By Nicole Friedman

Warren Buffett has one man to thank for Berkshire Hathaway

Inc.'s $29 billion windfall in 2017: President Donald Trump.

The Omaha billionaire backed Mr. Trump's opponent Hillary

Clinton during the 2016 presidential campaign. But new tax cuts the

president signed into law last December provided Berkshire with the

sizable one-time gain that helped inflate annual profits to nearly

$45 billion.

Other American corporations like AT&T Inc. and Comcast Corp.

also booked large paper gains as a result of the new tax

legislation.

Mr. Buffett, Berkshire's chairman and a Democrat, expressed

reservations last year about the need for corporate tax cuts. But

he also said any drop in corporate taxes would benefit many of

Berkshire's businesses and its shareholders.

"I got a million shareholders at Berkshire Hathaway. And they

would all love to see a corporate tax cut," he said on CNBC in

October. But, he added, "we have a lot of businesses, 60 or 70. I

don't think any of them are noncompetitive in the world because of

the corporate tax rate."

When asked on CNBC in January if he would have voted for the new

tax law, Mr. Buffett demurred: "I would have had a different bill

myself."

The tax changes lowered Berkshire's estimate of how much it

would have to pay in taxes if it sold the stock investments it

currently holds. Berkshire has around $100 billion in unrealized

gains on equity investments, Mr. Buffett has said, and those gains

are now expected to be taxed at a 21% rate, down from 35%.

The immediate net windfall for Berkshire was $29 billion, which

helped push Berkshire's net earnings to $44.94 billion in 2017 from

$24.07 billion the prior year while offsetting declines in certain

businesses. Berkshire's operating earnings fell 18%, from $17.6

billion in 2016 to $14.5 billion in 2017, as hurricanes and other

catastrophes caused losses in the company's insurance

operations.

Berkshire's book value per share rose 23% in 2017, the company

said, compared with a 22% total return in the S&P 500,

including dividends. Its overall net worth increased by $65

billion, $29 billion from the tax benefits and $36 billion from

operations.

Mr. Buffett said in a letter released to shareholders Saturday

that the increase in the company's net worth was "real" but "a

large portion of our gain did not come from anything we

accomplished at Berkshire."

The annual letter from Mr. Buffett is widely read by investors

and analysts. This year, the 16-page document was shorter than

usual and left out some of Mr. Buffett's usual themes on the

economy and the future prospects of the U.S.

"This is a company that would like to hold itself up as having a

superior business model and a superior strategy, yet the bump from

the results came from something that was not their doing," said

Cathy Seifert, equity analyst at CFRA Research. "It was a very

subdued letter."

The tax gain is the latest example of how Berkshire has

benefited from Trump's election. The company's stock price climbed

in the months following the election on the expectation that

reduced taxes and regulations would boost Berkshire's businesses,

which range from a railroad and utilities to industrial

manufacturers and retailers.

Mr. Buffett also said last year that the company planned to sell

some of its losing stock investments in 2017, when they would be

more advantageous from a tax perspective. Berkshire sold shares of

International Business Machines Corp. throughout 2017 and sharply

lowered its IBM stake in the fourth quarter.

However, at Berkshire's annual meeting last May, Mr. Buffett

said rising health-care costs were a bigger threat to the

competitiveness of U.S. companies than taxes. Berkshire joined

Amazon.com Inc. and JPMorgan Chase & Co. in January to form a

new company to figure out how to reduce health-care costs for their

employees. The company is in the early stages of planning, and Mr.

Buffett didn't write about it in his letter.

He did address the conglomerate's growing cash pile and lamented

the lack of well-priced acquisition opportunities. Berkshire's

cash, which is mostly invested in Treasury bills, ballooned to a

record $116 billion at year-end.

"We will need to make one or more huge acquisitions," Mr.

Buffett wrote in his letter. Prices for businesses were too high

for his taste in 2017, he said, but "our smiles will broaden when

we have redeployed Berkshire's excess funds into more productive

assets."

In October, Berkshire took a 38.6% stake in truck-stop company

Pilot Travel Centers LLC, which will increase to an 80% stake in

2023. But two potential large deals fell through last year. Kraft

Heinz Co. dropped a $143 billion offer, which would have been

partly backed by Berkshire, for Unilever PLC. And Texas

power-transmission company Oncor terminated a deal with Berkshire's

utility arm in favor of a higher offer from Sempra Energy.

Some of Berkshire's 60-odd subsidiaries completed acquisitions,

but those deals tend to be small. Berkshire spent $2.7 billion on

bolt-on acquisitions in 2017, the company said, up from $1.4

billion the prior year.

Mr. Buffett also avoided giving any new hints about his

succession planning after promoting two executives to vice chairmen

last month.

He reiterated his advice that individuals should invest

passively and avoid high money management fees while discussing the

final tally from his bet that an S&P 500 index fund would

outperform a basket of hedge funds over a decade.

Write to Nicole Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

February 24, 2018 13:57 ET (18:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

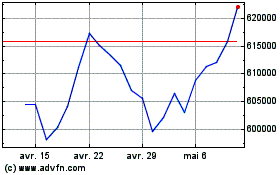

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

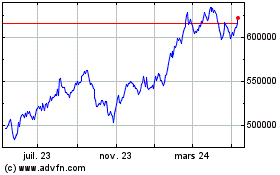

Berkshire Hathaway (NYSE:BRK.A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024