CREDIT AGRICOLE SA: 95.30% of KAS BANK Securities committed -

CACEIS declares Offer for KAS BANK unconditional

This is a joint press release by KAS

BANK N.V. (“KAS BANK”) and CACEIS Bank S.A. (“CACEIS” or the

"Offeror"), pursuant to the provisions of Section 16 paragraph 1

and 2 and Section 17 paragraph 1 of the Decree on Public Takeover

Bids (Besluit Openbare Biedingen Wft) (the "Takeover Decree") in

connection with the recommended public offer by CACEIS for all

listed issued depositary receipts of ordinary shares in the capital

of KAS BANK (the "Depositary Receipts") and all non-listed issued

ordinary shares in the capital of KAS BANK which are not registered

in the name of Stichting Administratiekantoor Aandelen KAS BANK

(the "Ordinary Shares" and together with the Depositary Receipts,

the "Securities"). Any offer is made only by means of the Offer

Memorandum dated 26 July 2019 (the "Offer Memorandum") approved by

the Netherlands Authority for the Financial Markets (Stichting

Autoriteit Financiële Markten) (the "AFM") and subject to the

restrictions set forth therein. This announcement is not for

release, publication or distribution, in whole or in part, in or

into, directly or indirectly, the United States or Canada or in any

other jurisdiction in which such release, publication or

distribution would be unlawful. Terms not defined in this press

release will have the meaning as set forth in the Offer

Memorandum.

95.30% of KAS BANK Securities committed

- CACEIS declares Offer for KAS BANK unconditional

Transaction highlights

- 95.30% of the KAS BANK all issued and outstanding Securities,

i.e. excluding any Treasury Securities, have been committed to

CACEIS

- All Offer Conditions have been satisfied or waived

- Settlement of tendered Securities will take place on 27

September 2019

- Remaining Securities can be tendered during the Post Acceptance

Period, commencing at 9:00 hours CET on Tuesday, 24 September 2019

and expiring at 17:40 hours on Monday, 7 October 2019

Paris, France and Amsterdam, the Netherlands, 23

September 2019

With reference to the joint press releases dated

25 February, 25 March, 26 July and 17 September 2019 and the Offer

Memorandum, KAS BANK and CACEIS are pleased to jointly announce

that approximately 95.30% of all issued and outstanding Securities,

i.e. excluding any Treasury Securities, have been tendered in the

Offer. All Offer Conditions have been satisfied or waived. CACEIS

declares the Offer unconditional (doet gestand).

Sikko van Katwijk, Chairman of the

Managing Board of KAS BANK

"We are very pleased that the shareholders of

KAS BANK share our conviction that CACEIS’ offer is in the long

term interest of KAS BANK and all of its stakeholders. As part of

the CACEIS’ global network, our clients will benefit from KAS BANK

being part of an international asset servicer in combination with

in-depth understanding of the local market. We look forward to the

collaboration with CACEIS to further improve our products and serve

our current clients even better. Joining CACEIS also gives us the

opportunity to further develop and export our expertise in

servicing pension funds. We look forward to working with the CACEIS

team to take the next step in our long history.”

Jean-François Abadie, Chief Executive

Officer of CACEIS

"I am delighted in the success of this

recommended public offer. The staff from KAS BANK will soon join

CACEIS and bring their expert knowledge of the servicing needs of

their institutional investor clients. CACEIS now adds a high level

of expertise in pension fund servicing to its offer. All clients of

the CACEIS group stand to benefit from the services of one of the

leading European asset servicing companies, our geographical

footprint and our financial strength. Together with the staff and

management of KAS BANK, we will leverage our extensive migration

experience to ensure uninterrupted service for KAS BANK

clients."

Acceptance

During the Acceptance Period that expired at

17:40 CET today, 14,088,162 Securities have been tendered for

acceptance pursuant to the Offer, representing approximately 95.30%

of all issued and outstanding Securities, i.e. excluding any

Treasury Securities. CACEIS currently holds no Securities in KAS

BANK, so will hold 95.30% of all issued and outstanding Securities

(i.e. 14,088,162 Securities) upon settlement of the

Securities tendered for acceptance during the Acceptance Period. At

an offer price of EUR 12,75 (cum dividend) in cash per Security,

this represents an aggregate value of EUR 179,624,065.50 (the

"Offer Price").

