Strong growth of +29% in recurring operating

income

Regulatory News:

Carrefour (Paris:CA):

- Sustained commercial activity in Q2: +6.3% on a

like-for-like (LFL) basis despite lockdown measures

- Good momentum in May/June

(+9.4% LFL) after the lockdown phase in April (+0.3%

LFL)

- Brazil (+14.9% LFL) and Spain

(+9.8% LFL) benefited from a competitive model and flawless

execution

- In France (+0.7% LFL),

hypermarkets, penalized in April during the lockdown, have seen

their performance improve since May; good performance in

supermarkets and convenience

- Strong growth of more than

+100% in food e-commerce in Q2

- Strong growth in recurring operating income (ROI) and free

cash flow

- Strong rise in ROI: +29% at

constant exchange rates, to 718 million euros

- Further improvement in net

free cash flow restated for exceptional items: +95 million

euros

- Solid performance reflecting the relevance of the strategic

initiatives implemented since 2018 within the Carrefour 2022

transformation plan

- Resilience of the

multi-format and omnichannel model throughout the

crisis

- Marked improvement in NPS®

(+3 points in H1), reflecting priority given to customer

satisfaction

- Commercial activity driven by

investments in price and non-price competitiveness

- Further strong cost-reduction

momentum (€480m in H1)

- Cost-savings plan raised to €3.0bn (vs. €2.8bn) on an annual

basis by the end of 2020. Heightened ambitions to reduce greenhouse

gas emissions. All the other objectives of the Carrefour 2022 plan

are confirmed

Alexandre Bompard, Chairman and CEO, declared:

“Our first-half performance is

very solid: It proves the resilience of our model, its dynamism and

its profitability. It owes a lot to the responsiveness and

exceptional commitment of our teams, who overcame difficult

operational conditions to provide our customers with the support

and solutions they expected from us.

The crisis confirms the

relevance of our multi-format and omnichannel strategy, as well as

the strength of our commercial assets, resulting from three years

of a demanding and rapid transformation. It is also rich in

lessons. It encourages us to step up our environmental commitments,

in the service of the food transition for all. And above all, it

sheds light on the need for proximity to our customers, which, when

it is a constant priority, is immediately reflected in

performance.

To draw all the operational

implications, I renewed the management team and united it around a

clear mandate: Operational excellence to better serve customers.

This is the reason behind the managerial changes made in France,

Spain, Italy and Poland. Now that solid foundations have been laid

in recent years in these countries, they bring new energy to

amplify our commercial gains.

The further improvement in our

results this half, the growing satisfaction of our customers, our

ability to seize opportunities to create value - all these

achievements further strengthen my confidence in the success of our

Group. We reaffirm or enhance the objectives that we have set for

ourselves, both financial and extra-financial."

H1 2020 KEY FIGURES

(€m)

H1 2019

H1 2020

Variation

Sales inc. VAT

38,849

38,079

+7.0% LFL

Recurring operating income

(ROI)1

624

718

+29.1%, +€181m (at constant

exchange rate)

Recurring operating margin

1.8%

2.1%

+31bps

Adjusted net income, Group

share

155

253

+63% / +€98m

Net free cash flow restated

for exceptional items

(1,934)

(1,839)

+€95m

Net financial debt

(5,958)

(5,218)

+€935m (at constant exchange

rate)

SECOND QUARTER: ATYPICAL ACTIVITY, MARKED BY THE SANITARY

CRISIS

Exceptional mobilization in the face of

the crisis

Faced with the COVID-19 pandemic, Carrefour's teams have shown

exceptional responsiveness to ensure the continuity of food

distribution and then meet new consumer expectations in a complex

and fast-changing environment.

The Group immediately implemented strong measures to protect the

health of employees and customers, by anticipating and going beyond

health rules recommended by public authorities in each country.

Carrefour has taken social responsibility measures and

implemented concrete solidarity actions, such as the creation of

dedicated services for priority customers (in particular the

elderly and medical staff), donations from the Carrefour Foundation

or actions to support local producers.

Resilience of the multi-format and

omnichannel model

The resilience of the multi-format and omnichannel model is

confirmed, with each store format meeting the needs of consumers

during the different phases of the crisis. The Group’s food

e-commerce offer met with strong success throughout the crisis.

April LFL

May/June LFL

Q2 LFL

Group

+0.3%

+9.4%

+6.3%

o/w hypermarkets

-4.6%

+8.0%

+3.9%

o/w supermarkets

+8.3%

+5.5%

+6.4%

o/w convenience

+19.0%

+8.9%

+12.2%

April LFL

May/June LFL

Q2 LFL

Group

+0.3%

+9.4%

+6.3%

Food

+1.6%

+7.5%

+5.5%

Non-food

-7.9%

+19.9%

+11.0 %

April: A month marked by lockdown

April was characterized by a lockdown situation in most of the

Group's countries. Quite similar purchasing behavior was observed

in the various countries, and particularly in Europe.

Consumers favored convenience (+19.0% LFL) and supermarkets

(+8.3% LFL), which were more accessible, at the expense of

hypermarkets (-4.6% LFL). Across all formats, the number of store

visits was lower, while the average basket increased significantly.

Food e-commerce maintained the strong momentum observed in

March.

The non-food market was penalized (-7.9%), in particular certain

categories such as apparel, which were deemed non-essential. In

several Group countries (notably in Spain and in Italy),

authorities also mandated the closure of certain non-food

departments.

Market players momentarily reduced promotional activity, notably

due to the suspension of catalogues during lockdown.

May and June: Good post-lockdown momentum

Gradually from May, European countries began to ease lockdown.

In Brazil, health policy is different from state to state, with a

local approach to lockdown, while Argentina remains confined to

this day.

Although health situations and timetables vary from country to

country, some trends stand out:

- In May and June, food markets were generally buoyant,

benefiting in particular from repressed demand for out-of-home

consumption

- The attractiveness of convenience and supermarket formats was

confirmed (+8.9% LFL in Group convenience and +5.5% LFL in Group

supermarkets in May/June). Carrefour continued expansion in

convenience: With 1,563 new convenience stores since the start of

the transformation plan (+521 in H1), the Group is on track to

reach its target of 2,700 openings by 2022

- Hypermarkets, which were again fully accessible, experienced

sustained activity (Group hypermarkets LFL at +8.0% in May/June).

