Casino Group: first half 2020 results and second quarter net sales

In line with the AMF’s recommendations, all

costs associated with the pandemic including special bonuses and

similar benefits paid to employees are presented in trading

profit

- Strong increase in consolidated net sales, up +10.4% on

a same-store basis, with:

- In France, same-store growth of +6.0% and +7.9% including

Cdiscount

- For Cdiscount1, acceleration in gross merchandise

volume (GMV) to +25% growth, driven by a +39% increase in the

marketplace, which accounted for 46.3% of GMV

- In Latin America, organic growth of +17.3%, led by Assaí

in Brazil (+26.4%1)

- Consolidated EBITDA for the first half of the year up 4%2

and EBITDA margin in France up + 9 bps despite the additional costs

of the pandemic, thanks to strengthened cost-saving plans

- In France, EBITDA margin for the retail business

improved by +9bps to 7.2%.

- Cost savings plans and the Rocade plan generated savings of

€40m, representing a sustained improvement in the cost ratio of

+50bps

- The health crisis generated a +€80m effect on activity, which

was more than offset by temporary additional costs related

to emergency measures taken to ensure the supply of populations in

challenging conditions (logistics costs: -€27m, staff

reinforcements: -€28m) and to protect our employees and clients

(safety, protection equipment, cleaning: -€38m). On top

of these operational effects of -€13m, the special employee bonus

of -€37m brings the net impact of the health crisis to €-50m in H1

2020

- Excellent performance by Cdiscount, with EBITDA up

+€30m, led by the marketplace

- In Latin America, EBITDA increased by +9.9%2, reflecting

excellent performance at Assaí

- In France, strong free cash flow generation of €507m over 12

months; solid liquidity at end-H1 2020 with €3.2bn including

€2.3bn in undrawn confirmed credit lines

- Growth pillars strengthened in France

- Formats: double-digit growth in urban and convenience

formats in the quarter, with 68 store openings; Growth of +14%

in organic sales. A total of 444 autonomous stores

- Food E-commerce3: triple-digit growth and

strong momentum maintained post-lockdown, with around

10,000 orders per day (vs. 6,500 before the crisis);

deployment of the Casino O’logistique automated warehouse

based on Ocado technology, with a five-fold increase in orders in

one month

- Non-food E-commerce: acquisition of one million new

customers in Q2

- Sale of Leader Price to Aldi France for €735m,

bringing total amount from disposals signed to €2.8bn, and

completion of the sale of Vindémia, bringing total

proceeds received to €2.0bn

|

In €m |

H1 2019 restated |

H1 2020 |

Reported change |

Change at CER |

|

Net sales |

16,842 |

16,140 |

-4.2% |

+5.9% |

|

EBITDA |

1,123 |

1,066 |

-5.1% |

+4.0% |

|

Trading profit |

455 |

386 |

-15.3% |

-3.6% |

|

Underlying net profit from continuing operations, Group share |

12 |

(87) |

- |

- |

|

Net debt |

(4,703) |

(4,834) |

-131 |

n.m. |

|

o/w France |

(2,899) |

(2,821) |

+77 |

n.m. |

First-half 2020 highlights

n Strong mobilisation of Group

resources during the unprecedented Covid-19 crisis

Casino Group mobilised its resources to

fulfil its essential role of securing food supplies for people

during the unprecedented health crisis. Priority was placed on

implementing measures to protect employees and customers:

face masks and hydro-alcoholic gels, plexiglass screens, systematic

cleaning in line with health guidelines, physical distancing

between customers, and automated checkout solutions. Measures were

also taken in concert with suppliers and public authorities

to ensure supply chain continuity and secure

operations.

The Group recorded additional costs related

to maintaining its operations under challenging conditions.

Most of these no longer apply since the lifting of

lockdowns.

- Additional logistics costs: extra transport costs,

organisational issues relating to problems with supplier

deliveries, non-application of logistics-related penalties;

- Additional staff costs: extra staff, night-time hours, employer

contributions for employees on sick leave or at home minding their

children;

- Additional health and safety costs: emergency mass purchases of

face masks, gloves and hydro-alcoholic gels, plexiglass screens,

reinforced store cleaning, security guards to regulate the distance

between customers;

- Additional costs relating to the special bonus for

employees.

- Acceleration in E-commerce and digital solutions, and further

development of buoyant formats

In the first half of the year, demand was

particularly high in the Group’s convenience stores and on its

E‑commerce sites. Food E-commerce generated triple-digit

growth in Q2 2020, with the deployment of click &

collect and home delivery solutions in urban and convenience

formats. The Casino O’logistique automated warehouse, based

on Ocado technology, was also deployed during the period. Ramp-up

at the warehouse was rapid, with a five-fold increase in the number

of orders between end-May and end-June. The delivery zone has been

extended to four departments (Paris and its inner suburbs),

covering 6.8m residents. When lockdown measures were lifted, the

transition to a new consumption model picked up pace.

