Correction: RAMSAY GENERALE DE SANTE : provisional annual results

at the end of June 2019

PRESS RELEASEParis, 28 August

2019

Provisional

annual results at the end of June

2019 Good

results and solid perspectives

- Annual reported turnover up 51.7% to EUR 3,401.1 million. On a

like-for-like basis, good growth (+2.1%) with an additional

business day;

- Increase in reported EBITDA of 29.4% to EUR 330.8 million and

improvement in EBITDA margin on a like-for-like basis.

- Group net profit of EUR 8.2 million (compared with a profit of

EUR 7.3 million at end June 2018);

- Strong appreciation of the value of the real estate portfolio

(former RGDS perimeter only) by 9.2% to EUR 781 million.

- Accelerating strategic transformation: from the leader of

private hospitalisation in France to leading provider of integrated

care in continental Europe;

- The integration of the Capio Group is ahead of schedule, which

will open up very good medium and long-term prospects.

Pascal Roché, Group CEO, declares :

« Ramsay Générale de Santé is now positioned as

a European leader in the provision of integrated health care

services (primary health care centres, specialised and general

hospitals...), operating in six countries, taking care of 7 million

patients who have put their trust in us in 2019 in order to provide

them with personalised, quality care that is coordinated across our

various areas of activity. The vigorous growth of the published

indicators reflects the ongoing integration of Capio over more than

7 months, ahead of our initial schedule – a development that holds

major potential for the future. The group has continued to invest

heavily in all the countries in which it operates, and the

improvement of the financial indicators on a like-for-like basis is

finally resulting in the diversity and complementarity of our

various segments in France (MCO, after care and rehabilitation,

mental health and medical imaging), and the continuous evolution of

the group towards care quality and the quest for efficiency.»

These provisional accounts were presented to the

Board of Directors at its meeting on 23 August 2019. The audit

procedures are in progress.

The final consolidated financial statements for

the year ended June 2019 will be approved by the Board of Directors

at its meeting on 25 September 2019.

|

In EUR million |

From 1 July 2018 to 30 June 2019 |

From 1 July 2017 to 30 June 2018 |

Change |

| Turnover |

3,401.1 |

2,241.5 |

+51.7% |

| Gross Operating

Profit (EBITDA) |

330.8 |

255.6 |

+29.4% |

| Current operating

profit |

156.9 |

125.7 |

+24.7% |

| As a % of

turnover |

4.6% |

5.6% |

-1.0 point |

| Operating

profit |

118.8 |

65.8 |

+80.5% |

| Net income - Group

share |

8.2 |

7.3 |

+12.3% |

| Net earnings per

share (in €) |

0.07 |

0.10 |

-30.0% |

|

In EUR million |

From 1 July 2018 to 30 june 2019 |

From 1 July 2017 to 30 June 2018 |

Change |

|

Île-de-France |

942.3 |

931.6 |

+1.1% |

|

Auvergne-Rhône-Alpes |

384.8 |

362.9 |

+6.0% |

|

Nord - Pas de Calais - Picardie |

376.9 |

358.7 |

+5.1% |

|

Provence Alpes Côte d'Azur |

159.3 |

163.6 |

-2.6% |

|

Bourgogne Franche Comté |

107.6 |

103.5 |

+4.0% |

|

Other regions |

329.3 |

316.7 |

+4.0% |

|

Other activities |

0.0 |

4.5 |

-100.0% |

|

Capio |

1,100.9 |

0.0 |

-- |

|

Published turnover |

3,401.1 |

2,241.5 |

+51.7% |

|

|

|

|

|

|

Of which: - At constant scope |

2,284.5 |

2,237.0 |

+2.1% |

|

- Changes in scope of consolidation |

1,116.6 |

4.5 |

|

Significant events during the year:

Acquisition of Capio

On 8 November 2018, following the end of the

acceptance period for its public takeover bid for Capio shares,

Ramsay Générale de Santé announced that on 7 November 2018, it had

acquired 98.51% of the capital of Capio, one of Europe’s leading

providers of healthcare and health services, enabling the Group to

position itself as a pan-European leader in private hospitalisation

and primary care, present in six countries with a prominent role in

Scandinavia (in particular Sweden) and France.