They played their role after lockdown (price, social distancing,

promotion), even if they were penalized in some countries by a slow

recovery in shopping mall traffic. Carrefour continued to invest in

customer satisfaction and purchasing power

- Non-food departments, reopened in all countries, have regained

attractiveness

Other activities

The COVID-19 crisis has had an impact on several other Group

activities:

- Financial services: Faced with an

uncertain macroeconomic environment, Carrefour very quickly

increased the selectivity of its credit granting policy, as well as

its recovery procedures. The Group has also taken cost-saving

measures. The cost of risk has increased in a context of economic

crisis

- Other services (travel, ticketing,

rentals, etc.): Qualified as “non-essential,” these services

were forced to close during lockdown

- BtoB (HoReCa): These activities

suffered from the closure of restaurants, bars, hotels and

collective catering sites. In Atacadão stores in Brazil, the

decline in business with professionals was offset by a marked

increase in sales to individuals

- Petrol: Petrol sales were

penalized by traffic restrictions (volume effect) as well as the

marked drop in oil prices (price effect)

THE GROUP IS ACCELERATING, SUPPORTED BY THE ACHIEVEMENTS OF

THE CARREFOUR 2022 PLAN

In the first half of 2020, the solid commercial (+7.0% LFL

growth) and operational (+29.1% increase in recurring operating

income at constant exchange rates) performance demonstrates that

Carrefour is fully benefiting from the initiatives of its strategic

plan and from its responsiveness to the crisis. The current period

thus confirms the relevance of the choices made in January 2018 and

strengthens the Group's confidence in the success of its

transformation plan.

Customer satisfaction: Further

three-point increase in NPS®

The priority given by Carrefour to customer satisfaction, based

on the “5/5/5” method, resulted in the first half in further

improvement in NPS® (+3 points at the end of June 2020 vs. December

2019).

This method is based on the individual and collective commitment

of employees, at headquarters and in stores, around a common

priority - customer satisfaction - through 15 commitments divided

into three categories (trust, service, proximity).

Since 2018, this method has contributed to commercial success in

the countries where it has already been implemented (e.g.

Argentina, Spain, Taiwan, Poland).

In 2019, Carrefour initiated the Group-wide deployment of the

"5/5/5" method, making it possible to meet customer expectations in

a very concrete way. This deployment accelerated in H1 2020 despite

health constraints.

Food e-commerce: Growth of above

+100% in Q2 2020 (c. +70% in H1)

The sanitary crisis is leading to unprecedented growth in food

e-commerce, which posted marked progression in all of the Group's

geographies in H1 2020. During the crisis, Carrefour attracted

850,000 new customers worldwide, of which more than 500,000 in

France.

The progress Carrefour has made in recent years has enabled it

to take full advantage of this trend, with adapted logistics and

services (overhaul of digital platforms, increase in order

preparation and distribution capabilities).

During the first half of the year, Carrefour demonstrated strong

responsiveness to meet the surge in demand:

- New services: “Essentials” baskets, launch of food marketplaces

in France and Brazil (Atacadão), new voiced-based food shopping

experience with Google in France

- Opening of new in-store order preparation areas and

acceleration of warehouses mechanization

- Increase in distribution capacities: Accelerated deployment of

a network of drives and pedestrian drives (2,033 units at end June

2020, including +337 in H1) and new partnerships (UberEats in

Belgium, Taiwan and France - with exclusivity in regions; Glovo in

Poland and Food Panda in Taiwan)

The Group is thus establishing itself as a leading player in

food e-commerce and intends to accelerate further on this

segment.

Price competitiveness: Continued

price investments

Carrefour has been making significant investments in the

competitiveness of its offer since 2018. Good levels of price

competitiveness have been achieved in many countries, particularly

in Latin America, Spain and Eastern Europe.

These investments contributed to the strong commercial momentum

in the first half. The Group intends to continue strengthening its

competitiveness, notably in France.

In H1, the Group invested notably:

- In France: Launch of the “Market Loyalty Rewards” in

supermarkets in January (10% discount every day on fresh products)

and “Committed Prices” (repositioning of 150 core Carrefour-branded

products) at the end of May

- In Belgium: New price cuts on 1,000 products initiated at the

end of May

Particular attention is paid to Carrefour-branded products,

which offer excellent value for money and whose penetration was up

by +2 points in H1 2020 (vs H1 2019) to 29% of sales.

Organic and local: Organic sales

up by c. 25% in H1 2020

In the first half of the year, the Group strongly accelerated

the development of organic product ranges (growth of c. +25% in H1

2020, i.e. sales of €1.4 billion) and local sourcing.

In France, Carrefour supports a growing number of local

producers on a daily basis in their conversion to organic farming.

The number of new support contracts since 2018, whose initial

target of 500 had already been reached one year ahead of plan,

stood at 682 at the end of June 2020 (+142 in H1).

Investments in organic products also materialized through the

acceleration of the development of the SoBio banner. Its store

network reached 18 points of sale at the end of June 2020 (+6

openings in H1) against 8 when initially acquired. The Group's

ambition is to continue the expansion of this banner.

Cost-reduction momentum and financial

discipline: Cost-savings plan raised to €3.0bn

Since the launch of the Carrefour 2022 plan, the Group has

adhered to unfailing financial discipline. With a strong

cost-reduction momentum, Carrefour benefited in the half from the

culture of operational efficiency implemented over the past three

years (purchasing alliances, negotiation protocols, etc.).

In H1 2020, the Group thus achieved further savings of €480m

(i.e. €2,440m since the start of the plan). This momentum now makes

it possible to raise the savings target to €3.0bn (vs. €2.8bn) by

the end of 2020. It will continue beyond 2020.

Carrefour is also vigilant with regard to the selectivity and

productivity of its investments, whose budget should be contained

below €1.5bn in 2020.

As part of its objective of additional disposals of

non-strategic real estate assets (€300m by 2022), Carrefour

concluded several transactions for a total amount of around €40m at

the end of June.

Consolidation strategy through targeted

acquisitions: First achievements in Brazil and

Taiwan

On the strength of its balance sheet, its enhanced know-how and

its solid market positions, Carrefour is positioned as a natural

consolidator in the regions in which it is present. The Group is

more attentive than ever to acquisition opportunities of moderate

size, offering perfect complementarity with its existing

activities. The acquisitions of Makro in Brazil and Wellcome in

Taiwan, carried out under attractive financial conditions, are a

perfect illustration of this strategy.

- In Q1, Carrefour Brazil signed an agreement with Makro

Atacadista SA for the acquisition of 30 Cash & Carry stores,

for a price of 1.95bn Brazilian Reais. The review process by the

Brazilian competition authority is progressing as expected. Closing

is expected in Q4 2020

- In Q2, Carrefour entered into an agreement with Dairy Farm to

acquire Wellcome Taiwan and accelerate its expansion with the

acquisition of 224 convenience stores, thereby consolidating its

position as the main multi-format food retailer in this market. The

transaction is subject to the approval of the Taiwanese competition

authority. Closing is expected by the end of 2020

CARREFOUR, A COMMITTED COMPANY

In the half, Carrefour took several steps in pursuit of a model

of sustainable value creation for all its stakeholders.