Orders were up by +50% to around

10,000 orders per day in the last weeks of the period,

versus 6,500 before the crisis.

Cdiscount maintained its strong growth

momentum, driven by an increase in the marketplace contribution

to gross merchandise value (GMV) to 46.3% in Q2, up +6.2pts. The

Group adjusted its product mix towards more high-margin, recurring

products (DIY, gardening, sport, daily shop). The customer base

increased significantly with 1m new clients in Q2, with a peak of

25m unique visitors in May.

Digital solutions continued to be rolled

out in stores. In June, automated checkouts4 represented 46%

of total checkouts in hypermarkets and 40% in supermarkets. The

Group now has 444 autonomous stores, of which half of hypermarkets

(58 stores) and half of supermarkets (167 stores). The

CasinoMax Extra5 subscription loyalty programme accounted

for 10% of net sales at hypermarkets and supermarkets during the

period.

At the same time, the Group continued to focus

on developing its premium and convenience formats, with

68 store openings during the first half. The objective

is to open 300 new stores by 2021, in addition to the

213 stores opened in 2019. The Group is also pursuing the

development of non-food corners, particularly at Franprix

with Hema and Decathlon, which have now been integrated into 79 and

18 stores, respectively. The organic segment

maintained its good momentum with growth of +14.4% for the

first half of the year.

n Continued development of new

businesses

Casino Group continues to develop its new

value-creating businesses. GreenYellow pursed its

international expansion during the period by signing its

100th photovoltaic contract in Thailand, as well as a 12MWp

photovoltaic contract in South Africa with a company that operates

in precious metals. In Brazil, energy efficiency contracts were

signed with several retailers.

Development of the Data business with

relevanC has continued, up by a strong +34% during

the first half to €44m, despite a downturn in the market.

The “relevanC Advertising” platform, for managing and monitoring

advertising campaign budgets, will help speed up the acquisition of

new clients.

In the Data Centers business,

ScaleMax, computing capacity at the warehouse in Réau

increased by +30% in the first half of the year. During

lockdown, computing capacity was made available to the

Folding@home project for research into Covid-19.

n Advances in the disposal of

non-strategic assets

Casino Group announced the sale of

567 Leader Price stores and 3 warehouses in

metropolitan France to Aldi France, for an enterprise value of

€735m6, bringing total amount from disposals signed to

€2.8bn.

The Group also completed the sale of its

subsidiary Vindemia, the leading retailer in the Indian

Ocean region. This brought the total proceeds received from

completed disposals to €2.0bn.

n Recognition of the Group’s CSR

commitments

Casino Group was named the No. 1

European retailer by Vigeo Eiris7 for its CSR policy and

commitments. The Group ranked as the top European retailer for

its commitments to the climate, to environmental

protection, its human resources policies and its

corporate governance, and for its employee relations

policies and human resources out of the entire panel of

129 French companies evaluated. Among its initiatives, the

Group promoted organic products, which generated €1.2bn in net

sales in H1 2020 (over a 12‑month period), notably via its

network of more than 200 specialised stores. It used

160 tonnes of recycled plastic for its packaging. In addition,

18,700 tonnes of products were donated to food banks and

other non-profit organisations in 2019. Lastly, the Group

reduced its direct greenhouse gas emissions by 19.6% between 2015

and 20198.

Second-quarter 2020 net sales

In the second quarter of 2020, consolidated

net sales came to €7,846m, down -7.5% in total. The currency

and fuel effects had unfavourable impacts of -13.1% and -2.9%

respectively over the period, while the calendar effect was -0.4%.

On a same-store basis, consolidated net sales rose by

+10.4%9, driven by strong demand in France and Latin

America, in an environment shaped by the unprecedented health

crisis.

In France, total sales were impacted by a

downturn in fuel sales (-€157m or -4.1pts) and by the impact of the

Rocade plan on hypermarkets and supermarkets. Same-store

growth for the quarter came to +6.0%, led by

double-digit growth in urban and convenience formats

(Franprix, supermarkets and convenience stores) and triple-digit

growth in food E-commerce. Monoprix posted a sharp increase in

food sales (+7.6% on a same-store basis) and enjoyed renewed

momentum in non-food sales from mid-May.

