CNOVA

N.V.

2017 Financial Results

AMSTERDAM, February 20, 2018,

07:45 CET Cnova N.V. (Euronext Paris: CNV; ISIN: NL0010949392)

("Cnova" or the "Company") today announced its financial results

for the full year 2017[1].

-

Traffic: 946 million visits

(+12%)

-

GMV: €3.4 billion (+10% like-for-like[2],

acceleration in 2H17)

-

Mobile share:

38.1% (+

737 bp)

-

Marketplace share:

32.0% (+ 56

bp)

-

CDAV share:

31.1% (+ 1,063 bp)

-

Net sales: €2.1 billion (+9%

like-for-like2)

-

Active customers: 8.6 million

(+6%)

-

Improvement in EBITDA in

2H17 versus 1H17

-

2017 EBITDA (€4 million) lower than 2016 due to

temporarily strategic plan implementation costs

-

Quarterly improvement in EBITDA throughout

2017

-

Back to 2016 level (4Q17 EBITDA higher than

4Q16)

-

Net financial debt improved

compared to June 30, 2017

Key figures

€ in millions |

2nd

semester (1) |

Change |

| 2017 |

2016 |

Reported |

L-F-L(2) |

| GMV |

1,935.0 |

1,624.0 |

+19.1% |

+10.8% |

| Net sales |

1,239.8 |

998.0 |

+24.2% |

+13.0% |

| Gross profit |

165.5 |

133.8 |

+23.7% |

|

| Gross margin |

13.4% |

13.4% |

-5 bp |

|

| SG&A |

(171.5) |

(133.4) |

+28.6% |

|

| Operating EBIT |

(6.0) |

0.4 |

nm |

|

| EBITDA([3]) |

8.6 |

10.7 |

-20.3% |

|

| Cdiscount |

10.8 |

16.4 |

-33.9% |

|

Key figures

€ in millions |

Full year (1) |

Change |

| 2017 |

2016 |

Reported |

L-F-L(2) |

| GMV |

3,390.5 |

2,994.3 |

+13.2% |

+9.6% |

| Net sales |

2,122.0 |

1,855.7 |

+14.4% |

+9.3% |

| Gross profit |

288.7 |

255.3 |

+13.1% |

|

| Gross margin |

13.6% |

13.8% |

-15 bp |

|

| SG&A |

(311.6) |

(258.1) |

+20.7% |

|

| Operating EBIT |

(23.0) |

(2.8) |

nm |

|

| EBITDA(3) |

3.6 |

17.7 |

-79.7% |

|

| Cdiscount |

9.1 |

25.1 |

-63.7% |

|

| Net profit/(loss) (from

continuing activities) |

(92.3) |

(65.2) |

nm |

|

| Adjusted EPS (from

continuing activities) |

(0.19) |

(0.11) |

nm |

|

***

2nd half

operational and financial performance

Gross merchandise

volume (GMV) totaled €1.9 billion in 2H17, an increase of 10.8%

versus 2016 on a like-for-like (l-f-l) basis, increasing versus

1H17 growth (8.8%). On a reported basis, including in particular

sales in Casino stores, GMV rose by 19.1% compared to 1H16. The

mobile share of GMV continued to strongly increase to reach 39.3%

in 2H17, i.e. +611 basis points compared to the same period in

2016.

Traffic at

Cdiscount.com accelerated in 2H17 (+13.2%) to 504 million visits.

For the first time, mobile accounted for more

than 60% of traffic in 2H17. According to Médiamétrie latest

survey[4], Cdiscount

ranks second among e-retailers in France in number of unique

monthly visitors with 18 million visitors on desktop and

mobile.

Net sales

totaled €1.2 billion in 2H17. The 13.0% growth on a l-f-l basis

showed a strong acceleration versus 1H17.

Gross profit

was €166 million in 2H17 with a gross margin of 13.4%, stable

versus 2H16.

SG&A

costs amounted to €(171) million in 2H17, i.e. 13.8% of net sales

with a strong improvement compared to 1H17 (15.9% of net sales).

Implementation costs of the new strategic plan launched in the

2nd quarter 2017

(expansion of assortment and subsequent warehouse capacity, revamp

of Cdiscount site and app) primarily explain the increase in

SG&A versus previous year.

EBITDA

totaled €9 million in 2H17, in progress versus 1H17. EBITDA

improved quarter after quarter in 2017 both in value and compared

to 2016. This trend reflects the first benefits of the strategic

plan which led to a y-o-y EBITDA growth in the 4Q17.