Leader of the food transition for

all: On track to achieve the 2020 objectives of the "CSR and

Food Transition" index

Since the launch of its transformation plan, Carrefour set

itself the ambition of being the leader in the food transition for

all. This ambition was enshrined in the Group's bylaws as its

"raison d'être" on the occasion of the 2019 Annual General

Meeting.

In 2018, Carrefour created the "CSR and Food Transition" index,

which tracks the performance of this strategy and the concrete

implementation of its "raison d'être." The Group achieved a score

of 104% in 2018 and 114% in 2019 and is on track to achieve its

2020 targets.

In H1 2020:

- Sales of products from Carrefour Quality Lines (FQC) are up by

+14%. Their penetration rate, which reached 7.2% in the fresh

department, is in line with the objective of 10% in 2022

- In-store energy consumption was reduced by 4%, in line with

targets

- The reduction in packaging should be equivalent to that

achieved in 2019 (i.e. a reduction of 2,000 tons), notably thanks

to the deployment of “zero plastic” in the fruit and vegetable

departments

Fight against climate change:

Heightened ambitions to reduce greenhouse gas emissions

Carrefour was committed to reducing the carbon footprint linked

to its stores by 40% by 2025 (vs. 2010). Having reached 39%, the

objective was already almost achieved by 2019. Carrefour is

therefore raising its ambitions for its stores (scopes 1 and 2) and

supplementing its climate plan with new ambitious commitments for

products sold in stores (scope 3). These new objectives2 were

approved by the Science Based Target initiative (SBTi) led by the

CDP, the Global Compact, the World Resources Institute (WRI) and

the WWF®, confirming Carrefour's commitment to the 2° C scenario

developed by the IPCC.

The Group also obtained an A rating from the CDP Climate. It is

thus recognized as the leading French distributor in this area and

ranks among the top 2% of companies in the fight against climate

change.

Partnerships with suppliers:

Major players associated with Carrefour's responsible

approach

Carrefour is the first retailer to invite its largest suppliers

to participate in its responsible approach. By signing the “Food

Transition Pact” proposed by Carrefour, the latter subscribe to

commitments on nutrition, controversial substances, packaging and

climate. 24 large international companies have thus joined forces

with Carrefour in order to pursue common initiatives on these

themes.

Carrefour recently launched the “Forest Positive Coalition of

Action” within the Consumer Goods Forum, which brings together more

than 400 global retailers and manufacturers. The approach is led by

Alexandre Bompard and Grant Reid, CEO of Mars.

Social and societal responsibility

measures: Decisions in the context of the pandemic

In the exceptional context of the pandemic and in a responsible

corporate approach, exceptional bonuses and similar benefits were

paid to front-line employees.

At the same time, Alexandre Bompard informed the Board of

Directors of his decision to give up 25% of his fixed compensation

for a period of two months. In addition, the fixed remuneration of

the members of the Executive Committee was frozen for all of 2020,

and they were asked to forsake 10% of their fixed remuneration for

a period of two months. Finally, the members of the Board of

Directors have decided to reduce their directors’ fees by 25% for

the current year.

The corresponding amounts will be used to finance solidarity

actions for Group employees, in France and abroad.

In a gesture of social and societal responsibility linked to the

particular context of the pandemic, the Board of Directors also

decided to reduce the dividend proposed for the 2019 financial year

by 50%, to 0.23 euro per share.

SECOND-QUARTER 2020 SALES INC. VAT

As in the first quarter, second-quarter sales were strongly

impacted by changes in consumer purchasing behavior, as well as by

lockdown measures linked to the COVID-19 pandemic in all the

Group’s countries.

On a like-for-like basis (LFL), second-quarter sales

including VAT increased by +6.3%. The Group's gross sales

reached €18,710m pre-IAS 29, an increase of +0.3% at constant

exchange rates. This increase includes an unfavorable petrol effect

of -5.8% due to mobility restrictions linked to lockdown and the

drop in oil prices. Taking into account an unfavorable exchange

rate effect of -6.7%, mainly due to the depreciation of the

Brazilian Real and the Argentine Peso, total sales variation at

current exchange rates amounted to -6.3 %. The impact of the

application of IAS 29 is - €66m.

In France, Q2 2020 sales were up +0.7% on a LFL

basis.

- Hypermarkets (-3.6% LFL) have

shown a marked improvement in performance since mid-May, after

having particularly suffered during lockdown due to mobility

restrictions

- Supermarkets (+4.3% LFL) posted a

solid performance and continued to benefit from the repositioning

initiated since 2018

- The excellent momentum in convenience (+11.4% LFL) was confirmed. Carrefour

is continuing to expand in this growth format for the Group with

+79 openings in H1 2020

- Promocash’s activities were penalized by restaurant closures

and lockdown

In Europe, LFL growth reached +4.7% over the quarter.

- In Spain(+9.8% LFL), in a market boosted by the shift

away from eating out-of-home, Carrefour benefited from its

increased attractiveness, including in hypermarkets, and confirmed

its excellent momentum. Food e-commerce sales doubled. Constant

attention to customer satisfaction continued to pay off

- In Italy (-7.4% LFL), the market entered negative

territory in June3. Carrefour was penalized by its exposure to

shopping centers, closed until May 18, and to tourist areas, which

were particularly affected by the crisis

- In Belgium (+15.9% LFL), Carrefour continued the market

share gains recorded in Q11. In a dynamic market benefiting from

the closure of borders, the Group capitalized on a well-adapted

store network, notably medium-sized hypermarkets close to city

centers. Carrefour also benefited from the price repositioning

initiated in November 2019, reinforced in May by a second wave of

investments in 1,000 products

- In Poland(-4.2% LFL) and Romania (-2.2% LFL), the

Group was penalized in the quarter by its strong exposure to stores

located in shopping centers, which have reopened only gradually

since May

Strong commercial momentum continues in Latin America

(+20.9% LFL).