Settlement

The Securityholders that have tendered and

delivered their Securities for acceptance pursuant to the Offer,

will receive on the Settlement Date the Offer Price in respect of

each Security validly tendered (or defectively tendered provided

that such defect has been waived by the Offeror) and delivered

(geleverd), under the terms and conditions set out in the Offer

Memorandum and subject to the restrictions stipulated therein.

Payment of the Offer Price per tendered Security will occur on 27

September 2019.

Upon Settlement the changes to the composition

of the Supervisory Board of KAS BANK, as approved by the general

meeting of KAS BANK on 12 September 2019, will become effective.

Following Settlement the Supervisory Board of KAS BANK will be

composed of: Peter Borgdorff, Pauline Bieringa, Hans Snijders,

Jean-François Abadie, Catherine Duvaud and Joseph Saliba.

Post Acceptance Period

CACEIS hereby announces that Securityholders who

have not tendered their Securities during the Acceptance Period

will have the opportunity to tender their securities under the same

terms and conditions as the Offer in a Post Acceptance Period

(na-aanmeldingstermijn) commencing at 9:00 hours CET on Tuesday, 24

September 2019 and expiring at 17:40 hours CET on Monday, 7 October

2019 (the "Post Acceptance Period").

Securities validly tendered (or defectively

tendered provided that such defect has been waived by the Offeror)

during the Post Acceptance Period may not be withdrawn.

The Offeror will, within three (3) Business Days

after the Post Acceptance Period has ended, announce the number and

percentages of Securities that have been tendered in the Post

Acceptance Period and the total number and percentage of Securities

the Offeror owns after the Post Acceptance Period has ended, in

accordance with Article 17, paragraph 4 of the Decree.

The Offeror will continue to accept for payment

all Securities validly tendered (or defectively tendered provided

that such defect has been waived by the Offeror) during such period

and will pay for such Securities within four (4) business days

following the end of the Post Acceptance Period.

During the Post Acceptance Period,

Securityholders have no right to withdraw Securities from the

Offer, regardless of whether their Securities have been validly

tendered (or defectively tendered, provided that such defect has

been waived by the Offeror) during the Acceptance Period or the

Post Acceptance Period.

Delisting and liquidity

CACEIS and KAS BANK intend to procure the

delisting of the Securities from Euronext Amsterdam and termination

of the listing agreement between the Company and Euronext Amsterdam

in relation to the listing of the Securities. Delisting may further

adversely affect the liquidity and market value of any Securities

not tendered.

Squeeze-out Procedure

CACEIS intends to commence in an expeditious

manner a compulsory acquisition procedure (uitkoopprocedure) in

accordance with article 2:92a DCC or the takeover buy-out procedure

in accordance with article 2:359c DCC. Reference is made to section

4.18.1 (Delisting, Squeeze-out Procedures) of the Offer

Memorandum.

Further implications of the Offer being

declared unconditional

Remaining Securityholders who do not wish to

tender their Securities in the Post Acceptance Period should

carefully review the sections of the Offer Memorandum that further

explain the intentions of the Offeror and KAS BANK, including

Section 4.19 (Consequences of the Offer) and Securities 4.18

(Post-Closing Restructuring Measures). This section describes

certain risks remaining Securityholders will be subject to if they

elect not to accept the Offer and certain measures the Offeror may

take to achieve its goal of obtaining 100% of the Securities. These

risks are in addition to the risks associated with holding

Securities issued by KAS BANK generally, such as the exposure to

risks related to the business of KAS BANK and its subsidiaries, the

markets in which KAS BANK operates, as well as economic trends

affecting such markets generally as such business, markets or

trends may change from time to time.

Announcements

Announcements in relation to the Offer,

including announcements in relation to an extension of the Offer

past the Acceptance Closing Time will be issued by press release

and will be made available on KAS BANK's website at

www.kasbank.com.

Subject to any applicable requirements of the

Merger Rules and without limiting the manner in which the Offeror

may choose to make any public announcement, the Offeror will have

no obligation to communicate any public announcement other than as

described above.

Further information

This press release contains selected, condensed

information regarding the Offer and does not replace the Offer

Memorandum and/or the Position Statement. The information in this

press release is not complete and additional information is

contained in the Offer Memorandum and the Position Statement.

Digital copies of the Offer Memorandum are

available on the website of KAS BANK at www.kasbank.com and on the

website of CACEIS at www.caceis.com. These websites do not

constitute a part of, and are not incorporated by reference into,

the Offer Memorandum.

Copies of the Offer Memorandum are furthermore

available free of charge at the office of the Settlement Agent at

the address mentioned below.

The Settlement Agent:

ING Bank N.V.