Operating

EBIT was €(6) million in 2H17, improving versus 1H17 (-€17

million).

Free cash

flow amounted to €31 million in 2H17.

FY2017 operational and financial

performance

Gross merchandise

volume (GMV) totaled €3.4 billion, up 9.6% versus 2016 on a

like-for-like (l-f-l). On a reported basis, including in particular

sales in Casino stores, GMV rose by 13.2% compared to 2016. The

mobile share of GMV strongly increased at 38.1% for the full year

2017, i.e. +737 basis points compared to 2016.

The marketplace share of total GMV reached 32.0% in 2017

compared to 31.4% in 2016. The number of marketplace references

increased by more than 80% year-on-year (y-o-y). The share of

marketplace GMV fulfilled by Cdiscount more than doubled y-o-y to

reach 19% at the end of 2017.

Traffic at

Cdiscount.com grew by 12.4% in 2017 to 946 million visits with an

acceleration in the 2nd half. The

mobile share of traffic rose 645 basis points

to 59.5% for the year 2017.

The number of active customers totaled 8.6 million, a y-o-y increase

of 6.0%. Membership of Cdiscount

à volonté (CDAV) continued to grow rapidly, increasing by

48% compared to December 2016.

Orders

increased by 8.3% to reach 26.8 million in 2017 while the number of items sold rose by 6.9% to 52.8 million in

2017. CDAV customers accounted for 29.7% of total orders in 2017

compared to 18.6% in 2016, purchasing on average three times more

frequently than non-CDAV customers.

Net sales

totaled €2.1 billion in 2017, up 9.3% on a l-f-l basis compared to

2016 (+14.4% on a reported basis). Home furnishings and household

appliances accounted for 45% of direct sales, while hi-tech items

(AV and smartphones) and IT goods contributed to 35% of direct

sales.

Gross profit

was €289 million in 2017, i.e. 13.6% of net sales. Gross margin

variation versus 2016 improved in 2H17.

SG&A

costs amounted to €(312) million, i.e. 14.7% of net sales (compared

to -€258 million and 13.9% in 2016), reflecting the strategic plan

implementation costs.

As a result, EBITDA totaled €4 million in 2017 compared to €18

million in 2016. EBITDA improved quarter after quarter in 2017 both

in value and compared to 2016.

It should also be noted that 2016 EBITDA benefitted from the

reversal of a €5 million provision at the holding level that had

been booked in 2015 in conjunction with divested operations in

Brazil.

Operating

EBIT was €(23) million.

The operating

loss reported for 2017 amounted to €(50) million, including

Cnova restructuring costs.

Net financial expense was €(40)

million in 2017, reflecting higher costs of consumer financing

activities which grow in line with the business.

Net loss from

continuing operations amounted to €(92) million with an

adjusted EPS of €(0.19).

Net financial

debt:

Net financial

debt position at December 31, 2017 was €(193)

million[5]. It

improved compared to June 30, 2017 level, following a degradation

in 1H17 mainly due to the strategic plan implementation (increase

in inventories related to product assortment growth and

multichannel agreement with Casino as well as increased

investment).

Key achievements

Customer offer

and service enhancements of the strategic

plan launched during the 2nd quarter of

2017 revolved around four main pillars: product catalogue

expansion, multichannel offer reinforcement, enhancements of

customer experience (including delivery edges) and technological

advantages. This strategic plan resulted in significant investment

(increase in inventory as well as technological and logistics

investments) which negatively weighted on 1H17 performance but

began to positively impact top-line and financial results in

3Q17.

Product catalogue

expansion

-

Product assortment: the number of products

eligible for free express delivery available to CDAV customers

tripled over the year while marketplace references surpassed the

original target of +50% to reach +80%. Overall product offerings

increased by 17 million throughout 2017 to reach 37 million by end

December 2017.

-

Warehouse capacity: to accommodate the extension

of product catalogue, Cdiscount's warehouse capacity increased by

around 70% to 530,000 sqm at end 2017. Three new warehouses were

opened in 2017, respectively near Orléans, Orly Airport and

Bordeaux - the latter being fully dedicated to Marketplace

fulfillment. A new 40,000 sqm DC near Orly Airport is planned to

open in 1Q18.