- In Brazil, Q2 sales were up +15.4% at constant exchange

rates, with like-for-like growth of +14.9%, a contribution from

openings of +4.5% and a negative petrol effect of -2.9%. The

currency effect was an unfavorable -29.5%

- Carrefour Retail posted

exceptional sales growth, up +30.3% LFL. This remarkable momentum

is driven by both food and non-food. It reflects the repositioning

of hypermarkets since 2018, allowing significant market share

gains. Food e-commerce recorded record growth of more than

+360%

- Atacadão’s sales are up +13.5% at

constant exchange rates, with like-for-like growth of +8.6% and a

contribution from openings of +6.3%. The banner continued its

expansion, with the opening of a new store in Q2 and 5 in the first

half

- Financial services billings were

broadly stable (+0.3%), given greater selectivity in granting

credit since Q1

- In Argentina (+54.0% LFL), the good commercial momentum

continued, with volumes increasing continuously. Strengthening

price leadership and proximity to customers are differentiating

assets

In Taiwan (Asia), sales increased by +2.2% at constant

exchange rates and by -2.5% on a LFL basis in Q2. In a shrinking

market, market share remained stable during the quarter4. Consumers

postponed certain non-food purchases in view of the expected

distribution of coupons by the government in July.

FIRST-HALF 2020 INCOME STATEMENT

On a like-for-like basis (LFL), first-half sales including

VAT increased by +7.0%. The Group’s gross sales stood at

€38,155m pre-IAS 29, an increase of +3.8% at constant exchange

rates. This increase took into account an unfavorable -3.7% petrol

effect. Including an unfavorable currency effect of -5.5%, the

total sales variation at current exchange rates was -1.6%. The

impact of the application of IAS 29 is -€76m.

Net sales stood at €34,265m.

Gross margin stood at 21.8% of net sales, down 21bps,

taking into account price investments, the momentary increase in

logistics costs and the evolution of the integrated/franchisee mix,

partly offset by purchasing gains.

Distribution costs decreased to 16.6% of net sales, vs

17.2% in H1 2019. They benefited from the cost-savings plans and

include costs related to store openings and new services offered to

customers, notably in digital.

Group EBITDA reached €1,886m, representing a margin of

5.5%, up +43bps.

Group recurring operating income (ROI) rose to €718m, an

increase of +€181m€ (+29.1%) at constant exchange rates (the

currency effect is a negative -€86m, notably due to the

depreciation of the Brazilian Real). Operating margin is up +31bps,

to 2.1%.

The strong increase in ROI (+€181m at constant exchange rates)

reflects:

- The good overall performance of retail activities

- The decrease of the contribution from financial services

(c.-€70m at constant exchange rates/c.-€90m at current exchange

rates) due to higher cost of risk

- The c.-€50m in total impact of lockdown on other services (e.g.

travel, ticketing) and on BtoB sales (HoReCa) in Europe (inc.

France)

- In France, recurring operating income amounted to €125m,

compared to €120m in H1 2019. Operating margin increased by +5bps

to 0.8%. This change reflects the good dynamics of distribution

activities, despite the drop in hypermarket activity during

lockdown. ROI in France was impacted by approximately -€70m by the

increase in the cost of risk in financial services and the sharp

slowdown in service activities and Promocash

- In Europe (ex-France), recurring operating income rose

sharply by +59.0% (+€74m) at constant exchange rates, to €199m.

Operating margin improved by +69bps to 1.9%. All countries saw an

increase in ROI. Profitability in Europe benefited from a

significant increase in activity as well as good cost-cutting

dynamics across all geographies

- In Latin America, recurring operating income rose +27.5%

at constant exchange rates, to €373m. Operating margin increased by

+60bps to 5.7%, reflecting a commercial strategy promoting volume

growth. The impact of the application of IAS 29 is -€11m

- In Brazil, the strong growth in activity was combined with

increased cost discipline and greater operational efficiency. ROI

is therefore up sharply, by +20.3% at constant exchange rates

- In Argentina, ROI increased significantly and turned positive

in the first half for the first time since 2012

- In Taiwan (Asia), profitability improved again with ROI

increasing to €49m vs €40m in H1 2019, i.e. an operating margin up

to 4.5% compared to 4.1% in H1 2019. This increase reflects good

expansion momentum and strict cost control

Non-recurring income and expenses stood at €(234)m vs

€(610)m in H1 2019. It notably includes the payment of exceptional

bonuses and similar benefits to Group employees for an amount of

€(128)m. Restructuring expenses are down to €(42)m vs €(342)m in H1

2019.

Net income, Group share improved by a strong +€437m and

stood at €(21)m, vs €(458)m in H1 2019. It includes the following

items:

- Net financial expenses of €(173)m, quasi stable vs H1

2019

- An income tax charge of €(238)m, compared to €(192)m in H1 last

year. This charge reflects the increase in pre-tax income and a

normative tax rate of 32.1% (compared to 33.9% in H1 2019),

excluding non-current income and taxes not assessed on pre-tax

income

- Net income from discontinued operations, Group share of

€3m

Adjusted net income, Group share improved by +€98m, to

€253m vs €155m in H1 2019.

CASH FLOW AND DEBT

In H1 2020, the Group posted an improvement of +€95m in net

free cash flow adjusted for exceptional items and discontinued

operations, going from €(1,934)m to €(1,839)m.

Net free cash flow amounted to €(2,193)m in H1 2020, up

by +€197m compared to H1 2019.

- It primarily reflects the increase in EBITDA of

+€116m

- It also includes the following items:

- The payment of exceptional bonuses and similar benefits

to Group employees (€128m)

- A lower cash-out for restructuring costs of €184m (vs.

€269m in H1 2019)

- The absence of a dividend from Carmila (vs €73m in H1

2019)

- A change in working capital requirement improving

by +€57m reflecting:

- Dynamic activity

- A stable level of inventories vs June 2019

- An unfavorable calendar effect on trade payables

- Lower petrol sales

- Capex down by -€179m to €449m in H1 2020, against €628m

in H1 2019. They continue to benefit from selectivity and

productivity measures and were reduced in the context of the

crisis

- A -€21m decrease in the cost of net financial debt

thanks to better refinancing of bond issues

Net financial debt decreased by €935m at constant

exchange rates to €5,218m at June 30, 2020 vs €5,958m at June 30,

2019, thanks to improved free cash flow and proceeds from disposals

in H2 2019 (China and Cargo).

Shareholder equity, Group share, stood at €9,283m at June

30, 2020.

DIVIDEND

Following the decision of the General Meeting of May 29, 2020,

shareholders were offered the option of receiving the dividend of

€0.23 per share in cash or in Group shares. At the end of the

option period on June 23, 2020, the shareholders who chose the

payment of the 2019 dividend in shares represented approximately

69% of the capital. Thus, of the total €183m in dividends, €57m

were paid in cash on June 29, 2020 and €126m were paid in the form

of 10,358,336 new shares (representing 1.28% of the capital as of

May 31, 2020).