Foppingadreef 71102 BD AmsterdamThe

Netherlands

For more information, please contact:

Press contact

CACEIS

Press contact KAS BANK Eric

Derobert

Remko Dieker Group Head of Communication and Public

Affairs

Secretary to the Managing Board Tel: +33 1 57 78 05

96

Tel: +31 20 557 51 80 Mobile: +33 6 83 78 65

59

Mobile: +31 6 51 68 54 79

About CACEIS

CACEIS is the asset servicing banking group of

Crédit Agricole dedicated to institutional and corporate clients.

Through offices across Europe, North America and Asia, CACEIS

offers a broad range of services covering execution, clearing,

forex, securities lending, depositary and custody, fund

administration, fund distribution support, middle office

outsourcing and issuer services. With assets under custody of €2.6

trillion and assets under administration of €1.7 trillion, CACEIS

is a European leader in asset servicing and one of the major

players worldwide (figures as of 31 December 2018).

www.caceis.com

About KAS BANK

KAS BANK is a European specialist for

safekeeping and administration of securities and high-quality risk-

and reporting services. We focus on securities services for

professional investors in the pensions and securities market. Our

strategy and services are based on clear principles about the role

custodians should perform in the financial markets. Integrity,

transparency and independence are important values for our bank, as

well as a low risk profile. KAS BANK is located in the Netherlands,

the United Kingdom and Germany. We offer access to more than 90

markets worldwide. KAS BANK is listed on Euronext Amsterdam.

www.kasbank.com

DISCLAIMER

The distribution of this press release may, in

some countries, be restricted by law or regulation. Accordingly,

persons who come into possession of this document should inform

themselves of and observe these restrictions. To the fullest extent

permitted by applicable law, CACEIS and KAS BANK disclaim any

responsibility or liability for the violation of any such

restrictions by any person. Any failure to comply with these

restrictions may constitute a violation of the securities laws of

that jurisdiction. Neither CACEIS, nor KAS BANK, nor any of their

advisors assumes any responsibility for any violation by any of

these restrictions. Any KAS BANK shareholder who is in any doubt as

to his or her position should consult an appropriate professional

advisor without delay. This announcement is not to be published or

distributed in or to the United States, Canada or Japan.

The information in the press release is not

intended to be complete. This announcement is for information

purposes only and does not constitute an offer or an invitation to

acquire or dispose of any securities or investment advice or an

inducement to enter into investment activity. This announcement

does not constitute an offer to sell or the solicitation of an

offer to buy or acquire the securities of KAS BANK in any

jurisdiction.

Forward Looking Statements

Certain statements in this press release may be

considered “forward-looking statements,” such as statements

relating to the impact of this transaction on CACEIS and KAS BANK.

Forward-looking statements include those preceded by, followed by

or that include the words “anticipated,” “expected” or similar

expressions. These forward-looking statements speak only as of the

date of this release. Although CACEIS and KAS BANK believe that the

assumptions upon which their respective financial information and

their respective forward-looking statements are based are

reasonable, they can give no assurance that these forward-looking

statements will prove to be correct.

Forward-looking statements are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from historical experience or from future results

expressed or implied by such forward-looking statements. Potential

risks and uncertainties include, but are not limited to, receipt of

regulatory approvals without unexpected delays or conditions,

CACEIS’ ability to successfully integrate KAS BANK, CACEIS’ ability

to achieve the anticipated results from the acquisition and

integration of KAS BANK, the effects of competition (in particular

the response to the transaction in the marketplace), economic

conditions in the global markets in which CACEIS and KAS BANK

operate, and other factors that can be found in CACEIS’ and KAS

BANK’s press releases and public filings.

Neither CACEIS nor KAS BANK, nor any of their

advisors, accepts any responsibility for any financial information

contained in this press release relating to the business, results

of operations or financial condition of the other or their

respective groups. Each of CACEIS and KAS BANK expressly disclaims

any obligation or undertaking to disseminate any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the expectations with regard thereto or any

change in events, conditions or circumstances on which any such

statement is based.

- Communiqué conjoint CACEIS KAS BANK - Declaration unconditional

press release 230919 final

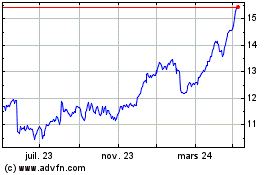

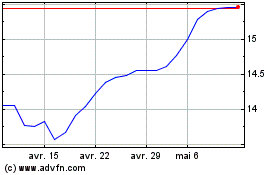

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024