Cdiscount10 delivered organic growth in

gross merchandise volume (GMV) of +24.8%, despite the postponement

of the summer sales period to mid-July, with growth driven by the

marketplace and by direct sales. The marketplace grew by

+39% over the quarter and accounted for 46.3% of GMV (+6.2pts).

Cdiscount attracted one million new customers during

the quarter, with a peak of 25m unique visitors in May.

International GMV doubled during the quarter, thanks to a platform

that brings together 88 websites covering

25 countries.

In Latin America (GPA Food and Éxito),

sales rose by +12.5% on a same-store basis and by +17.3% on an

organic basis. The total net sales figure was impacted by an

unfavourable currency effect of -28.2%. During the quarter, sales

in Latin America benefited from the success of Multivarejo’s

turnaround strategy, which resulted in +15.8% growth on a

same-store basis2, and from another excellent performance

by Assaí, which reported organic growth of +26.4%2. Éxito put

in a good performance, achieving same-store growth of +6.0%2

despite restrictions on movement in Colombia.

First-half 2020 results

Consolidated net sales amounted to

€16,140m in H1 2020, representing a change of -4.2% in

total and an increase of +9.4% on an organic basis and +8.4% on a

same-store basis.

In France, same-store H1 net sales

rose by +6.0%, led by the urban and convenience formats.

E-commerce (Cdiscount) posted an organic

increase in gross merchandise volume (GMV) of +12.0%11, driven by

the growing contribution of the marketplace and B2C services.

Cdiscount has recorded sustained growth since the end of the

lockdown, confirming the trend.

Sales in Latin America rose by +15.7% on

an organic basis and by +10.5% on a same-store basis, lifted by a

very good performance from Assaí and an upturn in demand at

Multivarejo.

Group EBITDA reached €1,066m, up

+4.0% at constant exchange rates.

In France, EBITDA margin for the

retail business improved by +9 bps to 7.2%.

The cost-saving plans and the Rocade plan

generated savings of +€40m, representing a sustainable

improvement in the cost ratio of +50bps.

The health crisis generated a +€80m effect on

activity, which was more than offset by temporary additional

costs related to emergency measures taken to ensure the supply

of populations in challenging conditions (logistics costs: -€27m,

staff reinforcements: -€28m) and to protect our employees and

clients (safety, protection equipment, cleaning: -€38m). On top

of these operational effects of -€13m, the special employee bonus

of -€37m brings the net impact of the health crisis to €-50m in H1

2020.

Cdiscount recorded an increase in

EBITDA of +€30m, for an EBITDA margin of

4.5% (+302bps), and an increase in gross margin of

+2.8pts, driven by a shift in the product mix to generate more

high-margin, repeat-purchases sales (DIY, gardening, sport, daily

shop).

In Latin America, EBITDA increased

by +9.9% excluding the currency effect. At GPA,

EBITDA grew by +10.9% excluding the currency effect,

led by the improving profitability of Assaí. For Grupo

Éxito, EBITDA was up +7.3% excluding the currency

effect.

Consolidated trading profit came to

€386m. Trading profit was impacted by the non-recurring

additional costs associated with Covid-19 (of which -€47m of

special employee bonus for the whole Group) and a currency impact

of -€55m. Excluding special employee bonuses, consolidated trading

profit improved by +7% at constant exchange rates. In France, the

retail trading profit amounted to €148m up +2% excluding special

employee bonus.

Underlying net financial expense and net

profit, Group share12

Underlying net financial expense for

first-half 2020 came to -€378m versus -€341m in first-half 2019.

Financial expenses were higher following the refinancing plan in

France in H2 2019, as the impact of the reduction in gross debt

from disposals already signed in 2020 is not yet reflected. GPA’s

financial expenses increased because of the takeover bid on Éxito

(acquisition of non-controlling shares) achieved in H2 2019.

Underlying profit (loss) from continuing

operations, Group share came out at -€87m in H1, compared with

€12m in first-half 2019.

Consolidated net profit (loss)

Consolidated net profit (loss) came to

-€445m in first-half 2020, versus -€226m in first-half 2019. Net

profit (loss) from continuing operations came to -€287m, primarily

reflecting -€249m of non-recurring expenses, most of which are

non-cash.Net profit (loss) from discontinued operations, Group

share came to -€158m, notably due to stock clearance

initiatives.

Financial position at 30 June 2020

France free cash flow excluding the disposal

plan and the Rocade plan came to -€40m in H1 2020,

representing a gain of +€140m versus H1 2019. Change in

working capital for H1 2020 reflected a

+€137m improvement on H1 2019 driven by the sales

momentum and the action plans. Gross Capex was down -14% over the

period.

