Banco Comercial Português, S.A. informs about Bank Millennium (Poland) results in 1H 2020

23 Juillet 2020 - 10:09AM

Banco Comercial Português, S.A. informs about Bank Millennium

(Poland) results in 1H 2020

Banco Comercial Português, S.A. informs

about Bank Millennium (Poland) results in 1H 2020

Banco Comercial Português, S.A. hereby

informs that Bank Millennium in Poland, in which it has a 50.1%

holding and whose accounts are fully consolidated at BCP group

level, released today its results for 1H 2020. Main highlights are

as follows:

Solid operational profitability in 1H20, affected by

integration costs and legal risk provisions

- Reported 1H20 net profit of 72 million PLN (16.2 million EUR)

and 54 million PLN (12.0 million EUR) in 2Q 2020, a y/y contraction

of 79% in 1H 2020 and 70% in 2Q20. When adjusted to extraordinary

items*, net profit of 394 million PLN (89.1 million EUR) in 1H20

and 204 million PLN (46.1 million EUR) in 2Q 2020, a y/y growth of

8% in 1H 2020 and a 14% contraction in 2Q20

- 35.3 million PLN (8.0 million EUR) of integration costs and

provisions related to Euro Bank

- 62 million PLN (14.0 million EUR) of merger synergies, well

above integration costs

- Extraordinary provisions: 168 million PLN (38.1 million EUR)

for foreign exchange (FX) mortgages legal risks, 69.3 million PLN

(15.7 million EUR) for Covid-19 related risks and 60.5 million PLN

(13.7 million EUR) for fee refunds on early repaid consumer

loans

- Reported ROE of 2.2% and Adjusted ROE of 8.7%

- Reported Cost/income ratio of 51.8% and adjusted Cost/income

ratio of 47.1%

Higher operating income and costs influenced by the

merger of Euro Bank

- Operating income grew 14% y/y

- Net interest income grew 23% y/y

- Net commission income grew 10% y/y

- Operating costs grew 21% y/y, excluding integration costs (22%,

including integration costs), and decreased 8% q/q (excluding

integration and Bank Guarantee Fund costs)

High asset quality and liquidity kept

- Impaired loans (stage 3) ratio at 4.9%

- Cost of Risk** at 98 b.p. (79 b.p., excluding Covid-19 related

provisions)

- Loans to deposits ratio at a record low of 83%

Solid capital position and lower regulatory

buffers

- Group’s Total Capital Ratio (TCR) at 20.0%, and CET1 ratio at

17.0%, comfortably above requirements (15.4% and 12.2%,

respectively)

- Systemic risk buffer down to 0%, from 3%, in March 2020

Retail business

- 2.62 million active Clients, a 34% y/y growth. +45,600 new

Clients YTD, with #2 score in new Clients acquisition in 1Q20

(PRnews)

- Deposits grew 10% y/y

- Loans grew 8% y/y (12%, excluding FX mortgages)

- New record high of 1.5 billion PLN (338 million EUR) in

mortgages loans origination in 2Q20, 2.9 billion PLN (653 million

EUR) in 1H20, a 50% y/y growth. This translates in a 10% y/y growth

of the mortgage loan book (17%, excluding FX mortgages)

- 2.4 billion PLN (540 million EUR) in cash loans origination in

1H20, a 4% y/y growth. 1.1 billion PLN (248 million EUR) in 2Q20, a

17% y/y and q/q decrease. This translates in a 2% y/y growth of the

non-mortgage retail loan book

- Market share of mortgages new production of 11.1% in 1H20, with

a 15.8% market share in June (#2)

- Accelerating the new microbusiness accounts acquisition pace,

almost 23 thousand net growth of active accounts, y/y

- Number of active microbusiness clients exceeded 100,000 (a 29%

y/y growth)

Companies business

- Companies’ deposits grew 13% q/q (19% y/y) with current account

deposits growing 25% q/q (77% y/y)

- Loans to companies decreased 4% q/q, stable y/y

- Factoring turnover stable y/y, with #6 ranking (PZF)

Quality and Innovations

- DGP/PwC’s “Stars of Banking in 2020”: 1st in the “Growth Star”

category, 2nd in the “Customer Relationship” category, 3rd for

overall achievement in the competition’s main category and in the

“Star of Innovation” category

- Golden Banker 2020: main award in the category “Fin-Tech

Innovation” for the implementation of the Autopay service (in

cooperation with Blue Media), 2nd place in the “Mortgage Loan”

category

- KPMG’s Customer Experience survey: Best in Customer Experience

among Polish banks

- Highest NPS ratio*** (52) among Polish banks

- Best Web Site Design in Central and Eastern Europe according to

Global Finance

- 1.8 million downloads of the Millennium Goodie app –

smartshopping platform

(*) without extraordinary items (pre-tax): in 1H20: 1)

integration costs: PLN 35.3 million (8.0 million EUR), 2) PLN 168

million (38.1 million EUR) provisions for FX mortgage legal risk,

3) PLN 69.3 million (15.7 million EUR) for Covid-19 related risk,

4) PLN 60.5 million (13.7 million EUR) provisions for the return of

commissions from loans repaid earlier by clients, 5) linear

distribution of BFG resolution fund fee of PLN 58.2mn (13.2 million

EUR); in 1H19: 1) integration costs: PLN 19.8 million (4.5 million

EUR), 2) PLN 26.9 million (6.1 million EUR) release of tax asset

provision, 3) acquisition related extra provisions for Euro Bank of

PLN 80.6 million (18.2 million EUR), 4) linear distribution of BFG

resolution fund fee of PLN 73.3mn (16.6 million EUR)

(**) total net provisions (including FV adjustment and

modification effect) to average gross loans, without extra IFRS9

provisions on Euro Bank acquired portfolio and without provisions

on FX mortgage legal risk

(***) based on ARC Opinia i Rynek survey

End of announcementBanco Comercial

Português, S.A.

- Resultados Polónia 1S20 EN

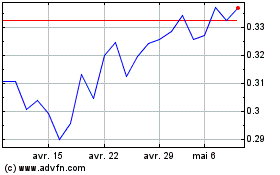

Banco Comercial Portugues (EU:BCP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

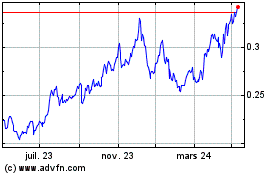

Banco Comercial Portugues (EU:BCP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024