Chip Stocks' Fate Hinges on Trade Deal -- WSJ

19 Mars 2019 - 8:02AM

Dow Jones News

By Jessica Menton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 19, 2019).

Shares of chip makers are surging toward their best quarter in

more than two years as U.S.-China trade tensions have thawed, but

they face a critical test as a trade deal is hammered out.

The PHLX Semiconductor Index, which includes chip makers such as

Intel Corp., Nvidia Corp. and Advanced Micro Devices Inc., has

advanced 20% in 2019, topping the S&P 500's 13% rise this year

and heading toward its best three-month period since the third

quarter of 2016. The index is 4% away from its record, set in March

2018.

Shares of semiconductor companies, which have been caught in the

crosshairs of the trade battle, have bounced back as tensions have

eased. But stumbling blocks remain, including concerns over China's

policies on intellectual property, technology, cybersecurity,

currency, agriculture and energy.

If a trade agreement doesn't come to fruition or terms of the

deal disappoint, analysts caution it could upend the rally in chip

shares.

"The space that has benefited the most from the China black

cloud being removed from tech is semiconductors," said Daniel Ives,

a Wedbush Securities analyst. "But those stocks would be front and

center in terms of being punished if the ultimate trade deal isn't

what investors were hoping."

Semiconductor shares are vulnerable to a trade war because China

is a strong driver for the chip-equipment sector, which includes

several hot areas of growth including gaming and artificial

intelligence.

The tariff battle threatens to raise costs for companies, which

investors fear will dent profit growth. The S&P 500

semiconductor group is expected to report a 24% drop in

first-quarter profits from a year earlier, compared with a 3.7%

decline expected for the S&P 500, according to FactSet.

The U.S. already imposed tariffs on $250 billion of imports from

China last year, as well as levies on steel and aluminum. President

Trump delayed an increase in tariffs on Chinese goods that had been

set to take effect earlier this month, as both sides discuss a date

for a potential summit.

"With tariffs going up, it's going to create slower export

opportunities for companies," said David Spika, president of

GuideStone Capital Management.

Pressure on chip stocks could be a bad sign for the broader

market; the S&P 500 and its semiconductor group, which makes up

3.7% of the total index, have moved in the same direction 79% of

the trading days this year, according to Dow Jones Market Data.

Investors fear the tariff spat and a stronger dollar could hurt

demand for U.S.-made products. The Federal Reserve, which has held

off on lifting short-term interest rates, is monitoring business

spending closely as demand has waned for U.S.-made computers and

electronic products. Global personal-computer shipments slumped in

the fourth quarter, sliding 6.9% from a year earlier, according to

research firm Gartner. World-wide sales of smartphones also

stalled, climbing 0.1% from a year ago, separate data from Gartner

showed.

Wall Street is seeking more concrete details on the trade

negotiations. Two key issues investors want resolved: Chinese

intellectual-property theft and cyberspying. U.S. technology

companies are seeking new guardrails to crack down on the theft of

emerging wireless technology known as 5G and cloud computing.

Investors are also looking for the two countries to soften their

stance on merger-and-acquisition activity after the U.S. blocked

Singapore-based Broadcom Ltd.'s planned $117 billion takeover of

chip maker Qualcomm Inc. last year on national-security

concerns.

Michael Arone, chief investment strategist at State Street

Global Advisors, cautioned that the U.S. still faces trade

skirmishes beyond China, including the U.S. Mexico Canada Agreement

to replace Nafta and a post-Brexit U.K.

"There might be progress with China, but there are still trade

challenges on multiple fronts with Europe, Canada and Mexico," Mr.

Arone said. "When it comes to the U.S.-China trade deal, the devil

will be in the details."

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

March 19, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

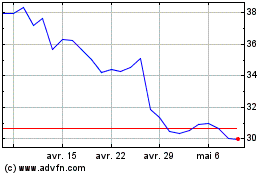

Intel (NASDAQ:INTC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Intel (NASDAQ:INTC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024