The public takeover bid by Ramsay Générale de

Santé concerned all of Capio’s shares at a price of SEK 58 per

share. The price of the Capio acquisition thus amounted to EUR

779.7 million (fair value of the 139,050,816 Capio shares at SEK 58

per share converted at the SEK/EUR hedging rate of 10.3437).

Ramsay Générale de Santé initiated a mandatory

squeeze-out procedure for shares that it did not hold at the end of

the offer and convertible bonds issued by Capio to its employees on

30 April 2016, pursuant to the Swedish Companies Act (Sw.

Aktiebolagslagen (2005:551)). As part of this mandatory squeeze-out

procedure, Capio initiated the procedure for delisting the Capio

shares from Nasdaq Stockholm on 28 November 2018.

Ramsay Générale de Santé was awarded, on 29 May

2019, advance title to all remaining shares in Capio and currently

controls 100% of Capio’s shares. The final price for the shares to

be transferred in the context of the buy-out proceedings is yet to

be determined within the scope of such proceedings.

Financing of the acquisition of Capio

Ramsay Générale de Santé secured financing for

the acquisition of Capio (i) through the issuing of subordinated

bonds underwritten by its two majority shareholders, Ramsay Health

Care (UK) and Crédit Agricole Dialogue ("Predica"), amounting to

EUR 550 million, and (ii) by setting up a loan of up to EUR 750

million, of which the initial lenders are Crédit Agricole Corporate

& Investment Bank and Société Générale, which takes the form of

an additional line of credit (“Incremental Facility”) set up under

the 2014 Credit Agreement, as amended.

The amount of these funds is intended to cover

the acquisition price of 100% of the shares to be acquired as part

of the offer and the subsequent mandatory squeeze-out, and the

refinancing of Capio's debt, which amounted to EUR 465.4 million as

at 31 December 2018, as well as the associated operating costs.

The Group's rating agencies, taking into account

the impact of the Capio acquisition and its strategic logic,

confirmed their rating of the Group at the end of November 2018

(Standard & Poor's: BB-; Moody's: Ba3).

Share capital increase

On 22 March 2019, Ramsay Générale de Santé S.A.

announced the launch of a capital increase with preferential

subscription rights of approximately EUR 625 million as part of the

refinancing of the Capio acquisition, as follows:

- Offer basis: 1 new share for 2 current shares

- Unit subscription price: EUR 16.46 per new share

- Negotiation period for preferential subscription rights: from

25 March 2019 to 3 April 2019 inclusive

- Subscription period: from 27 March 2019 to 5 April 2019

inclusive

The capital increase resulted in the issuing of

34,432,595 new shares at a unit price of EUR 16.46, representing a

gross amount raised (including issue premium) of EUR

566,760,513.70.

At the end of the subscription period, which

finished on 5 April 2019, 34,356,485 new shares had been subscribed

as of right and 76,110 new shares made redeemable.

In accordance with their subscription

commitments, the two majority shareholders of Ramsay Générale de

Santé, Ramsay Health Care (UK) and Prévoyance Dialogue du Crédit

Agricole (“Predica”), subscribed to the capital increase in full by

offsetting receivables against the company's certain, liquid and

due receivables they held in respect of the subordinated bonds used

to finance the acquisition of Capio, for EUR 318.1 million and EUR

239.9 million respectively. Their stake increased to 52.53% and

39.62% of the capital respectively after the capital increase.

The share capital of Ramsay Générale de Santé is

currently composed of 110,389,690 shares with a nominal value of

EUR 0.75 each, amounting to a total of EUR 82,792,267.50.

Operations and turnover:

During the financial year ended June 2019, the

Ramsay General Health Group reported consolidated turnover of EUR

3,401.1 million, compared with EUR 2,241.5 million from 1 July 2017

to 30 June 2018, up 51.7%.

On a like-for-like basis, the Group's turnover

increased by 2.1% with an additional business day.