ENHANCED LIQUIDITY AND SOLID BALANCE SHEET

Since 2018, Carrefour has demonstrated great financial

discipline and has strengthened its balance sheet and liquidity. It

has one of the strongest balance sheets in the industry.

At June 30, 2020, the Group

was rated Baa1 with negative outlook by Moody’s and BBB with stable

outlook by Standard & Poor’s.

The Group's liquidity was reinforced during the half by

the bond issue carried out in March for an amount of €1bn, maturing

in December 2027. The success of this operation, largely

oversubscribed, attests to the great confidence of bond investors

in the Carrefour signature.

In April, the Group redeemed a bond issue for an amount of

€802m.

In addition, Carrefour Brazil obtained bank financing for 1.5

billion Brazilian Reais over two and three years.

Finally, the Group has two credit facilities totaling €3.9bn,

which have not been drawn down to date. In June 2020, these two

facilities were the subject of a one-year maturity extension

agreement for 95% of the total amount, extending their maturity to

June 2025

Carrefour's solid balance sheet is an important asset in the

current context, marked by rapid changes in the food retail sector,

the COVID-19 pandemic and an economic slowdown.

STRATEGIC ORIENTATIONS AND OBJECTIVES CONFIRMED

The Group is continuously working on precisely assessing the

impact of the COVID-19 pandemic, notably on the evolution of

consumer purchasing behavior.

The Group reiterates the orientations of the Carrefour 2022

strategic plan, is raising its cost-reduction plan objective and

confirms all of its other operational and financial objectives.

Operational objectives

- Improvement in the Group NPS® of +15 points over 2020-22

period, i.e. +23 points since the start of the plan

- Reduction of 350,000 sq. m of hypermarket sales area worldwide

by 2022

- -15% reduction in assortments by 2020

- Carrefour-branded products accounting for one-third of sales in

2022

- 2,700 convenience store openings by 2022

Financial objectives

- €4.2bn in food e-commerce sales in 2022

- €4.8bn in sales of organic products in 2022

- Three-year cost-reduction plan raised to €3.0bn (vs €2.8bn

previously) on an annual basis by end 2020. Continued

cost-reduction momentum beyond 2020

- €300m in additional disposals of non-strategic real estate

assets by 2022

End 2019

End June 2020

Objective

Operational objectives

Improvement in the Group NPS®

+8 points

+11 points

+23 points by 2022

Reduction of hypermarket sales

area

115,000 sq. m

133,000 sq. m

350 000 sq. m by 2022

Reduction in assortments

-10.1%

-10.3%

-15% by 2020

Sales of Carrefour-branded

products

27% of sales +2 points yoy

29% of sales +2 points yoy

1/3 of sales by 2022

Convenience store openings

+1,042

+1,563

+2,700 by 2022

Financial objectives

Food e-commerce sales

€1.3bn

€1.1bn in H1

€4.2bn in 2022

Sales of organic products

€2.3bn

€1.4bn in H1

€4.8bn in 2022

Cost-reduction plan

€2.0bn

€2.4bn

€3.0bn by end 2020

Disposals of non-strategic real

estate assets

Initial objective of €500m

achieved at end-2019

€40m

€300m

additional

by 2022

The Carrefour Board of Directors met on July 28, 2020 under the

chairmanship of Alexandre Bompard and approved the condensed

consolidated financial statements for the first half of 2020. These

accounts were reviewed by the statutory auditors who expressed an

unqualified conclusion.

APPENDIX

Second-quarter 2020 sales inc. VAT

The Group's sales amounted to €18,710m pre-IAS 29. Foreign

exchange had an unfavorable impact in the second quarter of -6.7%,

largely due to the depreciation of the Brazilian Real and the

Argentine Peso. Petrol had an unfavorable impact of -5.8%. The

calendar effect was an unfavorable -0.4%. The effect of openings

was a favorable +1.2%. The impact of the application of IAS 29 was

-€66m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

8,896

+0.7%

-0.0%

-8.4%

-8.4%

Hypermarkets

4,327

-3.6%

-4.2%

-12.6%

-12.6%

Supermarkets

3,052

+4.3%

+2.9%

-6.3%

-6.3%

Convenience /other formats

1,516

+6.3%

+7.0%

+0.6%

+0.6%

Other European

countries

5,717

+4.7%

+4.5%

-0.1%

+0.5%

Spain

2,355

+9.8%

+9.8%

+1.7%

+1.7%

Italy

1,150

-7.4%

-8.5%

-11.1%

-11.1%

Belgium

1,193

+15.9%

+15.9%

+16.0%

+16.0%

Poland

479

-4.2%

-4.5%

-10.3%

-5.6%

Romania

540

-2.2%

+0.2%

-1.7%

+0.1%

Latin America (pre-IAS

29)

3,586

+20.9%

+24.2%

-11.8%

+20.9%

Brazil

2,982

+14.9%

+19.0%

-14.1%

+15.4%

Argentina (pre-IAS 29)

603

+54.0%

+53.5%

+1.4%

+52.8%

Asia

511

-2.5%

+1.6%

+8.7%

+2.2%

Taiwan

511

-2.5%

+1.6%

+8.7%

+2.2%

Group total (pre-IAS

29)

18,710

+6.3%

+6.6%

-6.3%

+0.3%

IAS 29(1)

(66)

Group total (post-IAS

29)

18,644

Note: (1) hyperinflation and currencies

First-half 2020 sales inc. VAT

The Group's sales amounted to €38,155m pre-IAS 29. Foreign

exchange had an unfavorable impact in the first half of -5.5%,

largely due to the depreciation of the Brazilian Real and the

Argentine Peso. Petrol had an unfavorable impact of -3.7%. The

calendar effect was a favorable +0.2%. The effect of openings was a

favorable +1.3%. The impact of the application of IAS 29 was

-€76m.

