with AMAZON.

Fabien Bardinet, Chairman and Chief Executive

Officer, stated: “We are very proud to have signed this

agreement. It represents an unprecedented opportunity for BALYO to

grow its business and supports the soundness of our investments

over the years to perfect our robotic solutions.”

Pursuant to the agreement signed today, AMAZON will receive free

stock warrants which will vest based on AMAZON’s purchase of

BALYO-enabled products. The full number of stock warrants,

representing up to 29% of BALYO’s share capital and voting rights

(before dilution of existing securities giving access to share

capital as of 31 December 2018), would become exercisable according

to AMAZON’s decision if AMAZON orders up to EUR 300 million of

BALYO-enabled products. The issuance of the warrants will be

submitted for the approval at an Extraordinary General Meeting of

BALYO’s shareholders.

Implementation schedule:

An Extraordinary General Meeting will be convened to be held end

of February 2019 so that all of BALYO’s shareholders can vote on

the resolution to grant reserved free stock warrants (“BSA”) to

AMAZON, by a majority of 2/3 of votes present and represented.

To date, industrial partners and shareholders of BALYO,

Hyster-Yale Group and Linde Material Handling, as well as the

founders and the Company’s major financial shareholders, Seventure

Partners and Bpifrance Investissement, have committed to vote in

favor of this resolution, within the framework of voting

commitments signed by each of them. The voting commitments together

represent approximately 55% of BALYO's voting rights.

Details on the BSAs:

The 11.753.581 BSAs freely allocated to AMAZON (each entitling

to the subscription of 1 new share) will have a term of seven years

from the date of allocation and can be exercised at the choice of

AMAZON and in full or in part, as follows: 1.621.184 BSA vested

immediately after a minimum order of EUR 10 million, and then

successive tranches of 405.296 BSA vested per tranche of EUR 12

million in orders fulfilled and paid (up to EUR 300m of orders).

All the BSAs allocated would be fully vested in the event of a

change in control. The exercise price of each warrant is EUR 3.03

per share for the entire period (equal to the 30-day VWAP at

January 9, 2019).

The warrants are non-transferable by AMAZON, except to an

affiliate or in the event of a change of control, and will not be

admitted to trading. The shares resulting from the exercise of the

warrants are not subject to a lock-up commitment by AMAZON.

AMAZON has the right to appoint an observer at BALYO'S Board of

Directors.

The reserved issue of the warrants will not result in the

preparation of a prospectus submitted to the Autorité des Marchés

Financiers ("AMF") for approval. A prospectus will be prepared and

submitted to the AMF for approval if the shares issued upon

exercise of the warrants or other securities giving access to

BALYO's share capital represent more than 20% of BALYO's share

capital in less than 12 months, in accordance with applicable

regulations.

Information regarding 2018 estimated revenue

BALYO’s 2018 revenue landing expected to be around EUR 23.3

million, growing more that 40% from 2017

Important information

No communication and no information in respect of this

transaction may be distributed to the public in any jurisdiction

where a registration or approval is required. No steps have been or

will be taken in any jurisdiction (other than France) where such

steps would be required. The issue, the subscription for or the

purchase of BALYO’s shares and/or warrants may be subject to

specific legal or regulatory restrictions in certain

jurisdictions.

This announcement is not a prospectus within the meaning of

Directive 2003/71/EC of the European Parliament and the Council of

November 4th, 2003, as amended, in particular by Directive

2010/73/EU (together, the “Prospectus Directive”).

No securities offering will be opened to the public in France

before the delivery of the visa on a prospectus prepared in

compliance with the Prospectus Directive, as approved by the French

Autorité des marchés financiers.

With respect to the member states of the European Economic Area

which have implemented the Prospectus Directive (each, a

“relevant member State”), other than France, no action has

been undertaken or will be undertaken to make an offer to the

public of the securities requiring publication of a prospectus in

any relevant member State.

The distribution of this press release is not made, and has not

been approved, by an “authorised person” within the meaning of

Article 21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments within the meaning of

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotions) Order 2005 (as amended), (iii) are persons

falling within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Services and

Markets Act 2000 (Financial Promotions) Order 2005 (as amended) or

(iv) are persons to whom this press release may otherwise lawfully

be communicated (all such persons mentioned in paragraphs (i),

(ii), (iii) and (iv) collectively being referred to as “Relevant

Persons”). The securities are directed only at Relevant Persons and

no invitation, offer or agreements to subscribe, purchase or

acquire the securities may be proposed or made other than with

Relevant Persons. Any person other than a Relevant Person may not

act or rely on this document or any provision thereof. This press

release is not a prospectus which has been approved by the

Financial Conduct Authority or any other United Kingdom regulatory

authority within the meaning of Section 85 of the Financial

Services and Markets Act 2000.

This press release does not constitute or form a part of any

offer or solicitation to purchase or subscribe for securities in

the United States. Securities may not be offered, subscribed or

sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “U.S. Securities

Act”), except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements thereof.

The warrants and the shares of BALYO and rights in respect thereof

have not been and will not be registered under the U.S. Securities

Act and BALYO does not intend to make a public offer of its

securities in the United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in the United States, Canada, Australia or Japan.

This press release may not be published, forwarded or

distributed, directly or indirectly, in the United States

(including its territories and dependencies and any state of the

United States), Canada, Australia or Japan.

ABOUT BALYO

BALYO transforms standard forklift trucks into standalone

intelligent robots thanks to its breakthrough proprietary Driven by

Balyo™ technology. The geoguidance navigation system developed by

BALYO allows vehicles equipped with the system to locate their

position and navigate autonomously inside buildings. Within the

automated handling vehicle market, BALYO has entered into two

strategic agreements with Kion Group AG (Linde Material Handling's

parent company) and Hyster-Yale Group, two major operators in the

material handling sector. BALYO is present in three major

geographic regions (Americas, Europe and Asia-Pacific). Its sales

revenue reached €16.4 million in 2017. For more information, please

visit our website at www.balyo.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190109005859/en/

BALYOStanislas PiotCFOinvestors@balyo.com

NewCapFinancial Communication and Investor

RelationsLouis-Victor Delouvrier/Thomas GrojeanTel: +33 1 44 71 98

53balyo@newcap.eu

Image 7Media relationsGrégoire Lucas / Roxane

Planasgregoire.lucas@image7.fr / rplanas@image7.frTel. : +33 1 53

70 74 89

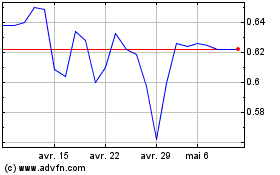

Balyo (EU:BALYO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Balyo (EU:BALYO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024