BNP Shares Rise After 1Q Results

05 Mai 2020 - 11:42AM

Dow Jones News

By Pietro Lombardi

Shares in BNP Paribas SA trade higher after the French bank

delivered a set of first-quarter results that some analysts see as

a proof of its resilience.

France's largest listed bank by assets warned that the

coronavirus pandemic may reduce profits this year by up to a fifth

from last year. It vowed to further cut costs after its

first-quarter profit fell by a third as it set aside more money to

cover potential soured loans and disruption sparked by the pandemic

wiped out revenue from its equities-trading division.

The increase in loan-loss provisions is consistent with steps

taken by many large banks in Europe and the U.S. as the banking

industry braces for the economic impact of the coronavirus. The

equities rout echoes a similar trend at French peer Societe

Generale, which last week posted a surprise loss after soaring

bad-loan charges and a collapse in stock-trading revenue.

BNP said Tuesday that net profit for 2020 may fall by 15% to 20%

due to the pandemic, the effects of which were already felt in the

first quarter. The lender will increase its efforts to cut

operating expenses, but this could be offset by growing

provisioning.

The outlook is better than consensus estimates, analysts

said.

"The optimistic outlook statement relative to expectations may

support the shares initially but we would expect this to fade as

focus shifts to worse-than-expected capital and a lack of

provisioning in all but the corporate bank and consumer credit,"

Barclays said.

BNP shares rose 5.8% at 0826 GMT. The stock is down roughly 46%

so far this year.

"At the end of a quarter supported by an excellent business

drive, in line with its 2020 objectives, the results of BNP Paribas

for the first quarter 2020 were impacted by the harshness of the

health crisis," Chief Executive Jean-Laurent Bonnafe said. "The

good resilience of revenues and results despite this shock

demonstrates the robustness of the group's diversified and

integrated model."

The bank set aside 1.43 billion euros ($1.56 billion) to cover

bad loans, more than a third of which related to the pandemic. This

is an 85% increase on year.

The higher provisions, coupled with lower revenue, led to a 33%

decline in net profit to EUR1.28 billion. Revenue fell 2.3% to

EUR10.89 billion.

"Underlying results were resilient," Jefferies said.

The pandemic dealt a EUR568 million blow to the bank's top line,

related to two one-off impacts in its equities and insurance

businesses.

Equities revenue in particular collapsed, with the business

posting a loss of EUR87 million in the quarter--from revenue of

EUR488 million a year earlier--as it was "badly hit by the sharp

falls in European markets at the end of March," it said. The

restrictions imposed by European authorities on 2019 dividends

resulted in a hit to revenue of EUR184 million, it said.

Fixed-income revenue rose around 35%.

BNP's core Tier 1 capital ratio--a key measure of capital

strength--was 12% in March compared to 12.1% in December.

"This set of results showed the resilience of the group CET 1...

and the benefit of a diversified business," Citi said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 05, 2020 05:27 ET (09:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

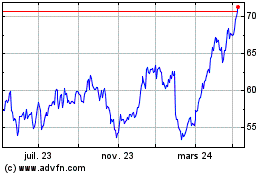

BNP Paribas (EU:BNP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

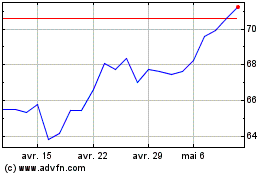

BNP Paribas (EU:BNP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024