Changes in the scope of consolidation are almost

entirely explained by the consolidation of the Capio Group as from

7 November 2018, which contributed EUR 1,100.9 million to the

Group's consolidated turnover.

In addition to this major acquisition, the

consolidation strategy for the divisions’ medical projects in the

territorial clusters in France led to the buyout of Clinique La

Parisière in July 2018 (Drôme-Ardèche Division).

At the end of June 2019, the total activity of

the French entities of Ramsay Générale de Santé, excluding Capio,

effectively increased by 1.9% in terms of the volume of admissions

(excluding emergencies). The breakdown by business segment is as

follows:

- +1.4% in Medicine-Surgery-Obstetrics

- +4.9% in sub-acute care and rehabilitation

- +0.7% in mental health

With regard to the public service tasks managed

by the group, the number of emergencies increased, up 1.9% over the

past year with close to 621,000 cases registered by the emergency

services at our facilities.

Results:

EBITDA for the year ended 30 June 2019 was EUR

330.8 million, up 29.4% on a reported basis. Using the same scope

and accounting methods, EBITDA was up 3.2% over the same period.

EBITDA margin as a percentage of turnover was 9.7%, down on the

same period last year (11.4%) on a reported basis, but up on a

like-for-like basis to 11.6%.

Reported current operating profit for the period

1 July 2018 to 30 June 2019 reached EUR 156.9 million (or 4.6% of

turnover), up 24.7% from compared to the previous year.

The amount of other non-current income and

expenses represents a net expense of EUR 38.1 million for the

period ended 30 June 2019, consisting of EUR 21.3 million of costs

related to the acquisition and integration of the Capio Group. From

1 July 2017 to 30 June 2018, the amount of other non-current income

and expenses represented a net expense of EUR 59.9 million.

At 30 June 2019, the net cost of borrowing

amounted to EUR 66.9 million, compared with EUR 39.1 million the

previous year. This consists primarily of interest on senior debt

and includes the cost of the subordinated bonds subscribed by the

shareholders of Ramsay Générale de Santé as part of the acquisition

of the Capio Group.

In total, Group net profit as at 30 June 2019

amounted to EUR 8.2 million, compared with EUR 7.3 million for the

period from 1 July 2017 to 30 June 2018.

Debt:

Net financial debt at 30 June 2019 increased

significantly to EUR 1,641.7 million compared to EUR 927.1 million

at 30 June 2018. This debt includes, in particular, EUR 1,955.3

million in non-current borrowings and financial debt, EUR 69.4

million in current financial debt, offset by EUR 368.5 million in

positive cash flow.

This change in the Group’s net financial debt

naturally reflects the impact of the takeover of the Capio Group,

including its own debt.

Implementation of IFRS 16:

The Ramsay Générale de Santé Group will apply

the new IFRS 16 standard on leases for its fiscal year beginning 1

July 2019. In preparation for this first application, the Group

established a dedicated work team to identify and analyse lease

contracts. It was also in charge of selecting and configuring the

IT solution for data processing and contract monitoring.

The Group has decided to adopt the simplified

retrospective approach by recognising the cumulative effects of

IFRS 16 at the date of first application, without restating

comparative periods.

The assets leased by the Group consist mainly of

hospital and clinic premises, care centres and offices. For these

assets, the balance sheet will be adjusted to recognise a

depreciable right of use and related rental debt. This debt will be

measured on the basis of the net present value of future leases,

including renewal options, in cases where the Group considers their

exercise to be reasonably certain. The Group anticipates that this

debt will amount to between EUR 1.8 billion and EUR 2.3

billion.

In the income statement, the corresponding lease

expense will be replaced by interest and straight-line depreciation

expense. The Group's EBITDA level will be significantly adjusted

and the impact on consolidated net income should result in an

additional net charge of between EUR 15 million and EUR 19

million.

These estimates have not been audited and may

differ from the actual impacts recorded in the financial statements

for the 12 months ending 30 June 2020, due to possible changes in

the portfolio of leased assets during the coming financial year or

changes in the assumptions used to date.

