Casino to Sell 32 Store Properties for EUR470 Million

23 Avril 2019 - 7:46AM

Dow Jones News

By Anthony Shevlin

Casino Guichard-Perrachon S.A. (CO.FR) said Monday that it has

agreed to sell 32 store properties to funds managed by affiliates

of Apollo Global Management LLC (APO).

The French retailer said the portfolio sale is worth 470 million

euros ($528.7 million), of which EUR374 million will be received by

the end of July.

The Apollo funds will create a special entity to acquire the

portfolio in order to enhance its value and sell it on the market

"under the best possible conditions," said Casino.

The retailer said it will get an interest in the new entity and,

depending on its performance, Casino could net up to an additional

EUR110 million in the next few years.

The deal is part of Casino's additional EUR1 billion of noncore

asset disposals--to be completed by the first quarter of 2020--and

more generally as part of the financial perspectives laid out by

the company last month.

Write to Anthony Shevlin at anthony.shevlin@dowjones.com;

@anthony_shevlin

(END) Dow Jones Newswires

April 23, 2019 01:31 ET (05:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

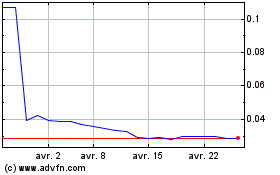

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Casino Guichard Perrachon (EU:CO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024