Campbell and Affiliate of Butterfly Equity Sign Definitive Agreement for Sale of Bolthouse Farms for $510 Million

12 Avril 2019 - 7:15PM

Business Wire

Bolthouse Farms Deal Marks the Divestiture

of Entire Campbell Fresh Division

Campbell Soup Company (NYSE: CPB) announced today that it

has signed a definitive agreement for the sale of Bolthouse Farms

to an affiliate of Butterfly Equity, a Los Angeles-based private

equity firm specializing in the food sector, for $510 million,

subject to customary purchase price adjustments.

Upon the completion of the sale of Bolthouse Farms, which is

expected by the end of fiscal 2019, Campbell will have divested its

entire Campbell Fresh division. Campbell recently announced the

sale of Garden Fresh Gourmet and the company’s Everett, Washington,

refrigerated soup plant. In fiscal year 2018, Campbell Fresh

recorded net sales of $970 million. Proceeds from the divestiture

of the Campbell Fresh businesses will allow the company to reduce

debt by approximately $570 million. The transactions are not

expected to impact the company’s fiscal 2019 guidance.

Mark Clouse, Campbell’s President and CEO, said, “The sale of

Bolthouse Farms supports our strategy to focus on our two core

North American businesses, Campbell Snacks and Campbell Meals and

Beverages, where we have iconic brands and strong market

positions.”

Acquired by Campbell in August 2012, Bolthouse Farms is a

leading producer of organic beverages, dressings and carrots.

Bolthouse Farms is based in Bakersfield and Santa Monica,

California, and operates facilities in Hodgkins, Illinois,

Wheatley, Ontario and Prosser, Washington. The company has

approximately 2,200 employees.

The transaction is subject to customary closing conditions.

Campbell was advised by Centerview Partners, Goldman Sachs and

Weil, Gotshal & Manges LLP.

As outlined in August 2018 as part of its Board-led strategy and

portfolio review, Campbell launched thorough divestiture processes

for both its Campbell Fresh and Campbell International businesses.

The process to divest Campbell International is ongoing.

About Campbell Soup Company

Campbell (NYSE:CPB) is driven and inspired by our Purpose, "Real

food that matters for life's moments." For generations, people have

trusted Campbell to provide authentic, flavorful and affordable

snacks, soups and simple meals, and beverages. Founded in 1869,

Campbell has a heritage of giving back and acting as a good steward

of the planet's natural resources. The company is a member of the

Standard and Poor's 500 and the Dow Jones Sustainability Indexes.

For more information, visit www.campbellsoupcompany.com or follow

company news on Twitter via @CampbellSoupCo. To learn more about

how we make our food and the choices behind the ingredients we use,

visit www.whatsinmyfood.com.

About Butterfly Equity

Butterfly Equity ("Butterfly") is a Los Angeles, California

based private equity firm specializing in the food sector, spanning

the entire food value chain from "seed to fork" via four target

verticals: agriculture & aquaculture, food & beverage

products, food distribution and foodservice. Butterfly aims to

generate attractive investment returns through deep industry

specialization, a unique approach to sourcing transactions, and

leveraging an operations-focused and technology-driven approach to

value creation. For additional information about Butterfly, please

visit its website at www.butterflyequity.com.

Forward-Looking Statements

This release contains “forward-looking statements” that reflect

the Company’s current expectations about the impact of its future

plans and performance on the Company’s business or financial

results. These forward-looking statements rely on a number of

assumptions and estimates that could be inaccurate and which are

subject to risks and uncertainties. The factors that could cause

the Company’s actual results to vary materially from those

anticipated or expressed in any forward-looking statement are

described in the Company’s most recent Form 10-K and subsequent

Securities and Exchange Commission filings, and include the

Company’s ability to execute on and realize the expected benefits

from the actions it intends to take as a result of its recent

strategy and portfolio review; the ability to differentiate its

products and protect its category leading positions, especially in

soup; the ability to complete and to realize the projected benefits

of planned divestitures and other business portfolio changes; the

Company’s indebtedness and ability to pay such indebtedness; and

changes in currency exchange rates, tax rates, interest rates, debt

and equity markets, inflation rates, economic conditions, law,

regulation and other external factors. The Company disclaims any

obligation or intent to update the forward-looking statements to

reflect events or circumstances after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190412005392/en/

INVESTOR CONTACT:Ken Gosnell(856)

342-6081Ken_Gosnell@campbellsoup.com

MEDIA CONTACT:Thomas Hushen(856)

342-5227Thomas_Hushen@campbellsoup.com

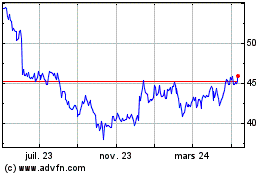

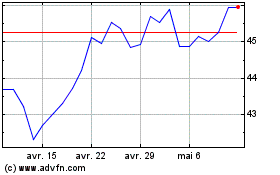

Campbell Soup (NYSE:CPB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Campbell Soup (NYSE:CPB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024