About Ramsay Générale de Santé

After the successfull acquisition of Capio AB

Group in 2018, Ramsay Générale de Santé is becoming one of the

leaders of the hospitalisation and primary care in Europe with 36

000 employees and 8 600 practitioners serving 7 millions patients

in our 343 facilities in six countries : France, sweden, Norway,

Denmark, Germany, Italy.Ramsay Générale de Santé offers almost all

medical and surgical care in three jobs : general hospitals

(medicine – surgery – obstetric), follow-up care and rehabilitation

clinics, mental health. In all its territories, the group develops

missions of public service and contributes to the territorial

sanitory disposal, as in Sweden with more than 100 proximity care

units.The quality and security of care is the group’s priority in

all its countries. That’s why our group is today a reference in

terms of modern medicine, especially in outpatient care and rapid

recovery.Each year, the group invests more than 200M€ in innovation

whether it is in new surgical or imaging technologies, in building

or modernising its facilities… The group also innovates with new

digital tools to the benefit of its patients or in improving its

organisations for a more efficient care.Internet site :

www.ramsaygds.frFacebook: https://www.facebook.com/RamsayGDS

Twitter: https://twitter.com/RamsayGDSLinkedIn:

https://www.linkedin.com/company/ramsaygds YouTube:

https://www.youtube.com/c/RamsayGDSante

ISIN and Euronext Paris code:

FR0000044471

A CONFERENCE CALL IN ENGLISH WILL BE HELD

TODAY

at 7.30 p.m. (Paris time) - Dial-in at

the following numbers

In

France:

+33 (0)1 76 77 22 61In the

UK:

+44 (0)330 336 6025In

Australia:

+61 (0)2 8524 5352

Access code: 465602

| Investor &

Analyst Relations Press RelationsArnaud Jeudy

Caroline DesaegherPhone: + 33 (0)1 87 86 21 88

Phone: + 33 (0)1 87 86 22a.jeudy@ramsaygds.fr

c.desaegher@ramsaygds.fr |

Glossary Constant scope of consolidation

- The restatement of the scope of consolidation for incoming

entities is as follows:

- Entities entering the scope of consolidation in the current

year must have the contribution from the acquired entity deducted

from the performance indicators in the current year;

- Entities entering the scope of consolidation in the previous

year must have the contribution from the acquired entity deducted

from the performance indicators of the previous month in the month

of the acquisition.

- The restatement of the scope of consolidation for outgoing

entities is as follows:

- For entities leaving the scope of consolidation in the current

year, the contribution of the outgoing entity must be deducted in

the previous year from the performance indicators as of the month

that the entity leaves the scope of consolidation.

- For entities leaving the scope of consolidation in the previous

year, the contribution of the outgoing entity must be deducted for

the full previous period.

Current operating profit is the operating profit before other

non-current income or expenses, consisting of restructuring costs

(expenses and provisions), capital gains or losses from disposal,

or significant and non-recurring depreciation or amortisation of

non-current assets, whether tangible or intangible; also, other

operating expenses and income such as provisions relating to major

litigation. EBITDA is the current operating profit before

depreciation and amortisation (charges and provisions in the profit

and loss account are grouped according to their nature). Net

financial debt consists of gross financial debts, less financial

assets.

- Gross financial debts consist of:

- bank loans, including incurred interest;

- loans relating to finance leases including incurred

interest;

- fair value hedging instruments recognised in the balance sheet

net of tax;

- current financial debt in relation to current financial

accounts with minority investors;

- bank overdrafts.

- Financial assets consist of:

- the fair value of hedging instruments recognised in the balance

sheet net of tax;

- current financial receivables in relation to current financial

accounts with minority investors

- cash and cash equivalents, including treasury shares held by

the Group (considered as marketable securities);

