Cegedim plans to respond positively to any acquisition offer for its Cegelease business

13 Juillet 2017 - 8:00PM

Financial information

IFRS - Regulated information

Cegedim plans to respond

positively to any acquisition offer for its Cegelease

business

Disclaimer: This press release is available in

French and in English. In the event of any difference between the

two versions, the original French version takes precedence. This

press release may contain inside information. It was sent to

Cegedim's authorized distributor, under embargo, on July 13, no

earlier than 5:45 pm Paris time.

The term "business model transformation" is

defined in the glossary. |

Boulogne-Billancourt, France,

July 13, 2017 after the market close

Cegedim, an innovative technology

and services company, has decided to sell its Cegelease business as

part of its business model transformation strategy.

Since 2001, Cegelease, a wholly owned

subsidiary of Cegedim, has been offering

leasing contracts chiefly to pharmacies and healthcare

professionals in France. The company has evolved from a reseller of

products developed exclusively by the Group into a broker offering

multi-solution financing contracts to a wide variety of clients.

Today, Cegedim accounts for a minority of

Cegelease's revenues. Eurofarmat, a wholly owned subsidiary of Cegedim Logiciels Médicaux, now specializes in selling

used equipment and also develops and maintains the software used by

Cegelease.

As part of the business model

transformation plan that the Group initiated in fall 2015,

Cegedim has decided to divest ifs Cegelease and Eurofarmat

subsidiaries. These subsidiaries operate principally in the

financial domain, are highly valued, and require additional

resources to continue pursuing and accelerating their development

for the benefit of their clients and employees.

The two businesses have 24

employees in France. In 2016 they contributed €5.4 million to Group

consolidated EBITDA. The subsidiaries' standalone EBITDA amounted

to €18.1 million in 2016.

If the Group receives satisfactory

offers and is able to obtain the necessary approvals, it plans to

close the deal in the second half of 2017. The Group in no way

guarantees that a deal will be carried out.

A successful sale would give the

Group a portfolio of businesses that fit well together and generate

strong synergies. Cegedim is not planning any

further divestments.

Cegedim

reiterates that the Group was in compliance with its "Covenant"

debt ratios as of June 30, 2017. A successful sale would improve

those ratios significantly.

Assisting Cegedim on this transaction are the consulting firm of

Ohana & Co and the law firm of Freshfields Bruckhaus

Deringer.

Immediately after issuing this

press release, the Group's quiet period will resume until its Q2

2017 revenue announcement on July 27.

Activities not allocated: This

division encompasses the activities the Group performs as the

parent company of a listed entity, as well as the support it

provides to the three operating divisions.

BPO (Business Process Outsourcing): BPO is the

contracting of non-core business activities and functions to a

third-party provider. Cegedim provides BPO services for human

resources, Revenue Cycle Management in the US and management

services for insurance companies, provident institutions and mutual

insurers.

Business model transformation: Cegedim decided

in fall 2015 to switch all of its offerings over to SaaS format, to

develop a complete BPO offering, and to materially increase its

R&D efforts. This is reflected in the Group's revamped business

model. The change has altered the Group's revenue recognition and

negatively affected short-term profitability

EPS: Earnings Per Share is a specific

financial indicator defined by the Group as the net profit (loss)

for the period divided by the weighted average of the number of

shares in circulation.

Operating expenses: Operating expenses is

defined as purchases used, external expenses and payroll

costs.

Revenue at constant exchange rate: When

changes in revenue at constant exchange rate are referred to, it

means that the impact of exchange rate fluctuations has been

excluded. The term "at constant exchange rate" covers the

fluctuation resulting from applying the exchange rates for the

preceding period to the current fiscal year, all other factors

remaining equal.

Revenue on a like-for-like basis: The effect

of changes in scope is corrected by restating the sales for the

previous period as follows:

-

by removing the portion of sales originating in

the entity or the rights acquired for a period identical to the

period during which they were held to the current period;

-

similarly, when an entity is transferred, the

sales for the portion in question in the previous period are

eliminated.