Multichannel

offer reinforcement

-

Multichannel offer: Cdiscount is now managing

the Hi-tech and Home Furnishing product categories of integrated

Géant hypermarkets and Casino supermarkets, providing immediate

in-store availability for

c.

4,000 references as well as combined promotions and commercial

events. The multichannel agreement with Casino, effective June 19,

2017, generated €108 million of net sales in 2017. The multichannel

strategy was reinforced by the opening of 4 Cdiscount showrooms in

Géant hypermarkets in 2017, presenting Cdiscount Home and Technical

goods product offerings as well as best deal offers with around 700

references displayed on more than 400 sqm. 6 new Cdiscount

showrooms are expected to open in 2018.

Enhancements of

customer experience

-

Same-day delivery: extension of Cdiscount's

unique same-day delivery offer in Bordeaux, Lille, Lyon and the

Paris region. This service will be extended to 4 additional large

cities to cover nearly half of the French population living in

cities of more than 10,000 inhabitants by end 2018.

-

Real-time geolocation: thanks to its exclusive

partnership with Bringg, Cdiscount became the forerunner of

real-time geolocation of large-product deliveries in France. This

service, currently available in Paris, Bordeaux and Lyon regions

will be extended all over France in 2018.

-

Logistics excellence: finalized roll-out of the

new warehouse management system in Réau and Saran DCs, allowing for

increased productivity and shortened delivery times.

-

Services: expanding range of services with the

successful launch in 2017 of "Coup de pouce", an exclusive instant

consumer credit offer, and Cdiscount Energie, the most affordable

home energy supply solution in the market. Roll-out of product

installation services "Cinstallé" launched end 2017 from over

20,000 references eligible today to 260,000 by end 2018.

-

Online customer experience: revamp of Cdiscount

sites and app with further personalization, value-added

functionalities (apps for Google Home - parcel tracking and best

deals, Paylib and chatbots) and daily games to offer a playful

experience. Launch in November 2017 of a product subscription offer

for recurring products, allowing automatic delivery at a chosen

date, frequency and shipping mode.

-

Performance of sites and app: Cdiscount mobile

site now ranks 2nd among main

e-commerce sites in France in terms of page loading

speed[6] while the

Cdiscount application is one of the best rated in the Apple store

with a 4.5/5 grade based on nearly 60,000 reviews.

-

Customer commitment: Cdiscount reinforced its

leadership on social media visibility and commitment (like, share,

comments) in 2017 and is now the number 1 in France and the number

3 worldwide on social media commitment among main

retailers[7].

Technological

advantages

-

DC Automation: Cdiscount developed with Exotec

Solutions a unique and state-of-the-art order robotized picking

system, Skypod. This new solution will significantly improve DC

productivity and Cdiscount's inventory storage surface

requirement.

-

Innovation: Cdiscount launched 52 POCs

(Proof of Concept) with start-ups in 2017 in

all service lines (Marketing, logistics, IT.), of which nearly two

thirds of finalized tests were industrialized.

In

addition, Cdiscount launched a logistics incubator, The Warehouse,

with 4 start-ups selected in 2017 to work in one of Cdiscount's DC

on new areas of logistics innovation.

Alongside with these strategic

initiatives, Cnova developed new revenue streams through the

creation of a comprehensive marketplace ecosystem with the ramp-up

of fulfillment services, the introduction of premium packs offering

increased visibility to sellers, tailored advertising, sales

reports, financial and transportation services.

Outlook

In 2018 Cnova plans to accelerate

the implementation of its strategic plan to offer the best on- and

offline customer experience and reinforce its market positions

through 4 main pillars:

· Offer

the best products and services to its customers

-

Reinforce its leadership in large products, benefiting from fast

delivery and installation services.

-

Drive increase in repurchases through assortment (daily products),

CDAV and product subscription.

-

Launch new services with landmark partners, starting with a new

long-term leasing offer.

· Further

improve the customer experience at all steps

-

Increased personalization and gamification on Cdiscount mobile site

and application.

-

Implement the rollout of Cdiscount's unique same-day delivery offer

to more large French cities.

· Accelerate

monetization

-

Benefit from the ramp-up of Marketplace services to sellers.

-

Generate new revenue streams based on a unique data expertise.

· Become

a platform that is increasingly more open

-

Accelerate the dynamics of innovation in all departments through

POCs with start-ups.

-

Develop partnerships with third parties.

***

About Cnova N.V.

