By James R. Hagerty

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 8, 2019).

Emerging from Army service in 1957, Andrew Craig had job offers

from International Business Machines Corp. and a drug company. He

saw more opportunity in banking.

When he interviewed at banks, he wrote later, "I remember

looking at their senior executives, who were all nearing retirement

age, and thinking, 'I want their jobs!' "

Mr. Craig, who died May 24 at age 88, went into banking when it

was mostly a local business. By the time he retired, he had helped

lead a consolidation wave that eliminated thousands of banks and

created a few giants operating across the nation.

As CEO of St. Louis-based Boatmen's Bancshares Inc. from 1988 to

1996, he used acquisitions to build a strong regional banker in

nine central states. He gave executives baseball bats embossed with

the order to "hit singles," rather than swinging wildly for the

fences. By the mid-1990s, consolidation by bigger banks made

Boatmen's look more like prey than a predator.

Mr. Craig agreed to sell Boatmen's to NationsBank Corp. for $9.5

billion in 1996. The offer was about 2.7 times book value at a time

when twice book value was considered pricey.

Mr. Craig served for 16 months as chairman of NationsBank. In

1998, NationsBank merged with BankAmerica Corp. and adopted the

Bank of America name.

Reflecting consolidation, the number of U.S. commercial banks

with federally insured deposits shrank to 8,777 in 1998 from 13,165

when Mr. Craig began his career 41 years earlier.

NationsBank's CEO, Hugh McColl, was so eager to buy Boatmen's

that he arrived for negotiations in St. Louis in a Cardinals

baseball cap. "Andy is a terrific trader," Mr. McColl said after

signing the deal. "That's why the price is as high as it is."

After retiring from Bank of America, Mr. Craig helped found a

venture-capital firm, RiverVest Venture Partners.

Andrew Billings Craig III, an only child, was born March 20,

1931, in Buffalo and raised in the village of Jasper, N.Y. His

parents operated a general store founded by his paternal

grandfather. His father also delivered groceries to farmers, worked

as an insurance agent and served on the board of a local bank.

On Sundays, Mr. Craig recalled in an unpublished memoir, the

family attended a Presbyterian church and heard "fire-and-brimstone

admonitions about all of our sins." The pastor "didn't seem to have

a lot of credibility with my parents and me. We just listened."

Young Andrew grew to 6-foot-4 and was on his high school's

basketball, baseball and track teams. At half-time in basketball

games, he dashed into the stands, still wearing his basketball

shorts, to blow his trumpet for the pep band.

After graduating from high school in 1949, he spent a year at

the Manlius military school near Syracuse, N.Y., and then enrolled

at Cornell University. Because his mother wanted him to become a

physician, he started on a pre-medicine major before switching to

zoology and then sociology. He served as president of his

fraternity. He transferred to the University of Buffalo to earn the

final credits needed for a bachelor's degree in sociology.

He served in the Army as an intelligence officer and met his

future wife, Virginia Jean Coskery, known as Jake, on a blind

date.

Buffalo, N.Y.-based Manufacturers & Traders Trust Co. hired

him in 1957 as a management trainee with a salary of $4,800 a year.

He was put to work answering customer questions and complaints. It

wasn't the challenging job he expected. "I wondered how the heck I

had gotten myself into this position," he wrote in his memoir.

To improve his chances for promotion, he started taking

accounting and banking courses at night. "From day one, I began to

calculate my career progression," he wrote. The goal was to learn

every aspect of banking, a task that proved "interesting,

challenging -- and sometimes boring."

After three years of training, he became a commercial loan

officer, starting with individual secured loans and moving on to

small business loans, then credits to big companies. In 1974, he

was promoted to CEO of M&T. He jumped to BancOhio Corp. in 1983

and two years later joined Boatmen's, a bank formed in 1847 to

serve workers on steamboats plying the Mississippi River. He rose

to CEO in 1988.

"Acquisitions are a line of business with us," he told a trade

publication in 1994. "We have a staff working on acquisitions all

the time."

Mr. Craig is survived by his wife of 61 years, Virginia, two

daughters and two grandsons.

His hobbies included hunting and fishing. A hammerhead shark he

caught off Florida was displayed in one of his offices. In his

retirement, he sometimes competed with friends in piloting

miniature remote-control sailboats.

Write to James R. Hagerty at bob.hagerty@wsj.com

(END) Dow Jones Newswires

June 08, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

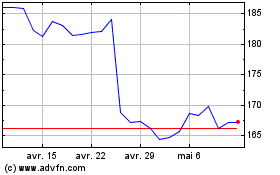

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

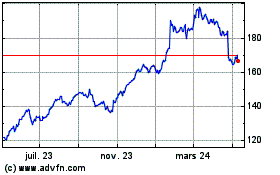

International Business M... (NYSE:IBM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024