- financial assets directly linked to the loans taken out and

recognised in gross financial debts

Selected provisional financial

information |

|

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME |

| (in million euros) |

from 1 July 2017 to 30 June 2018 |

from 1 July 2018 to 30 June 2019 |

| TURNOVER |

2,241.5 |

3,401.1 |

| Personnel expenses

and profit sharing |

(971.5) |

(1,647.9) |

| Purchased

consumables |

(450.0) |

(644.7) |

| Other operating

income and expenses |

(280.7) |

(408.6) |

| Taxes and

duties |

(93.8) |

(109.0) |

| Rents |

(189.9) |

(260.1) |

| EBITDA |

255.6 |

330.8 |

| Depreciation |

(129.9) |

(173.9) |

| Current operating

profit |

125.7 |

156.9 |

| Restructuring costs |

(58.0) |

(44.9) |

| Result of the management of real estate

and financial assets |

(1.9) |

6.8 |

| Impairment of goodwill |

-- |

-- |

| Other non-current income and

expenses |

(59.9) |

(38.1) |

| Operating profit |

65.8 |

118.8 |

| Gross interest expenses |

(39.8) |

(67.4) |

| Income from cash and cash equivalents |

0.7 |

0.5 |

| Net interest

expenses |

(39.1) |

(66.9) |

| Other financial income |

1.2 |

2.3 |

| Other financial expenses |

(4.4) |

(5.9) |

| Other financial income and

expenses |

(3.2) |

(3.6) |

| Corporate income tax |

(8.5) |

(33.0) |

| Amount attributable to associates |

0.1 |

-- |

| NET PROFIT FOR THE

PERIOD |

15.1 |

15.3 |

| Revenues and expenses recognized directly

as equity |

|

|

| - Retirement commitments |

(0.1) |

(55.2) |

| - Change in fair value of hedging

financial instruments |

-- |

(13.1) |

| - Translation differential |

-- |

8.0 |

| - Income tax on other comprehensive

income |

1.0 |

11.8 |

| Results recognized directly as

equity |

0.9 |

(48.5) |

| TOTAL COMPREHENSIVE INCOME FOR THE

PERIOD |

16.0 |

(33.2) |

| PROFIT ATTRIBUTABLE TO (in

millions euros) |

from 1 July 2017 to 30 June 2018 |

from 1 July 2018 to 30 June 2019 |

| - Group’s share of net earnings |

7.3 |

8.2 |

| - Non-controlling interests |

7.8 |

7.1 |

| NET PROFIT FOR THE

PERIOD |

15.1 |

15.3 |

| NET EARNINGS PER SHARE (in euros) |

0.10 |

0.07 |

| NET DILUTED EARNINGS PER SHARE (in

euros) |

0.10 |

0.07 |

| TOTAL COMPREHENSIVE INCOME

ATTRIBUTABLE TO (in million euros) |

from 1 July 2017 to 30 June 2018 |

from 1 July 2018 to 30 June 2019 |

| - Group’s comprehensive income for the

period |

8.2 |

(40.3) |

| - Non-controlling interests |

7.8 |

7.1 |

| TOTAL COMPREHENSIVE INCOME FOR THE

PERIOD |

16.0 |

(33.2) |

|

CONSOLIDATED BALANCE SHEET – ASSETS |

| (in million

euros) |

06-30-2018 |

06-30-2019 |

| Goodwill |

754.4 |

1,674.8 |

| Other intangible fixed assets |

23.8 |

263.5 |

| Tangible fixed assets |

869.2 |

1,107.1 |

| Investments in associates |

0.6 |

0.3 |

| Other long-term investments |

69.1 |

87.4 |

| Deferred tax assets |

45.2 |

146.3 |

| NON CURRENT

ASSETS |

1,762.3 |

3,279.4 |

| Inventories |

67.8 |

98.9 |

| Trade and other receivables |

157.6 |

361.0 |

| Other current assets |

190.6 |

231.9 |

| Tax assets |

9.8 |

11.8 |

| Current financial assets |

0.3 |

9.7 |

| Cash and cash equivalents |

308.0 |

368.5 |

| Assets held for sale |

5.6 |

-- |

| CURRENT ASSETS |

739.7 |

1,081.8 |

| TOTAL ASSETS |

2,502.0 |

4,361.2 |

|

CONSOLIDATED BALANCE SHEET – LIABILITIES AND

EQUITY |

| (in million euros) |

06-30-2018 |

06-30-2019 |

| Share capital |

56.9 |

82.7 |

| Additional paid-in capital |

71.2 |

611.2 |

| Consolidated reserves |

334.8 |

293.6 |

| Group’s share of net profit |

7.3 |

8.2 |

| Group’s share of

equity |

470.2 |

995.7 |

| Non-controlling interests |

40.8 |

42.8 |

| TOTAL SHAREHOLDERS’