In France, net debt declined slightly over

the 12 months to 30 June 2020 after the reintegration

of €555m corresponding to the Segisor repayment (c.€200m) and to

the settlement of the GPA forward and TRS (€357m). In France,

the Group generated operating free cash flow of €507m13 in

France, or €254m after financial expenses and dividends,

and collected €469m in proceeds from disposals.

At 30 June 2020, Casino France14

net debt stood at €2.8bn, versus €2.9bn a year earlier, and

E-commerce net debt was virtually stable. Latam net debt increased

by €187m in connection with the Group’s structural simplification

process in Latin America.

At 30 June 2020, Casino Group

consolidated net debt stood at €4.8bn vs. €4.7bn a year

earlier.

At 30 June 2020, Casino in France2

had €3.2bn in liquidity, comprising a gross cash

position of €913m and confirmed undrawn lines of

credit of €2.3bn. In addition, the Group had an

amount of €186m in an escrow account dedicated to the repayment

of bonds.

Additional financial information relating to

the 2019 refinancing documentation

At 30 June 2020, the Group complied with

covenants in the “France Retail + E-commerce” scope15. The gross

debt/adjusted EBITDA ratio was 6.62x, below the 7.50x limit,

with headroom of €764m in gross debt. The adjusted EBITDA/net

finance costs ratio was 3.76x, above the required 2.25x,

representing headroom of €350m in EBITDA.

Outlook for H2 2020

The Group's priorities in France for the second

half of the year are:

- Activity growth driven by food E-commerce and Cdiscount,

expansion in buoyant formats and the commercial momentum of the

banners;

- Continued improvement in profitability through the

ramp-up of ongoing cost-saving plans and the growth in new

activities (energy and data);

- Cash generation with continued efforts to reduce

inventories and control capex;

- Reduction in gross debt with the allocation of all

proceeds from the disposal plan to debt reduction, and the

continuation of the €4.5bn disposal plan of non-strategic

assets.

The Board of Directors met on 29 July 2020

to approve consolidated financial statements for first-half 2020.

These financial statements have been reviewed by the Statutory

Auditors.

The presentation of the

2020 half-year results is available on the Casino Group corporate

website (www.groupe-casino.fr/en)

APPENDICES – HALF-YEAR RESULTS

Consolidated net sales by segment

|

Net sales In €m |

H1 2019restated |

H1 2020 |

Change |

Change at constant exch. rates |

|

France Retail |

8,045 |

7,791 |

-3.2% |

- |

|

Latam Retail |

7,908 |

7,401 |

-6.4% |

+15.0% |

|

E-commerce (Cdiscount) |

889 |

948 |

+6.6% |

- |

|

Group total |

16,842 |

16,140 |

-4.2% |

+5.9% |

Consolidated EBITDA by segment

|

EBITDA In €m |

H1 2019restated |

H1 2020 |

Change |

Change at constant exch. rates |

|

France Retail |

601 |

564 |

-6.2% |

-5.7% |

|

Latam Retail |

508 |

459 |

-9.7% |

+9.9% |

|

E-commerce (Cdiscount) |

13 |

43 |

n.m. |

n.m. |

|

Group total |

1,123 |

1,066 |

-5.1% |

+4.0% |

Consolidated trading profit by

segment

|

Trading profit In €m |

H1 2019restated |

H1 2020 |

Change |

Change at constant exch. rates |

|

France Retail |

207 |

148 |

-28.7% |

-27.3% |

|

Latam Retail |

265 |

232 |

-12.5% |

+6.3% |

|

E-commerce (Cdiscount) |

(17) |

6 |

n.m. |

n.m. |

|

Group total |

455 |

386 |

-15.3% |

-3.6% |

Underlying net profit

|

In €m |

H1 2019restated |

Restated items |

H1 2019 Underlying |

H1 2020 |

Restated items |

H1 2020 Underlying |

|

Trading profit |

455 |

0 |

455 |

386 |

0 |

386 |

|

Other operating income and expenses |

(286) |

286 |

0 |

(249) |

249 |

0 |

|

Operating profit |

169 |

286 |

455 |

137 |

249 |

386 |

|

Net finance costs |

(156) |

0 |

(156) |

(188) |

0 |

(188) |

|

Other financial income and expenses16 |

(139) |

(47) |

(185) |

(264) |

74 |

(190) |

|

Income taxes17 |

(24) |

(33) |

(58) |

12 |

(66) |

(53) |

|

Share of profit of equity-accounted investees |

22 |

0 |

22 |

15 |

0 |

15 |

|

Net profit (loss) from continuing operations |

(127) |

206 |

79 |

(287) |

257 |

(30) |

|

o/w attributable to non-controlling interests18 |

45 |

22 |

67 |

47 |

9 |

57 |

|

o/w Group share |

(172) |

184 |

12 |

(334) |

248 |

(87) |

Underlying net profit corresponds to net profit

from continuing operations, adjusted for (i) the impact of other

operating income and expenses, as defined in the "Significant

accounting policies" section in the notes to the consolidated

financial statements, (ii) the impact of non-recurring financial

items, as well as (iii) income tax expense/benefits related to

these adjustments and the application of IFRIC 23 "Uncertainties

about Tax Treatment".

