BOURSE: Wall Street évolue peu en préouverture, les investisseurs marquent une pause

02 Avril 2019 - 2:23PM

Dow Jones News

NEW YORK (Agefi-Dow Jones)--Les contrats à terme sur les principaux

indices américains évoluent peu mardi en préouverture, les

investisseurs restant en marge du marché après la forte hausse

enregistrée lundi en réaction à des indicateurs encourageants sur

l'activité manufacturière en Chine et aux Etats-Unis.

Vers 14h00, les contrats à terme sur les indices Dow Jones, S&P

500 étaient quasiment inchangés, tout comme celui sur le Nasdaq

100.

"Les opérateurs sont de plus en plus convaincus que les deux

premières économies mondiales commencent à se stabiliser, comme

l'attestent les données récemment publiées", indique Jasper Lawler,

responsable de l'analyse chez London Capital Group.

VALEURS A SUIVRE :

-Kellogg est inchangé en préouverture, après l'annonce lundi soir

de la cession des biscuits Keebler ainsi que d'autres marques de

snacks du spécialiste américain des céréales de petit-déjeuner au

groupe italien Ferrero pour un montant de 1,3 milliard de dollars

en numéraire.

-Dow Inc. remplacera mardi DowDupont à la Bourse de New York. Le

groupe américain de chimie a finalisé la première phase de sa

séparation en trois entités, avec la scission de la branche

spécialisée dans les sciences des matériaux, Dow Inc.

-L'action Walgreens Boots Alliance chute de 6,3% en préouverture,

après une révision à la baisse des prévisions de résultats de la

chaîne de pharmacies.

EVENEMENTS A VENIR:

Les investisseurs surveilleront les chiffres des commandes de biens

durables en février à 14h30.

-William Watts, MarketWatch

(Version française et contribution de Aurélie Henri) ed: VLV

Agefi-Dow Jones The financial newswire

-0-

By William Watts, MarketWatch

Stock-index futures were little changed Tuesday, with investors on

the sidelines a day after a strong rally inspired by upbeat

manufacturing data out of China and the U.S.

What are major indexes doing?

Futures on the Dow Jones Industrial Average were up 5 points, or

less than 0.1%, at 26,263, while S&P 500 futures edged up 1.75

points, or 0.1%, to 2,872. Nasdaq-100 futures were up 3 points, or

less than 0.1%, to 7,501.50.

What's driving the market?

Investors appeared to be taking a breather after a Monday rally

(http://www.marketwatch.com/story/us-stock-futures-climb-on-upbeat-china-data-indicating-bullish-start-to-new-quarter-2019-04-01)

that saw the Dow rally 301 points, or 1.2%, while the S&P 500

rose 1.1% and the Nasdaq gained 1.2%. Stocks got off to a strong

start after a purchasing managers index reading for China pointed

to the first expansion in activity

(http://www.marketwatch.com/story/chinas-caixin-manufacturing-pmi-rises-in-march-2019-03-31)

in the country's manufacturing sector in four months, which was

followed by a stronger-than-expected reading

(http://www.marketwatch.com/story/us-manufacturing-rebounds-in-march-ism-index-shows-2019-04-01)

for the Institute for Supply Management's U.S. manufacturing

index.

Investors will look ahead to data on February durable-goods orders

due at 8:30 a.m. Eastern. Economists surveyed by MarketWatch look

for a 2.1% fall after a 0.3% rise in January.

Investors are also keeping an eye on the Treasury market. A closely

watched measure of the yield curve -- the spread between yields on

10-year Treasury notes and 3-month Treasury bills -- turned

negative, or inverted, on March 22. Such an inversion is viewed as

a reliable warning of a potential recession a year or more in the

future.

Read:Why the world's biggest bond investor is dismissing the yield

curve's recession warning

(http://www.marketwatch.com/story/why-the-worlds-biggest-bond-investor-is-dismissing-the-recession-warning-of-the-yield-curve-2019-04-01)

A subsequent retreat by Treasurys, however, has seen yields at the

long end rise in recent sessions, moving the curve out of

inversion. Yields rise as bond prices fall.

What shares are in focus?

Shares of Walgreens Boots Alliance Inc. (WBA) were off more than 6%

after the pharmacy chain reported second-quarter results.

What are analysts saying?

"Traders are growing increasingly optimistic that the world's two

largest economies are starting to stabilize, amid better recent

data prints. Yields on 10-year bonds have now gained considerably

since their inversion just a week or so go," said Jasper Lawler,

head of research at London Capital Group, in a note.

-William Watts; 415-439-6400; AskNewswires@dowjones.com

(END) Dow Jones Newswires

April 02, 2019 08:03 ET (12:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

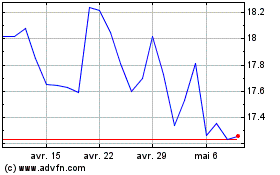

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024