Cnova N.V., one

of the leading e-Commerce companies in France, serves 8.6 million

active customers via its state-of-the-art website, Cdiscount. Cnova

N.V.'s product offering of more than 37 million items provides its

clients with a wide variety of very competitively priced goods,

several fast and customer-convenient delivery options as well as

practical payment solutions. Cnova N.V. is part of Groupe Casino, a

global diversified retailer. Cnova N.V.'s news releases are

available at www.cnova.com. Information available on, or accessible

through, the sites referenced above is not part of this press

release.

This press

release contains regulated information (gereglementeerde

informatie) within the meaning of the Dutch Financial Supervision

Act (Wet op het financieel toezicht) which must be made publicly

available pursuant to Dutch and French law. This press release is

intended for information purposes only.

***

Cnova Investor Relations Contact:

investor@cnovagroup.com

Tel: +31 20 301 22 40 |

Media contact:

directiondelacommunication@cdiscount.com

Tel: +33 5 56 30 07 14 |

Appendices

Cnova N.V. Consolidated Financial

Statements(1)

|

Consolidated Income Statement |

|

Full year |

Change |

|

€ in millions |

|

2017 |

2016 |

| Net sales |

|

2,122.0 |

1,855.7 |

+14.4% |

| Cost of sales |

|

(1,833.3) |

(1,600.4) |

+14.6% |

| Gross

profit |

|

288.7 |

255.3 |

+13.1% |

| % of net sales (Gross margin) |

|

13.6% |

13.8% |

-15 bp |

| SG&A(2) |

|

(311.6) |

(258.1) |

+20.7% |

| % of

net sales |

|

-14.7% |

-13.9% |

-78 bp |

| Fulfillment |

|

(162.5) |

(125.7) |

+29.2% |

| Marketing |

|

(45.4) |

(33.2) |

+36.7% |

| Technology and

content |

|

(69.8) |

(55.8) |

+25.0% |

| General and

administrative |

|

(34.0) |

(43.4) |

-21.6% |

| Operating EBIT(3) |

|

(23.0) |

(2.8) |

nm |

| % of net sales |

|

-1.1% |

-0.2% |

-93 bp |

| Other

expenses |

|

(26.9) |

(18.5) |

+45.6% |

| Operating profit/(loss) |

|

(49.9) |

(21.3) |

nm |

| Net

financial income/(expense) |

|

(40.3) |

(31.0) |

+29.9% |

| Profit/(loss) before tax |

|

(90.1) |

(52.3) |

nm |

| Income tax

gain/(expense) |

|

(2.2) |

(12.9) |

nm |

| Net profit/(loss) from continuing operations |

|

(92.3) |

(65.2) |

nm |

| Net

profit/(loss) from discontinued operations |

|

(8.0) |

132.2 |

nm |

| Net

profit/(loss) for the period |

|

(100.3) |

67.0 |

nm |

| % of

net sales |

|

-4.7% |

3.6% |

nm |

| Attributable to Cnova

equity holders (incl. discontinued) |

|

(100.0) |

73.1 |

nm |

|

Attributable to non-controlling interests (incl. discontinued) |

|

(0.3) |

(6.1) |

nm |

| Adjusted EPS (€) from

continuing operations |

|

(0.19) |

(0.11) |

nm |

| Adjusted EPS (€) from

discontinued operations |

|

(0.00) |

(0.40) |

nm |

| Adjusted EPS (€)(4) |

|

(0.19) |

(0.51) |

nm |

-

Ernst & Young have

substantially completed their audit of the annual financial

statements. In accordance with IFRS 5 (Non-current Assets Held for

Sale and Discontinued Operations), all figures have been adjusted

as of January 1, 2016, to reflect: i) the merger of Cnova Brazil

into Via Varejo on October 31, 2016, ii) the sale or closure of

international sites, and iii) the sale of the specialty site

MonShowroom. The results from these activities are reported under

net profit/(loss) from discontinued operations.

-

SG&A: selling, general and

administrative expenses.

-

Operating EBIT: operating

profit/(loss) before other expenses (strategic and restructuring

expenses, litigation expenses and impairment and disposal of assets

expenses) .

-

Adjusted EPS: net profit/(loss)

attributable to equity holders of Cnova before other expenses and

the related tax impacts, divided by the weighted average number of

outstanding ordinary shares of Cnova during the applicable

period.