Non-recurring financial items include fair value

adjustments to equity derivative instruments (such as total return

swaps and forward instruments related to GPA shares) and the

effects of discounting Brazilian tax liabilities.

Change in net debt by entity

|

In €m |

H1 2019 restated |

Change |

H1 2020 |

|

| |

France Retail |

(2,899) |

+77 |

(2,821) |

| |

E-commerce (Cdiscount) |

(356) |

-21 |

(376) |

| |

Latam Retail |

(1,449) |

-187 |

(1,636) |

| |

o/w GPA Food |

(322) |

-1,090 |

(1,412) |

| |

o/w Éxito |

(729) |

+715 |

(14) |

| |

o/w Segisor |

(381) |

+196 |

(185) |

| |

Total |

(4,703) |

-131 |

(4,834) |

Group net debt

|

In €m |

H1 2019 restated |

H1 2020 |

|

Group net debt at 1 January |

(3,378) |

(4,053) |

|

Free cash flow19 |

(893) |

(721) |

|

Financial expenses (excluding interest on lease liabilities) |

(245) |

(290) |

|

Dividends paid to the owners of the parent and holders of TSSDI

deeply-subordinated bonds |

(274) |

(67) |

| Share

buybacks |

(58) |

(1) |

| Other

net financial investments |

52 |

(238) |

| Other

non-cash items |

240 |

656 |

| Assets

held for sale recognised in accordance with IFRS 5 |

(148) |

(120) |

|

Group net debt at 30 June |

(4,703) |

(4,834) |

France net debt

|

In €m |

H1 2019 restated |

H1 2020 |

|

France net debt at 1 January |

(2,724) |

(2,282) |

|

Free cash flow20 before disposal plan and Rocade

plan |

(180) |

(40) |

|

Financial expenses (excluding interest on lease liabilities) |

(144) |

(208) |

|

Dividends paid to the owners of the parent and holders of TSSDI

deeply-subordinated bonds |

(218) |

(37) |

|

Share buybacks and transactions with non-controlling interests |

(94) |

(1) |

|

Other net financial investments (excl. settlement of GPA TRS) |

33 |

(30) |

|

Other non-cash items |

103 |

46 |

|

o/w non-cash financial expenses |

69 |

80 |

|

Change in net debt excl. settlement of GPA TRS, disposal

plan, Rocade plan and IFRS 5 |

(502) |

(270) |

|

Settlement of GPA TRS |

0 |

(248) |

|

Disposal plan |

38021 |

18622 |

|

Rocade plan |

72 |

(18) |

|

Assets held for sale recognised in accordance with IFRS 5 |

(125) |

(189) |

|

France net debt at 30 June |

(2,899) |

(2,821) |

Consolidated simplified balance sheet

|

In €m |

31/12/2019restated |

30/06/2020 |

|

Right-of-use assets |

4,837 |

4,837 |

|

Other non-current assets |

17,687 |

15,123 |

|

Current assets |

12,603 |

10,630 |

|

Total assets |

35,127 |

30,590 |

|

Total equity |

8,291 |

6,627 |

|

Non-current financial liabilities |

8,100 |

7,326 |

|

Non-current lease liabilities |

3,937 |

3,627 |

|

Other non-current liabilities |

1,624 |

1,345 |

|

Current lease liabilities |

740 |

671 |

|

Other current liabilities |

12,436 |

10,993 |

|

Total equity and liabilities |

35,127 |

30,590 |

APPENDICES – NET SALES – Q2 2020

Quarterly consolidated net sales by

segment

|

NET SALES In €m |

Q2 2020net sales |

Total net sales growth |

Organic net sales growth23 |

Same-store sales growth1 |

|

France Retail |

3,906 |

-5.6% |

+3.1% |

+6.0% |

|

Cdiscount |

499 |

+20.9% |

+20.9% |

+20.9% |

|

Total France |

4,405 |

-3.2% |

+4.9% |

+7.9% |

|

Latam Retail |

3,441 |

-12.5% |

+17.3% |

+12.5% |

|

GROUP TOTAL |

7,846 |

-7.5% |

+10.8% |

+10.4% |

Consolidated net sales in France by

banner

|

NET SALES BY BANNER |

Q1 2020 |

Same-store growth1 |

Q2 2020 |

Total growth |

Organic growth1 |

Same-store growth1 |