Sales inc. VAT (€m)

Variation ex petrol ex

calendar

Total variation inc.

petrol

LFL

Organic

at current exchange

rates

at constant exchange

rates

France

18,188

+2.4%

+1.6%

-3.0%

-3.0%

Hypermarkets

8,952

-1.4%

-2.0%

-6.8%

-6.8%

Supermarkets

6,235

+6.2%

+4.5%

-0.4%

-0.4%

Convenience /other formats

3,001

+6.6%

+7.3%

+4.2%

+4.2%

Other European

countries

11,364

+5.4%

+5.1%

+2.6%

+3.0%

Spain

4,636

+8.3%

+8.1%

+3.5%

+3.5%

Italy

2,376

-2.6%

-4.1%

-5.3%

-5.3%

Belgium

2,247

+11.2%

+11.1%

+11.5%

+11.5%

Poland

1,005

+2.0%

+1.7%

-2.2%

+0.5%

Romania

1,101

+3.5%

+6.0%

+4.8%

+6.4%

Latin America (pre-IAS

29)

7,463

+19.0%

+22.2%

-6.1%

+20.7%

Brazil

6,224

+11.4%

+15.3%

-8.2%

+13.8%

Argentina (pre-IAS 29)

1,239

+61.4%

+60.4%

+6.0%

+60.6%

Asia

1,140

+2.1%

+7.0%

+12.1%

+6.0%

Taiwan

1,140

+2.1%

+7.0%

+12.1%

+6.0%

Group total (pre-IAS

29)

38,155

+7.0%

+7.3%

-1.6%

+3.8%

IAS 29(1)

(76)

Group total (post-IAS

29)

38,079

Note: (1) hyperinflation and currencies

Geographic breakdown of H1 2020 net sales and recurring

operating income

Net sales

Recurring operating

income

(in €m)

H1 2019

H1 2020

Variation at constant

exchange

rates

Variation at current

exchange

rates

H1 2019

H1 2020

Variation at constant

exchange

rates

Variation at current

exchange

rates

France

16,789

16,357

(2.6%)

(2.6%)

120

125

4.2%

4.2%

Europe (ex France)

9,988

10,246

3.0%

2.6%

126

199

59.0%

58.9%

Latin America

7,134

6,569

20.0%

(7.9%)

362

373

27.5%

2.9%

Asia

974

1,092

6.0%

12.1%

40

49

15.0%

21.6%

Global functions

-

-

-

-

(25)

(28)

(13.4%)

(12.7%)

TOTAL

34,885

34,265

3.9%

(1.8%)

624

718

29.1%

15.2%

Consolidated income statement H1 2020 vs H1 2019

(in €m)

H1 2019

H1 2020

Variation at constant exchange

rates

Variation at

current exchange rates

Net sales

34,885

34,265

3.9%

(1.8%)

Net sales, net of loyalty

program costs

34,549

33,949

4.0%

(1.7%)

Other revenue

1,204

1,121

0.8%

(6.9%)

Total revenue

35,752

35,070

3.9%

(1.9%)

Cost of goods sold

(28,086)

(27,612)

4.0%

(1.7%)

Gross margin

7,667

7,457

3.3%

(2.7%)

As a % of net sales

22.0%

21.8%

(13pbs)

(21pbs)

SG&A

(6,015)

(5,700)

0.4%

(5.2%)

As a % of net sales

17.2%

16.6%

(58pbs)

(61pbs)

Recurring operating income

before D&A (EBITDA)(1)

1,770

1,886

13.4%

6.5%

EBITDA margin

5.1%

5.5%

47pbs

43pbs

Depreciation and amortization

(1,029)

(1,039)

4.2%

1.0%

Recurring operating income

(ROI)

624

718

29.1%

15.2%

Recurring operating margin

1.8%

2.1%

43pbs

31pbs

Income from associates and joint

ventures

(1)

(2)

Recurring operating income

including income from associates and joint ventures

622

716

Non-recurring income and

expenses

(610)

(234)

Operating income

12

482

Financial result

(165)

(173)

Finance costs, net

(112)

(91)

Net interests related to leases

commitment

(60)

(48)

Other financial income and

expenses

7

(34)

Income before taxes

(153)

308

Income tax expense

(192)

(238)

Net income from continuing

operations

(345)

70

Net income from discontinued

operations

(45)

3

Net income

(390)

73

of which Net income, Group

share

(458)

(21)

of which continuing

operations

(415)

(23)

of which discontinued

operations

(43)

3

of which Net income,

Non-controlling interests

68

94

of which continuing

operations

70

94

of which discontinued

operations

(2)

-

Net Income, Group share,

adjusted for exceptional items

155

253

Depreciation from supply chain

(in COGS)

(118)

(129)

Net Income, Group share,

adjusted for exceptional items, per share

0.20

0.32

Weighted average number of shares

pre-dilution (in millions)

781.6

801.3

Note: (1) Recurring Operating Income Before Depreciation and

Amortization (EBITDA) also excludes depreciation and amortization

from supply chain activities which is booked in cost of goods

sold

Consolidated balance sheet

(in €m)

June 30, 2019

June 30, 2020

ASSETS

Intangible assets

9,410

9,300

Tangible assets

11,311

10,424

Financial investments

1,443

1,393

Deferred tax assets

770

770

Investment properties

312

277

Right-of-use asset

4,226

4,052

Consumer credit from financial-service

companies – Long-term

2,406

2,070

Other non-current assets

1,755

1,621

Non-current assets

31,633

29,906

Inventories

5,848

5,555

Trade receivables

2,752

2,532

Consumer credit from financial-service

companies – Short-term

4,163

3,179

Tax receivables

895

793

Other assets

884

957

Current financial assets

316

357

Cash and cash equivalents

1,522

2,750

Current assets

16,380

16,123

Assets held for sale

2,452

24

TOTAL

50,465

46,053

LIABILITIES

Shareholders' equity, Group share

8,277

9,283

Minority interests in consolidated

companies

2,157

1,480

Shareholders' equity

10,434

10,763

Deferred tax liabilities

598

600

Provision for contingencies(1)

3,991

2,854

Borrowings – Long-term

6,215

6,379

Lease liabilities – Long-term

3,495

3,348

Bank loans refinancing – Long-term

1,878

1,298

Tax payables – Long-term(1)

-

314

Non-current liabilities

16,178

14,793

Borrowings – Short-term

1,624

1,909

Lease liabilities – Short-term

822

892

Trade payables

11,619

11,157

Bank loans refinancing – Short-term

3,975

3,275

Tax payables – Short-term(1)

996

1,030

Other debts

2,773

2,234

Current liabilities

21,808

20,496

Liabilities related to assets held for

sale

2,046

-

TOTAL

50,465

46,053

Note: (1) The application of IFRIC 23 had an impact on the

presentation of the Group's financial statements from December 31,

2019 (see Note 4 of the consolidated financial statements as of

December 31, 2019). As a result, tax risks relating to income tax,

classified under Provision for contingencies as of June 30, 2019,

are shown under tax payables - long or short term as of June 30,

2020

Consolidated cash-flow statement

(in €m)

H1 2019

H1 2020

NET DEBT AT OPENING

(3,510)(1)

(2,615)

Gross cash-flow (continuing

operations)

1,263

1,260

Change in working capital

(2,159)

(2,102)

Impact of discontinued

operations

(9)

(27)

Cash-flow from

operations

(904)

(869)

Capital expenditure

(628)

(449)(2)

Change in net payables to fixed

assets suppliers

(183)

(328)

