Casino Focused on Strategic, Financial Objectives After Moody's Downgrade

03 Avril 2019 - 8:01AM

Dow Jones News

By Anthony Shevlin

Casino Guichard-Perrachon SA (CO.FR) said late Tuesday that it

remains focused on its strategic and financial objectives for

2019-2021 in light of Moody's decision to downgrade the company's

financial rating.

"Casino Group takes note of Moody's decision to downgrade its

financial rating from Ba1 negative outlook to Ba3 negative

outlook," said the retailer.

Casino said the ratings cut has no impact on the availability or

cost of the group's financial resources and noted Moody's positive

comments on the company's limited and decreasing exposure to the

declining hypermarket format.

"The group notes that Moody's bases its analysis on Casino's

gross debt at the end of 2018, which takes into account neither the

disposal plan nor the future reduction in bond debt," said

Casino.

The French retailer highlighted its recently increased asset

disposal plan target, which it raised to at least 2.5 billion euros

($2.8 billion) by the first quarter of 2020, from EUR1 billion.

Casino said it also plans to generate free cash-flow in France

of EUR500 million, enabling it to cover its dividends and financial

expenses.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

April 03, 2019 01:46 ET (05:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

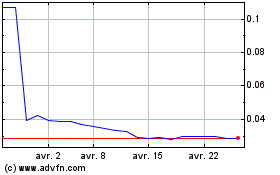

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024