|

Monoprix |

1,156 |

+3.6% |

1,137 |

-0.5% |

+0.3% |

+2.9% |

|

Supermarkets |

747 |

+7.4% |

779 |

-1.4% |

+8.9% |

+9.9% |

|

o/w Casino Supermarkets24 |

711 |

+7.5% |

740 |

-0.7% |

+9.8% |

+11.8% |

|

Franprix |

412 |

+12.6% |

446 |

+11.8% |

+13.7% |

+14.7% |

|

Convenience & Other25 |

622 |

+9.5% |

631 |

-1.3% |

+4.9% |

+12.8% |

|

o/w Convenience26 |

336 |

+11.5% |

362 |

+11.1% |

+11.5% |

+18.0% |

|

Hypermarkets |

948 |

+1.7% |

912 |

-21.6% |

-3.7% |

-0.8% |

|

o/w Géant2 |

900 |

+1.5% |

868 |

-22.0% |

-3.1% |

-0.1% |

|

o/w Food |

631 |

+2.9% |

641 |

-13.5% |

n.a. |

-0.7% |

|

o/w Non-food |

97 |

-8.1% |

110 |

-15.9% |

n.a. |

+3.1% |

|

FRANCE RETAIL |

3,885 |

+5.8% |

3,906 |

-5.6% |

+3.1% |

+6.0% |

Main quarterly data – Cdiscount27

|

KEY FIGURES |

Q2 2019 |

Q2 2020 |

Reportedgrowth |

Organic growth |

|

GMV total including tax |

847 |

1,047 |

+23.5% |

+24.8% |

|

o/w direct sales |

414 |

449 |

+7.9% |

|

|

o/w marketplace sales |

282 |

393 |

+39.3% |

|

|

Marketplace contribution (%) |

40.1% |

46.3% |

+6.2pts |

|

Net sales (in €m) |

469 |

556 |

+18.6% |

+16.9% |

|

Traffic (millions of visits) |

235 |

315 |

+34.0% |

|

Mobile traffic contribution (%) |

71.5% |

71.1% |

-0.4pts |

|

Active customers (in millions) |

9.2 |

9.6 |

+5.2% |

Gross sales under banner in France

|

Total estimated gross food sales under banner In €m,

excluding fuel |

Q2 2020 |

Same-store change (excl. calendar effects) |

|

|

Monoprix |

1,156 |

+2.9% |

|

|

Franprix |

513 |

+14.7% |

|

|

Supermarkets |

769 |

+9.9% |

|

|

Hypermarkets |

774 |

-1.3% |

|

|

Convenience |

451 |

+18.0% |

|

|

Other |

298 |

n.a. |

|

|

Total Food |

3,962 |

+6.4% |

|

|

|

|

|

|

Total estimated gross non-food sales under banner In €m,

excluding fuel |

Q2 2020 |

Same-store change(excl. calendar effects) |

|

Hypermarkets |

131 |

+2.5% |

|

Cdiscount |

801 |

+20.9% |

|

Total Non-food |

932 |

+17.8% |

| |

|

|

|

Total estimated gross sales under banner In €m, excluding

fuel |

Q2 2020 |

Same-store change (excl. calendar effects) |

|

Total France and Cdiscount |

4,894 |

+8.2% |

APPENDICES – ADDITIONAL Q2 2020 FINANCIAL

INFORMATION RELATING TO THE AUTUMN 2019 REFINANCING

DOCUMENTATION

See press release dated 21 November

2019

Financial information for the first half

ended 30th June, 2020:

|

In €m |

France Retail + E-commerce |

Latam |

Total |

|

Revenues28 |

8,747 |

7,393 |

16,140 |

|

EBITDA1 |

606 |

460 |

1,066 |

|

(-) impact of leases29 |

-323 |

-150 |

-474 |

|

Adjusted Consolidated EBITDA including leases1 |

283 |

310 |

592 |

Trends underlying the variations of these

financial metrics are as described elsewhere in this press

release.

Financial information on a last 12-month

period ended 30th June, 2020:

|

In €m |

France Retail + E-commerce |

Latam |

Total |

|

Revenues1 |

18,109 |

15,834 |

33,943 |

|

EBITDA1 |

1,526 |

1,057 |

2,583 |

|

(-) impact of leases2 |

-654 |

-303 |

-958 |

|

(i) Adjusted Consolidated EBITDA including leases1 4 |

872 |

754 |

1,625 |

|

(ii) Gross financial debt: loans and borrowings1 30 |

5,776 |

2,777 |

8,554 |

|

iii) Gross Cash & Cash Equivalent1 3 |

950 |

1,258 |

2,207 |

As at 30th June 2020, the Group’s liquidity

within the “France + E-commerce” perimeter was €3,25bn, with €922m

of cash and cash equivalent and €2.33bn of undrawn confirmed credit

lines.