Consolidated Balance

Sheet

At December 31 (€ in millions) |

|

2017 |

|

2016

|

| |

|

|

|

|

| ASSETS |

|

|

|

|

| |

|

|

|

|

| Cash and cash

equivalents |

|

43.8 |

|

15.3 |

| Trade receivables,

net |

|

155.4 |

|

91.1 |

| Inventories, net |

|

407.9 |

|

224.8 |

| Current income tax

assets |

|

2.4 |

|

1.3 |

| Other

current assets, net |

|

107.1 |

|

346.2 |

| Total current assets |

|

716.7 |

|

678.7 |

| |

|

|

|

|

| Other non-current

assets, net |

|

6.1 |

|

4.6 |

| Deferred tax

assets |

|

-- |

|

-- |

| Property and

equipment, net |

|

34.3 |

|

15.3 |

| Intangible assets,

net |

|

99.8 |

|

71.9 |

|

Goodwill |

|

58.2 |

|

56.5 |

| Total non-current assets |

|

198.4 |

|

148.4 |

| |

|

|

|

|

| TOTAL ASSETS |

|

915.1 |

|

827.1 |

| |

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

| |

|

|

|

|

| Current

provisions |

|

9.0 |

|

6.8 |

| Trade payables |

|

579.7 |

|

576.6 |

| Current financial

debt |

|

237.9 |

|

93.6 |

| Current tax

liabilities |

|

48.8 |

|

46.4 |

| Other current

liabilities |

|

142.3 |

|

110.7 |

| Total current liabilities |

|

1,017.8 |

|

834.1 |

| |

|

|

|

|

| Non-current

provisions |

|

14.0 |

|

12.1 |

| Non-current financial

debt |

|

-- |

|

-- |

| Deferred tax

liabilities |

|

0.4 |

|

-- |

| Other non-current

liabilities |

|

4.5 |

|

2.1 |

| Total non-current liabilities |

|

18.9 |

|

14.2 |

| |

|

|

|

|

| Share capital |

|

17.2 |

|

17.2 |

| Reserves, retained

earnings and additional paid-in capital |

|

(138.6) |

|

(37.2) |

| Equity attributable to equity holders of Cnova |

|

(121.4) |

|

(20.0) |

| Non-controlling interests |

|

(0.1) |

|

(1.2) |

| Total equity |

|

(121.5) |

|

(21.2) |

| |

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

915.1 |

|

827.1 |

|

Consolidated Cash Flow Statement |

|

|

|

at December 31 (€ in

millions) |

|

2017 |

2016 |

| Net profit/(loss) from

continuing operations |

|

(92.0) |

(65.4) |

| Net profit/(loss),

attributable to non-controlling interests |

|

(0.3) |

0.2 |

| Net profit (loss) for the period excl. discontinued

operations |

|

(92.3) |

(65.2) |

| Depreciation and

amortization expense |

|

26.6 |

20.6 |

| (Income) expenses on

share-based payment plans |

|

0.4 |

0.1 |

| (Gains) losses on

disposal of non-current assets and impairment of assets |

|

1.8 |

6.1 |

| Other non-cash

items |

|

0.0 |

0.5 |

| Financial expense,

net |

|

40.3 |

31.0 |

| Current and deferred

tax (gains) expenses |

|

2.2 |

12.9 |

| Income tax paid |

|

(2.4) |

(2.1) |

| Change in operating

working capital |

|

(244.2) |

17.3 |

| Inventories of products |

|

(183.1) |

19.3 |

| Accounts payable |

|

13.2 |

(41.5) |

| Accounts receivable |

|

(80.2) |

35.2 |

| Working capital non-goods |

|

5.9 |

4.4 |

| Net

cash from/(used in) continuing operating activities |

|

(267.7) |

21.1 |

| Net cash from/(used in) discontinued operating

activities |

|

6.5 |

(585.5) |

| Purchase of property,

equipment & intangible assets |

|

(68.6) |

(44.0) |

| Purchase of

non-current financial assets |

|

(1.7) |

(2.0) |

| Proceeds from disposal

of prop., equip., intangible assets |

|

0.0 |

0.6 |

| Movement of perimeter,

net of cash acquired |

|

0.0 |

21.0 |

| Investments in

associates |

|

(2.2) |

(3.0) |

| Changes in

loans granted (including to related parties) |

|

(0.2) |

106.5 |

| Net

cash from/(used in) continuing investing activities |

|

(72.6) |

78.9 |

| Net cash from/(used in) discontinued investing

activities |

|

2.7 |

25.1 |

| Transaction with

owners of non-controlling interests |

|

(0.1) |

0.0 |

| Additions to financial

debt |

|

(1.2) |

(7.4) |

| Repayments of

financial debt |

|

8.5 |

(10.2) |