Life-for-like data (L-f-l): At constant scope

and exchange rates.

Internal growth: Internal growth covers growth

resulting from the development of an existing contract,

particularly due to an increase in rates and/or the volumes

distributed or processed, new contracts, acquisitions of assets

allocated to a contract or a specific project. |

|

External growth: External growth

covers acquisitions during the current fiscal year, as well as

those which have had a partial impact on the previous fiscal year,

net of sales of entities and/or assets.

EBIT: Earnings Before Interest and Taxes. EBIT

corresponds to net revenue minus operating expenses (such as

salaries, social charges, materials, energy, research, services,

external services, advertising, etc.). It is the operating income

for the Cegedim Group.

EBIT before special items: This is EBIT

restated to take account of non-current items, such as losses on

tangible and intangible assets, restructuring, etc. It corresponds

to the operating income from recurring operations for the Cegedim

Group.

EBITDA: Earnings before interest, taxes,

depreciation and amortization. EBITDA is the term used when

amortization or depreciation and revaluations are not taken into

account. "D" stands for depreciation of tangible assets (such as

buildings, machines or vehicles), while "A" stands for amortization

of intangible assets (such as patents, licenses and goodwill).

EBITDA is restated to take account of non-current items, such as

losses on tangible and intangible assets, restructuring, etc. It

corresponds to the gross operating earnings from recurring

operations for the Cegedim Group.

Adjusted EBITDA : Consolidated EBITDA

adjusted, for 2016, for the €4.0m of negative impact from

impairment of receivables in the Healthcare Professional

division

Net Financial Debt: This represents the

Company's net debt (non-current and current financial debt, bank

loans, debt restated at amortized cost and interest on loans) net

of cash and cash equivalents and excluding revaluation of debt

derivatives.

Free cash flow: Free cash flow is cash

generated, net of the cash part of the following items: (i) changes

in working capital requirements, (ii) transactions on equity

(changes in capital, dividends paid and received), (iii) capital

expenditure net of transfers, (iv) net financial interest paid and

(v) taxes paid.

EBIT margin: EBIT margin is defined as the

ratio of EBIT/revenue.

EBIT margin before special

items: EBIT margin before special items is defined as the ratio

of EBIT before special items/revenue.

Net cash: Net cash is defined as cash and cash

equivalent minus overdraft.

|

Glossary

About Cegedim:

Founded in 1969, Cegedim is an innovative technology and services

company in the field of digital data flow management for healthcare

ecosystems and B2B, and a business software publisher for

healthcare and insurance professionals. Cegedim employs more than

4,000 people in 11 countries and generated revenue of €441 million

in 2016. Cegedim SA is listed in Paris (EURONEXT: CGM).

To learn more, please visit: www.cegedim.com

And follow Cegedim on Twitter: @CegedimGroup

|

Aude Balleydier

Cegedim

Media

Relations

and Communications Manager

Tel.: +33 (0)1 49 09 68 81

aude.balleydier@cegedim.com |

Jan Eryk Umiastowski

Cegedim

Chief Investment Officer

and head of Investor Relations

Tel.: +33 (0)1 49 09 33 36

janeryk.umiastowski@cegedim.com |

Anne Pezet

PRPA Agency

Media Relations

Tel.: +33 (0)1 46 99 69 69

anne.pezet@prpa.fr |

Follow Cegedim:

|

Cegedim_13072017_ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cegedim SA via Globenewswire

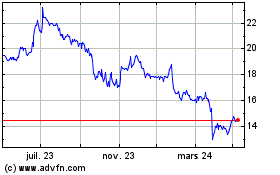

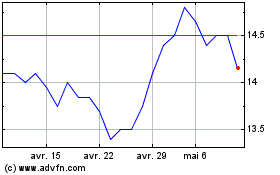

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Cegedim (EU:CGM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024