Additional information regarding covenants

and segregated accounts:

|

Covenants tested as from March 31st 2020 pursuant to the €2bn

Revolving Credit Facility dated November 18th 2019 |

|

Type of covenant (France and E-commerce) |

As at 30 June 2020 |

|

Adjusted Gross Financial Debt/Adjusted EBITDA31

<7.50x32 |

6.62x |

|

Adjusted EBITDA4 / Net finance costs >2.25x |

3.76x |

Covenant metrics tested as of end June 2020 do

not yet reflect the impact of the Leader Price disposal.

The Group confirms that €186m arising from the

disposal of Vindemia were credited to the Segregated Account during

the Financial Quarter ended 30th June 2020.

No cash has been debited from the Segregated

Account and its balance stood at €186m as at June 30th 2020. No

cash has been credited or debited from the Bond Segregated Account

and its balance remained at €0.

Store network at period-end

|

FRANCE |

|

30/09/2019 |

31/12/2019 |

31/03/2020 |

30/06/2020 |

|

Géant Casino hypermarkets |

|

110 |

109 |

104 |

104 |

|

o/w French franchised affiliates |

|

6 |

4 |

4 |

4 |

|

International affiliates |

|

5 |

6 |

6 |

6 |

|

Casino Supermarkets |

|

421 |

411 |

411 |

415 |

|

o/w French franchised affiliates |

|

91 |

83 |

69 |

69 |

|

International franchised affiliates |

|

21 |

22 |

22 |

22 |

|

Monoprix |

|

778 |

784 |

789 |

789 |

|

o/w franchised affiliates |

|

180 |

186 |

190 |

190 |

|

Naturalia |

|

181 |

182 |

181 |

181 |

|

Naturalia franchises |

|

19 |

23 |

26 |

26 |

|

Franprix |

|

881 |

877 |

867 |

869 |

|

o/w franchises |

|

448 |

459 |

441 |

478 |

|

Convenience |

|

5,142 |

5,139 |

5,130 |

5,134 |

|

Other activities (Restaurants, Drive, etc.) |

|

394 |

367 |

223 |

219 |

|

Total France |

|

7,726 |

7,687 |

7,524 |

7,530 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERNATIONAL |

|

30/09/2019 |

31/12/2019 |

31/03/2020 |

30/06/2020 |

|

ARGENTINA |

|

25 |

25 |

25 |

25 |

|

Libertad hypermarkets |

|

15 |

15 |

15 |

15 |

|

Mini Libertad and Petit Libertad mini-supermarkets |

|

10 |

10 |

10 |

10 |

|

URUGUAY |

|

91 |

91 |

93 |

93 |

|

Géant hypermarkets |

|

2 |

2 |

2 |

2 |

|

Disco supermarkets |

|

29 |

29 |

29 |

29 |

|

Devoto supermarkets |

|

24 |

24 |

24 |

24 |

|

Devoto Express mini-supermarkets |

|

36 |

36 |

36 |

36 |

|

Möte |

|

0 |

0 |

2 |

2 |

|

BRAZIL |

|

1,054 |

1,076 |

1,072 |

1,070 |

|

Extra hypermarkets |

|

112 |

112 |

107 |

107 |

|

Pão de Açúcar supermarkets |

|

185 |

185 |

185 |

182 |

|

Extra supermarkets |

|

161 |

153 |

151 |

151 |

|

Compre Bem |

|

13 |

28 |

28 |

28 |

|

Assaí (cash & carry) |

|

153 |

166 |

167 |

169 |

|

Mini Mercado Extra & Minuto Pão de Açúcar

mini-supermarkets |

|

236 |

237 |

238 |

238 |

|

Drugstores |

|

123 |

123 |

123 |

122 |

|

+ Service stations |

|

71 |

72 |

73 |

73 |

|

COLOMBIA |

|

1,980 |

2,033 |

1,984 |

1,981 |

|

Éxito hypermarkets |

|

92 |

92 |

92 |

92 |

|

Éxito and Carulla supermarkets |

|

158 |

158 |

157 |

157 |

|

Super Inter supermarkets |

|

70 |

70 |

69 |

69 |

|

Surtimax (discount) |

|

1,537 |

1,588 |

1,540 |

1,536 |

|

o/w “Aliados” |

|

1,445 |

1,496 |

1,460 |

1,459 |

|

B2B |

|

30 |

30 |

32 |

32 |

|

Éxito Express and Carulla Express mini-supermarkets |

|

93 |

95 |

94 |

95 |

|

CAMEROON |

|

1 |

1 |

1 |

1 |

|

Cash & carry |

|

1 |

1 |

1 |

1 |

|

Total International |

|

3,151 |

3,226 |

3,175 |

3,170 |

ANALYST AND INVESTOR CONTACTS

Lionel Benchimol – +33 (0)1 53 65 64 17

lbenchimol@groupe-casino.fr

or

+33 (0)1 53 65 24 17

IR_Casino@groupe-casino.fr

PRESS CONTACTS

Casino Group – Communications

DepartmentStéphanie Abadie – sabadie@groupe-casino.fr – +33

(0)6 26 27 37 05

or

+33 (0)1 53 65 24 78 –

