Claranova: Growth outlook confirmed

10 Septembre 2018 - 8:13PM

Business Wire

Implementation of the share buyback

program

Regulatory News:

Confident in its develop prospects, Claranova (Paris:CLA)

announces the further implementation of its share buyback program,

in accordance with the authorization granted by the Shareholders’

Meeting of November 30, 2017.

Boosted by an excellent 4th quarter (+37%1), the Claranova group

surpassed the €160 million mark in fiscal year 2017-2018, reporting

full-year consolidated revenue of €161.5 million, up

32% at constant exchange rates (+24% at current exchange

rates). This strong performance confirms the relevance of the

Group’s strategic direction and the effectiveness of its business

model.

This upward trend will strengthen further in the coming months,

with the consolidation from July 1, 2018 of the Canadian companies

acquired by the Avanquest division. These acquisitions should also

significantly improve the division’s profitability. The

Group’s other two businesses are more than ever fully operational.

PlanetArt and MyDevices reported full-year growth for fiscal

year 2017-2018 of +47% (€122 million) and +43%

(€3.7 million) at constant exchange rates and +37% and

+31%, respectively, on a reported basis.

PlanetArt strengthened its offering during the period

with the launch of the FreePrints Photo Tiles application in

the Unites States and the United Kingdom. It was also launched in

Ireland in August. Initial figures are good for this new

application, which customers use to easily order photo tiles that

can be stuck to walls, unstuck and moved as often as they want

without damage. The application fits perfectly with the division’s

traditional applications, FreePrints and FreePrints Photobooks. Its

launch in France is expected soon.

myDevices accelerated its business, boosted by the

signature of the agreement with the U.S. telecoms operator, Sprint.

It reported full-year revenue in excess of USD 2 million,

following the launch of the Sprint IoT factory platform in May

2018. myDevices will attend the Mobile World Congress

Americas in Los Angeles from September 12 to 14, where it will

continue to roll-out its offering and present its full range of IoT

solutions.

With cash in excess of €65 million at the end of June 2018, the

Group has decided to increase the number of treasury shares held

and optimize its financing capacity.

For Pierre Cesarini, CEO of the Claranova group: “We have

decided to continue implementing our share buyback program,

following on from the program launched last June. The last fiscal

year was excellent. All the lights are green for the Group to

continue growing and improve its profitability and we fully intend

to continue in this direction.”

Signature of a purchase agreement with an investment services

provider

Pursuant to the Management Board’s decision of June 28, 2018,

Claranova signed an agreement with an investment services provider

for the purchase of the Company’s shares.

Under the terms of this agreement, the service provider may

purchase a maximum of 7 million shares at a maximum unit price of 1

euro, at the dates it considers appropriate and in accordance with

applicable regulations, throughout the term of the share buyback

program. The program cannot exceed €5 million overall.

The Company reserves the right to interrupt implementation of

the share buyback program at any time.

1 At constant exchange rates

Next Claranova group event:

2017-2018 annual results : October 2,

2018

About Claranova:

A global Internet and mobile player, Claranova is one of the few

French companies in this sector to post sales of over EUR 150

million, more than half of which is generated in the United States.

Claranova focuses its strategy on three areas of business – digital

printing through the Group’s PlanetArt division, management of the

Internet of Things (IoT) via the myDevices division and e-commerce

through the Avanquest division:

- PlanetArt: A world leader in mobile

printing, specifically via the FreePrints offer – the cheapest and

simplest way to print photos from a smartphone – FreePrints is

already a must-have for several million customers, a figure that

has grown every year since its launch;

- myDevices: A global platform for IoT

(Internet of Things) management enabling major corporations from

different business sectors to quickly develop and roll out IoT

solutions for their customers;

- Avanquest: the Group’s legacy activity

covering the distribution of third-party software, a business that

is shifting towards the monetization of Internet traffic.

For more information on the Claranova group: www.claranova.com

or www.twitter.com/claranova_group

CODES

Ticker : CLA

ISIN : FR0004026714

www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180910005819/en/

ANALYSTS - INVESTORSClaranova+33 1 41 27 19

74contact@claranova.comorFINANCIAL COMMUNICATIONAELIUM+33 1

75 77 54 65skennis@aelium.fr

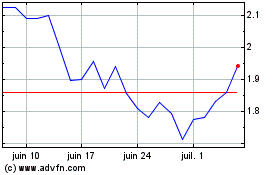

Claranova (EU:CLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Claranova (EU:CLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024