Net asset disposals

50

51

Impact of discontinued

operations

(23)

-

Free cash-flow

(1,689)

(1,595)

Free cash-flow excluding

exceptional items and discontinued operations

(1,350)

(1,241)

Financial investments

(73)

(122)

Proceeds from disposals of

subsidiaries

74

14

Others

(59)

(72)

Impact of discontinued

operations

1

-

Cash-flow after

investments

(1,746)

(1,775)

Capital increase

45

1

Dividends paid

(60)

(145)

Cost of net financial debt

(112)

(91)

Operating leases payment incl.

interests

(496)

(525)

Others

(79)

(67)

NET DEBT AT CLOSE

(5,958)

(5,218)

Notes : (1) Finance lease liabilities recognized in accordance

with IAS 17 for €275m at December 31, 2018 were reclassified in

lease commitments at January 1, 2019; (2) Restated for the

downpayment made in respect of the acquisition of Makro

EBITDA to free cash-flow bridge

(in €m)

H1 2019

H1 2020

Variation

EBITDA

1,770

1,886

116

Income tax paid

(231)

(227)

4

Financial result (excl. cost of

debt and interest related to leases obligations)

7

(34)

(41)

Others (incl. cash impact of

restructuring items)

(283)

(365)

(82)

Gross cash-flow (excl.

discontinued)

1,263

1,260

(3)

Change in working capital

(2,159)

(2,102)

57

Discontinued operations

(9)

(27)

(18)

Operating cash-flow (incl.

exceptional items and discontinued)

(904)

(869)

35

Capital expenditure

(628)

(449) (1)

179

Change in net payables to fixed

asset suppliers

(183)

(328)

(145)

Net asset disposals

(business-related)

50

51

1

Discontinued operations

(23)

-

23

Free cash-flow

(1,689)

(1,595)

94

Free cash-flow from continuing

operations, excl. exceptional items

(1,350)

(1,241)

109

Exceptional items and

discontinued operations (2)

(339)

(354)

(15)

Operating leases payment (incl.

interests) (financial lease IAS 17) – Excl. China

(24)

(19)

5

Operating leases payment (incl.

interests) net of financial sub-lease payment received – Excl.

China

(448)

(488)

(40)

Operating leases payment (incl.

interests) – China

(117)

-

117

Cost of debt

(112)

(91)

21

Net free cash-flow

(2,390) (3)

(2,193)

197

Net free cash-flow from

continuing operations, excl. exceptional items

(1,934)

(1,839)

95

Exceptional items and

discontinued operations (4)

(456)

(354)

102

Notes : (1) Restated for the downpayment made in respect of the

acquisition of Makro ; (2) Discontinued operations, restructuring

(€184m in H1 2020 and €269m in H1 2019), payment of exceptional

bonuses and similar benefits to Group employees (€128m in H1 2020),

Cargo capex cashed out (€29m in H1 2019) and others ; (3) €(2,390)m

= €(2,273)m [net free cash-flow published on June 30, 2019] +

€(117)m [Operating leases payment (incl. interests) – China] ; (4)

€(456)m = €(339)m [Exceptional items and discontinued

operations(2)] + €(117)m [Operating leases payment (incl.

interests) – China]

Change in shareholders’ equity

(in €m)

Total shareholders'

equity

Shareholders' equity, Group

share

Minority interests

At December 31, 2019

11,675

9,940

1,736

Total comprehensive income over

the period

(790)

(593)

(197)

Dividends

(130)

(57)

(73)

Impact of scope and others

7

(6)

13

At June 30, 2020

10,763

9,283

1,480

Net income, Group share, adjusted for exceptional

items

(in €m)

H1 2019

H1 2020

Net income, Group

share

(458)

(21)

Restatement for non-recurring

income and expenses (before tax)

610

234

Restatement for exceptional items

in net financial expenses

10

19

Tax impact(1)

16

29

Restatement on share of income

from companies consolidated by the equity method

-

-

Restatement on share of income

from minorities

(67)

(7)

Restatement for net income of

discontinued operations, Group share

43

(3)

Adjusted net income, Group

share

155

253

Note: (1) Tax impact of restated items (non-recurring income and

expenses and financial expenses) and exceptional tax items

Impact of the COVID-19 on the interim financial

statements

Impact in Income Statement:

Income and expenses for

first-half 2020 have been recorded and are presented using the same

principles as those applied in the 2019 Consolidated Financial

Statements. As a result, the effects of the COVID-19 crisis are

reflected at all levels of the income statement. The costs incurred

in connection with the COVID-19 health crisis were recognized in

recurring operating income for first-half 2020, including necessary

costs relating to logistics or product distribution in stores or to

customers’ homes, as well as costs relating to protecting the

health of employees, customers and service providers. In accordance

with the Group’s accounting principles, exceptional bonuses and

similar benefits have been recognized in non-current expenses for a

total amount of €128m.

Others:

For further detail, please refer to note 3.1 of the Condensed

Consolidated Financial statements.

Application of IAS 29 - Accounting treatment of

hyperinflation for Argentina

The impact on Group sales is presented in the table below:

Sales incl. VAT (€m)

2019

pre-IAS 29(1)

LFL(2)

Calendar

Openings

Scope and others(3)

Petrol

2020 at constant rates

pre-IAS 29

Forex

2020 at current rates

pre-IAS29

IAS 29(4)

2020 at current rates post-IAS

29

Q1

18,819

+7.8%

+0.9%

+1.3%

-0.8%

-1.5%

+7.5%

-4.2%

19,445

-10

19,435

Q2

19,974

+6.3%

-0.4%

+1.2%

-1.0%

-5.8%

+0.3%

-6.7%

18,710

-66

18,644

H1

38,793

+7.0%

+0.2%

+1.3%

-0.9%

-3.7%

+3.8%

-5.5%

38,155

-76

38,079

Notes: (1) restated for IFRS 5; (2) excluding petrol and

calendar effects and at constant exchange rates; (3) including

transfers; (4) hyperinflation and currencies

The impact of the application of IAS 29 on the main income

statement aggregates for H1 2020 is presented in the table

below:

IAS 29 impact (€m)

H1 2020

Recurring operating income

(ROI)

(11)

Financial result

12

Net Income, Group share, adjusted

for exceptional items

2

Application of IFRS 16 – Principles of accounting for

leases

The impact of the application of the IFRS 16 standard on the

main income statement aggregates for H1 2020 is presented in the

table below:

IFRS 16 impact (€m)

H1 2020

Recurring operating income

(ROI)

33

Recurring operating income before

D&A (EBITDA)

494

Financial result

(53)

Net Income, Group share, adjusted

for exceptional items

(14)