| Changes in loans

received |

|

384.7 |

(275.0) |

| Interest

paid, net |

|

(39.9) |

(31.7) |

| Net

cash from/(used in) continuing financing activities |

|

352.1 |

(324.3) |

| Net cash from/(used in) discontinued financing

activities |

|

(1.7) |

137.5 |

| Effect of

changes in foreign currency translation adjustments from

discontinued operations |

|

0.0 |

259.6 |

| Change in cash and cash equivalents from continuing

operations |

|

11.8 |

(224.3) |

| Change in cash and cash equivalents from discontinued

operations |

|

7.5 |

(163.3) |

| Cash and cash equivalents, net, at period begin |

|

4.2 |

391.8 |

| |

|

|

|

| Cash and cash equivalents, net, at period end |

|

23.6 |

4.2 |

| Upcoming Event |

| |

| Tuesday,

February 20, 2018 at 16:00 CET |

Cnova

2017 Financial Results

Conference Call & Webcast |

| Conference Call and Webcast connection details |

| |

| Conference Call Dial-In Numbers: |

|

Toll-Free: |

|

| France |

0 800 912 848 |

| UK |

0 800 756 3429 |

| USA |

1 877 407 0784 |

| Toll: |

1 201 689 8560 |

| |

|

| Conference Call Replay Dial-In Numbers: |

|

Toll-Free: |

1 844 512 2921 |

| Toll: |

1 412 317 6671 |

| |

|

| Available

From: February 20, 2018 at |

13:00

ET / 19:00 CET |

| To:

February 28, 2018 at |

00:00 ET / 06:00 CET |

| Replay Pin

Number: |

13675582 |

| |

|

| Webcast: |

|

http://public.viavid.com/index.php?id=128019 |

| |

|

|

Presentation materials to accompany the call will be available at

cnova.com on February 20, 2018. |

| |

|

| An archive

of the conference call will be available for 3 months at

cnova.com. |

|

|

[1] Ernst &

Young have substantially completed their audit of the annual

financial statements. In accordance with IFRS 5 (Non-current Assets

Held for Sale and Discontinued Operations), all figures have been

adjusted as of January 1, 2016, to reflect: i) the merger of Cnova

Brazil into Via Varejo on October 31, 2016, ii) the sale or closure

of international sites, and iii) the sale of the specialty site

MonShowroom. The results from these activities are reported under

net profit/(loss) from discontinued operations.

[2]

Like-for-like (l-f-l): figures have been adjusted to make them

comparable across periods, by eliminating: i) operating data

related to the specialty sites Comptoir des Parfums, Comptoir Santé

and MonCornerDéco due to their sale or closure in 2016, ii) B2B

operating data due the voluntary pullback of their sales initiated

in the 3rd quarter of

2016, iii) leap year impact in 2016 (-0.4 pt and -0.3 pt on FY17

GMV and net sales growth, respectively) and iv) Cdiscount sales

made to Casino hypermarket and supermarket clients in France in

relation with the multichannel agreement with Casino effective June

19, 2017 (+4.3 pts and +5.8 pts on FY17 GMV and net sales growth

respectively, and +7.6 pts and +10.2 pts in 2H17). 1H17 growth

excludes the adjustment related to TV products, which positively

impacted 1H16 due to the mandatory shift to Digital Terrestrial

Television (DTT), and the Euro football championship.

[3] EBITDA:

calculated as operating profit/(loss) from ordinary activities

(Operating EBIT) before depreciation and amortization expense.

[4] Médiamétrie

study published in January 2018, based on October 2017 traffic

data.

[5]

Including €23.8 million (US$28.5 million) of restricted cash

on an escrow account.

[6] Fasterize

data.

[7] According

to a Sprinklr study published in February 2018, based on the number

of social media interactions in 2017 of main French and

US retailers.

PR FY17 Financial results

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cnova N.V. via Globenewswire

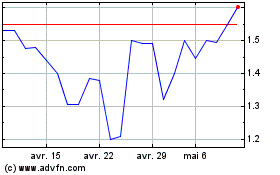

Cnova NV (EU:CNV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cnova NV (EU:CNV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024