EQUITY |

511.0 |

1,038.5 |

| Borrowings and financial debts |

1,195.6 |

1,955.3 |

| Provisions for retirement and other

employee benefits |

51.0 |

132.9 |

| Non-current provisions |

63.5 |

128.3 |

| Other long term liabilities |

12.2 |

32.4 |

| Deferred tax liabilities |

50.9 |

112.6 |

| NON CURRENT

LIABILITIES |

1,373.2 |

2,361.5 |

| Current provisions |

17.8 |

36.5 |

| Accounts payable |

191.9 |

266.2 |

| Other current liabilities |

329.5 |

574.3 |

| Tax liabilities |

13.3 |

14.8 |

| Short-term borrowings |

63.7 |

69.4 |

| Bank overdraft |

--- |

--- |

| Liabilities related to assets held for

sale |

1.6 |

--- |

| CURRENT

LIABILITIES |

617.8 |

961.2 |

| TOTAL EQUITY AND

LIABILITIES |

2,502.0 |

4,361.2 |

|

consolidated statement of changes in equity |

| (in million

euros) |

SHARE CAPITAL |

ADDITIONAL PAID IN CAPITAL |

RESER-VES |

RESULTS RECOGNISED DIRECTLY AS EQUITY |

TOTAL COMPRE

HENSIVE INCOME FOR THE

PERIOD |

GROUP’S SHARE OF EQUITY |

NON CONTROL-LING INTERESTS |

SHARE-HOLDERS’ EQUITY |

| Shareholders’ equity at June

30, 2017 |

56.9 |

71.2 |

288.2 |

(11.3) |

57.0 |

462.0 |

40.0 |

502.0 |

| Capital increase (including net

fees) |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

| Treasury shares |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

| Stocks options and free share |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

| Prior year appropriation of

earnings |

-- |

-- |

57.0 |

-- |

(57.0) |

-- |

-- |

-- |

| Distribution of dividends |

-- |

-- |

-- |

-- |

-- |

-- |

(7.0) |

(7.0) |

| Change in consolidation scope |

-- |

-- |

|

-- |

-- |

-- |

-- |

-- |

| Total comprehensive income for the

period |

-- |

-- |

-- |

0.9 |

7.3 |

8.2 |

7.8 |

16.0 |

| Shareholders’ equity at June

30, 2018 |

56.9 |

71.2 |

345.2 |

(10.4) |

7.3 |

470.2 |

40.8 |

511.0 |

| Capital increase (including net

fees) |

25.8 |

540.0 |

-- |

-- |

-- |

565.8 |

-- |

565.8 |

| Treasury shares |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

| Stocks options and free share |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

