Regulatory News:

CNP Assurances and its partner Tikehau Capital (Paris:TKO),

an alternative asset management group, are launching the first

private-equity unit-linked product on the energy transition theme,

exclusively for CNP Patrimoine customers. “CNP Relance et Climat”

provides individual investors with access – through Tikehau

Capital’s private equity fund dedicated to the energy transition –

to investments in unlisted assets by investing in the real economy

to respond to the climate emergency.

Through the partnership, CNP Assurances intends to provide its

partners’ individual customers with a unit-linked tool offering an

attractive alternative to listed investments through access to a

private equity fund hitherto reserved to institutional investors.

As a conviction-based investment, it helps to finance the real

economy by supporting the growth of companies carefully selected by

Tikehau Capital for their growth potential and their contribution

to the fight against climate change.

Tikehau Capital launched the first private equity fund dedicated

to the energy transition back in 2018. The company itself invested

€100 million in the fund through its balance sheet, and CNP

Assurances is one of the leading investors. It is a globally unique

platform aimed at accelerating the growth of European SMEs and

intermediate-sized enterprises (ISEs) that are already responding

to the climate emergency and contributing to the transition to a

low-carbon economy.

Tikehau Capital's energy transition fund, subscribed €1 billion

by institutional investors, including CNP Assurances, was labelled

“Relaunch” at the end of 2020, an initiative set up by the French

government as part of the economic recovery plan to address the

health crisis.

French savings currently amount to €3.3 trillion1. The COVID-19

crisis has revealed the equity deficit of SMEs and ISEs and the

pressing need to step up the transition to a lower-carbon economy.

It is therefore vital that these savings are directed effectively

towards financing businesses and the real economy, as they help to

build future growth and a production model that is less dependent

on fossil fuels.

“We are pleased to offer our partners this new tool to diversify

their customers’ savings. In life insurance, this private-equity

unit-linked product lends more meaning to savings by contributing

to the financing of the energy transition, which will represent the

largest investment opportunity in the next ten years. CNP Relance

et Climat also contributes to CNP Assurances' commitment to the

energy transition and to limiting global warming in accordance with

the Paris Agreement,” said Cécile Blondeau-Dallet and François

Guilgot, co-Directors of the Engineering and Wealth Management

Business Unit of CNP Assurances.

“Global savings represent 80,000 billion dollars. According to

the International Energy Agency, 10% of these savings could be used

to meet the investment needs of the next ten years for the energy

transition and thus respect the Paris Agreement and the

recommendations of the IPCC2, which aim to limit global warming to

below two degrees. We believe that this is an achievable objective

and that this fund is aligned with that goal. Through this

initiative with CNP Assurances, we are bringing individual

investors the opportunity to contribute to restoring the investment

capacity of companies coming out of the crisis. At the same time,

it responds to their growing demand to give meaning to their

savings while providing them with a revaluation of their

investments,” said Emmanuel Laillier, Head of Private Equity for

Tikehau Capital together with Mathieu Badjeck and Pierre Abadie,

co-managers of the energy transition fund of Tikehau

Capital.

About CNP Assurances

A leading player in the French personal insurance market, CNP

Assurances operates in 19 countries in Europe, notably in Italy,

and Latin America, where it is very active in Brazil, its second

largest market.

As an insurance, coinsurance, and reinsurance provider, CNP

Assurances designs innovative personal risk/protection and

savings/retirement solutions. The company has more than 36 million

insured in personal risk/protection insurance worldwide and more

than 12 million in savings/retirement. In accordance with its

business model, its solutions are distributed by multiple partners

and adapt to their physical or digital distribution method as well

as to the needs of customers in each country in relation to their

protection and making their lives easier.

CNP Assurances has been listed on the Paris Stock Exchange since

October 1998, and is a subsidiary of La Banque Postale. The Company

reported net income of €1,350 million in 2020.

About Tikehau Capital

Tikehau Capital is a global alternative asset management group

that manages €28.5 billion in assets (at 31 December 2020). Tikehau

Capital has developed extensive expertise in four asset classes –

private debt, real assets, private equity, capital markets

strategies – as well as strategies focused on multi-asset solutions

and special situations.

Headed by its co-founders, Tikehau Capital has a differentiating

business model, a solid balance sheet, privileged access to

transaction opportunities worldwide, and robust experience in

supporting high-quality companies and executives. Tikehau Capital

is deeply rooted in the real economy. It provides bespoke and

innovative alternative financing solutions to the companies it

supports and strives to create long-term value for its investors.

Drawing on significant equity (€2.8 billion at 31 December 2020),

the Group invests its capital alongside investor customers in each

of its strategies.

Controlled by its management, alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA. These qualities are shared by its 594 employees (at

31 December 2020) working at 12 offices in Europe, Asia and North

America.

Tikehau Capital is listed on the regulated market of Euronext in

Paris, Compartment A (ISIN: FR0013230612; Ticker: TKO.FP)

To find out more: www.tikehaucapital.com

The Energy transition fund T2 is managed by TIKEHAU INVESTMENT

MANAGEMENT SAS, a portfolio management company approved by the AMF

since 19/01/2007 under number GP-0700000006.

Disclaimer:

This document does not constitute an offer to sell securities

or investment advisory services. This document contains only

general information and is not intended to represent general or

specific investment advice. Past performance is not a reliable

indicator of future results and targets are not guaranteed.

__________________ 1 Source: Banque de France; Eurostat. 2 IPCC

: Intergovernmental Panel on Climate Change

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210406006109/en/

CNP Assurances Florence de Montmarin – +33 (01) 42 18 86 51

Tamara Bernard – +33 (01) 42 18 86 19 Caroline Ceintrey – +33 (01)

42 18 85 73 servicepresse@cnp.fr

Follow us on: Twitter | LinkedIn | Facebook

| Instagram

Tikehau Capital Press: Valérie Sueur – +33 (0)1 40 06 39 30

Image 7: Charlotte Le Barbier & Juliette Mouraret – +33 (0)1 53

70 74 70 press@tikehaucapital.com

Shareholders and investors: Louis Igonet – +33 (0)1 40 06 11 11

shareholders@tikehaucapital.com

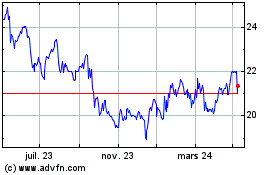

Tikehau Capital (EU:TKO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

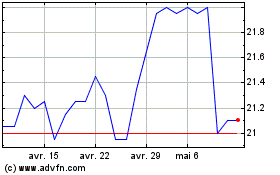

Tikehau Capital (EU:TKO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024