Bitcoin Bearish Signal: Exchange Reserves Show Sharp Increase

02 Décembre 2021 - 8:00PM

NEWSBTC

Bitcoin exchange reserves have shown a sudden sharp spike recently,

despite being in a declining trend for months. After Months Of

Downtrend, Bitcoin Exchange Reserves Shoot Up As pointed out by a

CryptoQuant post, on-chain data shows that BTC exchange reserves

have spiked up in the past couple of weeks. The “all exchanges

reserve” is an indicator that measures the total amount of Bitcoin

stored in wallets of all exchanges at a particular point in time.

If the value of the metric goes down, it means investors are taking

their coins off exchanges. Holders may be withdrawing their BTC to

accumulate them as they might believe that the price would

appreciate further. As a result, this trend could be bullish for

the crypto. On the other hand, if the indicator increases in value,

it implies holders are transferring their Bitcoin to exchanges,

possibly for withdrawing to fiat or for purchasing altcoins. Such a

trend can prove to be bearish for the coin. Related Reading

| Bitcoin Open Interest Remains Elevated Post Dramatic Dip

Now, here is a chart that shows the trend in the BTC exchange

reserves over the past few months: The indicator seems to have

spiked up recently | Source: CryptoQuant As you can see in the

above graph, the Bitcoin exchange reserves have been falling down

for a while now. However, in the past couple of days, the

indicator’s value has shown a sudden increase. This rise in the

reserve amounts to around 39k BTC being deposited to exchanges

between yesterday and today alone. Related Reading | The

Bitcoin Saga: A Look At BTC’s History Of Up’s And Down’s Such sharp

trend is usually an indication of whale activity. The price of

Bitcoin has struggled recently so it’s possible some institutional

investors could be preparing to pull out from the market. If it’s

indeed a sign of whale dumping, then the outlook of the crypto’s

price could be bearish at least in the near future. BTC Price At

the time of writing, Bitcoin’s price floats around $56.4k, down 2%

in the last seven days. Over the past month, the crypto has lost 8%

in value. The below chart shows the trend in the price of the coin

over the last five days. BTC's price has mostly consolidated in the

past few days | Source: BTCUSD on TradingView Over a week ago,

Bitcoin had a crash triggered by fud from the Omicron COVID

variant. The coin’s price dropped to as low as $53k, but a few days

ago the coin recovered its losses. However, since then, the crypto

has mostly trended sideways. It’s unclear at the moment which

direction the coin might break out of this consolidation, but if

the exchange reserve is anything to go by, BTC might face bearish

trend soon. Featured image from Unsplash.com, charts from

TradingView.com, CryptoQuant.com

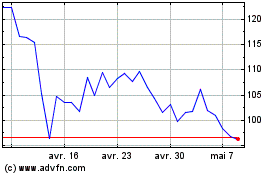

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Quant (COIN:QNTUSD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024