-- |

| Prior year appropriation of

earnings |

-- |

-- |

7.3 |

-- |

(7.3) |

-- |

-- |

-- |

| Distribution of dividends |

-- |

-- |

-- |

-- |

-- |

-- |

(6.8) |

(6.8) |

| Change in consolidation scope |

-- |

-- |

|

-- |

-- |

-- |

1.7 |

1.7 |

| Total comprehensive income for the

period |

-- |

-- |

-- |

(48.5) |

8.2 |

(40.3) |

7.1 |

(33.2) |

| Shareholders’ equity at June

30, 2019 |

82.7 |

611.2 |

352.5 |

(58.9) |

8.2 |

995.7 |

42.8 |

1,038.5 |

|

statement of income and expenses recognized directly in

equity |

| (in million

euros) |

06-30-2017 |

Income and expenses July 1, 2017 to June 30,

2018 |

06-30-2018 |

Income and expenses July 1, 2018 to June 30,

2019 |

06-30-2019 |

|

| Translation differential |

(0.3) |

-- |

(0.3) |

8.0 |

7.7 |

|

| Retirement commitments |

(4.9) |

0.5 |

(4.4) |

(43.9) |

(48.3) |

|

| Fair value of hedging financial

instruments |

(6.1) |

0.4 |

(5.7) |

(12.6) |

(18.3) |

|

| Results recognized directly as

equity (Group’s share) |

(11.3) |

0.9 |

(10.4) |

(48.5) |

(58.9) |

|

|

CONSOLIDATED STATEMENT OF CASH FLOWS |

| (in million euros) |

from 1 July 2017 to 30 June 2018 |

from 1 July 2018 to 30 June 2019 |

| Total net consolidated profit |

15.1 |

15.3 |

| Depreciation |

129.9 |

173.9 |

| Other non-current income and expenses |

59.9 |

38.1 |

| Amount attributable to associates |

(0.1) |

-- |

| Other financial income and expenses |

3.2 |

3.6 |

| Cost of net financial debt |

39.1 |

66.9 |

| Income tax |

8.5 |

33.0 |

| Gross operating

surplus |

255.6 |

330.8 |

| Non-cash items relating to recognition and

reversal of provisions (transactions of a non-cash nature) |

(2.9) |

(9.7) |

| Other non-current income and expenses

paid |

(18.0) |

(44.0) |

| Change in other non-current assets and

liabilities |

(13.5) |

(10.0) |

| Cash flow from operations before

cost of net financial debt and tax |

221.2 |

267.1 |

| Income tax paid |

(26.4) |

(28.0) |

| Change in working capital requirement |

19.1 |

(25.5) |

| NET CASH FLOWS FROM OPERATING

ACTIVITIES: (A) |

213.9 |

213.6 |

| Investments in tangible and intangible

assets |

(62.6) |

(178.0) |

| Disposals of tangible and intangible

assets |

7.2 |

21.3 |

| Acquisition of entities |

(21.1) |

(824.3) |

| Disposal of entities |

0.5 |

65.2 |

| Dividends received from non-consolidated

companies |

0.6 |

0.4 |

| NET CASH FLOWS FROM INVESTING

ACTIVITIES: (B) |

(75.4) |

(915.4) |

| Capital and share premium increases:

(a) |

--- |

557.8 |

| Dividends paid to minority interests of

consolidated companies: (b) |

(7.0) |

(6.8) |

| Net interest expense paid: (c) |

(39.1) |

(58.9) |

| Debt issue costs: (d) |

(4.9) |

(11.4) |

| Cash flow before change in

borrowings: (e) = (A+B+a+b+c+e) |

87.5 |

(221.1) |

| Increase in borrowings: (f) |

122.2 |

1 305.3 |

| Repayment of borrowings: (g) |

(82.5) |

(1,022.8) |

| NET CASH USED FOR FINANCING

ACTIVITIES: (C) = a + b + c + d + f + g |

(11.3) |

763.2 |

| NET INCREASE (DECREASE) IN CASH

AND CASH EQUIVALENTS: ( A + B + C ) |

127.2 |

61.4 |

| Currency differences in cash and cash

equivalents |

-- |

(0.9) |

| Cash and cash equivalents at beginning of

period |

180.8 |

308.0 |

| Cash and cash equivalents at end of

period |

308.0 |

368.5 |

| Net indebtedness at beginning of

period |

964.0 |

927.1 |

| Cash flow before change in borrowings:

(e) |

(87.5) |

221.1 |

| Capitalization of financial leases |

68.7 |

41.1 |

| Loan issue charges fixed assets |

(1.4) |

(6.6) |

| Assets held for sale |

-- |

-- |

| Fair value of financial hedging

instruments |

(0.9) |

11.2 |

| Change in scope of consolidation and

other |

(15.8) |

447.8 |

| Net indebtedness at end of

period |

927.1 |

1,641.7 |

- RGDS - provisional annual results at the end of June 2019

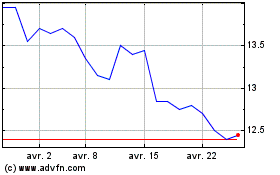

Ramsay Generale De Sante (EU:GDS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ramsay Generale De Sante (EU:GDS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024