Boeing Expects Pandemic to Put Big Dent in Jet Demand

06 Octobre 2020 - 9:24PM

Dow Jones News

By Doug Cameron

Boeing Co. said the coronavirus pandemic will reduce global

jetliner demand by around 2,000 planes over the next decade as

people around the world remain wary of air travel.

The company said in its annual market forecast on Tuesday that

the coronavirus pandemic would likely curb the global aerospace

industry's sales by $200 billion through 2029. That figure is

equivalent to less than two years' worth of combined Boeing and

Airbus SE aircraft deliveries at pre-pandemic levels.

The forecast is the first from a major aircraft maker since the

pandemic drove a slump in airline travel that halved passenger

traffic, triggering thousands of job cuts and upending a decadelong

surge in jetliner demand. The International Air Transport

Association, a trade group, said Tuesday that global airlines are

burning through $13 billion in cash a month.

Boeing shares were down about 3% to $165.70 in midafternoon

trading Tuesday.

Boeing trimmed the value of aircraft and aviation services to

$8.5 trillion over the next decade as it cut the number of expected

aircraft deliveries in its annual 20-year forecast for the first

time since the global financial crisis a decade ago, reducing its

outlook for annual global traffic growth to 4%.

Boeing and Airbus have cut production rates sharply as the

pandemic left airlines and leasing companies unable or unwilling to

accept many of the new planes ordered in recent years.

The U.S. company forecast demand for 18,350 aircraft through the

end of 2029, down 11% from its estimate a year ago as airlines

focus on replacing older planes and pare back expansion into new

markets. Boeing expects demand for over 44,000 planes through 2039,

down 5% from its prior forecast.

The pandemic-driven shock has led airlines to retire hundreds of

older jets earlier than planned, which Boeing said would lead to a

bigger share of new deliveries in the next few years for replacing

them rather than growing the business.

The pandemic has hit demand for long-haul jets particularly hard

as a patchwork of government restrictions and quarantines have left

international air travel volume down 90% from a year ago.

Boeing expects an eventual recovery in the business-class travel

that is crucial to airline profitability, which had all but

disappeared as companies kept employees at home and quarantines

made short trips impractical.

"We do see business travel recovering, even in the long-haul

market," Darren Hulst, Boeing's vice president for commercial

marketing, told reporters.

Some industry leaders such as Delta Air Lines Inc. Chief

Executive Ed Bastian have said they don't expect business travel to

ever return to pre-pandemic levels.

Boeing also doesn't expect airlines to reverse the trend of

adding more seats to aircraft to boost revenue, even as the

pandemic drove some carriers to block seats to promote social

distancing.

"We don't see a change in seating density as a result of the

virus," said Mr. Hulst.

Boeing expects global economic growth to return the airline

industry to expansion mode in the 2030s, albeit at a slower pace

than the boom that led airlines to amass orders for more than

13,000 jets.

The latter half of the 20-year forecast period assumes plane

makers introduce new jet models, which typically spur sales, said

Mr. Hulst. Boeing and Airbus haven't announced any new planes,

though analysts expect both will have to replace their bestselling

single-aisle jets, partly in response to tougher environmental

regulations.

Airbus, which reclaimed its position from Boeing as the world's

largest jetliner maker last year, said it had no immediate plans to

provide a new forecast, given widespread uncertainty over the

airline industry's recovery.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

October 06, 2020 15:09 ET (19:09 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

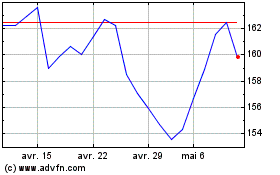

Airbus (EU:AIR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Airbus (EU:AIR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024