directiondelacommunication@groupe-casino.fr

Agence IMAGE 7Karine Allouis – +33 (0)1 53

70 74 84 – kallouis@image7.frFranck Pasquier – +33 (0)6 73 62 57 99

- fpasquier@image7.fr

Disclaimer

This press release was prepared solely for

information purposes, and should not be construed as a solicitation

or an offer to buy or sell securities or related financial

instruments. Likewise, it does not provide and should not be

treated as providing investment advice. It has no connection with

the specific investment objectives, financial situation or needs of

any receiver. No representation or warranty, either express or

implied, is provided in relation to the accuracy, completeness or

reliability of the information contained herein. Recipients should

not consider it as a substitute for the exercise of their own

judgement. All the opinions expressed herein are subject to change

without notice.

1 Data published by the subsidiary

2 Growth at constant exchange rates

3 Food E-commerce = E-commerce France excluding Cdiscount

4 Via smartphone or self-service checkout

5 Subscription of €10 per month (or €90 for 12 months) offering

an immediate 10% discount on all purchases

6 Including a €35m earn-out, contingent on the achievement of

certain operating indicators during the transition period

7 A subsidiary of rating agency Moody’s

8 Tonnes of CO2 equivalent in Scopes 1 + 2, based on the 2019

scope of consolidation

9 Excluding fuel and calendar effects

10 Data published by the subsidiary

11 Data published by the subsidiary

12 See definitions on page 8

13 Excluding disposal plan and Rocade plan

14 Casino Group’s holding structure, including the French

activities and the wholly-owned holding companies

15 Perimeter as defined in financing documentations with mainly

Segisor accounted for within France Retail + Ecommerce

perimeter

16 Other financial income and expenses have been restated,

primarily for the impact of discounting tax liabilities, as well as

for changes in the fair value of the total return swaps on GPA

shares and the GPA forward

17 Income taxes have been restated for the tax effects

corresponding to the above restated financial items and for the tax

effects of the restatements and the application of IFRIC 23

"Uncertainties about Tax Treatment"

18 Non-controlling interests have been restated for the amounts

relating to the restated items listed above

19 Before dividends paid to the owners of the parent and holders

of TSSDI deeply-subordinated bonds, and before financial

expenses

20 Before dividends paid to the owners of the parent and holders

of TSSDI deeply-subordinated bonds, excluding financial expenses,

including rental expense (repayments of lease liabilities and

interest on leases)

21 Store properties and restaurants

22 Proceeds received from the sale of Vindémia

23 Excluding fuel and calendar effects

24 Excluding Codim stores in Corsica: 8 supermarkets and 4

hypermarkets

25 Other: mainly Vindémia and restaurants

26 Convenience stores excluding Leader Price Express; net sales

on a same-store basis include the same-store performance of

franchised stores

27 Data published by the subsidiary

28 Unaudited data, perimeter as defined in financing

documentations with mainly Segisor accounted for within France

Retail + Ecommerce perimeter

29 Interest paid on lease liabilities and repayment

of lease liabilities as defined in the documentation

30 Data as of 30th June, 2020

31 EBITDA as defined in the refinancing documentation is

restated for rents paid and interest on rents

paid.

32 7.50x at 30 June 2020, 7.25x at 30 September 2020, 5.75x at

31 December 2020, 6.50x at 31 March 2021, 6.00x at 30 June 2021 and

30 September 2021, and 4.75x as from 31 December 2021.

- 20203007 - PR - H12020 Results

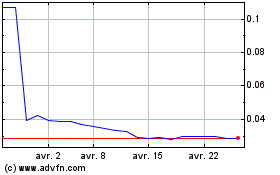

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024