Expansion under banners – H1 2020

Thousands of sq. m

Dec. 31 2019

March 31 2020

Openings/ Store

enlargements

Acquisitions

Closures/ Store

reductions

Total Q2 2020 change

June 30 2020

France

5,475

5,467

+10

-

-11

-1

5,466

Europe (ex Fr)

5,596

5,793

+312

-

-23

+290

6,082

Latin America

2,616

2,632

+8

-

-

+8

2,640

Asia

1,050

1,046

-

-

-0

-0

1,045

Others1

1,379

1,385

+20

-

-2

+18

1,403

Group

16,116

16,322

+350

-

-35

+315

16,637

Store network under banners – H1 2020

N° of stores

Dec. 31 2019

March 31 2020

Openings

Acquisitions

Closures/ Disposals

Transfers

Total Q2 2020 change

June 30 2020

Hypermarkets

1,207

1,202

+5

-

-

-

+5

1,207

France

248

248

-

-

-

-

-

248

Europe (ex France)

455

453

+2

-

-

-

+2

455

Latin America

188

185

-

-

-

-

-

185

Asia

175

174

-

-

-

-

-

174

Others5

141

142

+3

-

-

-

+3

145

Supermarkets

3,344

3,360

+24

-

-9

0

+15

3,375

France

1,071

1,071

+3

-

-1

-

+2

1,073

Europe (ex France)

1,798

1,815

+15

-

-7

0

+8

1,823

Latin America

150

151

-

-

-

-

-

151

Asia

9

9

-

-

-

-

-

9

Others1

316

314

+6

-

-1

-

+5

319

Convenience stores

7,261

7,629

+97

-

-61

0

+36

7,665

France

3,959

3,928

+32

-

-27

-

+5

3,933

Europe (ex France)

2,646

3,047

+64

-

-33

0

+31

3,078

Latin America

530

527

+1

-

-

-

+1

528

Asia

68

69

-

-

-

-

-

69

Others1

58

58

-

-

-1

-

-1

57

Cash & carry

413

421

+2

-

-1

+1

422

France

146

147

-

-

-1

-

-1

146

Europe (ex France)

60

61

+1

-

-

-

+1

62

Latin America

193

199

+1

-

-

-

+1

200

Asia

-

-

-

-

-

-

-

-

Others1

14

14

-

-

-

-

-

14

Group

12,225

12,612

+128

-

-71

0

+57

12,669

France

5,424

5,394

+35

-

-29

-

+6

5,400

Europe (ex France)

4,959

5,376

+82

-

-40

0

+42

5,418

Latin America

1,061

1,062

+2

-

-

-

+2

1 064

Asia

252

252

-

-

-

-

-

252

Others1

529

528

+9

-

-2

-

+7

535

DEFINITIONS

Free cash-flow

Free cash flow corresponds to cash flow from operating

activities before net finance costs and net interests related to

lease commitment, after the change in working capital, less net

cash from/(used in) investing activities.

Net free cash-flow

Net free cash flow corresponds to free cash flow after net

finance costs and net lease payments.

Like for like sales growth (LFL)

Sales generated by stores opened for at least twelve months,

excluding temporary store closures, at constant exchange rates,

excluding petrol and calendar effects and excluding IAS 29

impact.

Organic sales growth

Like for like sales growth plus net openings over the past

twelve months, including temporary store closures, at constant

exchange rates.

Gross margin

Gross margin corresponds to the sum of net sales and other

income, reduced by loyalty program costs and cost of goods sold.

Cost of sales comprise purchase costs, changes in inventory, the

cost of products sold by the financial services companies,

discounting revenue and exchange rate gains and losses on goods

purchased.

Recurring Operating Income (ROI)

Recurring Operating Income corresponds to the gross margin

lowered by sales, general and administrative expenses, depreciation

and amortization.

Recurring Operating Income Before Depreciation and

Amortization (EBITDA)

Recurring Operating Income Before Depreciation and Amortization

(EBITDA) also excludes depreciation and amortization from supply

chain activities which is booked in cost of goods sold.

Operating Income (EBIT)

Operating Income (EBIT) corresponds to the recurring operating

income after income from associates and joint ventures and

non-recurring income and expenses. This latter classification is

applied to certain material items of income and expense that are

unusual in terms of their nature and frequency, such as impairment

of non-current assets, gains and losses on sales of non-current

assets, restructuring costs and provisions recorded to reflect

revised estimates of risks provided for in prior periods, based on

information that came to the Group’s attention during the reporting

year.

® Net Promoter, Net Promoter System, Net Promoter Score, NPS and

the NPS-related emoticons are registered trademarks of Bain &

Company, Inc., Fred Reichheld and Satmetrix Systems, Inc

DISCLAIMER

This press release contains both historical and forward-looking

statements. These forward-looking statements are based on Carrefour

management's current views and assumptions. Such statements are not

guarantees of future performance of the Group. Actual results or

performances may differ materially from those in such forward

looking statements as a result of a number of risks and

uncertainties, including but not limited to the risks described in

the documents filed with the Autorité des Marchés Financiers as

part of the regulated information disclosure requirements and

available on Carrefour's website (www.carrefour.com), and in

particular the Annual Report (Document de Référence). These

documents are also available in English on the company's website.

Investors may obtain a copy of these documents from Carrefour free

of charge. Carrefour does not assume any obligation to update or

revise any of these forward-looking statements in the future.

1 H1 2020 ROI includes income and expenses related to COVID-19

effects. Exceptional bonuses and similar benefits to Group

employees (€128m in H1 2020) are accounted for under other

non-current income and expenses (see page 21 of this press release)

2 See press release of June 5, 2020: “World Environment Day:

Carrefour has set a new target to decarbonize its business and aims

to reduce the CO2 emissions of the products sold in its stores by

20 megatons by 2030” 3 Source: Nielsen 4 Source: Nielsen 5 Africa,

Middle East and Dominican Republic.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200728005776/en/

Investor Relations Selma Bekhechi, Anthony Guglielmo and

Antoine Parison Tel : +33 (0)1 64 50 79 81

Shareholder Relations Tel : 0 805 902 902 (toll-free in

France)

Group Communication Tel : +33 (0)1 58 47 88 80

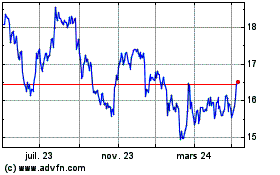

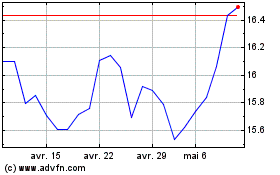

Carrefour (EU:CA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Carrefour (EU:CA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024